Leggi questo articolo in Italiano

Franklin Templeton's FOBXX fund now also lands on Solana

By Daniele Corno

Franklin Templeton officially launches its FOBXX on-chain money market fund on the Solana blockchain, a new step for RWAs

Real World Asset also on Solana

Asset manager Franklin Templeton, with over $1.5 trillion under management, launches its on-chain monetary fund FOBXX on the blockchain of Solana.

The launch follows previous developments on blockchains such as Stellar, Aptos, Avalanche, Sui and Coinbase.

FOBXX, which operates similar to a stablecoin and has a fixed value of $1, invests in US government securities, including bonds, secured loans, treasury securities and, in part, cash.

With the tokenization and RWA markets growing strongly, this new launch on the Solana Blockchain marks an important transition. Until now, in fact, most of this market has been developed on Ethereum and its Layer 2, although this launch by Franklin Templeton could accentuate the competition between the two main blockchains for smart contracts currently on the market.

RWA and US on-chain securities on the rise

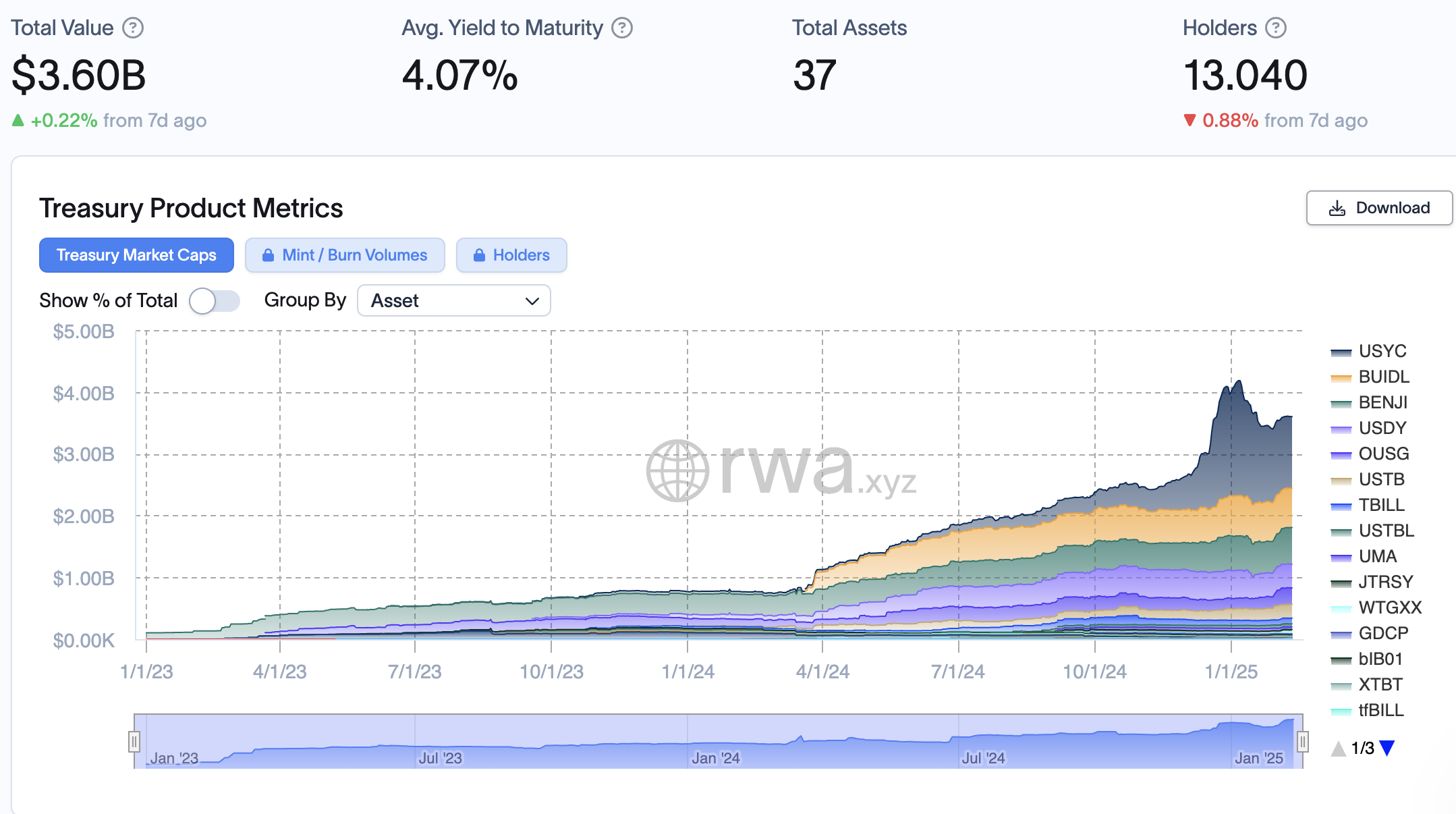

The fund, third in terms of TVL for the US Treasury category, as reported by rwa.xyz (under the name “Benji”), manages over $580 million, preceded only by Buidl by BlackRock and USYC by Hashnote

As shown in the image below, on-chain tokenized US Treasuries are showing strong growth. With a value of $770 million as of December 31, 2023, the sector grew to a high of $4 billion in the first week of January 2025.

Of these, over $2.5 billion are on Ethereum. This figure clearly shows where development began, although the advantage of starting early does not offer a guarantee for the future.

This trend is clearly different from the boost of Meme Coins that contributed to the very strong development of Solana and Sol in 2024. It will therefore be interesting to observe how this market moves in the coming months, with development accelerated by the new Trump administration.