Introduction to copy trading

Among the tools available to us in the crypto world, copy trading is definitely worth looking into.

The careful trader is constantly looking for new methods to maximize profit, or to decrease risk. The topic of this article follows this path, but beware: there are still dangers; there is no guarantee of success.

We will shortly find out what copy trading is, analyzing its pros and cons. We will then look at Bybit and Bitget, two platforms that offer it to their clients.

Our focus will obviously be geared toward the world of cryptocurrencies. However, copy trading is also widespread on other types of assets such as forex, stocks, commodities and futures. Therefore, what we will see will also be of interest to those trading outside crypto.

We can begin: in the next section we will understand what copy trading is on cryptocurrencies, highlighting its risks and opportunities.

Index

How does copy trading work?

The name is enough to spoil the answer: copy trading is a mode of operation that allows users to copy the actions of another trader.

This system works in a totally automated manner. The user only has to choose which trader to copy, as well as allocate a certain amount of funds. After that, everything proceeds on autopilot.

Let us imagine that we decided to copy trader ABC. If he/she were to set a short position on bitcoin, we would also do the same thing automatically. The moment the trader were to close the position, we would follow suit. Plain and simple!

A point in favor of this operation lies in capital management: the trader we copy will not have any access to our funds, as could happen with other instruments. Everything goes through the trading platform.

Copy trading is not to be confused with other practices. For example, there is also social trading, but it is not the same thing: it is one thing to follow a user’s performance, comment on it, and discuss it; it is another to tell a platform “okay, copy pari-pari everything he does”. We can see copy trading as a type of operation that falls under the broader social trading umbrella.

Now, however, we might ask why we should consider copy trading. Let’s answer right away.

By choosing the right pattern to copy, we can make a good profit without having to spend hours analyzing charts and setting up strategies. The right trader achieves high performance and we with it.

There, it all sounds beautiful but it is not so.

First of all, by copy trading we give up control to someone else. That might be a good thing, however in investing we think it is essential to take responsibility.

In addition, copy trading seems perfect for inexperienced or beginners. On the one hand, this may be true; however, on the other hand, there is less understanding of the tools: copying another person lacks the whole set of actions that give awareness.

Moreover, the copied trader may achieve losses, no one is immune. Herein lies the importance of our experience: with the right background we would know how to evaluate his moves in advance, assessing their riskiness. The latter should be aligned with our risk profile, otherwise there would be no point in continuing.

In short, copy trading should be seen as one more method to differentiate the investment portfolio. We could allocate a portion of the trading quota to this instrument, so as to benefit from any positive performance. Forbidden, however, to go all-in, that would be foolish.

Before proceeding, we repeat, we analyze the data of the trader we wish to copy. We evaluate each number and action and then decide whether it actually reflects our ideas. We continue to monitor and study, standing ready to take action if necessary.

Copy trading can only be useful if it is followed. Abandoning it to itself would be dangerous and devoid of useful experience.

An alternative to copy trading is precisely the aforementioned social trading, limited to observation. Comparing and poking around what others are doing offers meaningful insights to evaluate our strategies. Looking at things from different points of view is always valuable. However, one point remains: choose with your own head.

Let’s move on to crypto platforms that offer copy trading to their clients. Let’s start with Bybit!

Bybit copy trading

Bybit is a popular crypto exchange that we have also talked about several times in videos on the TCG channel.

A platform known for its generous bonuses to new users, Bybit offers a variety of products and tools including spot crypto market, margin trading and bot trading. Of course, we also find copy trading, accessible from the main menu under Derivatives.

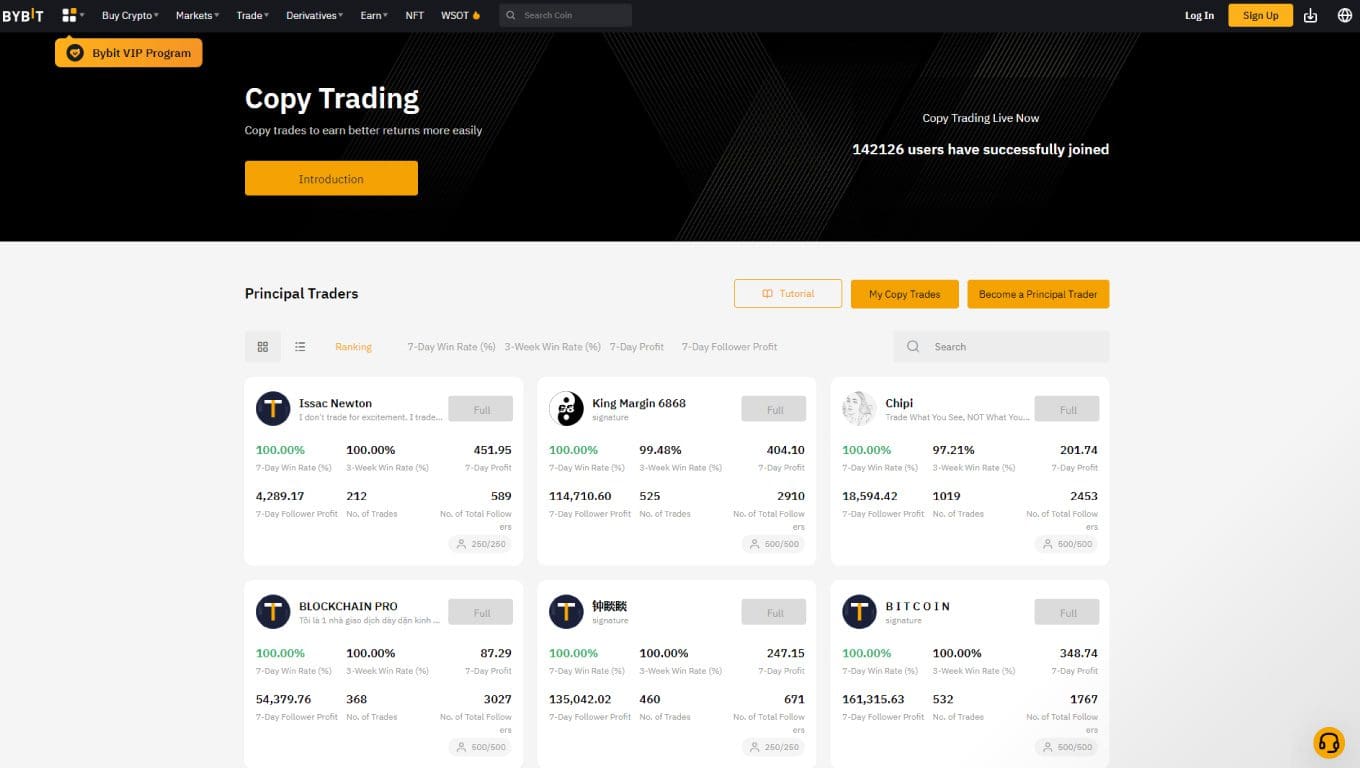

This image is what is presented to us on the screen.

Starting at the top, clicking on the button labeled Introduction takes us to a comprehensive information section. A tutorial is also offered that answers all common questions, guiding us from scratch to order placement.

The most important part, however, is the long list of copyable traders. Already here we can immediately jump to the performance over the past 7 and 21 days, as well as profits and number of trades.

Each trader can be copied by a limited number of users. In the case of the image, all alternatives are Full, that is, already at maximum capacity. Scrolling through the following pages, however, we will be able to find viable alternatives that can be subscribed to.

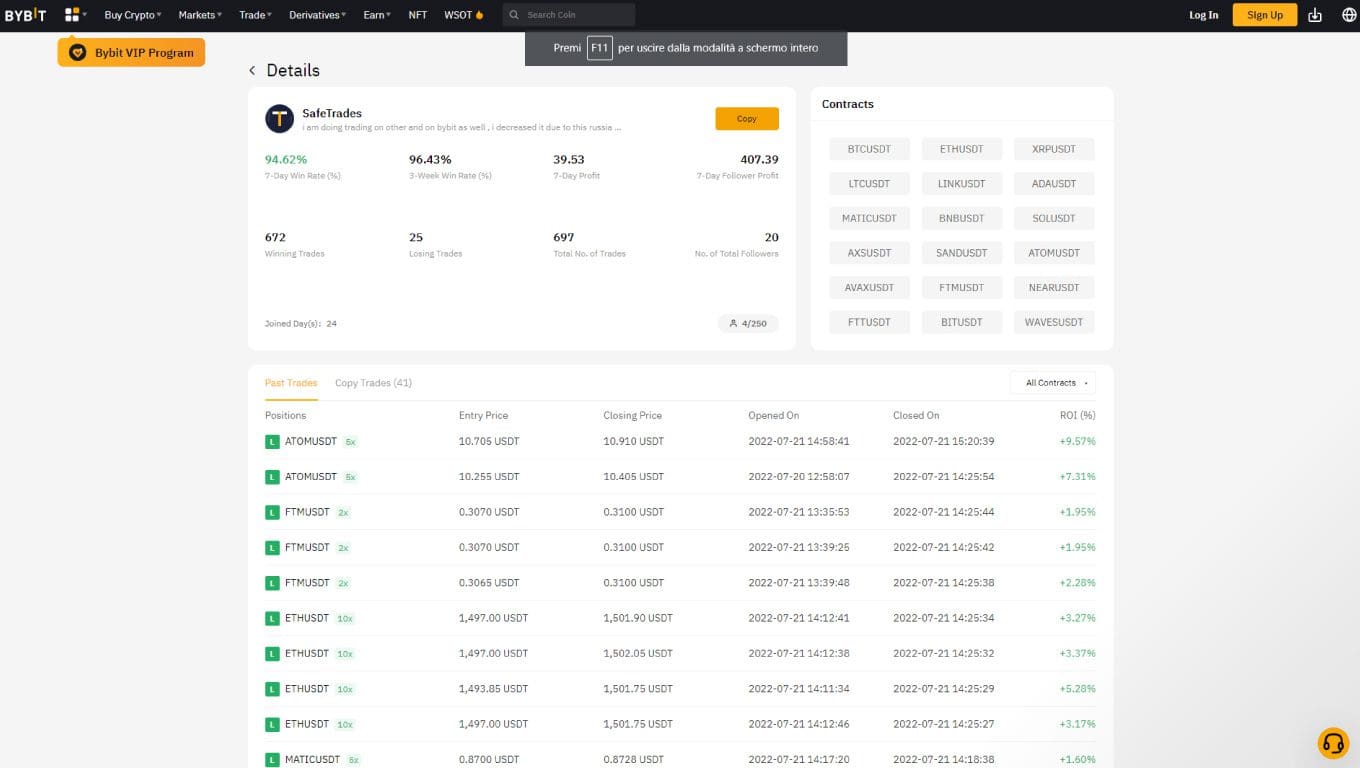

Clicking on a specific box will open the trader’s detail screen:

In addition to the information already displayed above, it will be possible to consult each trade made. This feature is essential to be able to evaluate the trader in depth, comparing his operations with our analysis.

Of note is the presence of many young profiles, so let’s not just look at the Win Rate but measure every aspect.

In addition, also pay attention to the levers: although limited, users (called followers) can get up to 5x, more than enough multiplier to get hurt.

Bybit’s copy trading supports several crypto pairings including BTC-USDT, ETH-USDT, BIT-USDT, XRP-USDT, ADA-USDT, SOL-USDT, MATIC-USDT, SAND-USDT, NEAR-USDT, ATOM-USDT, FTM-USDT, LINK-USDT, AVAX-USDT, and AXS-USDT. The omnipresence of the USDT stablecoin jumps out at once, which can be both good and bad: it depends on how we are used to thinking.

Speaking of costs, great news: there are none! The only price to pay will be that of having to surrender 10% of our profits to the trader we copied. A fee that in case of success is more than willingly paid, right?

Bybit copy trading has minimum and maximum limits on the invested capital. On the former, the amount must be USDT 10 or more; on the other hand, the ceiling is set at USDT 1,000.

The procedure to become a trader’s follower is very simple: we will have to choose him, click on the Copy button , set capital and leverage and that’s it!

Newcomers will first have to make a capital deposit: just click on the My Copy Trades button (see first image of the paragraph) and select the Transfer button to proceed.

In any case, FAQs and dedicated guides are always in the foreground and easily accessible.

If you think this is for you, sign up for Bybit and get the benefits reserved for our readers now.

Bitget copy trading

The alternative to Bybit for copy trading is Bitget.

Although less high-profile in name than some of its competitors, this exchange is available in about 50 states and serves more than 2 million users.

In addition to classic cryptocurrency spot trading, Bitget offers futures, launchpad and passive annuity instruments .

Copy trading plays a central role for this platform: let’s take a look.

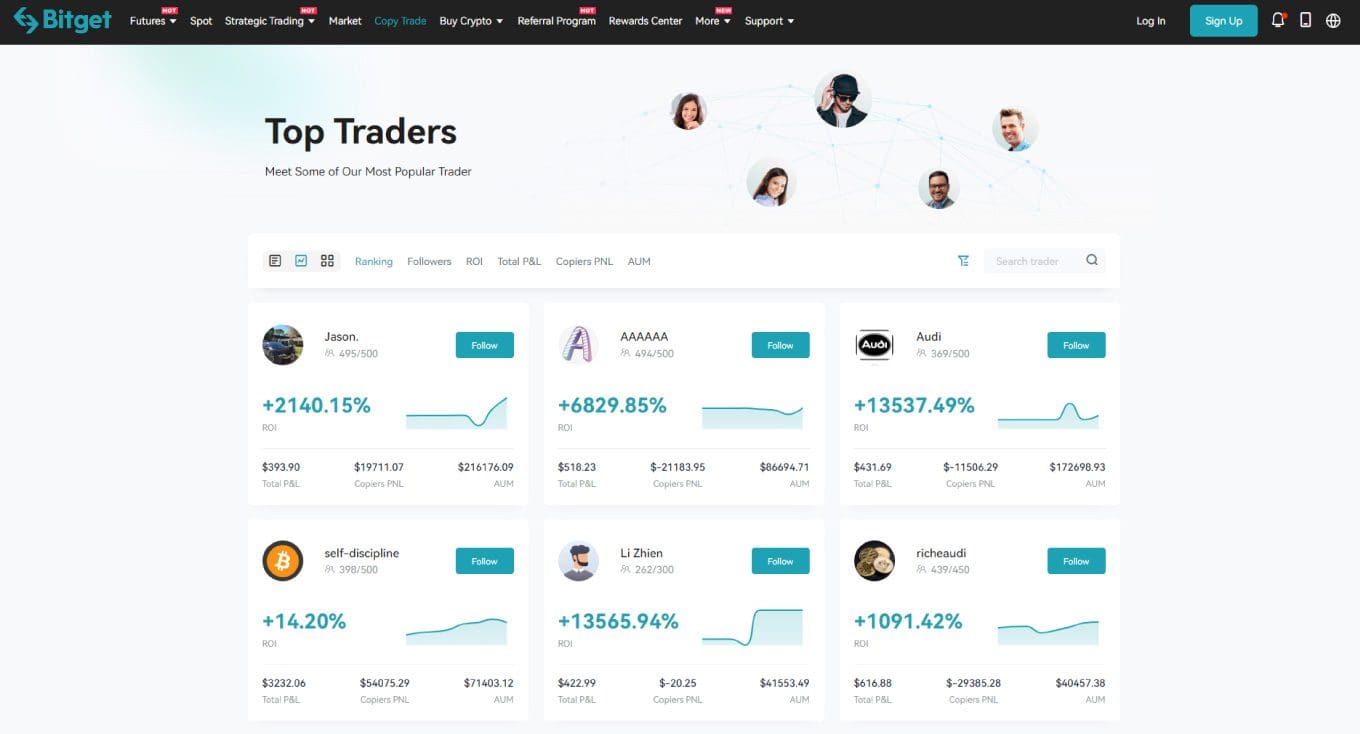

Already on the main menu the words Copy Trade are prominently displayed. Clicking it will take us to the dedicated section.

Outside of the graphical aspect, there are not that many differences from Bybit. In fact, here again we find a grid of traders that can be copied, each of which has a ceiling of followers. Well in view parameters such as ROI, total P&L and especially the GNP of followers.

As seen in Bybit, clicking on a specific box opens the screen dedicated to the trader in question.

Traders receive 4 to 8 percent of the followers’ profit, depending on the number of locked BGBs (this is Bitget’s native token).

Followers, on the other hand, benefit from ready-made strategies that they do not have to worry about: the system is fully automated.

The comments made earlier apply: it is right to analyze traders carefully, choose the most suitable one, and monitor investment performance.

The Support menu item provides access to good documentation accompanied by FAQs. The section reserved for Copy Trade is extensive: hard not to find what you are looking for. However, the operation follows Bybit’s lead and is rather quick and easy.

Copy trading: promoted with reservation

After what has been written, surely there is food for thought.

Copy trading is an interesting alternative to classic trading, but not without its critical points.

Seeing it as a method to differentiate the portfolio, it is certainly worth considering.

Instead, in case we want to chase easy profits without commitment, well, we will probably be disappointed. Individualanalysis and monitoring will still have to be a constant.

Perhaps the best aspect of copy trading comes from its teaching power: by copying a trader we will get to learn new things, as well as achieve successes or make mistakes in a totally different situation than usual.