Leggi questo articolo in Italiano

Bitcoin climbs global rankings, and does so via blackrock

By Daniele Corno

October closes in green. Bitcoin touches ATH and climbs the world rankings. Blackrock's Bitcoin spot ETF, IBIT, reaches new RECORD

Record volumes and price on highs in October

The month of October has come to a close and Bitcoin demonstrates its strength. With11 percent net growth, BTC is approaching its ATH and the market is watching.

The monthly close is the second highest ever, with a price of $70,200, preceded only by the March 2024 close, when the price closed at $71,300, only $1,000 higher than the current close.

Monthly volumes are huge, only on Bitcoin, according to Coinmarketcap reports , volumes traded are over $1.25 trillion, almost equal to Bitcoin’s total market capitalization. About 80 percent of the volumes come from the derivativesmarket , while only about 20 percent are related to the SPOT market.

Volumes on Bitcoin ETFs in October are just over $45 billion, a value still far from the total traded, but scaling rapidly in comparisons to the SPOT market trades.

Bitcoin buyers today switch to Blackrock

In the month of October, ETFs made staggering numbers. In fact, over $5.4 billion was added to the AUM (assets under management) of ETFs.

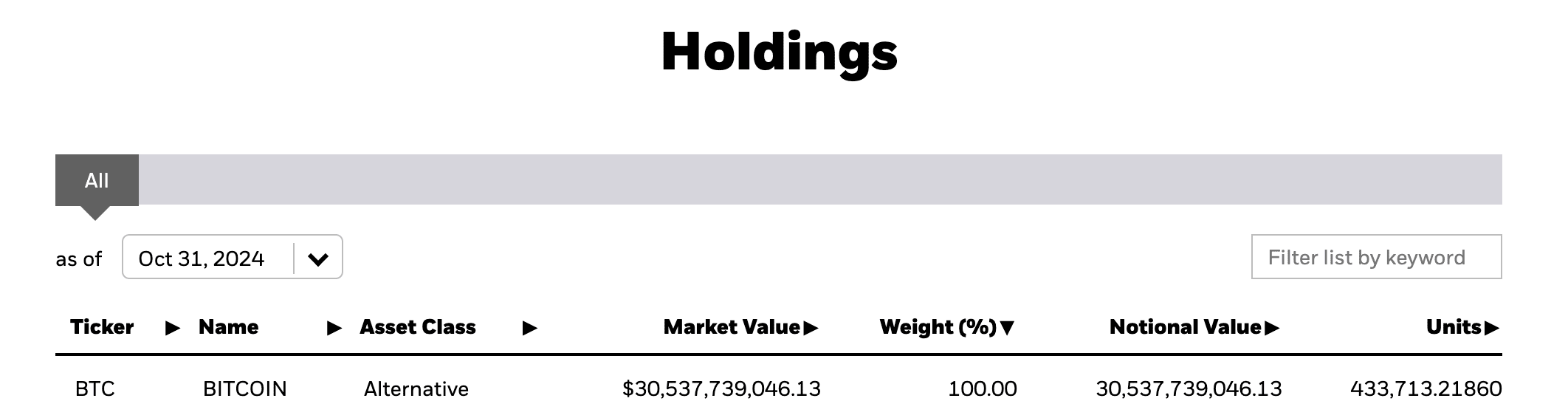

The truly impressive figure is that almost all of it, $4.6 billion, entered the market through IBIT, Blackrock’s ETF, which currently, has over 433,000 Bitcoins under management.

Therefore, with this AUM, exceeding $30 billion, the IBIT ETF ranks in the global rankings.

In the global ranking of ETFs , which is dominated by SPY, the main benchmark ETF for the Standard & Poor’s 500 Index, IBIT ranks sixty-seventh. This figure highlights the importance that the market and investors attach to Bitcoin, in fact placing IBIT in the top global rankings.