Leggi questo articolo in Italiano

Crypto and ETF investments: the institutional flight continues

By Davide Grammatica

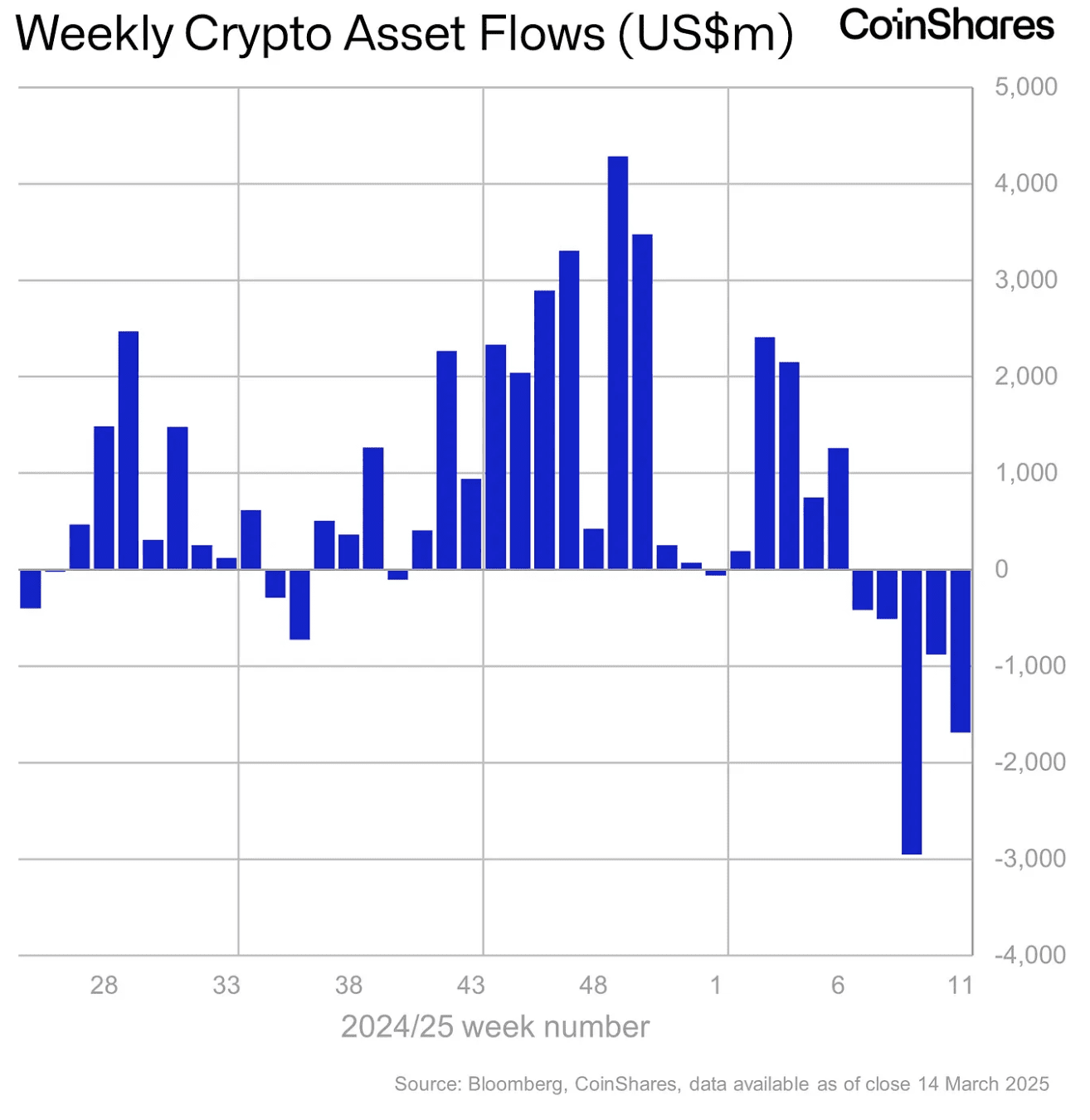

Crypto and Bitcoin investment products are recording outflows for the fifth consecutive week. It's the longest series of daily outflows ever

There's a flight from crypto products

In the wake of recent weeks, there is no end to the flight of capital from crypto and Bitcoin investment products. The trend also closely follows the price of BTC, still struggling above $80k, and has recorded a whopping $1.7 billion in outflows in the last week alone.

Adding to the previous ones, these outflows reach a total of $6.4 billion, for the longest negative phase since the introduction of BTC spot ETFs.

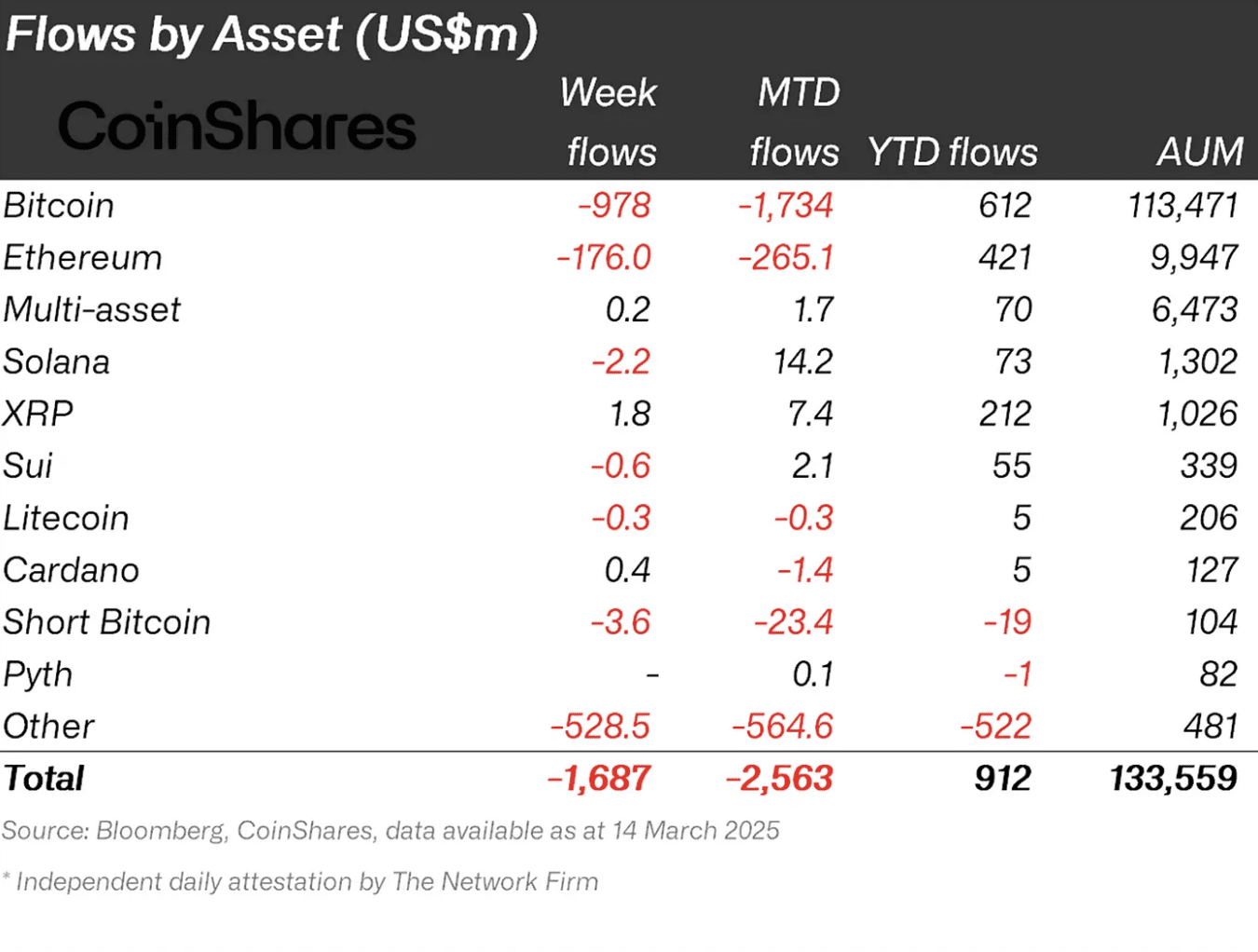

The total inflows of 2025 are now at $912 million, but the annual balance is likely to soon become negative as well. Total assets under management (AuM), on the other hand, have decreased by $48 billion.

In addition to the pessimism in the United States, where outflows of $1.16 billion were recorded, there were also significant outflows in Switzerland, with $528 million leaving. Apparently, only Germany is betting on an increase, with inflows of $8 million.

Almost no one is saved, except XRP

Of all the assets, only Bitcoin weighs on the negative balance sheet with $978 million, for a total of $5.4 billion outflow in the last 5 weeks. However, short products are also falling, with sell positions and outflows of $3.6 million.

The outflows also affect the entire altcoin world, with Ethereum and Solana in the front row losing $175 million and $2.2 million respectively. Only XRP goes against the current, which as in the whole of the last period continues to be resilient in attracting new inflows (this time $1.8 million).

Finally, blockchain stocks recorded outflows totaling $40 million.