Introduction to the Proof of Stake consensus algorithm

Proof of Stake is an ever-hot topic in the cryptocurrency world. This article will be devoted to understanding how it works and its pros and cons.

Consensus algorithms are a tough but fundamental topic. They are the basis of any blockchain and a minimum of knowledge any investor should have.

The most famous algorithm is the Proof-of-Work, the beating heart of the bitcoin cryptocurrency. The subject of our in-depth study, however, is more recent, adopted by Ethereum and numerous altcoins such as Solana, Avalanche and Cardano.

Proof-of-Stake is a mechanism with numerous advantages, chief among them scalability. However, it is not without its criticalities that need attention: we will discover them.

At the end of these lines we will be more aware of the technologies operating behind the scenes, so that we can better evaluate the many crypto projects equipped with the PoS algorithm.

Index

What is a consensus algorithm?

Before we kick off the in-depth discussion on Proof-of-Stake, we need to be clear on what a consensus algorithm is.

The blockchain is a decentralized database, distributed over several nodes. This technology is the basis of smart contracts, DeFi and, of course, cryptocurrencies. If you have any questions, our article on what a blockchain is is available.

Transactions are gathered into “packets” called blocks. These are constantly added to the blockchain and become immutable after approval.

In an environment without central authority, the information in the database must be correct. The consensus algorithm has precisely this task: to coordinate the parties involved in the network and prevent discrepancies. Simultaneously, it must prevent tampering from occurring.

In the decentralized environment, people do not know each other. Therefore, we must assume that no one can be trusted.

The database is distributed to all participants and not kept in one place. For everything to work properly, everyone has to own a copy of it, obviously identical to the others.

The consensus algorithm is what ensures the balance and smooth operation of the network.

The mechanism behaves in this way:

- Each transaction does not occur immediately but requires validation.

- Anyone who wants to add a new block to the chain must put something into play. This can be an amount in cryptocurrency, spending on computational energy, or something else. There is therefore an interest in proposing only tamper-free blocks. Otherwise, what has been put on the line (stake) is lost. In short, the advantages of a malicious action are less than the disadvantages.

- By proposing a new block you get a reward. That is why this work is carried out: there is a payoff to be pocketed.

Thus, the consensus algorithm is a system that ensures stability and security by incentivizing the proposal of correct blocks through rewards. Conversely, those who were to provide incorrect information would suffer the consequences, collecting economic and/or reputational damage.

Thanks to the consensus algorithm, the database that is distributed is always correct. The ability to withstand malicious and erroneous actions is extremely high.

What is the Proof of Stake algorithm?

Having made the necessary premise, let us find out what the Proof-of-Stake consensus algorithm is.

Like its colleague Proof-of-Work, this mechanism is concerned with ensuring the regularity of transactions on the blockchain. It also keeps the environment secure and safe from malicious acts.

There is, however, a huge difference between the two: while PoW requires solving complex calculations to validate transactions, the PoS algorithm relies on the coins placed in stakes…let’s delve deeper!

Each validator purchases and stakes a certain amount of the network’s native cryptocurrency. For example, on Ethereum it will be ETH, on Solana SOL and on Avalanche we are talking about AVAX.

Based on the total amount paid, the validator will have a higher probability of winning a block. There are also other methods of awarding the same, this however is the most popular one. In the following section we will explore the Tendermint BFT mechanism, which is among the best known in PoS (employed, for example, on Cosmos).

Staking ensures that each does its job well: if a validator were to give the okay to a block containing erroneous transactions, it would immediately be deducted a variable portion of what was put into the stake. In addition, it could be turned away from the network, losing the opportunity to perform this activity.

Therefore, coin staking plays the role that mining plays in the Proof-of-Work algorithm. While the latter leverages energy expenditure to ensure reliability in the work of validators, Proof of Stake instead exploits the economic penalty on the capital blocked by the validator itself.

Importantly, there is a difference in the process of creating new coins: whereas in PoW they are mined, PoS forges them. When inquiring about a network we hear about minted coin, minting , and similar terminologies, we are probably dealing with a Proof-of-Stake algorithm.

Many blockchains impose rather high minimum crypto limits in stakes. Ordinary people cannot therefore validate on their own.

This is not to say that people cannot still participate in the process: anyone can delegate their coins to a validator and get a percentage of their take.

The security of the network is quite robust: an attacker would have to have 51 percent of the total in stakes to manipulate transactions. These are huge amounts of capital, and they shelter against such risks.

Proof of Stake is the most popular consensus algorithm today, employed by numerous blockchains. The reason? It is a modern solution and has several advantages. We will explore them later.

There are also different declinations of PoS, designed for various needs; however, the principle is the same and it all revolves around the native crypto stake.

How does proof of stake work?

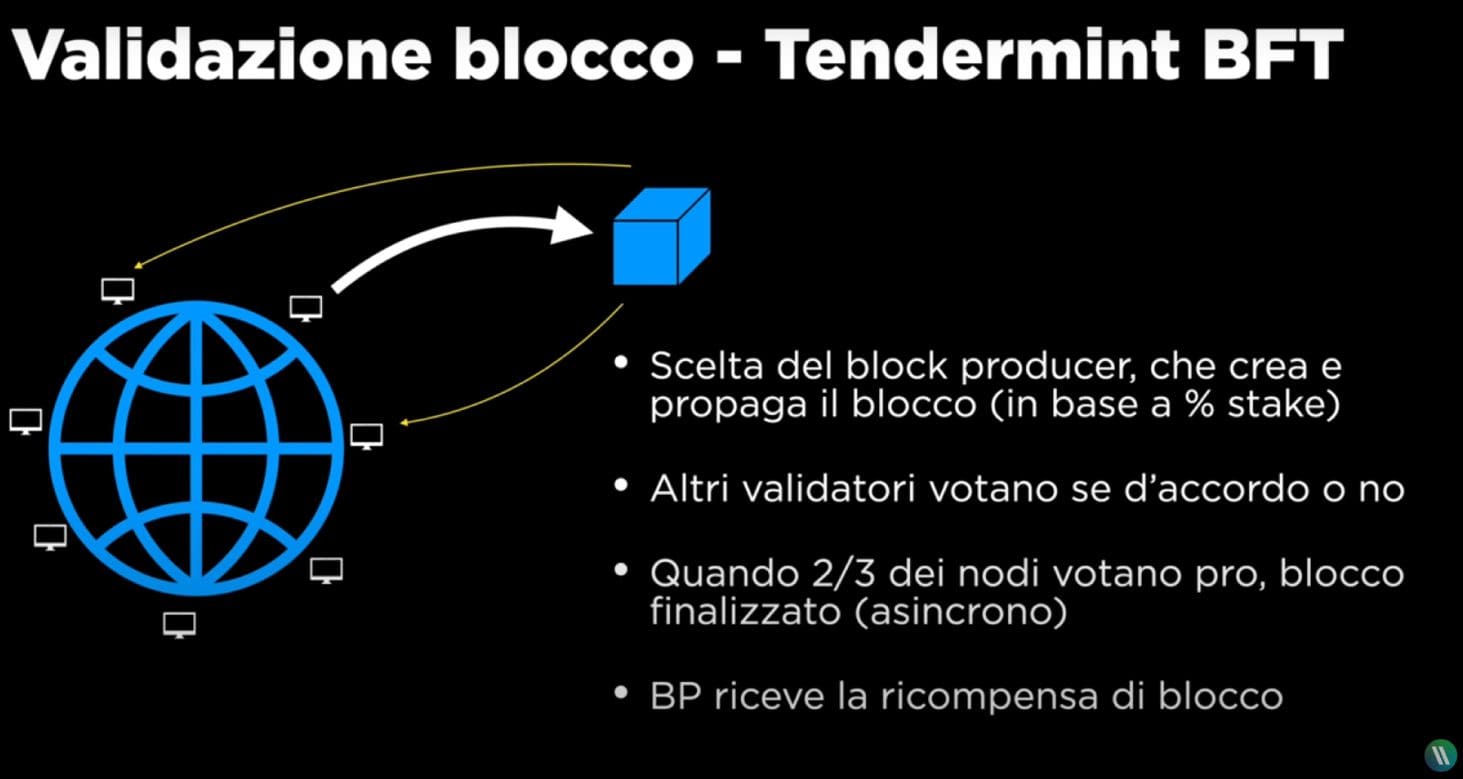

Let us explore one of the main Proof of Stake validation mechanisms in a few lines: Tendermint BFT.

As a first step, the block validator, also called block producer, is proclaimed. This is done randomly, based on the coins staked: the higher the percentage of the total, the greater the chance of winning the “win.”

The validator then proceeds to create the block, placing the various transactions within it. After that it propagates on the blockchain itself. Beware, however: this is not the end of the story!

At this point, the voting phase involving all other validators is initiated. These can approve the blockchain, as well as not approve it.

Upon reaching a certain threshold in favor, the block is confirmed, finalized and added to the blockchain. The validator gets its reward.

If it packages a block containing false information, the other validators prevent it from being approved. In addition, the person directly involved suffers punishment on the stake capital, up to and including total seizure and removal from office.

There are also punishments for nodes that do not reach a minimum online presence value. Be careful: these penalties also involve users who have delegated their coins into stakes. Therefore, we try to choose reliable parties to avoid unpleasant surprises.

Pros and cons of Proof-of-Stake

The Proof of Stake mechanism brings with it several advantages: let’s look at all of them.

First, decentralization.

Although many chains place stringent access limits, it is usually cheaper to become a PoS validator than a miner on PoW networks. Think of Bitcoin: mining is now carried out only by specially created crypto farms.

Proof-of-Stake is more affordable and incentivizes more participation by the entire community, including proxies.

Another point in favor of PoS lies in energy savings.

Here there is really little to argue about: this algorithm is significantly more efficient than Proof-of-Work.

Since it does not have to solve any computation, the computational power required to validate a block is reduced. As a result, the power demand also drops dramatically.

At the same time, the requirements at the hardware level are quite low.

Let’s move on to what is perhaps the biggest advantage of Proof of Stake: scalability.

Bitcoin’s biggest limitation lies in its lack of ability to respond to increasing demand for use. In fact, Proof-of-Work takes time to close transactions. Moreover, on average it cannot handle more than 3-5 per second. Therefore, it is not a suitable chain for the demand for fast and numerous transactions.

When scalability is needed, there are two solutions: a Layer-2 like Lightning Network; a Proof-of-Stake chain.

The latter allows processing thousands of transactions per second. In addition, it is truly adaptable. This makes PoS networks perfect for enterprise applications, DeFi, gaming, payments and more.

Continuing on from what has just been written, another strong point is precisely that of adaptability.

A PoS chain is versatile and unlikely not to fit a specific reality. Think of Solana: it has excellent DeFi platforms (see Raydium), NFTs marketplaces (OpenSea and Blur) and gaming projects such as Star Atlas.

Let’s close with security.

The Proof-of-Stake algorithm has a high tolerance to possible malicious nodes. As long as the bad guys do not have control over at least 51% of the total in stake, the chain will be safe from any attack. While not impossible, we are talking about huge numbers. It therefore seems unlikely that anyone would act in this way. However, there is an exception; we will see it in a moment.

In addition to the many pros, we must also take into account the cons.

First, you need a native coin to be staked. Therefore, the development team will have to work with exchanges such as Binance, put it up for sale, and shell out substantial amounts in marketing; all while hoping that the public will respond well. In Proof-of-Work networks, this is not necessary: in the early days, anyone can mine coins and validate transactions.

Let’s shift the focus to security.

We mentioned the unlikelihood of a Proof-of-Stake chain being compromised.

However, very young and low-capitalization realities could be manipulated: it is one thing to seize Avalanche, another to attack a network with a few million circulating. So let’s be careful about investing in fledgling projects because some risk in this regard is there.

Proof-of-Stake: the best compromise?

After what we have seen, a question comes to mind: is the Proof-of-Stake consensus algorithm the best compromise out there?

We said that Proof-of-Work is great but burdened by limitations. The high energy demand and poor scalability are rather detrimental.

At the same time, PoS still has some critical issues that we have mentioned.

Among these realities arise numerous declinations designed to overcome its limitations and shortcomings.

In truth, there is no perfect consensus algorithm: each possesses specific pros and cons. Therefore, one cannot say “A is better than B” because everything depends on the use cases of the project. For example, a blockchain designed for payments will necessarily have to be fast. Therefore, The PoW algorithm would not be the best choice.

In conclusion, Proof of Stake is a very good consensus algorithm that needs some tweaking to be perfect. After all, improving and evolving is the basis of any industry, blockchain included.