Bybit exchange: introduction

Bybit is an exchange that was born in 2018, has millions of users, and continues to grow. Its main qualities are the variety of exchangeable coins and tokens and the amount of crypto trading tools available.

Reliability is also high: historically, Bybit is among the few exchanges that do not go down during volatile periods.

The platform includes both spot market (direct buying and selling) and leveraged futures and perpetuals (for more advanced trading: speculative or hedging).

In addition, Bybit provides tools for earning returns on deposits and numerous launchpads, i.e., launches of new cryptocurrencies with potentially excellent gains (but high risks).

Let’s find out about this crypto exchange and explore all its features.

Index

- How does Bybit work? Overview

- How to buy and sell crypto on Bybit

- How to deposit, withdraw and trade crypto on Bybit

- How to withdraw from Bybit?

- Spot trading: how to trade crypto on Bybit

- Types of orders on Bybit

- Futures and perpetuals: derivatives on Bybit

- Passive return on cryptos: Bybit Earn

- Bybit Launchpad

- How secure is Bybit?

- How to receive Bybit bonuses?

- Bybit's fees

- Bybit: opinions and final review

How does Bybit work? Overview

Let’s find out how Bybit works.

First of all, the exchange allows both buying and selling on the spot market and crypto trading on a large number of exchange pairs. Buying and selling can be done in euros, dollars and other fiat currencies, which can also be deposited via commission-free bank transfer (with a small spread), or on the crypto/crypto markets (with BTC or the USDT stablecoin).

The choice is really wide: there are hundreds of coins that can be purchased including, in addition to the main ones, some little-known ones especially from the gaming, gameFi and metaverse sector, an area in which Bybit is very active. This makes it one of the exchanges with the most exchange pairs ever.

Direct buying and selling, both in EUR and on crypto and stablecoin pairs, is referred to as the spot market; in a moment we will find out step by step how it works.

First, however, let’s look at the other features, moving straight to the most widely used and desired one: futures and perpetuals. These are speculative derivative instruments dedicated, therefore, only to professional traders, under pain of getting hurt or liquidated; if used in the right way, they allow the implementation of very interesting strategies.

The collateral can be either a stablecoin (where USDT is used to open and close positions) or with the coin itself, a perfect solution for hedging or amplification positions. The maximum leverage you can trade with on Bybit is 100x.

Moving on, good choice of tools to put cryptos deposited on the exchange into annuity via staking, lending or other platform solutions. APYs vary and are generally very competitive.

Finally, one last interesting feature are launchpads, i.e., initial sales of new tokens, which are distributed directly by the exchange and often already at listing (the time they are put on the market) have very good returns.

There is a lot to remember, isn’t there? Don’t worry: we go into all these points in more detail in the next few paragraphs, so that you can trade completely independently and without the risk of making mistakes.

How to buy and sell crypto on Bybit

Let’s start with the first thing a user usually wants to do on an exchange: buy and sell crypto.

As a very first thing, we obviously need to open an account and verify our identity through the classic KYC procedure. We will then be asked to provide ID, as required by law. If you prefer not to reveal your information (but remember that anonymity does not mean secrecy), take a look at Relai.

One last important and welcome thing: to sign up, use this link to Bybit and you will be eligible for discounts and benefits.

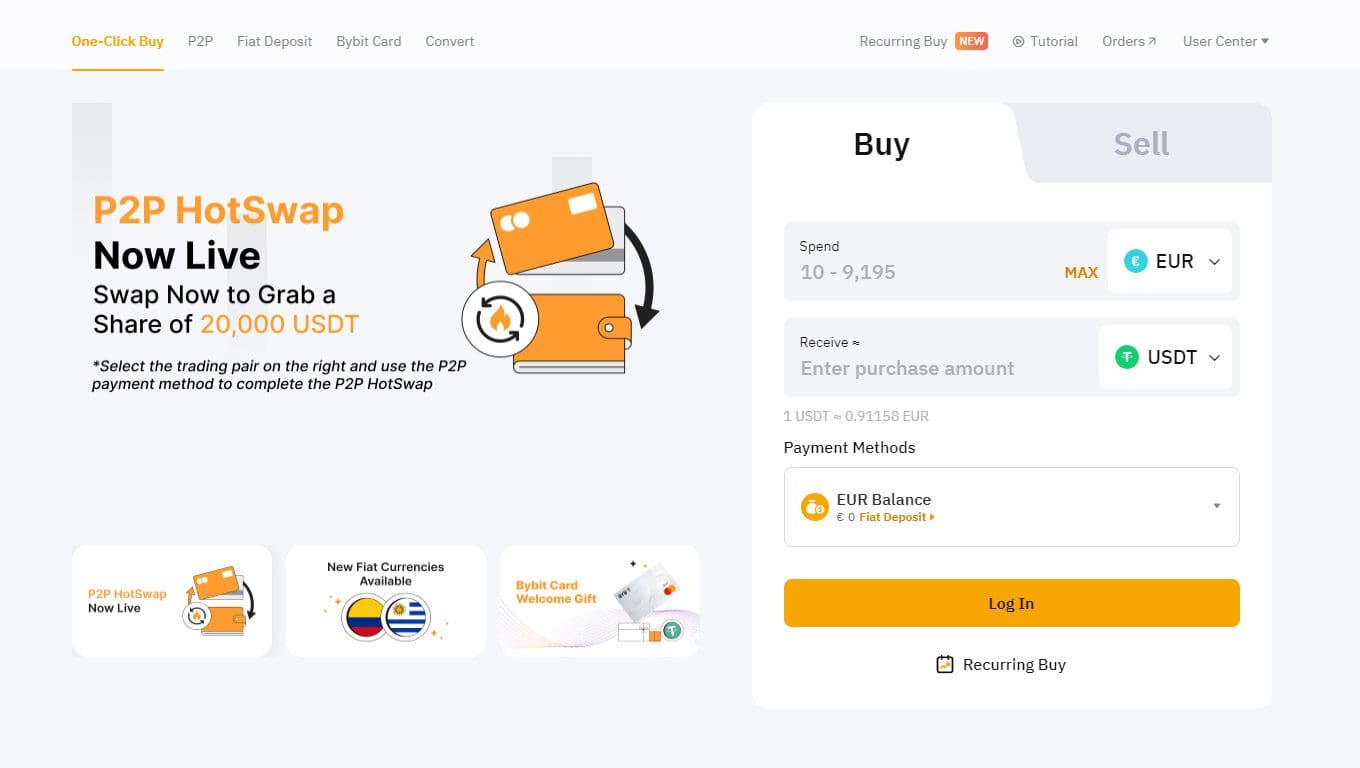

Having completed the exchange registration, select Buy crypto -> One-Click Buy from the main menu:

We will be catapulted to the dedicated page, where we can choose the purchase channel and the crypto we want to buy in EUR. Depending on the chosen channel we can pay by bank transfer or by credit and debit cards; the platform also supports Google Pay. The bank details or data to be entered will be shown to you right after the selection.

Before proceeding, we always take a look at the fees and evaluate the cost-price ratio, also based on our operational urgency.

If you do not find the coin you are interested in in the list, fear not: you can buy BTC or USDT and then, via the spot market, go to the next exchange.

You will find the purchased coin directly in the spot wallet, of course giving waiting for the normal technical times. Let’s not forget that, if you had opted for payment by wire transfer, it will take a few days for crediting to take place.

At one time this was not the case, but today on Bybit you can also sell your cryptos for euros. Therefore, it is not necessary to make a second step through other exchanges.

How to deposit, withdraw and trade crypto on Bybit

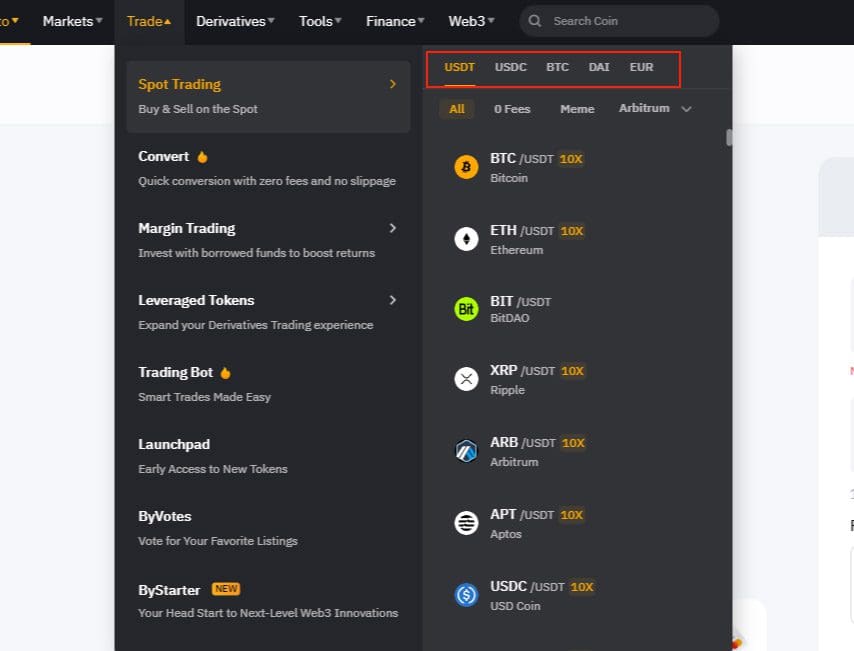

From the Trade menu we can see all available exchange pairs, listed on certain markets: USDT, USDC, BTC, DAI and EUR. To make a trade we must then have one of these currencies, or one of the altcoins listed against them.

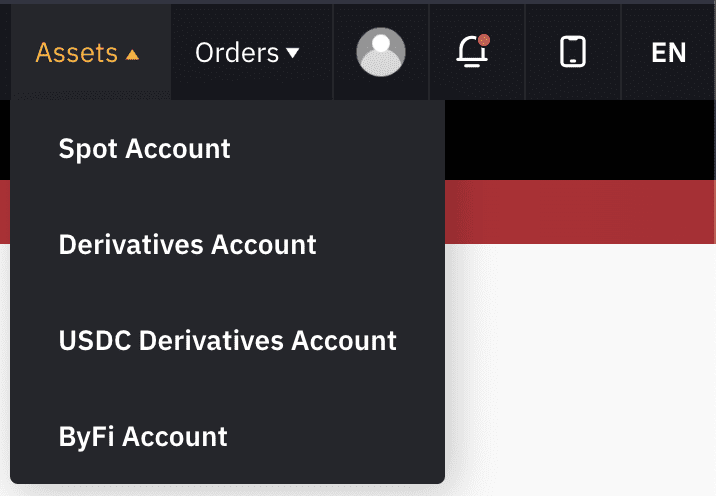

To make a deposit, we access our wallet, which is divided into Spot Wallet and Derivatives wallet.

The former contains the assets we want to use in the spot market (the direct buying and selling); the latter is dedicated to derivatives (futures and perpetuals).

Transfers from one wallet to another (from spot to derivatives or vice versa) are free and instant, so don’t be afraid if you have any doubts about this. Our advice is to always deposit on the spot wallet and then eventually transfer funds.

By selecting Spot account we are catapulted to a list of all the coins available on Bybit, as well as a summary of our already deposited assets. To make a deposit, we select the coin we are interested in by clicking Deposit.

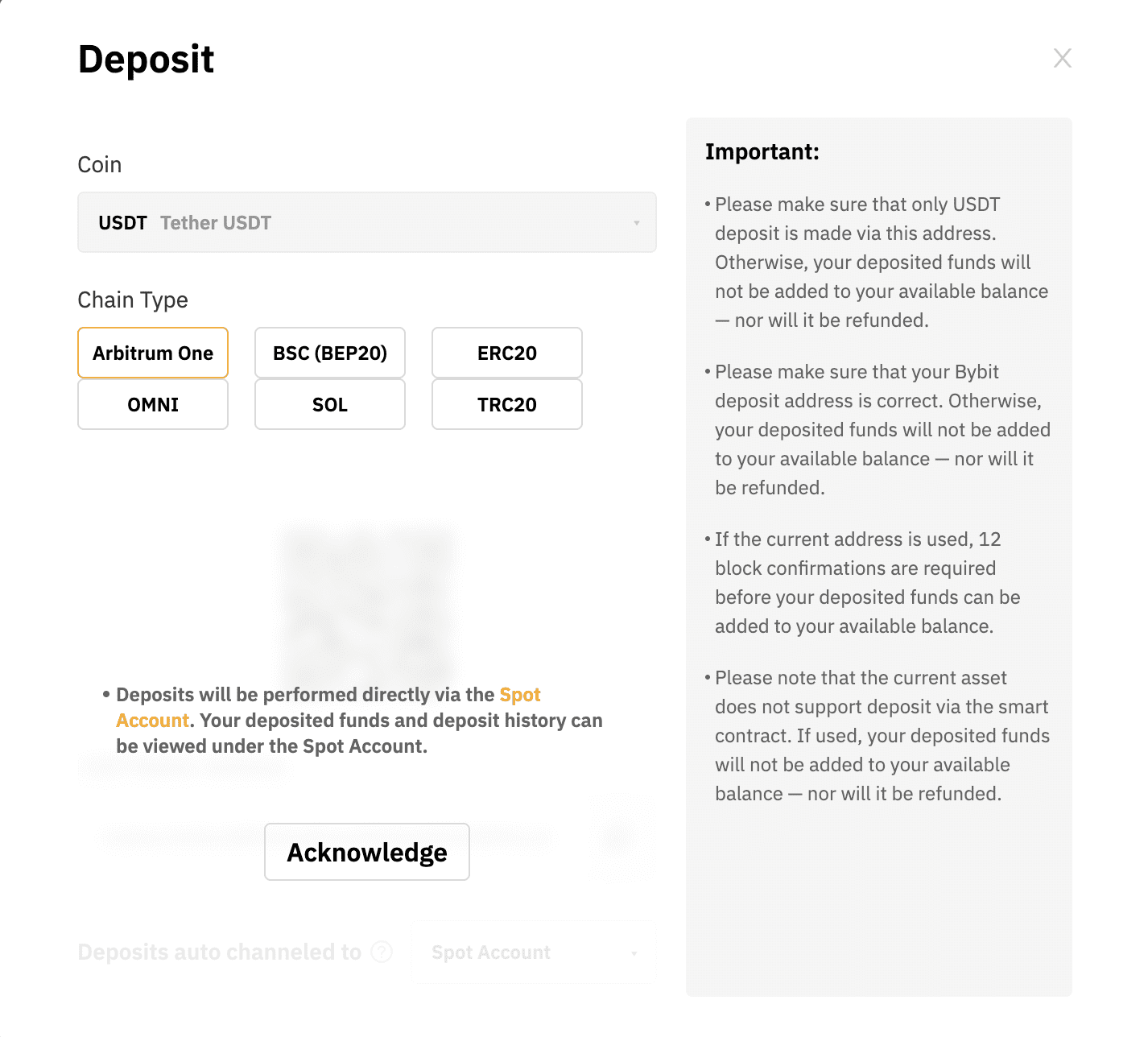

Having done so, we will be asked to choose the chain on which to make the deposit. This operation is most important to do correctly: choosing the wrong chain would risk losing the cryptos involved in the transaction.

We are therefore careful to select the chain that is the same as the one from which we are making the submission. For example, sending crypto via Ethereum network, we choose ERC20; via Tron, we select TRC20 and so on.

The important thing is that the sending and receiving chains match.

Also be careful in case we are sending cryptocurrencies from another exchange, such as Binance. Again, let’s make sure we select the same receiving chain.

Once everything is done and the coins are sent, within a short time the transaction will be finalized and we will find them uploaded to our account, ready to be traded.

How to withdraw from Bybit?

The procedure for withdrawing from Bybit is quite similar to depositing, but it is done in reverse.

We will have a way, from our wallet, to withdraw cryptocurrencies via the Withdraw button. Again, utmost care in matching the sending and receiving blockchain.

In addition, we will also be able to receive fiat currency directly into our account. Warning: by switching from cryptocurrency to fiat currency, if there is a capital gain we may have to pay taxes on our next tax return. Be sure to know about laws in your Country to avoid any problem.

Spot trading: how to trade crypto on Bybit

The spot market refers to the direct buying and selling of cryptocurrencies, whether with fiat currency or other cryptos such as USDT or bitcoin.

If, for example, we wanted to buy a specific altcoin, we would have to use this very section, search for the exchange pair we are interested in and carry out the transaction.

There are three Spot markets on Bybit, listed in USDT, USDC and BTC, each of which could have different cryptos exchangeable. So, let’s first make sure we have the necessary coin.

For example, Dogecoin is only exchangeable with certain cryptos (such as USDT), so we will need to have USDT in our portfolio to proceed with the purchase of DOGE. If we had another coin not paired with DOGE, no harm done: we would just need to make an exchange of that coin with USDT and, later, on DOGE/USDT.

After selecting the exchange pair, we would have to execute the trade. This part requires a little elaboration, as it may be difficult to understand. In fact, the interface that is opened is crypto trader-like, with the various order types to choose from and so on. Let’s look at it together so we don’t get confused.

Types of orders on Bybit

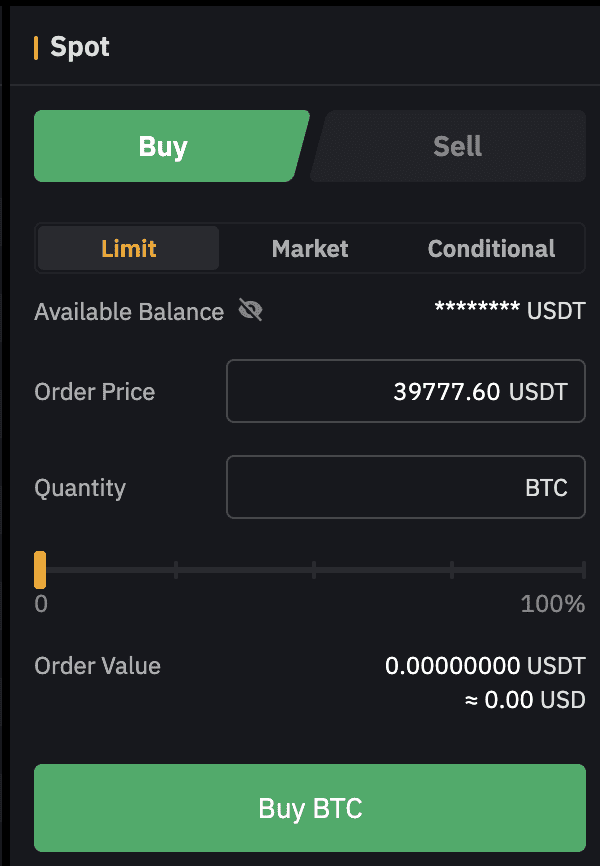

Bybit’s dedicated trading screen is divided into three parts: on the left we see the list of all the available markets; in the middle we have the chart, on which we can do any analysis and drawing as it takes advantage of the TradingView platform; finally, on the right we find the area of our interest, that is, the one dedicated to the insertion and execution of orders. This is what it looks like:

At the top we are allowed to choose between buying and selling. Everything is very simple to notice: when we have selected purchase, the buttons are colored in green, while sale in red.

Just below we have to choose the type of order, and this is where we will have to pay particular attention.

If we simply want to buy or sell a coin at its current price, we will want to select market, so that we place a market order.

By setting a market buy or sell, the only variable to be entered is quantity: how much do I want to buy or sell?

Let’s increase the difficulty slightly and go to limit order, which is very convenient for setting purchases on a lower price, or sales at a profit.

In this case, in addition to the quantity we will also have to enter the price at which I want the order to be executed. This price is called the limit price (also known as the order price).

After setting the order, it will remain in the queue until the price reaches the indicated level; at that point, execution will be triggered. Until that happens we can cancel the order at any time and without any fees.

Finally, we have the TP/SL order, which is effectively equivalent to a stop or take profit order. It is the most complex, requiring three parameters.

First, we will have to indicate the quantity to buy or sell. Next, we will be asked for the trigger price, the level at which the order will be entered. Unlike the limit price, in this case the trigger price can be either higher or lower than the current market price, while the limit price must be higher in the case of selling and lower in the case of buying.

Finally, it is asked whether to enter a limit order once the whole thing is triggered (resulting in a request for the limit price as well), or whether to enter a market order (in this case no other variable is asked, as the execution price will be the market price).

What is this last order used for? Typically as a stop loss: I put the trigger price at the price at which I want to close a losing position (which will be less than the market price) and queue a market order. By doing this, if the price falls below, my position will be closed.

Conditional orders can also be revoked at any time as long as they are not executed.

Futures and perpetuals: derivatives on Bybit

In addition to spot trading, Bybit offers the ability to trade derivatives. This is an advanced operation, dedicated to those who are well acquainted with the world of trading; therefore, if you are just starting out, we recommend that you do not resort to these instruments until you have built up a good body of knowledge and experience.

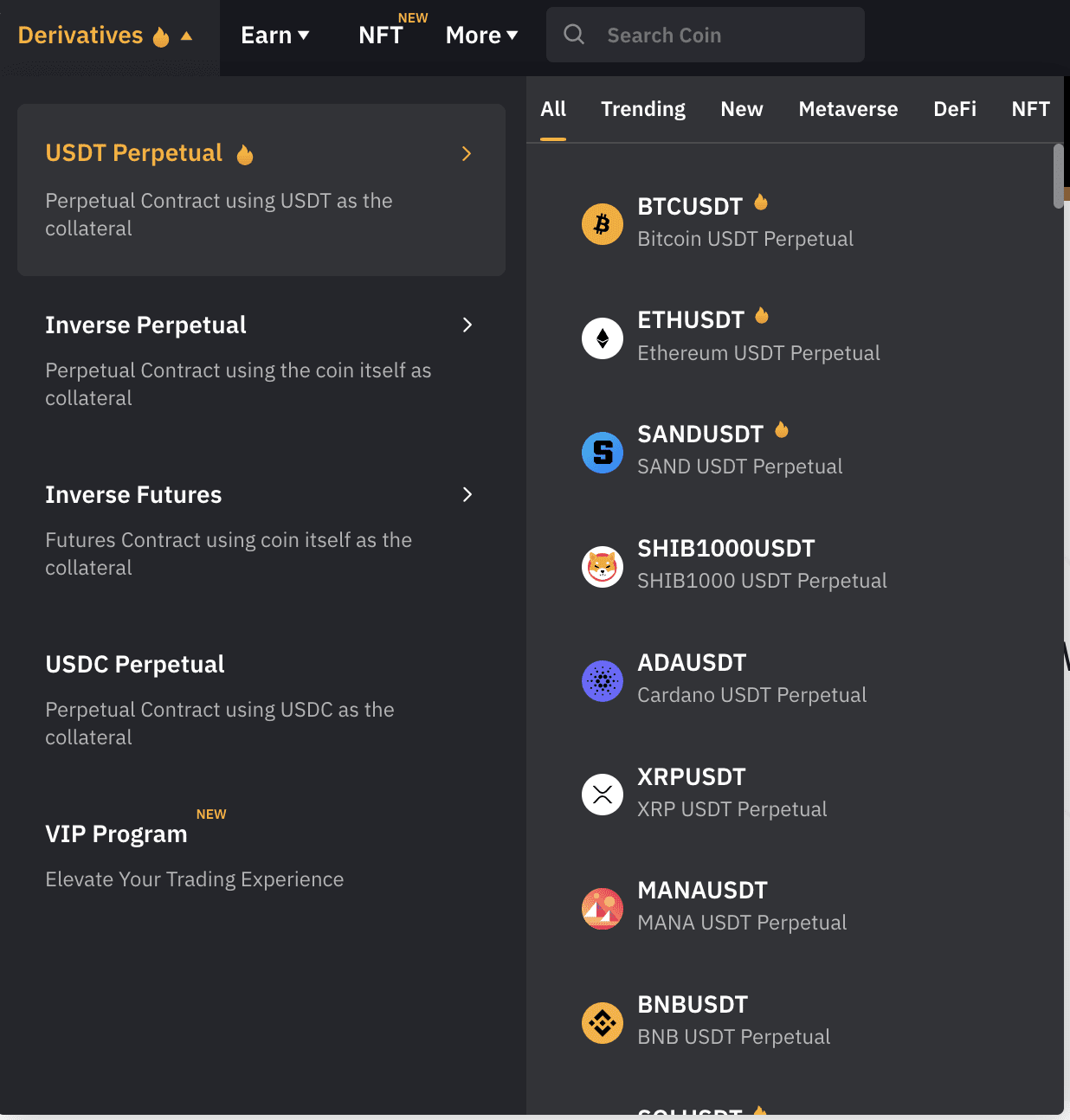

The derivatives offered by Bybit are of two types: futures and perpetuals. They, in turn, are divided into different types based on the collateral provided.

Futures are maturity-based. In fact, they are “bets” on the future price of the underlying asset, specifically the value on the futures contract’s expiration date.

For this reason, their price often diverges from the SPOT price, only to converge again on the day of maturity; this is because the future matures at the price of the underlying asset.

In contrast, perpetuals are derivatives without maturity whose price remains pegged to the underlying due to the funding system.

Every 8 hours, depending on the overpricing, those who opened bullish positions (LONG) pay those who opened bearish positions (SHORT) or vice versa, based on the difference between the price of the perpetual and the underlying. If the perpetual is overpriced, LONGs will pay SHORTS; this provides an incentive to open new SHORT positions by bringing the price back to converge with the underlying. In case of underpricing, the mechanism works in reverse.

What does LONG and SHORT mean?

Trading LONG results in a gain if the instrument rises in price, vice versa for SHORT.

On derivatives you can trade in either direction, which is useful both in speculative terms and for hedging and hedging strategies. For example, one might want to hedge a spot position with a SHORT on futures of the same asset.

Different types of collateral

As noted in the image above, you can choose instruments with USDT, USDC or the same coin collateral.

There is a big difference: with underlying USDT, as long as there are no open positions we are flat, that is, completely agnostic to the market. When we open a position, depending on whether it is LONG or SHORT, we are exposed in that direction.

When we use an instrument with an underlying coin, on the other hand, we have to consider that all the time we are holding it and thus will be exposed to its price change.

If, for example, we open a SHORT on an instrument with the coin as collateral, it is as if we were flat: we would be holding the coin (so we would gain if its price were to rise) and at the same time we would be exposed SHORT (so we would gain if the price were to fall). Doing the math, we would be perfectly neutral.

When planning a position, remember: the profit and loss curve of the two types of instruments is quite different.

Passive return on cryptos: Bybit Earn

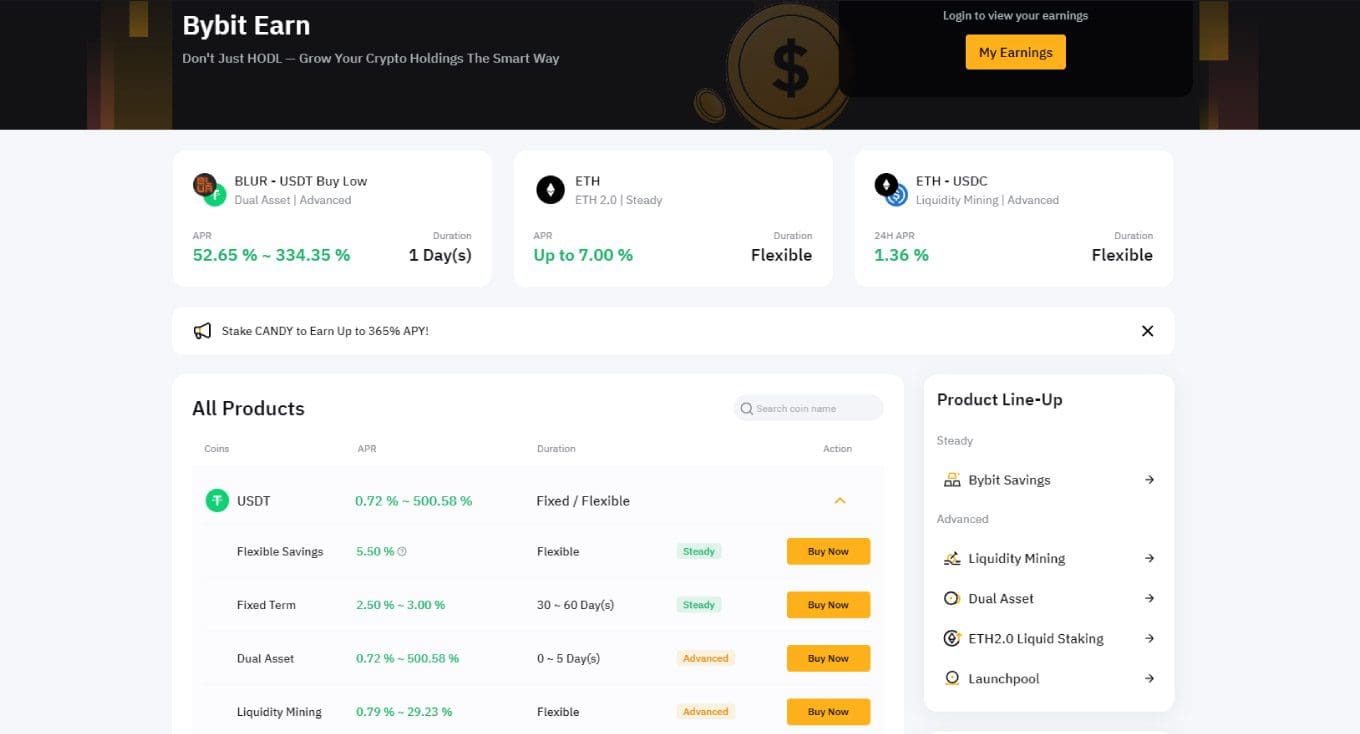

Last but not least, Bybit offers a variety of options for making an annuity on one’s cryptos. They are grouped and shown under the menu item Finance -> Earn.

As you can see from the first line of the menu, the section is divided into categories, so as to make it easier to browse and use the annuity products on cryptos. Let’s look at them one by one and try to understand how they work.

Bybit Savings

With Bybit Savings we can stake different cryptocurrencies in the amount we want and on the terms we see fit.

Really wide choice and relatively low risk. Beware, however, of leaving the funds on an exchange or CeFi: in case of default, we may not be able to get them back.

Dual Asset

This is a kind of option: the product expires on a specific date; if the price of the coin used is below a reference price, you receive the annuity and your collateral in the form of the coin.

Conversely, if the coin has exceeded the reference price, you receive everything in stablecoin.

In this way, should the price of the coin go up a lot, we would have a loss of income. If, on the other hand, it were to go down a lot, we would realize a loss since, in the meantime, we could not sell.

Yes, the platform still pays us an annuity, but this is likely to go by the wayside. In fact, profit is maximized in the event that the coin price moves as little as possible.

Liquidity Mining

This tool relies on DeFi platforms to get the annuity, selecting the safest ones such as Curve.

They usually sell out quickly (the products offered are limited capacity), and last a few weeks.

Launchpool

Very simple concept: deposit one coin and make me another (or the same one). BIT, the token of BitDAO (of which Bybit is also a part), is often employed.

The operating model is similar to Binance Launchpools.

Bybit Launchpad

As on Binance, launchpads, or initial sales of new tokens to be listed later on the exchange, are available on Bybit.

To enter a launchpad, one must lock in an amount in BIT or USDT. Periodic snapshots will then be taken and, at the end, depending on the capital employed and participation, we will get a share of the new tokens available.

Remember that the process is not automatic: cwhenever there is a Launchpad you will have to actively participate from the relevant page.

How secure is Bybit?

It is a secure exchange with several years of experience behind it.

Like many players in the industry, after the failure of FTX there was a decision to pay more attention to the storage of funds and actual availability. However, we urge people to consider that the risk of something going wrong is always there; therefore, we weigh the risk-return ratio carefully according to our risk tolerance.

It always remains a good practice to use exchanges for desired transactions, leaving non-trading funds on one or more noncustodial wallets.

How to receive Bybit bonuses?

Like many cryptocurrency exchanges, a Bybit bonus is available to reward new users. By using our Bybit referral code, you will be eligible for increasing benefits based on your trading.

Sign up for Bybit and take advantage of offers reserved for readers of The Crypto Gateway now.

Bybit's fees

This centralized exchange offers affordable and attractive fees for all categories of investors. This point, combined with the great selection of crypto products and assets, makes Bybit one of the best choices available to investors.

The exchange’s fees are presented on the dedicated page of the official website.

Bybit: opinions and final review

Summing up and reflecting on the user experience we have on this exchange, we feel like saying that it is one of the best currently existing.

The main reason lies in the abundance of products and cryptos available, combined with the huge volume and liquidity, as well as the reliability of the platform. In fact, even during the hectic phases of the market, it never demonstrates instability.

Bybit fees are very low, EUR can also be deposited and it allows advanced operations thanks to derivatives (perpetuals and futures).

In short, it lacks nothing and there is no reason not to use it.