APR and APY: an introduction

When investing one frequently comes across two acronyms that can cause confusion: APR vs APY.

The chaos can further increase in the world of cryptocurrencies, where classic financial terms are compounded by those derived from the blockchain.

Even before reading charts or performing fundamental analysis, the profitable investor needs to know the basics. In fact, it would be arduous to develop winning strategies by ignoring the meaning of key words in this industry.

APR and APY mislead not only the less experienced: sometimes, people who are already seasoned struggle to illustrate the difference.

There is good news: it is all easier than it seems.

This mini-guide will remove any doubt about the difference between APR and APY, and also help us understand how to calculate them.

What is APR?

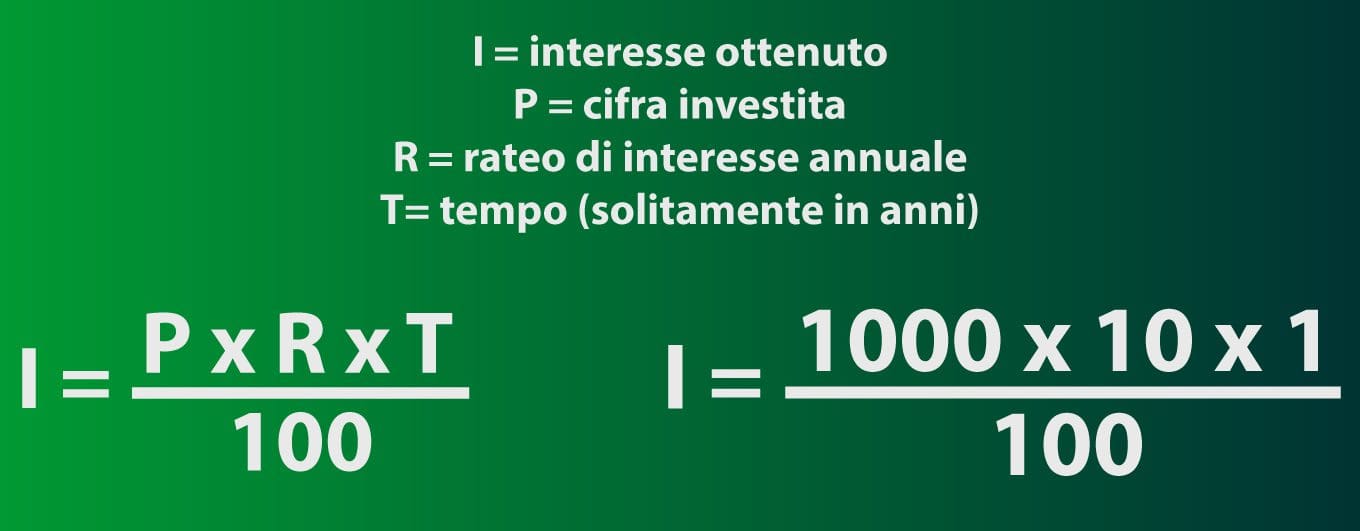

APR is short for Annual Percentage Rate, which is the interest you get annually from the investment. This is a simple figure to calculate since it does not include compound interest. Making use of an example will make it easier to understand.

Let us imagine that we invest 1000€ in a product that will yield an APR of 10%.

At the end of the first year we will have earned 100€, exactly 10% of the amount invested.

Keeping the same amount placed, even in the years to come we will always get 100€.

The APR is a basic figure and one that depends solely on the initial investment. In fact, the calculation does not take into account the gains generated as time goes by.

Next we find formula and its application to the data used in the example.

A question arises: how can we calculate the interest on the principal added to the interest already received? Simple: by resorting to the APY.

"I= P*R*T/100 (I: interest received; P= invested capital; R= annual interest ratio; T= time)"

What is APY?

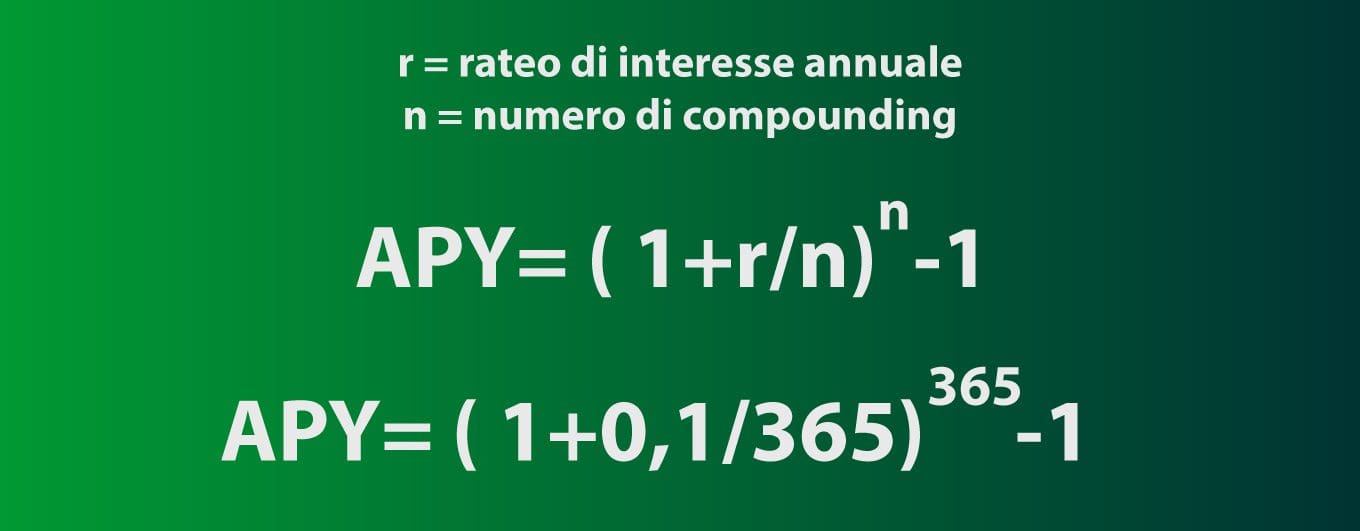

APY stands for Annual Percentage Yield, which is the annual return on an investment including compound interest. Compound interest allows interest to be generated on interest, thus amplifying earnings. Pardon the pun, it was impossible to avoid .

Let us return to the example brought up with the APR.

In that case, the 10 percent per year did not include any reinvestment of the interest earned. At the end of each year, the return would still be the same: 100€ out of the 1000€ initially invested.

Suppose, on the other hand, we now go to take compounding into account.

We always start with 1000€. Let us assume, however, that the interest is paid daily and later reinvested.

At the end of the annuity we will have obtained 1105.15€, with an effective rate of about 10.5155%.

The more frequently the compound interest is paid out, the greater the gain we are going to receive.

Below is the formula and its application to the data used in the example.

"APY = (1+r/n)ⁿ -1 (r= annual interest rate; n= compounding times)"

APR vs APR in the crypto space

When investing in cryptocurrencies we frequently come across APR, APY and compounding. We should always remember these points:

- When the annuity is denoted by APR, there is usually no automatic compounding. We will be the ones who have to reap the benefits obtained and reinvest them. The good thing is that by performing this action often, the interest we are going to collect will be higher than the APR;

- In contrast, in the case of the APY there should be an independent procedure that periodically puts our income into the pool. The amount corresponding to the APY will be exactly what we will get after one year.

Let us resort to an example to remove any doubt: farm in the ETH-USDC liquidity pool, Ethereum coin and famous stablecoin respectively.

If there is no auto-compound, we should proceed in this way:

- Collect the tokens obtained;

- Eventually convert them 50:50 into ETH and USDC. This is usually the practice since annuities are often paid in utility tokens;

- Pour them into the liquidity pool in exchange for LP tokens;

- Deposit the obtained LP tokens in the respective farm.

In contrast, in the presence of auto-compounds, no action on our part will be required.

Automated and non-automated processes can also be found in staking.

Interest rates can also express debt. Borrowing an asset on a given protocol, a negative NET APR will be the annual interest to pay, not to receive.

While the action can safely be conducted manually, what really matters is to check whether the interest is expressed as APR or APY. That way we can make all our considerations correctly and take advantage of the best opportunities available.

On a positive note, there is no need to live with a calculator in hand! If you want to convert APR to APY, or to convert APY to APR, many platforms have built-in calculators, and there are plenty of them on the Web as well.

Conclusions

This little in-depth study draws to a close.

Before studying complex crypto embeddings and strategies, the basics must be crystal clear.

APR and APY are part of these pillars: impossible to have certain numbers in mind while ignoring or confusing these data.

We hope that what has just been written will help you invest in cryptocurrencies in a safer and more informed way.