Limitations of Ethereum and the Optimism solution

Today we discuss Optimism, Ethereum’s scalable, high-performance Layer 2.

By now we are well aware of how some blockchains are not able to hold up at the pace we have reached.

DeFi, NFT, and cryptocurrencies see new investors and users coming in all the time.

While some networks are born with the idea of catering to large user bases, others begin to limp along as soon as traffic reaches a certain level.

Unfortunately, Ethereum is in the “slow” category, although things are improving.

Until September 2022, this blockchain saw the Proof-of-Work consensus algorithm governing its operation.

To understand it better, transactions on this blockchain were validated by solving complex calculations that prove (proof) the work done (of-work). This ensured the security of the system as well as the correctness of each transaction.

The problem with mining lies in the significant energy and computational consumption required. The processors need time to complete the problems; hence the slowness of the network. We have greatly simplified but the concept is this.

Not being able to meet the growing demand, Ethereum was often quite congested. This happened mainly at the hands of two entities: NFTs and DeFi.

NFTs lived 2021 under the banner of madness; everyone wanted them: creations by unknown “artists” reached sky-high figures, inflating the prices of the entire industry and leading to a speculative frenzy.

Creating, selling and buying NFTs requires interaction with several smart contracts, thus a number of transactions. When thousands and thousands of people move these assets simultaneously, the Ethereum blockchain found itself under water, overburdened by the workload.

The result? Slowdowns and soaring gas fees. Yes, because the mechanism governing the cost of transactions is identical to that of any other market: the more demand there is, the higher the price will go.

DeFi, short for decentralized finance, did the rest. The platforms on which it is possible to invest in the sector have multiplied and offer inviting opportunities for profit and return. At the time, the problem was always the same: interacting with these realities meant dealing with smart contracts. Thus, what we saw just now regarding NFTs was repeated.

In short, a solution had to be found.

The Ethereum team is hard at work on a series of updates that will radically restructure this blockchain from how we know it today.

The most prominent update (formerly Ethereum 2.0) took place in September 2022, leading the network to change the consensus algorithm toward proof-of-stake, which is better in terms of scalability and computational requirements.

In addition to this, the ability to create parallel chains will be introduced, which will further lighten Ethereum’s workload. However, the roadmap issued by Vitalik Buterin in late October 2022 no longer mentions sharding. Instead, rollups are mentioned as the ultimate solution to the scalability problem.

Let us then move on to layer 2, chains that offload their layer 1 from the heavy burden of transactions, leaning on it only for security and validations.

Ethereum is a layer 1 on which several layer 2 realities are founded. Among these, we finally arrive at the subject of our interest: Optimism.

Index

What is Optimism?

Optimism is a well-known layer 2 on Ethereum blockchain.

It is part of the category of layer 2 called “optimistic rollup.” These services make it possible to execute transactions on the blockchain without actually going to interact with it.

Layer 1, in this case Ethereum, is relieved of the burden of transactions, making it possible to scale very high without having to worry about gas fees.

This is done by the fact that transactions are annotated. Then, the moment there is a certain amount, they are packaged and sent in bulk to layer 1.

On Optimism, the mechanism just described is called Sequencer.

As seen, it is responsible for accomplishing several tasks:

- Provide instant confirmation of each operation, as well as its status;

- Compose and process Layer 2 (hence Optimism) blocks;

- Send transactions to layer 1 (Ethereum).

The end result is an overall better user experience for the user.

More specifically, the strengths of Optimism are:

- Reduced gas fees resulting from the transaction batching operated by the sequencer.

- Speed, again due to instant confirmation on layer 2.

- Scalability and sustainability, leading Optimism to be the winning choice for multiple use cases.

- Security, guaranteed by having Ethereum behind its back to handle the consensus.

In all of this, however, there is one major limitation: the challenging period.

This consists of a waiting period for withdrawals from Optimism to Ethereum.

This is necessary: there must be sufficient time to detect any tampering or problems in the transactions that have occurred on the L2 so that it can be corrected.

This wait is long but consistent with other realities: one week.

Summing up what has been said, looking for more pragmaticity: Optimism is a layer 2 chain resting on Ethereum. It handles the unwinding of transactions, so it offloads the already burdened layer 1. By using it, the user saves time and money, except for the time when it is necessary to bring capital back to the parent blockchain.

In all this, the security standards of Ethereum, precisely responsible for this task, are preserved.

The good thing is that the environment is friendly and not complex: on Optimism we find wallets (such as MetaMask) and DeFi protocols from the Ethereum world.

It takes very little to enter this dimension. We will see that shortly.

Before concluding this paragraph, let’s look at some additional details.

Optimism is open-source, permissionless, and decentralized.

First, anyone can view the programming code and work on alternatives based on it.

Also, any programmer or team has the ability to publish applications to it: it is a permissionless environment, precisely “without permission” to require in order to proceed.

Finally, being decentralized, Optimism has no major players deciding its fate.

There is, however, a company leading the project, Optimism PBC: it is a public benefit corporation. So there is an obligation to balance profit between corporate interests and community and environmental benefits.

In fact, as of today, Optimism is not yet decentralized: there is a program of interventions designed to achieve this goal (see image below). Until then, PBC will donate all profits from the business (as also stated on the official website).

Optimism clashes with another reality layer 2: Arbitrum. Let us then compare the two opponents, identifying their similarities and differences.

Optimism: similarities and differences with Arbitrum

At this point, those who know a little about the Ethereum environment might wonder what the differences are between Optimism and Arbitrum. Fair question: after all, both are Ethereum layer 2s characterized by several similarities. However, there are also some important differences.

Similarities between Optimism and Arbitrum.

In order to understand the differences between Ethereum’s most popular layer 2s, we must first identify their similarities.

First, both are optimistic rollups with the task of relieving Layer 1 of the burden of transactions. In doing so, everything is speeded up and gas fees are really low.

Scalability is high and meets no obstacles on the way.

Both chains are universal. This means that they can meet a variety of needs-from DeFi to payments to business applications or more.

Operability is instantaneous as there is no need for several confirmations: the transaction is concluded upon creation of the block that hosts it.

Both layers 2 interact with the Ethereum smart contract act to process deposits and withdrawals, as well as verification of transactions that have occurred off-chain. Translated: the parent blockchain guarantees maximum security of transactions, which are impossible to manipulate.

Staying with the theme just mentioned, anti-fraud mechanisms are called in only when invalid blocks are detected and not with every transaction. This results in significant savings in computing power and resources.

Differences between Optimism and Arbitrum

Yes, there are several similarities but also many distinctive peculiarities for both networks. We highlight two of them, the ones that are actually most important.

First, the fraud verification process changes.

While Optimism employs single-round fraud proofs, the rival applies multi-round fraud proofs. What this means.

Optimism relies on Ethereum and offloads the entire transaction that needs checking. In itself, the result is perfect but the gas cost soars as the layer 1 chain is precisely called in for the whole process.

On the other hand, as we had seen in the dedicated in-depth study, Arbitrum independently breaks down the transaction until the element of discord between the parties is discovered. At this point, only the latter is turned over to Ethereum for the final verdict. In this way, the transaction cost is significantly reduced compared to the Optimism case.

The second point concerns the dependence on Ethereum. Again, Optimism shows that it has a little less than its “cousin.”

As we know, both layer 2s employ Ethereum validators to certify security and authenticity of transactions.

However, should there be major restructuring in the latter’s consensus, re-executing transactions would lead to different results than the current ones. Let’s see why.

For smart contract execution, Optimism employs the Ethereum Virtual Machine.

Arbitrum, on the other hand, has its own dedicated machine, theArbitrum Virtual Machine. It is in fact identical to the EVM but its own. Therefore, this reality is in control.

Should there be major changes on the consensus (such as forks) Optimism could find itself in an uncomfortable situation, where decisive intervention would be needed to fix inconsistencies and issues. Arbitrum, on the other hand, would have no problem.

Thus, there are similarities but also significant differences that are impossible to overlook.

"While there are many similarities, Optimism shows some flaws compared to Arbitrum"

Interacting with Optimism: wallet and bridge

How to interact with Optimism? Let’s find out.

First, you will need a suitable wallet. The good news is that this layer 2 supports the major software available. Therefore, it will not be difficult to find what is right for us.

As is often the case, the number one choice falls on MetaMask. Not surprisingly, it is a versatile, secure wallet that is easy to use and comes with extensive documentation.

We also find well-known and reliable alternatives such as Coinbase Wall et and TrustWallet, joined by other lesser-known entities.

The Ledger hardware wallet, on the other hand, is not supported but can still be employed via MetaMask.

Returning to the latter, configuring the Optimism network is easy.

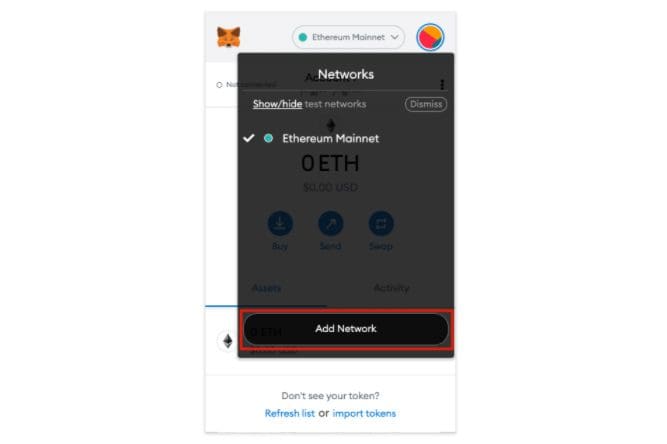

First, we click on the Add Network button highlighted in the following image.

After that we add the following parameters, taking care to save:

Network: Optimistic Ethereum

Chain ID: 10

Currency: Ether (ETH)

Node: https://mainnet.optimism.io

Explorer: https://optimistic.etherscan.io

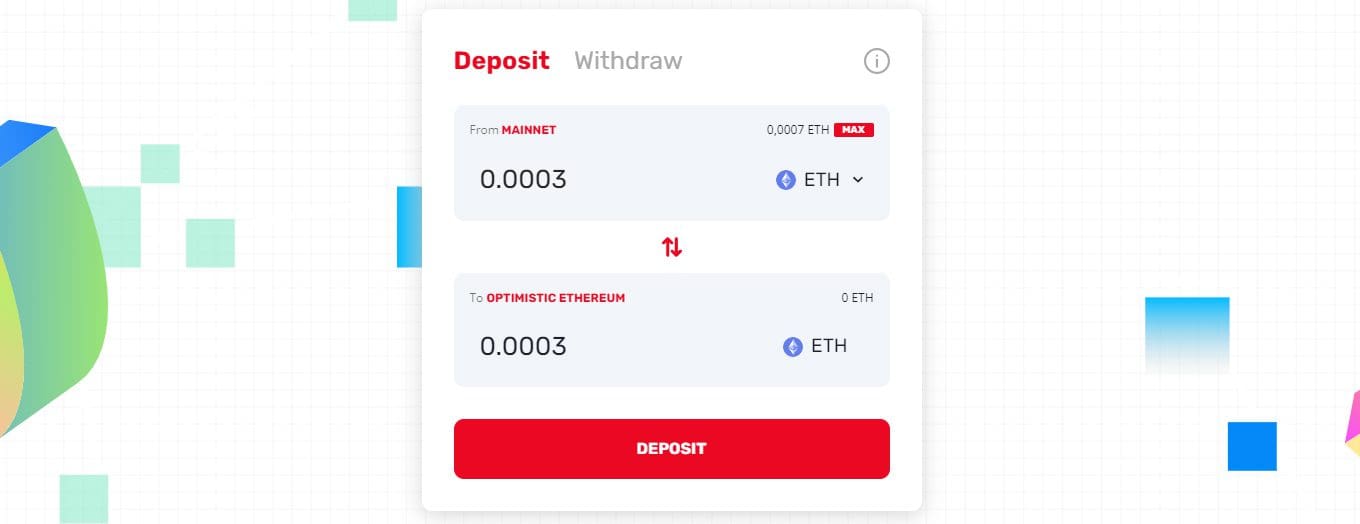

We then move on to moving cryptocurrencies from Ethereum to Optimism, which is also easy and uncomplicated.

Several bridges are available. However, we recommend using the official gateway, which can be reached at gateway.optimism.io. Good supporting documentation (in English) can also be found here.

The process consists of a few simple steps.

First of all, from the main page we go to connect our wallet via the appropriate button in the top right corner.

Next, from the screen as pictured we will go to indicate in the topmost box how many Ether (or other asset) to turn over on Optimism. From here we will also be able to reverse the process by clicking on the word Withdraw.

At this point we just select the Deposit button to continue and find ourselves in another screen from which we click Deposit again.

Finally, we confirm the transaction in the wallet to conclude the procedure.

Warning: moving coins and tokens from Ethereum will pay a fee on the blockchain. We need to calculate whether making the move pays off: it depends on the capital involved. In any case, the whole thing should justify the expense in gas fees.

At the end of what we have just seen we will be ready to operate in the world of Optimism…let’s find out!

Optimism's DeFi: opportunities from the Ethereum world

…and there came DeFi!

Being a layer 2 of Ethereum, applications native to the latter network are easily transportable to Optimism, NFTs included (yes, there is also OpenSea).

Therefore, some well-known realities are available and with them decent possibilities for passive income and return. We say neither “good” nor “excellent” because the capital raised is to date quite small.

First of all Uniswap, in its v3 version. The famous DeFi protocol has been working hard to offer a viable service based on this layer 2, and it shows!

It is possible to swap tokens and coins at negligible cost, as well as turn over funds in liquidity pools. However, at the moment the platform raises fairly little capital; it will need more time to gear up properly.

The protocol placed first in liquidity on DefiLlama, however, is Synthetix, followed by Velodrome.

Synthetix is a derivatives platform, focusing mainly on forex-style exchange between currencies, as well as some cryptocurrencies. Interesting but with still limited offerings, there is room for expansion.

Also accessible is the giant DeFi Curve but with decidedly low liquidity, less than half a million dollars as of the date of writing. This aspect, frankly said, makes one a bit leery of exploiting this service: low capital means low stability.

Lyra, a portal dedicated to options, is interesting. The markets available are really limited but we always reason with the view that various bricks will be added over time. To keep an eye on.

Optimism: good layer 2 Ethereum with room for improvement

After all the information we have seen, it is time to draw conclusions.

Optimism is a good solution to the scalability problems of its Layer 1. Users find a fast, fast environment in which they can operate without any thought.

Ethereum obviously benefits from this.

First for traffic: by no longer having to worry about the transactions processed by layer 2, the chain can catch its breath.

Second for the whole ecosystem: Optimism still operates within Ethereum and adds value to it. Also, Layer 2 gas fees are paid in Ether, so there is constant demand for this coin.

Optimism certainly has room for improvement, and the roadmap testifies to the intention to file down flaws and limitations.

But a fundamental question remains: will the improvements come in time or will the competition already be too far behind? We will find out not too soon 😀

What do you think about Optimism? leave a comment on our social channels, we are very curious.