Leggi questo articolo in Italiano

Bitcoin: the number one cryptocurrency

By Luca Boiardi

Let's find out how bitcoin (BTC) works and the whole world around it: miners, Proof-of-Work, Satoshi Nakamoto and more...

Introduction to the bitcoin cryptocurrency

How do bitcoins work? If you have opened this in-depth study, you have probably asked yourself this question at least once in your life.

The bitcoin cryptocurrency is the first ever, created back in 2008 by a person still unknown, known by the pseudonym Satoshi Nakamoto.

The goal was to start a network on which peer-to-peer payments could be made, free of intermediation and without having to depend on a central server. To do this, Satoshi based the entire infrastructure on blockchain and cryptography, starting a real revolution.

In the next few paragraphs we will cover the topic as extensively as possible.

To begin with, we will provide a definition in simple words.

We will then see how the Bitcoin blockchain came into being. Unfortunately, we will not be able to answer the question “who is Satoshi Nakamoto?” an almost legendary person who is still shrouded in mystery after a good 15 years.

Next we will move more into the practical. We will see what bitcoins are and how they work, focusing mainly on the topic of blockchain and miners.

After that we will be able to understand what bitcoins are used for, exploring the various use cases known to date.

We will see where you can make a payment with bitcoins and where to buy them, introducing the figure of cryptocurrency exchanges.

We have plenty to talk about: let’s start with the definition of bitcoin.

Index

What are bitcoins?

Bitcoin, usually abbreviated to BTC, is the most famous and capitalized cryptocurrency in circulation, as well as the first ever.

It is a real currency, present, however, only in digital form. It can exist thanks to the structure that underlies it: the blockchain. We will go into more detail on this topic before long.

The value of bitcoin is given by several factors that we will explore later. However, blockchain and innovativeness give it a decidedly remarkable growth potential.

To date there are just over 19.4 million BTC (now you know how many bitcoins exist). The maximum supply is immutable and set at 21 million, a number we will reach in over a century, around 2140. Considering that a good percentage of it has been lost, scarcity is certainly an element that gives additional value.

Let us, however, find out more about the birth of BTC, and then delve into the more technical aspects.

BTC: a bit of history

Let’s discover some bitcoins history. The idea of Bitcoin was born on October 31, 2008, the day the whitepaper signed under the pseudonym Satoshi Nakamoto was published.

A term widely used in the cryptocurrency world, the whitepaper is a summary document that technically explains the project, its purpose and execution.

Satoshi described the method of creating and maintaining a database containing financial transactions, which has a twofold special feature.

First, to be validated and finalized, the transactions did not require any guarantor or intermediary. Exactly the opposite of the classic circuits we exploit on a daily basis.

In addition, the database itself was replicated and kept updated in real time on various nodes of a network, so that it did not depend on a single central server.

Thus, a system was being outlined that was free of controls but at the same time secure and non-manipulable. We would like to make an addition, dispelling a false myth: by “freed from controls” we mean that no one will be able to censor us; however, every transaction is perennial and can be followed by anyone. It is therefore difficult to withdraw funds without losing anonymity, which is instead thought by those who are not familiar with the blockchain technology behind cryptocurrencies such as bitcoin.

Staying on the topic of security, the Bitcoin whitepaper also described how to avoid double spending, one of the main obstacles in the world of electronic currency.

This concept refers to the ability to spend the same unit of value twice. When the currency is physical, it is easy to avoid this problem: the spending itself implies that the transferor no longer owns the amount. Instead, when the currency is virtual, a method is needed to authenticate it and make it somehow “unique.” The blockchain makes this possible; in the following paragraphs we will delve into the various technicalities.

The other key point described in the whitepaper concerned the method of issuing Bitcoin, as well as the flow.

Unlike a Central Bank-which can issue currency at its own discretion, like the FED, the rate at which new bitcoins are created is defined within the relevant source code. As we said, there would never be more than 21 million. Issuance would decrease over time, halving every 4 years or so (a phenomenon called halving bitcoin). According to these numbers, the last fraction of bitcoins would be issued in the year 2140.

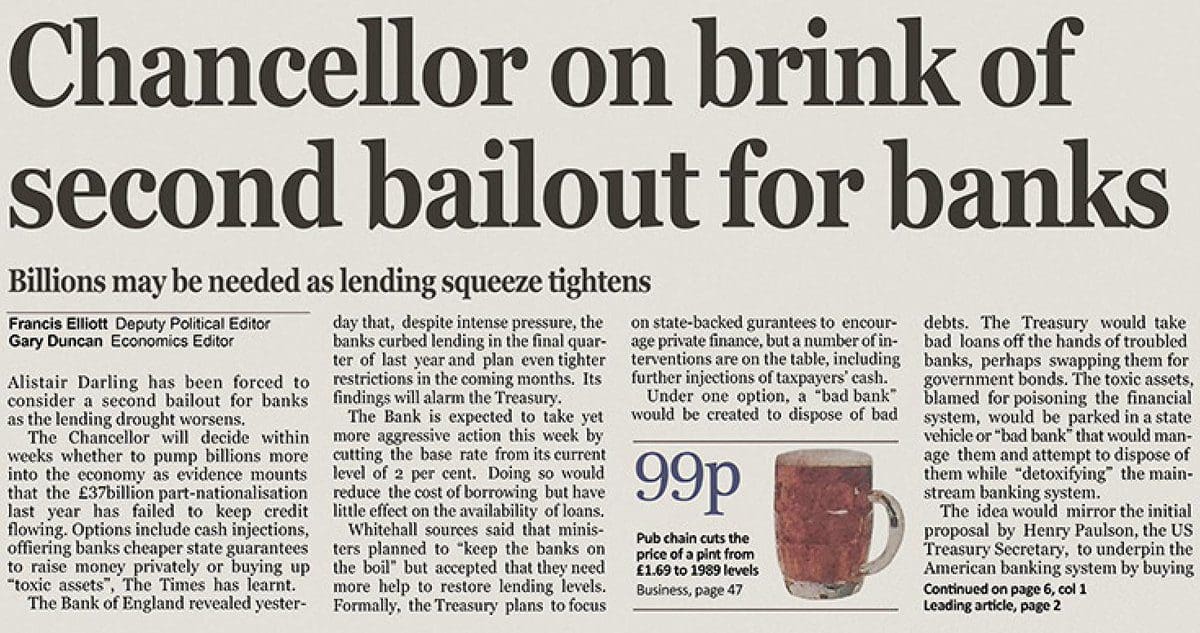

Fun fact: Bitcoin’s genesis block, or the first block of its blockchain, contains a very significant sentence. It reads “Chancellor on brink of second bailout for banks.” This was the headline in The Times magazine of January 3, 2009, the day the genesis block was created. The period was the aftermath of the 2008 financial crisis, during which the debts of risky banks were nationalized through so-called bailouts.

Bitcoin was born like a phoenix from the ashes of that malfunctioning financial-economic system, offering for the first time in history an alternative. Therein lies the big change: no longer a currency managed by a few but a free, decentralized asset capable of breaking down diversity.

Now that we know a bit of history, let’s roll up our sleeves and get more technical.

How much was bitcoin worth when it was born? Initially, BTC had almost no value. After that, it went from a few cents to tens of thousands over time… a very good investment, no doubt about it!

How does bitcoin work?

Bitcoin how do they work? To answer this question, we need to focus on two key elements: blockchain and cryptography. Only then can we be clear about the process that governs how Bitcoin works. Let’s get to it!

The Blockchain

We can imagine the blockchain as a huge database containing various tables of data. It is divided into many units called blocks.

In the Bitcoin blockchain, a new block is added every 10 minutes or so. In this way, a “chain” is created in which each link (precisely the block) is independent but indivisible from those who precede it and those who follow it. Hence the name blockchain. Within this database are all Bitcoin transactions, from genesis to the present.

What distinguishes the blockchain from a traditional database is that it is distributed over all the nodes participating in its network. By doing so, even if one or more nodes are unreachable there will always be some active ones. The system thus guarantees perfect stability.

In addition, there is no central controller, i.e., a server that coordinates activity. Transaction validation is performed by the nodes in a democratic manner, following a distributed consensus algorithm called Proof-of-Work, to which we will return.

Another feature inherent in blockchain is transparency: anyone can read the data contained within it at any time. This is also why you can easily validate transactions: just check that the sender can afford to spend those BTC and that the signature is authentic, nothing more. To understand the concept of a signature, we need to talk about cryptography, so bring some more patience, it will be worth it!

Last peculiarity of the blockchain, already anticipated a few lines above, is immutability. Once blocks are validated, changing one becomes more and more expensive with each new block that follows. We will better understand why after we clarify the concept of mining, don’t worry. For now, just keep in mind that it is this aspect that makes the BTC chain one of the most secure structures around.

Let’s shift the focus to cryptography so we can continue to put the pieces of the puzzle together.

The Cryptography

Bitcoin is made secure and reliable by cryptography.

When we send BTC bitcoins (or fractions thereof) to someone, the private key that holds them is a must. It is an alphanumeric string that allows us to spend our bitcoins, a kind of fingerprint with which we sign the transaction.

A private key is associated with a public key, also called an address. The latter is derived from its private key through an encryption algorithm called ECDSA (Elliptic Curve Digital Signature Algorithm). It has the peculiarity of being non-reversible: from the public key one NEVER gets to the private one: possession of the private key allows one to spend the bitcoins associated with it.

Finally, another key feature: it is possible to verify the authenticity of the signature even without having the private key. This is how nodes validate transactions so easily.

To sum up: thanks to cryptocurrencies we can sleep soundly, knowing that our BTC are safe.

How does bitcoin mining work?

Who creates bitcoins? Who are the miners? We have finally reached the point where we can answer that question.

Mining is how new blocks are created and validated, increasingly expanding the distributed ledger of the blockchain. Miners are those who provide special computers to bring the process to life.

The star of the scene is called Proof-of-Work, the distributed consensus algorithm based on energy consumption. Each node involved in the mining procedure has to solve a probabilistic calculation, a real labor of effort. All while competing with other miners.

We can imagine mining as a continuous drawing of numbers from an urn containing millions of millions, until someone draws one less than a certain threshold. This level is a dynamic parameter, changing as the number of extractions performed in the unit of time changes.

A block of Bitcoin must be created every 10 minutes.

In case more numbers are started to be mined (out of our metaphor it means that the number of miners increases) it would risk taking less time. Consequently, it becomes necessary to increase the difficulty of the probabilistic calculation, so as to ensure that the correct timing is met. Everything is automatic: the system is specially designed for this purpose.

The extraction we are talking about is actually hashing. The function takes an input and outputs its hash, a random alphanumeric string 256 bits long.

Here you will find a SHA-256 calculator to convert anything you want to write into a string. The same input will always generate the same output, which makes the string easily verifiable.

The first miner to find a hash less than the threshold (example: hash starting with ten zeros) wins. Each node will then have to work hard to compute as many hashes as possible in the shortest time.

Initially it was possible to be competitive even with a simple PC to mine bitcoin. Over time, machines (ASICs) were invented that were optimized to perform as many hashes as possible per second. In doing so, the difficulty soared; therefore, today it takes many more hashes to find the solution and validate a block.

Each time a block is mined, the validator receives Bitcoins (BTC) as a reward for their hard work.

To make it possible for even less powerful miners to participate in the network, there are so-called pools. Into them flows the power of all participants, coming to validate blocks far more often than individual miners. Once the block is mined and the reward is received, it is distributed to all pool participants in proportion to the computing power of each.

In fact, nowadays all miners rely on pools, otherwise they would rarely collect rewards.

"Bitcoin mining is how new blocks are created and validated"

Bitcoin value: where does it come from?

The price of BTC bitcoin is trivially decided by supply and demand. If buyers outnumber sellers, the price goes up. Conversely, if sellers outnumber buyers, the price goes down. This is how it works for all financial assets: from stocks to precious metals and commodities such as gold and silver.

However, the price rarely mirrors the value of the underlying asset. This is due to the huge speculation component.

In cryptos, we know, it is dominant, which is why one has to be careful in phases of euphoria, or else buy at exaggerated prices. At the same time, one must be cautious and analyze each project carefully: it is easy to be tempted by something that has no intrinsic value.

But the questions now are more: beneath the layer of speculation, What is the intrinsic value of BTC? What is it given by? What is bitcoin used for?

Bitcoin began as a decentralized medium of value exchange, establishing itself over time also as a store of value, a safe haven asset with which to guard against inflation and diversify one’s portfolio. Therefore, the better it fulfills these tasks, the greater its value will be.

Speaking of the use of bitcoins as a form of money, the main variables at play are trust and adoption by people, companies and merchants. The more they grow, the more successful bitcoin will be as a currency.

Scaling technologies, such as Lightning Network, also help in these terms, as they make small payments cheaper and faster.

Historically, we have seen a growing trend in adoption, trust and volumes on Lightning Network. We expect it to continue in this direction. If you would like to explore this topic further, you will find a video on LN at the end of this paragraph.

To the question “what can I buy with bitcoins” we could potentially answer “Everything!”. In fact, bitcoins lend themselves to being spent in any context; it all depends on how much sellers and buyers wish to rely on them.

As a store of value, bitcoin’s value comes from scarcity and its demand as a financial asset.

The scarcity datum is mathematically defined and unchangeable. Demand depends on bitcoin’s desirability to investors. That is, is it easy to invest in it? Is it worth doing?

Demand increases (and desirability improves) as “traditional” financial vehicles move toward bitcoin.

A fund or company will not feel like buying bitcoins on Binance and holding them in a wallet: it is too difficult and risky. Therefore, they will look for an ETF, ETP or similar product.

The more companies and large funds publicly invest in bitcoin, the more bitcoin will become a strong asset in terms of reputation, fueling a positive feedback loop. At the moment, this trend is also blatantly growing and is led by MicroStrategy, an American company founded by Michael Saylor.

So we can say that, for now, Bitcoin is succeeding on all fronts. About the future, is bitcoin a good investment? We cannot know but we want to be optimistic.

Well, then, how to buy bitcoin? If you have done your research and are convinced that the quintessential cryptocurrency may be right for you, let’s find out where to buy bitcoin.

How to buy bitcoin?

We have several ways to buy bitcoins.

First of all we mention the centralized exchanges, real companies in the industry where we can deposit traditional currency and buy coins and tokens.

Among this category we find giants such as Binance, OKX, Bybit and Bitget, companies that make billions of dollars every year thanks to the fees they charge for each transaction. Fortunately, it is possible to keep these costs down through referrals; if you want to sign up for an exchange, do so using one of our referral codes so you can save money. Here they are:

- Binance: 20% fee discount and $100 rebate on first commissions paid;

- Bybit: variable bonuses based on deposits;

- OKX: get mystery boxes worth up to $10,000;

- Bitget: 15% rebate on fees and up to $8,000 bonus.

You can also buy bitcoin from other CeFi (Centralized Finance) entities. Of these, Nexo is one of the best known.

For those who already own cryptocurrencies, DEX (Decentralized Exchanges) are a viable option.

Finally, there are applications such as Relai that allow you to buy bitcoin easily, securely and without providing sensitive data.

You can check out our in-depth review on Relai, where you will find our code GATEWAY that will entitle you to a discount on fees.

"Exchanges like Binance are cheap and allow us to buy bitcoin in simplicity and security"

How much does it cost to buy bitcoin today?

Where to follow the bitcoin to us dollars price? And what about BTC/EUR? The sites available abound.

The best known are CoinMarketCap and CoinGecko, websites specialized in cryptocurrencies that offers all the informations we need.

From here you can view the bitcoins price against US dollar or other fiat currencies.

CoinMarketCap and similar portals offer bitcoin dollar exchange rate in real time. However, if we wanted to have something more professional on our hands, we should turn to TradingView, the reference platform for technical analysis.

TradingView allows us to consult real-time charts on stocks, indices, commodities, Forex, economic parameters and, of course, cryptocurrencies. An indispensable tool for any investor and trader at an absolutely competitive price.

How much is 1 bitcoin now? Here you can find the real time chart (Bitcoins to us dollars price by TradingView).

What happens if I invest 100 dollars in bitcoin?

Before we close, let’s answer smilingly one of the most searched questions ever: how much do I earn if I invest 100 dollars in bitcoin?

We believe in well-thought-out investments that require experience, study and time. We are not for waves of elation that put capital at risk. Therefore, here is our answer.

It is not possible to determine a priori how much an investment will yield, whether it is 100, 100,000 or 1 dollars. Certainly, should things turn out for the best, the greater the initial investment, the greater the gain will be; at the same time, this will also be true in the event of slumps and losses.

We can also say with sufficient certainty that 100 dollars will not be enough to change lives: the days when it was possible, at least with bitcoin, are long gone.

Reasoning logically, if BTC were to go up quite a bit in valuation, we could achieve really interesting gains. If from 100 dollars we could, for example, make a total of 200, that would be a very high performance of 100 percent, something you don’t see every day.

In short, it’s okay to dream of a better future, but be careful about overdoing it. There are no limits as long as you have three essentials: knowledge, experience and, above all, patience.

How much will bitcoin be worth in 2025?

What will happen in the future? What will be the value of bitcoin in 2025? We wish we could answer these questions but the market will decide.

However, it seems that the adoption of blockchain is something inevitable. As a first mover, bitcoin should retain an important role in this new scenario.