Leggi questo articolo in Italiano

Bitcoin collapse and crypto in deep red: A fiery February

By Daniele Corno

The bearish force continues in February, with Bitcoin collapsing below $90k and the crypto market averaging -30%

Big liquidations in a red-tinged February

Overnight there was a new contraction in the crypto market, with significant discharges on Bitcoin and Altcoins.

Bitcoin fell out of its trading range of the last month, losing the round level of $90,000. The price lost -4% in the space of two hours, finding the first significant buying pressure on the low created in the $88,000 area.

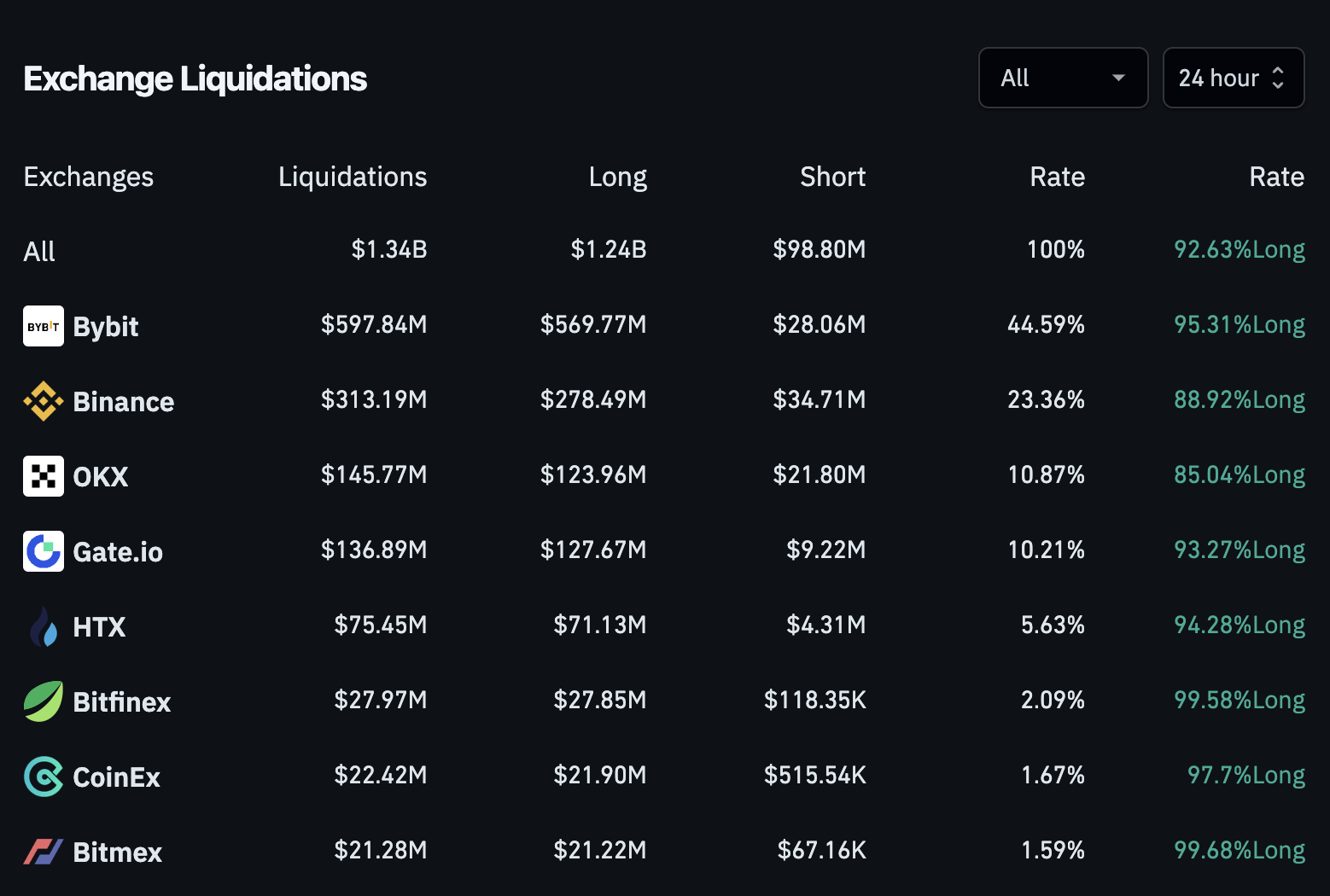

In addition to macroeconomic uncertainty, related to the fear of new tariffs, the fall was also due to significant liquidation, in the order of $1.3 billion.

However, as Coinglass reports, unlike the crash of February 3, where liquidations mostly affected the Altcoin market, today, almost 50% of liquidations affected BTC.

In fact, over $520 million dollars have been liquidated on Bitcoin, an indication that the lateral movement of the previous weeks has created significant liquidation thresholds at the extremes of the trading range.

Very bad for altcoins, -30% in February

-$620 billion, is currently the result of crypto capitalization prices in February.

While Bitcoin shows a -12.7% on a monthly basis, for Altcoins the result is quite different. Honorable mention for BNB which, among the main ones, with a -10.4% shows a better performance than BTC.

Starting with Ethereum, in fact, the market fluctuates between losses ranging from -25% to -50% in a single month.

For the more resilient altcoins, last night’s plunge brought prices down to the lows of February 3, while for others, as in the specific case of Solana, the situation is much more critical. The price has in fact returned to the levels of October 2024, with a –55% from the highs in the $300 area.

Uncertainty is the order of the day and, although the stock markets, with the exception of last week’s small dump, are at highs, investors have put the handbrake on risk-on assets.

All that remains is to wait for a change in narrative to see positive performance in the Altcoin market. Bitcoin, on the other hand, at the time of writing, is in the process of recovering to the $90,000 area, albeit with weak buying pressure.