Litecoin: introduction

This in-depth look at one of Bitcoin ‘s most famous “children”: Litecoin.

We prepare ourselves for the discovery of a long-lived reality, on the scene for more than a decade.

The term Litecoin (sometimes improperly spelled lite coin) identifies two things:

- The blockchain, born precisely from the code of Bitcoin;

- The cryptocurrency linked to it with ticker LTC.

Note: In this article we will use the term Litecoin interchangeably.

We will get to see how Litecoin was designed to improve Bitcoin, trying to overcome its limitations and creating a truly usable everyday asset.

We anticipate that in theory the mission is accomplished. However, in practice, the alternatives that have sprung up over the years have relegated Litecoin to a more backward position than what was thought in its early days.

Still, this reality remains in a respectable position in terms of capitalization and tends to follow the industry trend. We will therefore find out whether it may be worth investing in Litecoin (LTC) by highlighting its weaknesses and strengths.

Let’s waste no more time and dive into the study: we start with the main characteristics of Litecoin.

Index

What is Litecoin (LTC)

Litecoin is a historiccryptocurrency and an open source blockchain fork of Bitcoin.

The project was born back in 2011 at the hands of Charlie Lee, an engineer with experience in major companies including Google.

The idea behind the creation of Litecoin was to improve on the “father” Bitcoin, resulting in a faster, cheaper and more decentralized network.

The ultimate goal was to offer a cryptocurrency that was truly expendable as if it were a traditional currency.

Several experiments designed to improve Bitcoin had already sprung up until then, including the famous Tenebrix. However, for a variety of reasons, none of these managed to stand as a real alternative to the quintessential cryptocurrency.

Litecoin (LTC) was launched without any ICO, pre-mining or other early selling mechanisms. Simply, from date “X” it was possible to mine the cryptocurrency, that’s all.

This is certainly a positive aspect: no “greedy team” behind the scenes. However, Charlie Lee himself liquidated all his Litecoin a few years later, during a major bull run. He claimed that his intention was to “test the tightness of the project” as well as check his direct influence. Needless to say, the move did not sit well with the community.

Differences between Litecoin and Bitcoin

Litecoin is a fork of Bitcoin, suitably modified to match the ideas behind it. So let’s find out the main differences between these two worlds.

Let’s start with a very important question: how many Litecoins are there? This crypto holds 84 million, compared to only 21 million for BTC. LTC therefore has exactly four times the supply of bitcoin. This affects the potential in terms of price; we will see this more in the section strictly devoted to the coin.

Moving on to infrastructure, we might ask , “What network does Litecoin use?” Well, this crypto is equipped with its own structure called precisely…Litecoin!

Getting to know it better, let us first call into question the transactions per second, which are significantly higher for Litecoin (50/55) than for Bitcoin (3/5). It comes naturally to the conclusion that the subject of this in-depth study lends itself less to congestion and slowdowns.

This point is critical for Litecoin, a network designed as an alternative to traditional currencies: you have to have a smooth process of transactions in the payment world, you cannot stop and wait for hours at the checkout!

The timelines for validating a blockchain are also much shorter: 2.5 minutes for Litecoin, 10 for Bitcoin.

Coupled with the important difference regarding transactions per second, the Litecoin blockchain performs significantly better.

A smoother and faster network also means lower costs per transaction.

Litecoin allows capital to move for pennies on the dollar, another important element in view of alternative payments to classical methods.

As for how the blockchain works, the consensus algorithm is identical: Proof-of-Work. Therefore, the production of new ones also involves the process known as Litecoin mining.

There is, however, an important difference regarding the type of algorithm dedicated to hashing, that is, the processing of the complex calculations that the miners’ processors must solve in order to produce new cryptocurrencies.

The Bitcoin blockchain uses the SHA-256 algorithm, which is able to adapt the difficulty of problems according to the overall computing power available to miners.

Given the increasing complexity, special computers called ASICs, which are definitely expensive but very efficient, are used in this context today.

Litecoin, on the other hand, adopts theScrypt algorithm, designed to facilitate lighter Litecoin mining that is feasible even with home computer CPUs. However, today Litecoin miners employ dedicated machines for this purpose; mining LTC with just a PC is therefore no longer profitable. You can therefore stop googling “how to mine Litecoin?” because without a considerable investment you will not get much.

Finally it’s up to halving, or halving in coin issuance.

As with bitcoin, Litecoin miners get a certain amount of currency after successfully completing a block.

At regular cadences, this number halves, until the maximum supply is reached.

Bitcoin’s halving occurs every 210,000 blocks, or about 4 years. Litecoin’s, on the other hand, happens every 840,000; nothing changes: it is still 4 years.

After this overview we should have a clearer idea. Litecoin originates from Bitcoin but makes several significant changes, so it would be incorrect to say that they are the same thing (as we often hear or read).

Let’s shift the focus to the LTC coin and look in more detail at its performance over time.

What is the price of 1 litecoin?

We have already answered the question “how many Litecoins exist?” and found that there are 84 million.

Of these, just under 75 million, 89% of the total, are in circulation at the time of writing.

In contrast, the LTC market cap stands at $4.7 billion, around the 20th position in the overall ranking(Top 3: bitcoin, Ether, USDT). The data are of course variable and always to be verified on portals such as CoinMarketCap and CoinGecko.

The price at which this cryptocurrency is traded is far from the all-time high of over $386 reached in December 2021 (market cap USD25.8 billion). Power of the 2022 bear market.

We come to the fateful question: is Litecoin a good investment?

It would be nice to know, so that we can position ourselves “wickedly” in case of a positive answer.

As always, no financial advice is ever given on this portal. Everyone should do some research, consider risk appetite and decide how to proceed.

Litecoin certainly has positive aspects to support it but it is not bitcoin. It therefore lacks that intrinsic value given by being a universally recognized asset as a store of value.

Therefore, one has to move so cautiously.

Before opting for an investment in this crypto, it is advisable to explore the many projects available to date. Beware also of trusting a phantom Litecoins price forecast you might find online: impossible to know where it will go!

The data reported on LTCUSD are subject to change over time. To always know the correct price, here is a chart from TradingView, the ultimate platform for asset tracking and technical analysis.

What does Litecoin do? Use cases, pros and cons

Let us proceed to analyze pros and cons of Litecoin, sometimes resorting to comparison with its “father” Bitcoin.

First, it is necessary to highlight the use cases of Litecoin. Here, in truth we should speak in the singular: we are dealing with a cryptocurrency designed to be an alternative to traditional coins and other payment or funds shifting circuits.

Therefore, Lite coin is a reality that aims to be a real currency, exchangeable and expendable with ease and at low cost.

Moreover, the blockchain wants to pose as a variant to the most widely used and well-known ones. Will the construction actually be in line with the goals? We are about to find out.

Lite coin’s strengths include the community, which has been solid and involved in the project for more than a decade.

We have seen how the strength of several realities lies precisely in the people (e.g., for Cardano). In this case, the community is certainly important but not so central.

Another pro of Litecoin is its longevity. As an “old” cryptocurrency, it is well known even among non-experts. Talking to an absolute beginner, despite the current power ratios he or she is more likely to know LTC than Avalanche (AVAX). In short, always better to be known than unknown.

On top of that, longevity still gives the asset a fair amount of stability, precisely because it has been in the market for a long time and has a huge amount of experience behind it: from the darkest bear markets to screaming bull runs. Be careful, however: even here, losing or gaining 10/15% is really a matter of a few hours.

Finally, we have already mentioned the fact that Litecoin processes more transactions per second than Bitcoin; moreover, the same are significantly cheaper.

In short, significant plus points considering the main objective.

However, we must also mention several critical issues and weaknesses.

First of all, the intrinsic value.

Litecoin does not possess the potential of bitcoin, let’s put it bluntly. BTC is the number one cryptocurrency on which investment strategies have been developed that also embrace traditional finance, see ETFs. Some countries have given it legal tender (such as El Salvador) and others are considering making the same move.

Litecoin is not remotely comparable. It is a long-lived, solid and well-crafted fork. However, it has not inherited the power of its “parent”: the numbers say so.

Linked to what has just been said, although Litecoin is a well-known topic it is not as talked about as the major cryptocurrencies.

Finally, the heaviest cons: alternatives.

Litecoin was born in 2011, a time when blockchain and cryptocurrencies were experiencing an era of discovery and pioneering. Thus, alternatives were limited, as were technical solutions.

Over the years, realities have appeared on the scene that implement increasingly specific, comprehensive or niche-focused features.

While a few years ago LTC might have been a good cryptocurrency, backed by a good blockchain, today there are more efficient proposals. For example, Solana focuses strongly on micropayments and does so on the strength of tens of thousands of transactions per second, combined with a lightweight and nonexpensive consensus algorithm.

In short, phrases like “Litecoin is digital silver” really no longer make sense in the current scenario.

Going back to the first lines of the paragraph, Litecoin is certainly well built considering its mission. However, the competition is fierce and is challenging this world. Will there be a way to recover? Only time will tell but at the moment it is a rather difficult mission.

"At the end of the analysis of the pros and cons, right now the balance hangs on the latter."

How to buy Litecoin?

The time has come to find out how to buy Litecoin.

We have good news: as one of the longest-lived cryptocurrencies, LTC is available on so many exchanges. You really are spoiled for choice, so here are a few names:

- Binance: the exchange par excellence with 20% off fees forever by following the link provided.

- Crypto.com: a solid exchange with an immense offering of products and services, including VISA prepaid cards.

- These three are joined by a list that includes names such as Kraken and Bybit. In short, buying Litecoin on spot is really simple.

For decentralized finance (DeFi) fanatics, this crypto is also available on BNB Smart Chain as a BEP-20 token. We specify, however, that this is not the original coin but a synthetic asset whose value corresponds to that of LTC, covered by reserves of the same.

The purchase of this token is possible on several DeFi platforms including PancakeSwap, one of the most well-known and employed when it comes to the BSC.

Turning the page, let’s take a look at wallets.

"Being a long-lived cryptocurrency, Litecoin (LTC) can be purchased on a great many exchanges."

Litecoin wallets: which one to choose?

After purchase, our Litecoins will need to be kept in a safe place. Which wallet represents the best option?

We have several solutions available, let’s see them.

For PC, MAC and Linux, Electrum-LTC is among the leading candidates. It is a noncustodial wallet that is simple to use and has some authority in the industry. Opting for Electrum-LTC provides peace of mind. Downloadable versions are available at electrum-ltc.org.

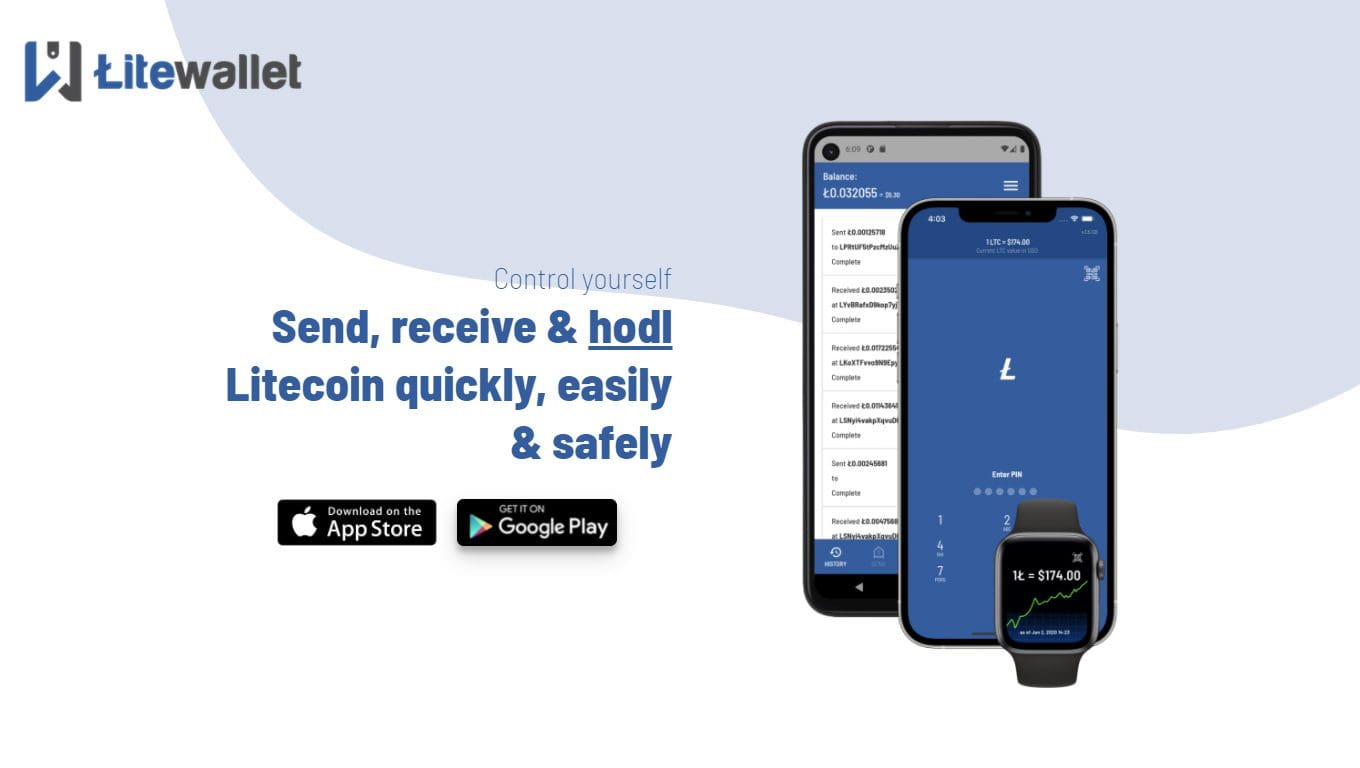

For those looking for a mobile solution, Litewallet is the right choice. A fairly lightweight, well-made wallet with a friendly interface, it is available for Android and IOS devices. The official litewallet.io website has download links from Google Play and the App Store.

The possibilities certainly do not stop there. In fact, Litecoin is supported by many famous software including Trust Wallet (mobile) Exodus and Atomic Wallet.

If security is to be superior, Ledger is the ideal option. The world’s most popularhardware wallet fully supports Litecoin (LTC) for greater protection of one’s funds. Here are our tutorials on Ledger Nano X, Ledger Nano S Plus and Ledger Flex. The alternative to the well-known brand is Trezor.

On the other hand, as always, we advise against leaving cryptocurrencies on the custodial wallets of exchanges, whether Litecoin or other: better to store them on one of the software or devices just mentioned.

Does Litecoin have a future?

Litecoin has been on the scene for many years and deserves the right treatment.

The basics of being a good ecosystem are all there: faster and cheaper transactions, solid community and rather limited supply.

In addition, Lightning Network is also deployable on Litecoin, further improving its performance.

Unfortunately, this does not seem to be enough: better performing and promising alternatives are available for the future, with already significantly higher capital.

Of course, the development team (under the non-profit Litecoin Foundation) could make improvements that would turn the tables. To date, however, we are far from this scenario.

What can we say then, is Litecoin worth investing in? Is it a dying reality or will it still have a say?

The blockchain and crypto universe is still in its infancy, so anything could really happen.

Lite coin is not dying but it is certainly at a disadvantage today compared to other players.

In any case, we cannot help but consider that 10 years of life gives a pretty solid foundation. Right or wrong, there will always be someone who wants to buy and hold LTC as well as use the related blockchain.

Only time will tell who is right. Today we simply suggest that you carefully analyze the alternatives and then decide which path to take.

Do you hold Litecoin or do you prefer other cryptocurrencies? Tell us about it on our social channels!