What is the Nexo Card

Nexo Card has been available since 2022, the result of a collaboration between the well-known CeFi platform Nexo and Mastercard. It is a crypto payment card that allows users to spend without having to sell their digital assets, used instead as collateral for the credit granted.

Typically, a line of credit offers better rates and high limits. On the other hand, however, a credit card enjoys the advantage of being an extremely convenient tool, allowing access to credit at all times. However, this instrument can have restrictions, whereas with a line of credit you tend to plan repayment more flexibly. In short, there are both advantages and disadvantages to both solutions.

Well, Nexo seems to have found a way to combine the two and take advantage of their strengths, namely a card that gives access to lines of credit. As you may have guessed, we are indeed talking about the Nexo Card.

Unique to Nexo, the card allows Nexo users to use lines of credit to finance it, as well as allowing them to leverage their cryptocurrency holdings as collateral to take out new ones.

Before you read on, if you have already decided that you want to add it to your wallet at all costs, you can apply for the Nexo Card here. Let’s continue.

Index

Nexo Card: a few more details

The Nexo Card offers the option of not selling their cryptocurrencies to make purchases, and this is where the breakthrough occurs: fiat currency is offered by the exchange itself. Not to mention some rewards that users can receive as a result of each purchase.

This is a substantial novelty, especially if one were to compare it with other cards linked to CeFi platforms such as Crypto.com’s might be, for example. Specifically, the latter are debit cards, not credit cards. The user must then load funds before making charges, somewhat like one must do with a prepaid card.

Or the Binance Card, which allowed people to pay by having BNBs in their wallet, but only because these were instantly converted to fiat currency. By the way: as of December 20, 2023, the Binance Card is no longer available.

With the Nexo Card, the customer can then make purchases by obtaining a line of credit secured by the deposited assets, effectively accessing a loan. Alternatively, it is of course also possible to switch to the classic debit mode, which allows us to directly spend the currency we have available on Nexo.

Nexo's breakthrough

The Nexo platform acts as an intermediary in the world of cryptocurrency lending.

The company allows its users to earn an annual interest on cryptos deposited on the platform. And the latter lends its customers the liquidity, charging them interest. Their income, at this point, comes from the percentage difference there is between how much interest they pay to the lenders and how much they receive from their customers.

By itself, Nexo has good interest rates compared to its competitors; these can be further increased by 2 percent by receiving the interest in NEXO tokens.

The new crypto card fits into this context and goes to meet the platform’s main product, namely lines of credit that use one or more types of cryptocurrency as collateral for repayment.

Through the Nexo Card, users can have direct access to these lines, thus avoiding the need to transfer borrowed funds to a debit card or bank account.

Nexo Card's details

The card can be applied for free (just order it from the app) and allows you to spend up to 90 percent of the value of the cryptocurrencies you hold.

The interest charged on the credit line starts at 2.9 percent, which is very competitive compared to other credit cards out there.

That’s not all. The card also allows you to make free ATM withdrawals, depending on your level of loyalty. Specifically:

- Basic: up to €200 per month (£180);

- Silver: up to €400 per month (£360);

- Gold: up to €1,000 per month (£900);

- Platinum: up to €2000 per month (£1800).

Exceeding the thresholds just above, a 2% fee (minimum amount €1.99/£) is charged for each additional withdrawal during the month.

The Nexo Card has no periodic or inactivity-related fees. To be eligible for it, the necessary and sufficient conditions are therefore exclusively to keep one’s balance above $50 for the virtual card, and $500 (plus the minimum Gold status, we’ll get to that shortly) for the physical version.

The real strength of the Nexo Card lies in its hybrid operation. So far we have defined it as a crypto credit card; but in addition to this guise, as mentioned, it can also be a debit card: just select the mode on the app according to what we want. The debit mode will allow us to spend fiat currency, just as with a classic prepaid card.

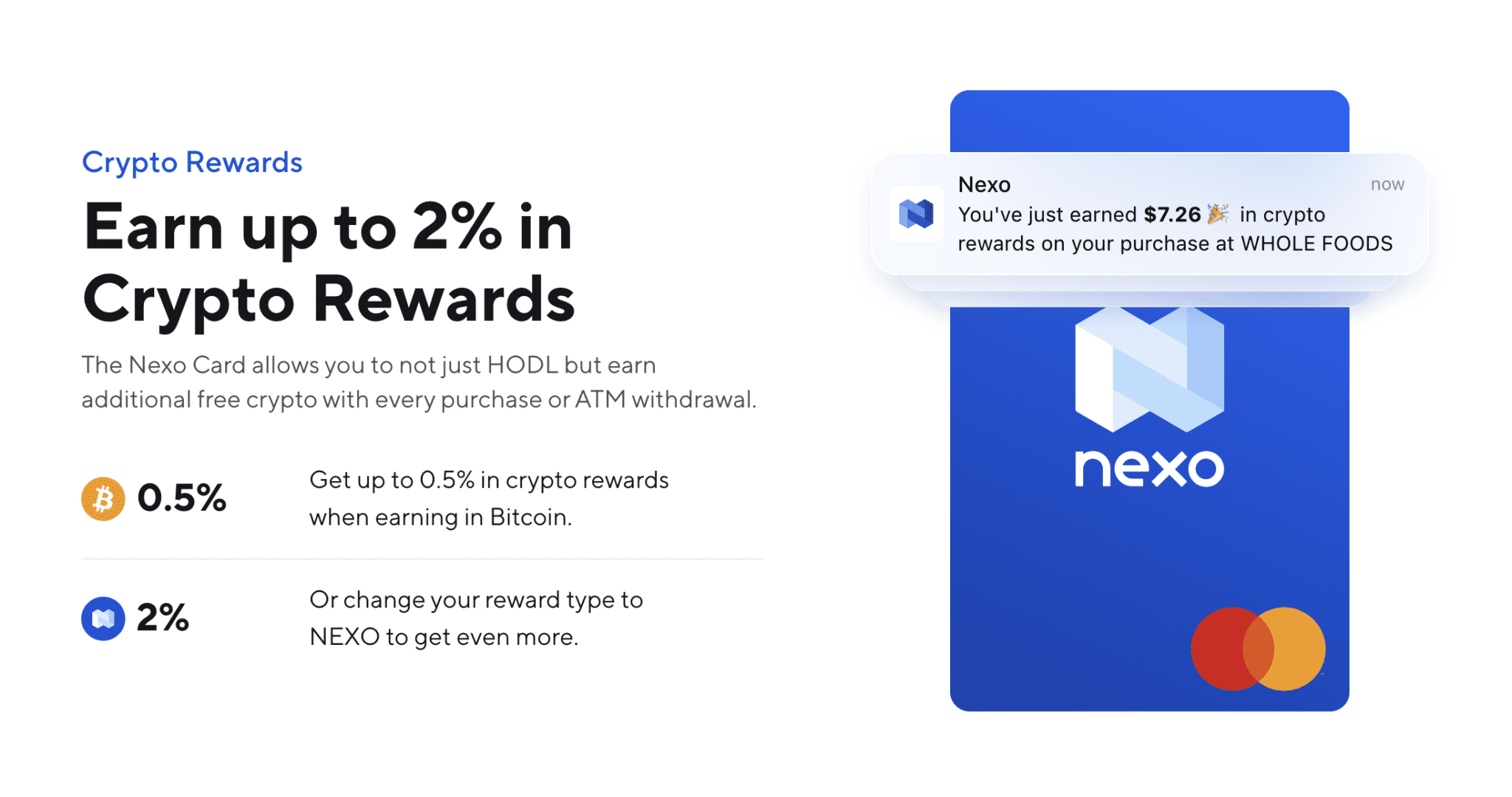

Nexo Card crypto cashback

Then there is a loyalty program that Nexo users are already familiar with. It allows users to get up to 2% cash back on all transactions, dividing into four levels: basic, silver, gold and platinum.

The former offers rewards of 0.5% in the native NEXO token (or 0.1% in bitcoin); the latter offers 0.7% in NEXO or 0.2% in BTC. The gold level gives a reward of 1% in NEXO or 0.3% in BTC; finally platinum, with 2% in NEXO or 0.5% in BTC.

A user’s level depends on the amount of Nexo tokens they have in their wallet balance. Nexo tokens are not required to be in the base level, but at least 1% of the balance must consist of NEXO to be in the silver level. Gold requires 5% and platinum 10%.

These levels also give the opportunity to accrue extra interest regardless of card ownership.

"Loyalty program gives access to various levels of crypto cashback"

How to repay Nexo Card Debt

Let’s see how to repay the debt generated as a result of borrowing for any payment.

The operation is actually very simple: just transfer (or use another payment method) to your Nexo account the necessary amount.

This dynamic brings out an additional detail, which from one point of view is yet another advantage: none of these transactions can be considered a taxable event , since a collateralized loan does not consist of a sale. And if there is no sale there is no capital gain, that is, a taxable circumstance (verify the laws in your country to avoid problems). In short: the Nexo Card makes us spend easy, without getting paranoid about cashouts, accountants and tax returns.

Conclusions

Nexo Card is a valuable tool to keep in our wallet, full of strengths. Of course, it will be up to us to decide whether the ways of using it are right for us, or whether to opt for another card. Click here to sign up for Nexo and apply for your card now.