Leggi questo articolo in Italiano

Hyperliquid: Hype hits lows on FUD for $4 million lost

By Daniele Corno

Hype hits 90-day lows following huge liquidation on Hyperliquid: Between Fud and doubts, here's what happened

$4 milioni di dollari persi su HLP, i dubbi della community

A few hours ago, the price of the Hyperliquid HYPE token suffered a crash of -12% – soon recovered – following a liquidation event that triggered panic in the community.

The doubts stem from a loss in the Hyperliquidity Provider Vault (HLP) of approximately $4 million dollars, the result of a huge liquidation, with users seized by fear of possible manipulation or hacking, promptly denied by the team of the protocol.

HLP is a vault that acts as a market maker on Hyperliquid, creating counterparties for traders and managing liquidation operations. It also allows anyone to participate through the stablecoin USDC, distributing profits and losses equally according to the weight of the specific holdings of the users.

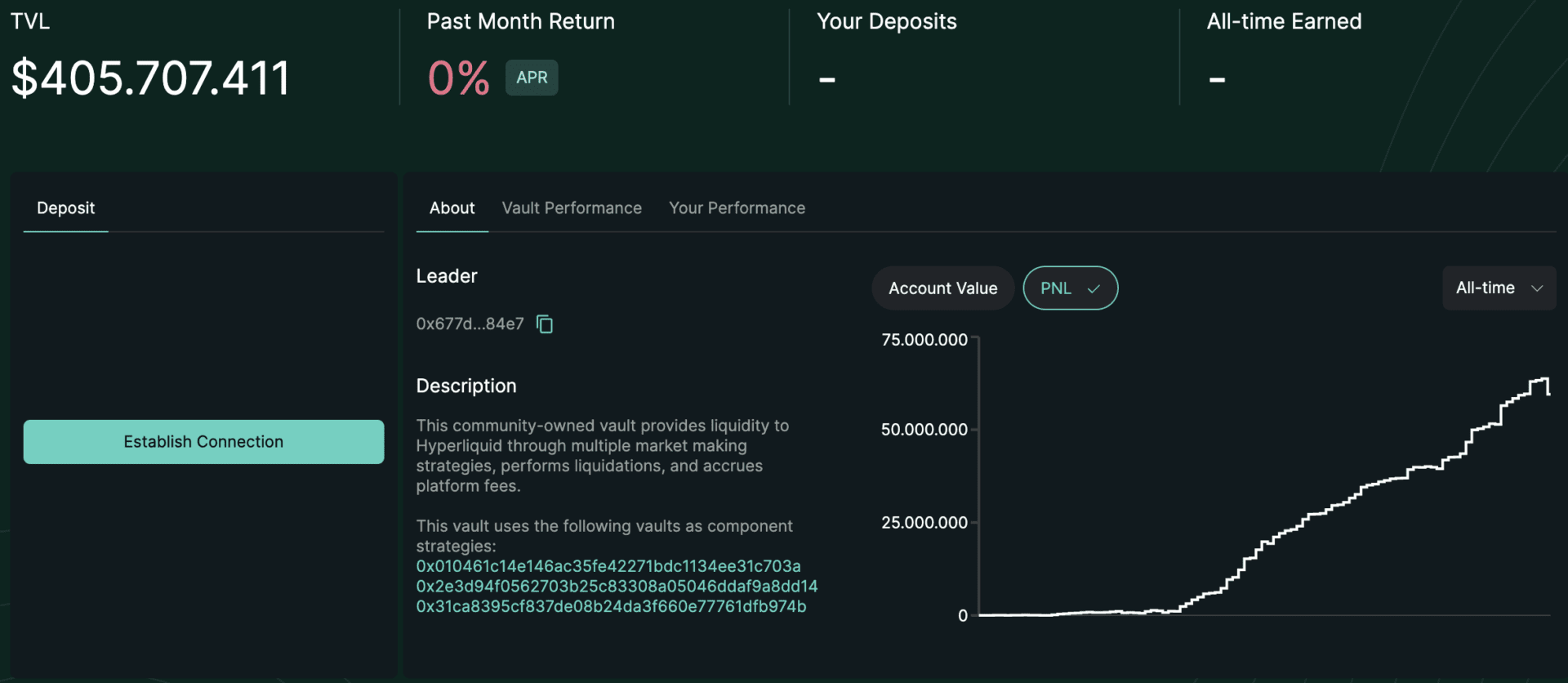

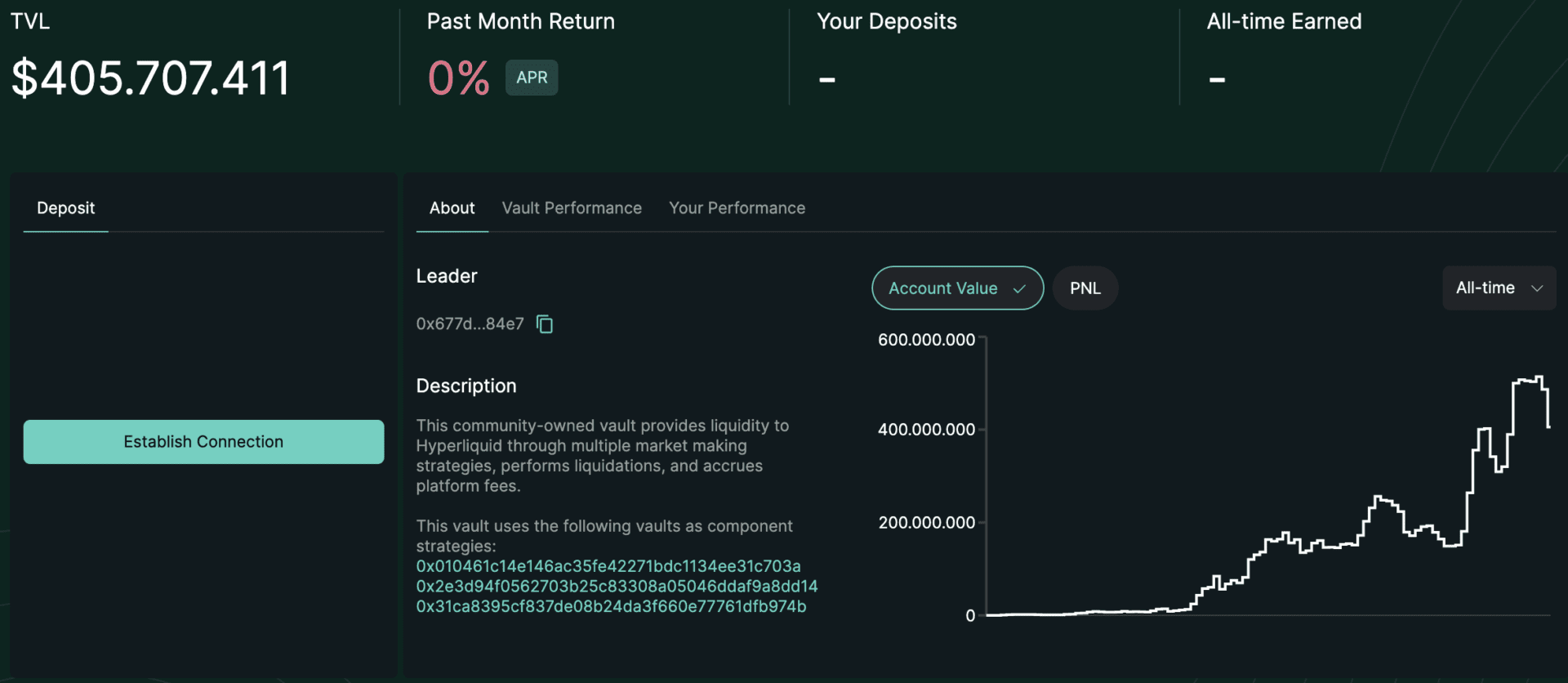

With this loss, the profits of the vault dropped from about $63.7 million to $59.4 million, which led many users to withdraw their funds, reducing the value of the vault from $486 million yesterday to about $404 million today.

How did this happen?

As confirmed by the protocol team, who promptly intervened to respond to the doubts raised by the community, this event was generated by a liquidation, eliminating any doubt regarding possible hacks.

Everything is related to a single user’s trade. This user opened a LONG position on Ethereum with 15.23 million USDC in leverage, for a market value of approximately $306 million. As the position grew in value, with a positive PNL (Profit and Loss), the trader withdrew their margin from the position.

Subsequently, the protocol proceeded with the liquidation of the position. However, the liquidation management was not completely efficient given the huge amount of the position.

The trader therefore cashed in about 17.09 million USDC, with a net profit of +$1.8 million, but the liquidation resulted in a loss in the HLP vault of about $4 million.

This highlighted a major limitation for Hyperliquid. The team intervened, stating that they would update the leverage maximum for Bitcoin to 40x and for Ethereum to 20x.