Leggi questo articolo in Italiano

Crypto market in sharp decline: The numbers of a fiery February

By Daniele Corno

February brings with it sharp declines in the crypto market, with sales driving down prices and interest: Some numbers of these strong sales

Liquidation and collapse of interest

The month of February brought heavy sell-offs in the sector, with sharp contractions in the price of crypto-assets and continuous phases of uncertainty.

Bitcoin lost 17.65% in price while altcoins suffered much greater losses. Ethereum, first and foremost, lost 32% against the dollar and the price against Bitcoin lost almost 18%.

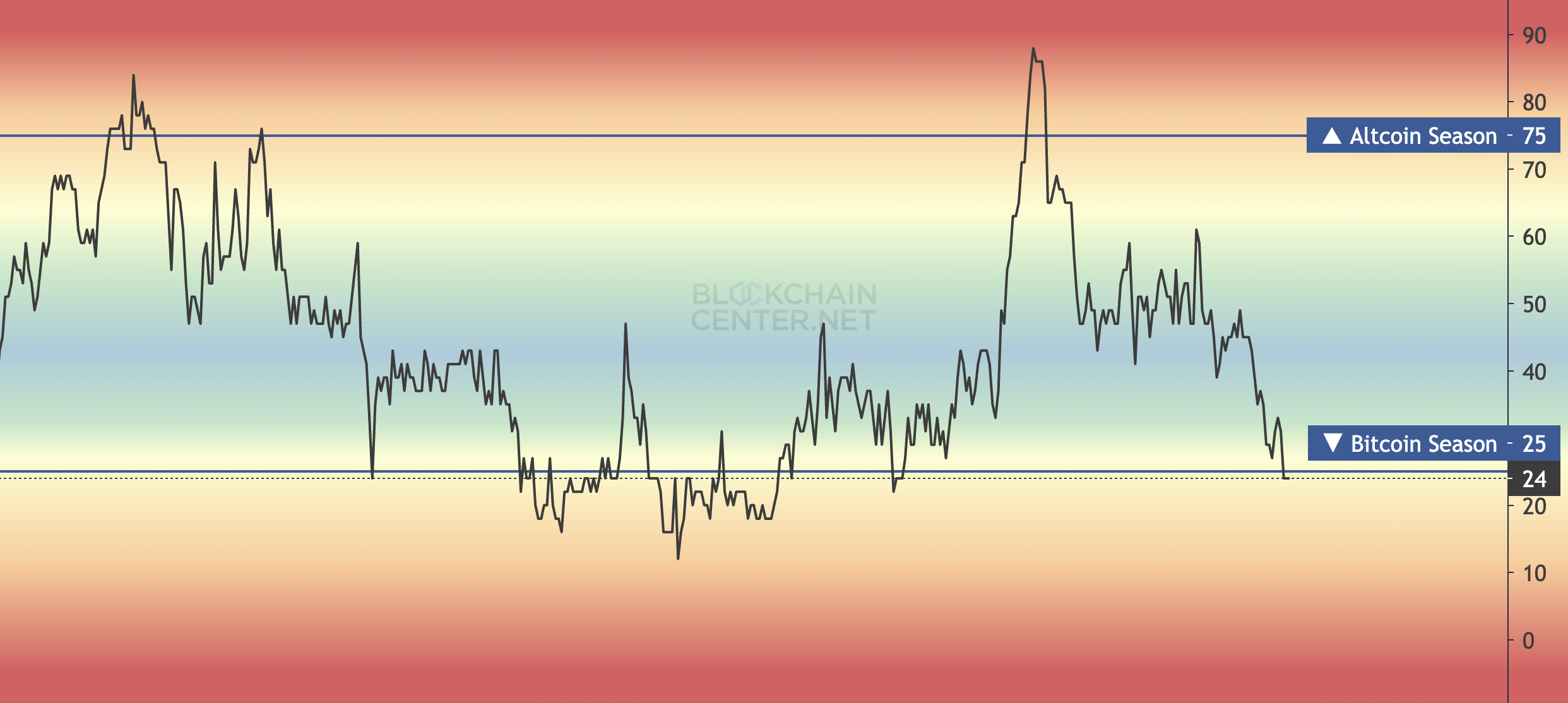

The results for altcoins are no different, with losses averaging -30% for the most capitalized, bringing the market into a Bitcoin Season phase with a level of 24 according to the “altcoin season index.”

The watchword for February is LIQUIDATION. According to data from Coinglass, total liquidation on exchanges is over $12 billion. Of this, $8.290 billion relates to long positions while the remaining $3.3 billion relates to short positions, making it one of the worst months in recent years.

The result is a huge collapse in the values of open interest on the exchanges. The value of open positions on Bitcoin has plummeted from $61.6 to $50.7 billion, a drop of 17.7%, while on Ethereum we have gone from $32 to $19.7 billion, a drop of 34.7%.

Record outflows

The general outflow involved significant sales from US spot ETFs on Bitcoin, while despite the sharp drop in Ethereum, flows remain positive.

-$3.482 billion is the result of sales on Spot Bitcoin products, while the Ethereum countertrend shows inflows for the modest figure of +$56.6 million.

As an obvious consequence, on the altcoin market, both for big caps and mid-caps, the numbers are much worse. In fact, prices have completely canceled out the $Trump Trade that started in November.

The result is a market cap that goes from $3,700 to $2,900 billion, with over $800 billion eroded from the market. Of these, over $200 billion, equal to 25%, are related to the Altcoin market, excluding BTC and ETH.

A complex phase for the market that, between heavy sell-offs and macroeconomic uncertainties, is still waiting for a recovery phase.