Introduction

New year, same challenge: Ethereum vs Solana. Will there finally be a winner between the two most active and platform-rich blockchains and applications? Or will we witness a draw?

In this article, we want to analyze some key points of this “clash,” while keeping in mind one consideration: it is not necessarily the case that one network must prevail over the other. In fact, there is a real possibility that both of these names can grow and establish themselves, and that is exactly what we hope to see.

So let’s take a look at these environments, the issues to watch out for in 2025, DeFi, and much more.

Index

Ethereum vs. Solana: markets compared

Let us begin with some simple thoughts on the native cryptocurrencies of the two projects: Ethereum ETH and Solana SOL .

Both coins experienced a period of growth in late 2024, strong for the latter, somewhat more muted for the former. 2025 could hold more positive surprises, provided the bullish market continues on the right tracks and there are no unforeseen setbacks.

If we consider price action alone, SOL could have a higher margin of growth. This is pure logic: with the same amount of new capital coming in, having a significantly lower market cap than ETH, SOL would rise in value more, outperforming the #2 coin overall.

As it continues to rise, the market would attract new capital from fresh investors. The latter will likely want to bet on the faster (and speculative) horses; hence what was just said about SOL.

Attention will have to be paid, however, to the early months of 2025. Indeed, a substantial release of SOL coin is expected, which could affect the price in the short term. Consequently, ETH may behave better at this early stage of the new year.

Clearly, we are oversimplifying quite a bit, because in order to evaluate the success of a coin, many other points must be brought to the table. Exactly what we will do as we continue in the article.

Following is the SOL/ETH chart from TradingView. It can be seen that in 2024 the SOL coin outperformed ETH…will it continue on this path?

ETFs: challenges and opportunities

We have already seen with bitcoin that ETFs are a very powerful tool to make anyone approach the cryptocurrency market.

In 2024, the spot ETF on Ethereum was also approved, which in the last months of the year finally started to grind out significant numbers. At the same time, spot products on SOL may also arrive.

In addition, we should keep in mind that the offering is being further enriched and will continue in this direction. For example, to keep an eye on ETFs based on staking, offered/proposed by different brands. Let’s not forget that with the changing of the guard in the White House (and SEC) things should get easier for our industry; thus, in the U.S., expect more traditional cryptocurrency-related products.

It will therefore be interesting to observe these points:

- First, which coin between ETH and SOL will attract more capital through Exchange Traded Funds. Clearly, the greater the proposition, the better the chances of showing off;

- Platforms and custody: who will stand out? What are the entities on which funds and institutional players that offer/will offer ETFs? For example, Coinbase could flourish further for coin custody related to spot products;

- Dynamics related to centralization. We will elaborate on this point in a general way shortly.

ETFs offer attractive outlets for both coins. However, should one reality succeed in prevailing, these financial products would have no small weight in shifting the balance of the Ethereum vs. Solana challenge.

Key projects

Both networks have key projects that are the core of the ecosystems.

On the Ethereum side, we know well that in addition to decentralized finance platforms, there are increasing structures that build on the chain as well as applications on the institutional side as well. As a result, this name stands as increasingly natural and solid in the even traditional financial world.

Solana is a different reality. In 2024 it was memecoins that were the talk of the town, contributing in no small part to pushing the value of the native coin to new all-time highs. In this context, Raydium was (and still is) the platform of choice for crypto exchange, on which huge volumes of capital have been passed (look at the graph below, impressive). And the meme trend, as we will see in a moment, may continue this year.

In a nutshell: SOL could grow with conviction even in 2025, but ETH seems to have the strongest foundation for those looking at longer time frames. Reminding us, however, that Solana has what it takes to be among the top blockchains.

Watch out for memecoins...

Memecoins, which have been extremely successful on Ethereum in the past, are now at home on Solana. The arrival of the Pump.fun platform has thrown the doors wide open to the creation and buying and selling of cryptocurrencies with little intrinsic value on this network as well, giving rise to some of the major trends of recent times.

In 2024, Solana volumes literally exploded thanks to the success of Pump.fun and the subsequent proliferation of token memes. Anyone who wants to try their hand at betting on the next 1000x crypto overnight will find the perfect place here:

- Lots of people interested and ready to place. So, there is liquidity in abundance;

- An easy-to-use portal, really suitable for everyone, removing barriers to entry;

- New memecoins every day at peak hype times;

- Super low fees, super fast blockchain.

When a trend breaks out on a chain, it works and grows in no small part. Considering the bullish period, 2025 could also be under the banner of memecoins, with great benefit to the entire network.

We generally tend to leave memecoins aside as very dangerous and lacking in fundamentals. However, they can give a significant boost to the ecosystem that hosts them. Of course, not everything depends on these tokens, but it is undeniable that they should be watched, as the past teaches us.

Decentralized finance and other trends

Decentralized finance will undoubtedly play a major role in bringing capital to these two networks, helping to increase the value of their respective coins as well.

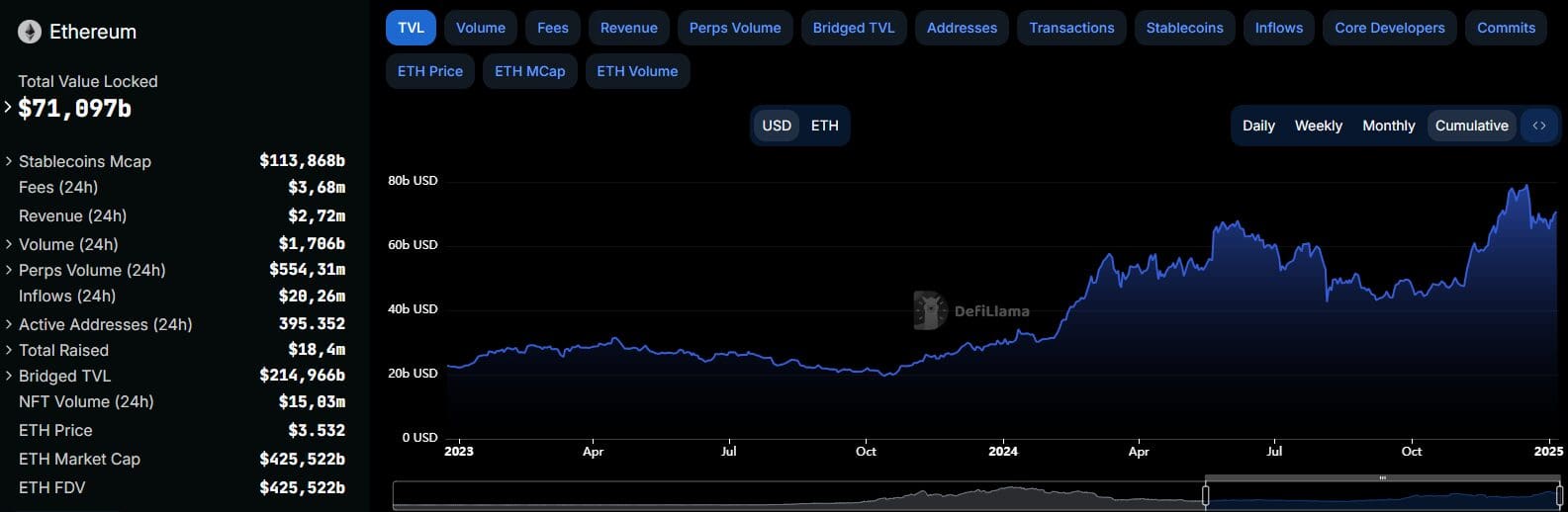

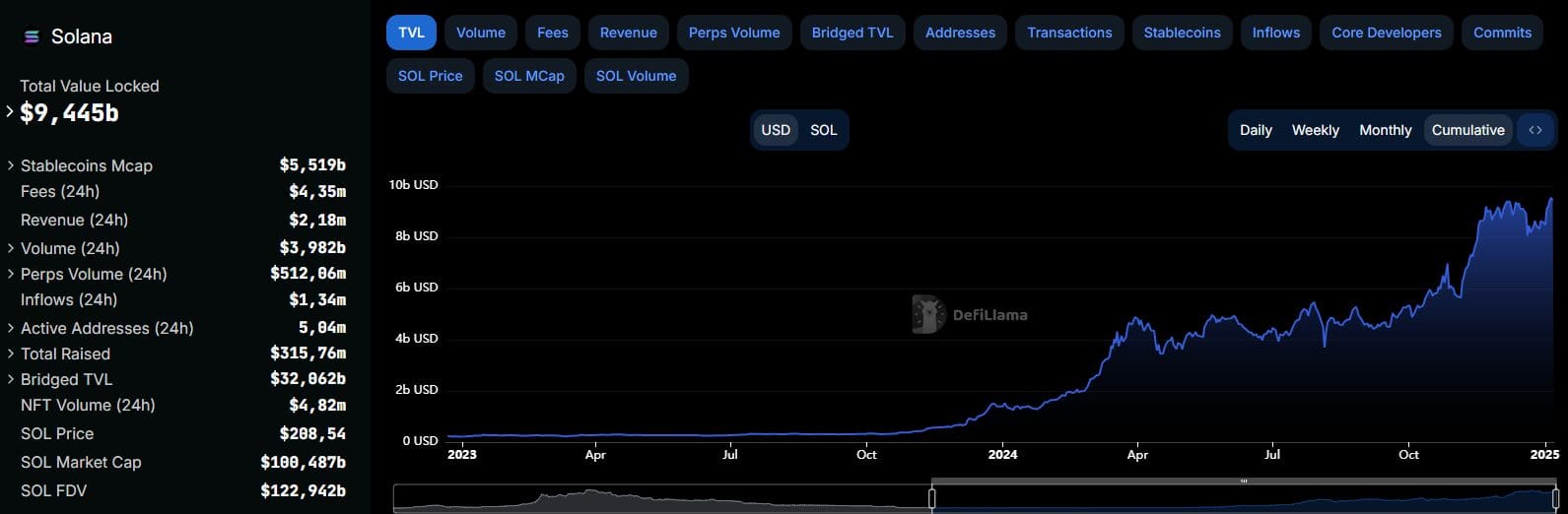

In this regard, Ethereum continues to be the frontrunner with an LTV as of January 7, 2025 of more than $71 billion. Solana is quite a bit behind (about 9.5 billion), but in percentage terms it has grown more than its rival in 2024. Below are two images on TVL borrowed from the analysis portal DefiLlama.

On these networks, ETH in primis, we find all the giants of the decentralized environment. Although this is an area reserved for a user base with established knowledge, the importance of DeFi is not to be underestimated; in fact, in addition to its function as a magnet for capital, it can give rise to links with traditional players, push new realities to develop and start new trends (as has happened in the past).

Woe betide, however, if we reason only about DeFi, because other trends have shown that they can act as a driving force. Case in point are the DePINs for Solana, a 2024 narrative that lays the groundwork for mass adoption of blockchain technology.

This, of course, is just one example: from Non-Fungible Tokens in the past to AI Agents, from RWAs to micropayment solutions, we will need to keep track of all narratives. If there is one area where Ethereum vs. Solana could give us something to talk about, it is this: the race for innovations, new trends and, most importantly, where these will find their home.

Ethereum vs. Solana: blockchain dominance

At present, both blockchains are among the most dominant in the landscape. However, the situation between them is very different.

Ethereum is a layer 1 in continuous development, which is slowly changing its skin. There is still a long way to go, but if everything goes right, we would end up with one of the most solid and structured entities ever (and it already is anyway).

The known limitations are being reduced thanks to layers 2, which are increasing more and more and improving quality side. After all, starting a project for an L2 is definitely less complex than starting an L1, as well as cheaper. Entering the Ethereum ecosystem provides immediate access to abundant liquidity, as well as a number of protocols with years of operation behind them .

Solana is different. Layer 2 has always been “frowned upon,” although that may be changing. Performance is far superior to its rival, but limits could still be touched and a solution would be essential. In addition, the ratio of successful to failed transactions leans toward the latter, giving rise to a reliability problem (something Ethereum does not have, even if some L2s occasionally miss hits).

In 2025, the Ethereum vs. Solana challenge will also be played out here. However, the former has a distinct advantage in the medium and long term, because it is building and innovating with the future in mind.

Ethereum vs. Solana: final considerations

We have seen several interesting themes from one of the most popular clashes in the crypto landscape.

This year could be good for both coins of these chains, but the future looks more promising for Ethereum. After all, it is an increasingly central, irreplaceable network with no direct competitors. Solana will have to scramble to carve out such a favorable position and shelter itself from other existing or incoming rivals, but you never know how things will turn out in this industry.

We urge investing only after carefully studying the situation and planning all the correct steps.