Leggi questo articolo in Italiano

Bitcoin slump, but 80 percent of liquidations are on altcoin

By Daniele Corno

January proves turbulent for Bitcoin, plummeting from levels above $100k, but 80% of liquidations are on altcoins

Bitcoin at Jan. 1 prices

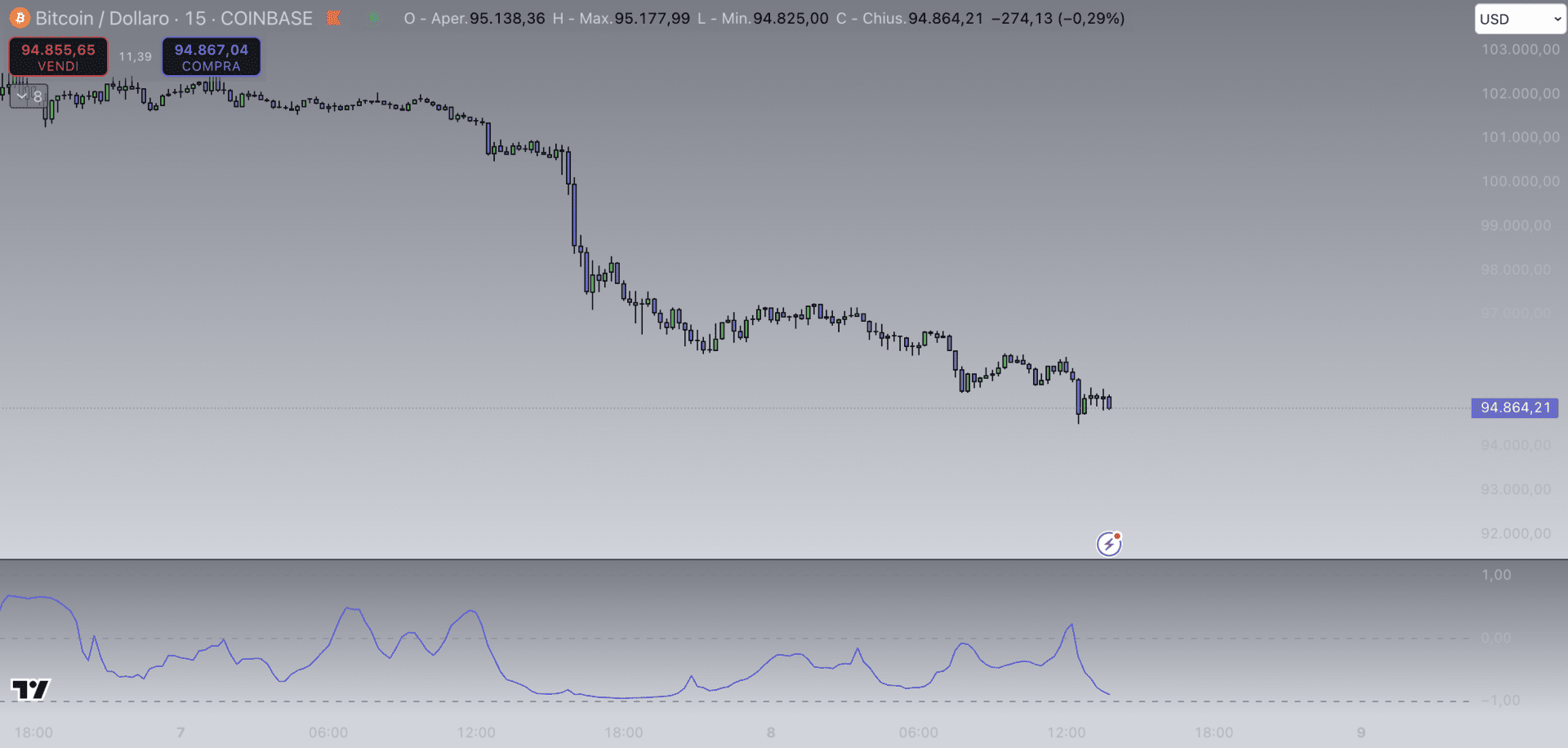

All it took was 48 hours of Bitcoin ‘s decline to undo all the return it achieved in the first week of the year.

After a tentative break of $100k for Bitcoin, which occurred on Monday the 6th during theopening of the U.S. markets, the price of Bitcoin suffered a small collapse, returning to levels below $95,000, down 7% in the last two days. Follow us on Telegram so you don’t miss any updates.

Over the past 48 hours, the price appears to be strongly correlated with the movements of the U.S. stock exchanges. In particular, on short-term timeframes such as M15, the correlation coefficient (CDC) between Bitcoin and the S&P 500 is at levels between 0.70 and 0.80.

It also turns out, in the last few hours an inverse correlation to the chart of the DXY, (dollar index) which with a +0.55% on the day is heading towards the highs of the last 2 years, creating weakness in all markets. In the early afternoon hours in fact, the correlation between BTC and DXY exceeds levels of -0.90, indicating a strong opposite directional movement.

Specifically, a CDC of 1 indicates a direct correlation between the two assets while, a CDC of -1 indicates an inverse correlation.

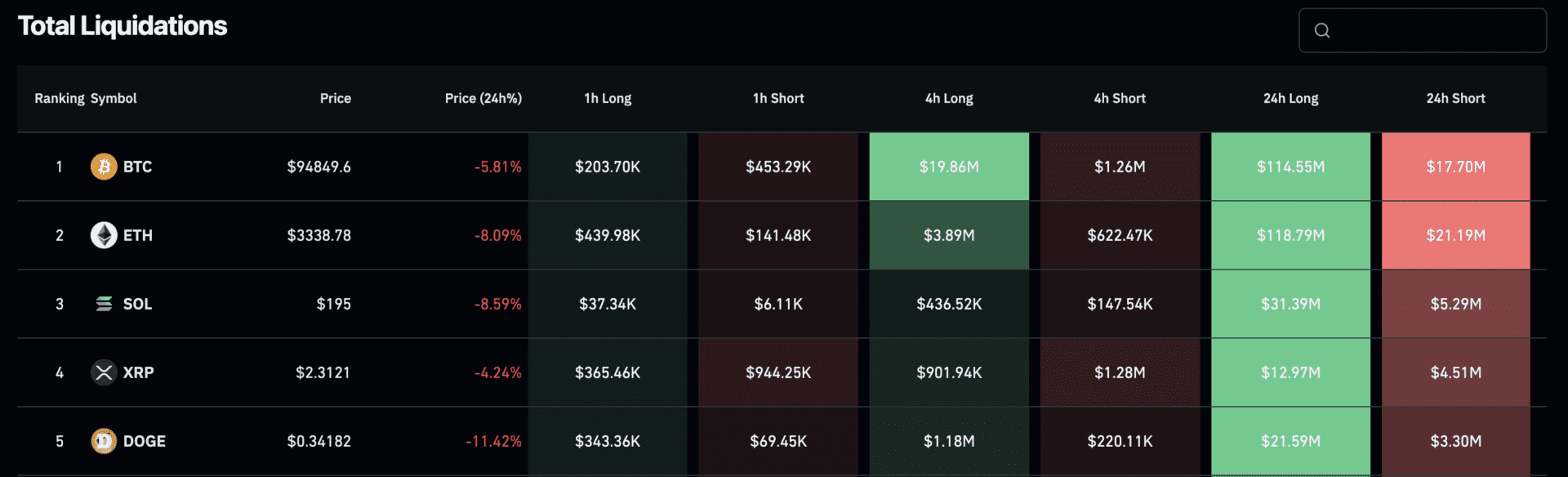

$700 million in liquidations, but only 20% on Bitcoin

As with any fall and strong price growth, there is no shortage of liquidations in the market. In recent days, however, as reported by Coinglass, liquidations on leveraged positions affect altcoins the most .

Yesterday ‘s day saw over $520 million liquidated, while in today’s day, as of now, we are at levels of $250 million. Interestingly, however, only $130 million out of a total over $700 million affects Bitcoin.

In fact, over 80% of the liquidations come from positions on altcoins. Ethereum leads the pack as of now, with $140 million in liquidated positions, a sign that speculation is mostly affecting the altcoin market in the short term.

It is followed by SOL, DOGE and XRP, with nearly $80 million in total liquidations and an average loss close to 10 percent in the last 48 hours.