Leggi questo articolo in Italiano

Bitwise: Bitcoin “insurance” against global debt crisis

By Davide Grammatica

With the debt of major global economies skyrocketing, Bitwise says Bitcoin could become valuable “insurance”

Bitcoin's prospects in the face of global sovereign debt

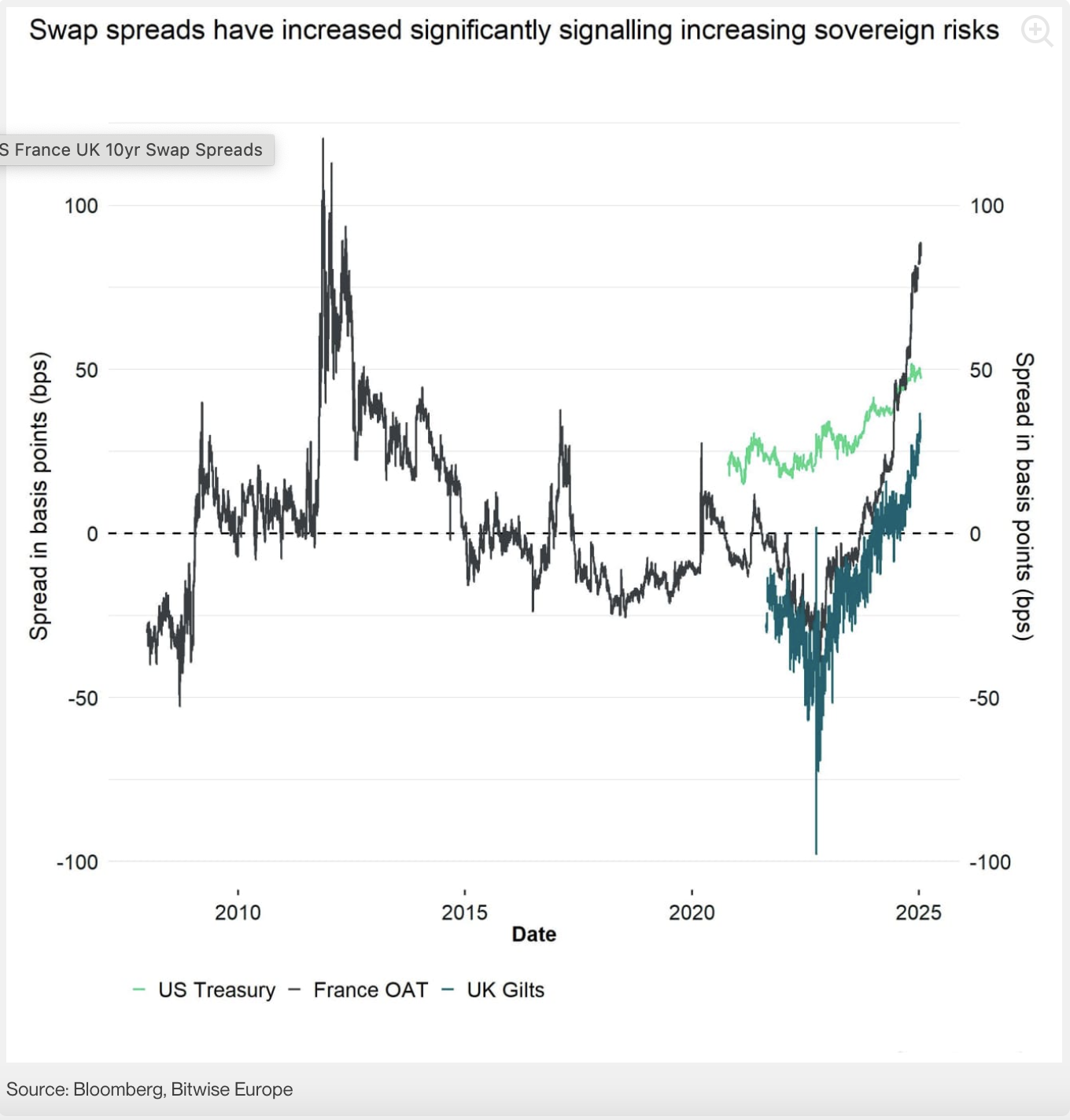

The world’s major economies, starting with the U.S. economy, have been facing significant growth in recent times in risks derived from rising sovereign debt. And in the face of a steadily rising fiscal debt-to-GDP ratio, an asset like Bitcoin could find fertile ground to thrive, according to Bitwise.

In a recent report, the financial manager’s analysts even suggested that Bitcoin could exceed $200,000 in an environment where the asset would be leveraged as “insurance ” against potential defaults.

“Sovereign default risks have increased globally,” the report reads. “And the fiscal health of several countries is becoming worrisome for bond investors.”

But Bitcoin, in this new Trump era, faced with market uncertainty, could behave differently than it has in the past, perhaps acting as a hedge against default itself.

According to a theoretical model reported by Bitwise, in which Bitcoin acts precisely as “insurance,” BTC could touch $219,000.

Trump's new “fiscal” challenges

Playing in favor of the first cryptocurrency is its decentralized nature, as well as its independence from governments or financial institutions, and these would be factors that alone would cover the collateral risks derived from its volatility.

It is precisely BTC’s volatility these days that seems to worry investors, as the asset, despite its latest upward movement, is also registering an increase in the latter. But on a more general view, the most optimistic think that Bitcoin can benefit from an environment in which global economies, starting with the U.S., are approaching their “borrowing limits”.

It is no coincidence that, just in recent days, Fitch Ratings has expressed concerns about Trump’s new fiscal policies, threatening a new downgrade of U.S. debt.