Leggi questo articolo in Italiano

Crypto investments: new inflows to reverse the trend?

By Davide Grammatica

After a complicated period, net-inflow is back on the weekly interval for crypto investment products

Are the institutions back to pushing?

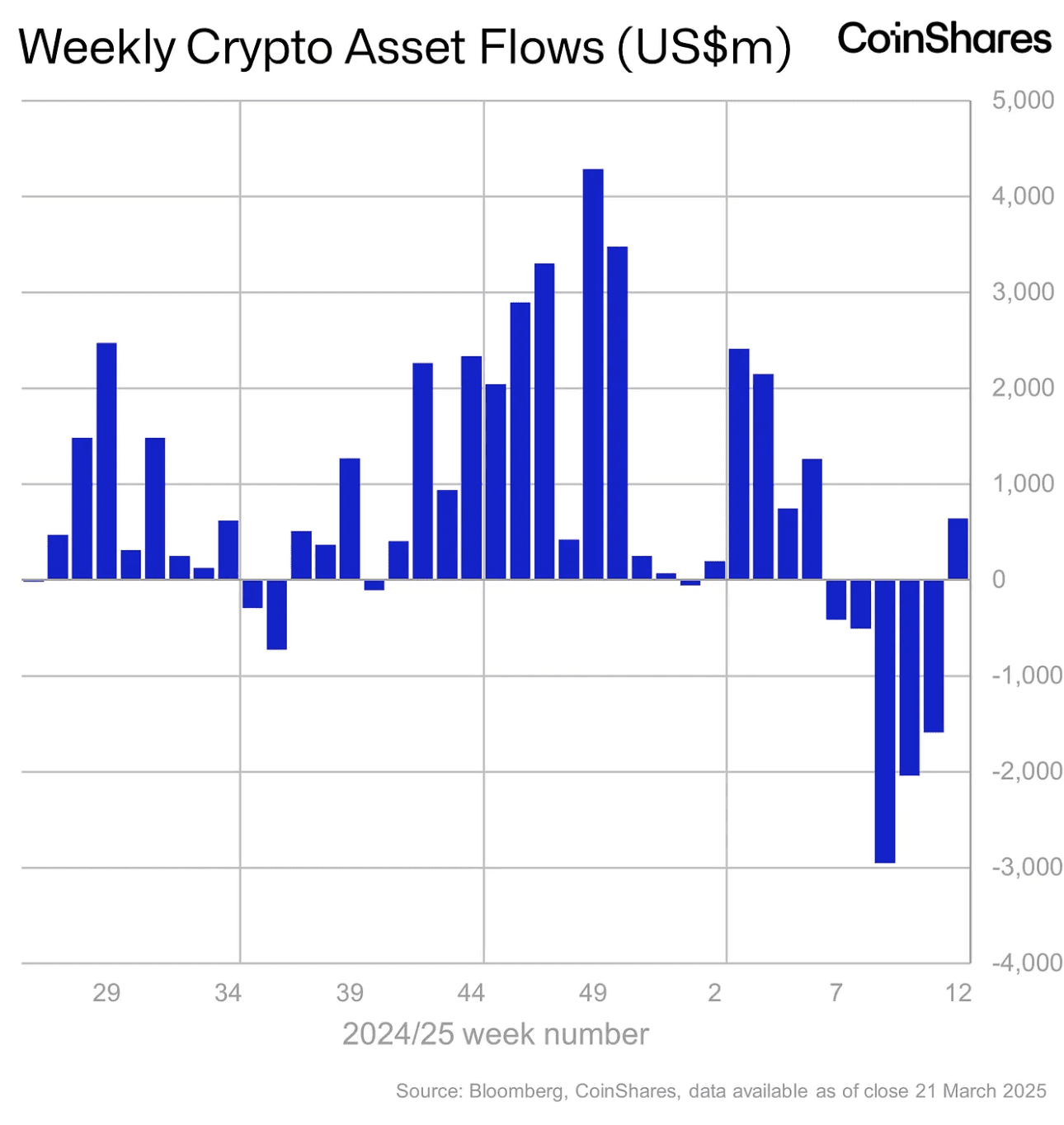

After several weeks of dramatic data for crypto investments products and Bitcoin, the sector is finally back to registering net-inflow on the weekly interval.

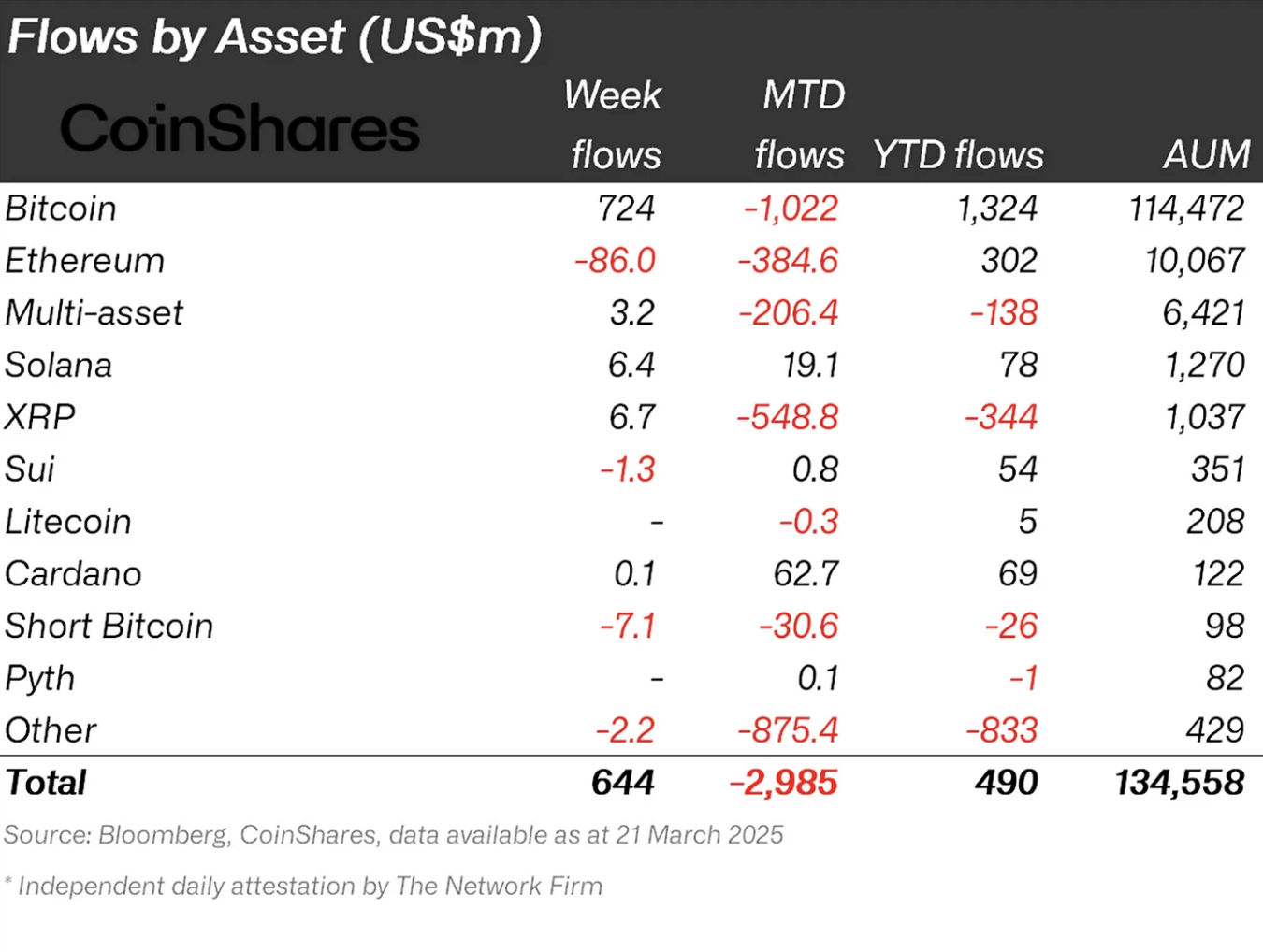

In fact, there is a possible trend reversal after 5 weeks of outflows, thanks to $644 million in inflows into the sector. Compared to the March 10th “dip”, total assets under management (AuM) increased by 6.3%, for a new series of positive days after a streak of 17 days of consecutive outflows.

As reported by Coinshares, the US is leading the renewed bullish sentiment of investors (perhaps in the wake of the optimism derived from the last FOMC) with $632 million in inflows. But investors in the rest of the world are also positive, with products from Switzerland, Germany and Hong Kong collecting inflows of $15.9 million, $13.9 million and $1.2 million respectively.

Good Bitcoin, bad alts

Among the assets, as always, Bitcoin attracts the most capital, with $724 million in inflows, largely channeled through spot ETFs. At the same time, short-BTC products continue to record outflows ($7.1 million).

The world of altcoins is still difficult to interpret, with the performance of the various assets still reflecting some uncertainty among investors. Ethereum, for example, is still recording heavy outflows ($86 million), while assets such as Solana, Polygon and Chainlink are reporting significant inflows, respectively $6.4 million, $0.4 million and $0.2 million.

On the other hand, the numbers for Sui, Polkadot, Tron and Algorand remain negative.