Leggi questo articolo in Italiano

Public debt: what it is and how it works

By Gabriele Brambilla

The indebtedness of a country is a serious topic with a great impact on all citizens. Let us know in detail about the public debt

What is public debt?

We hear about it on an almost daily basis, but usually shoot straight without paying much attention; yet public debt is one of the most important economic dynamics, which without proper monitoring and management plan can become a real scourge. Let us therefore understand what it is, why it takes shape and what its usefulness is.

Let us therefore start from the beginning. Public debt is a theoretically neutral instrument, in the sense that it has both positive and negative points. Like any other entity, a state also needs to finance its activities, from basic and continuous to extraordinary measures that may take shape over time. Where does the money needed to carry out these initiatives come from? The sources are diverse, and prominent among them are taxes and fees paid by citizens and businesses.

In addition, a country can also call in appropriate financial instruments; Government Bonds are the most popular and well-known. As many will know, these are bonds issued directly by the treasury. Anyone can buy them, creating a debtor-creditor relationship: the first is the state itself, which receives the money needed for the activities mentioned above; the second is the person who buys the bond.

Like any loan, the Government Bond also carries interest, which is the element that drives the saver to purchase the instrument in question. Consequently, the moment a country issues Securities, it is incurring debt to citizens, businesses, corporations and foreigners who proceed to purchase.

The debts arising from the Securities, combined with other items such as borrowings, are liabilities that burden the country. The sum, which is negative, is called the public debt.

Public debt utility

Public debt finances the state machine, which is often heavy and expensive to maintain. In addition, as we said, it can also be useful to support extraordinary expenditures, perhaps geared toward the development of a particular sector and job creation. In the latter case, the debt incurred has a positive connotation, because it could lead to higher future earnings, a true investment.

But in the norm, unfortunately, debt is resorted to simply to make the machine keep running more or less smoothly.

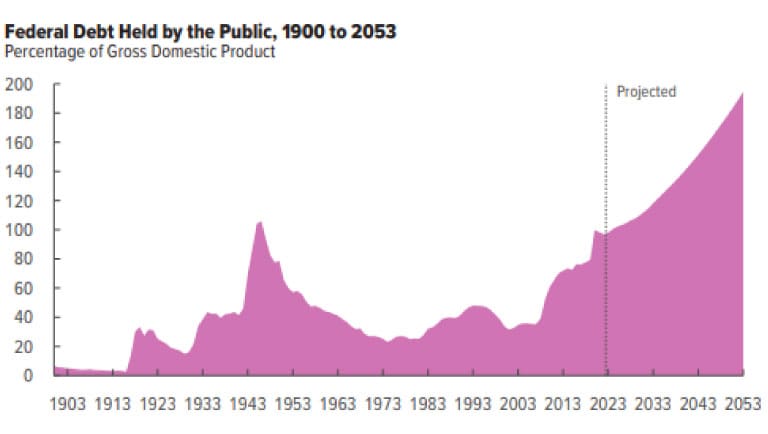

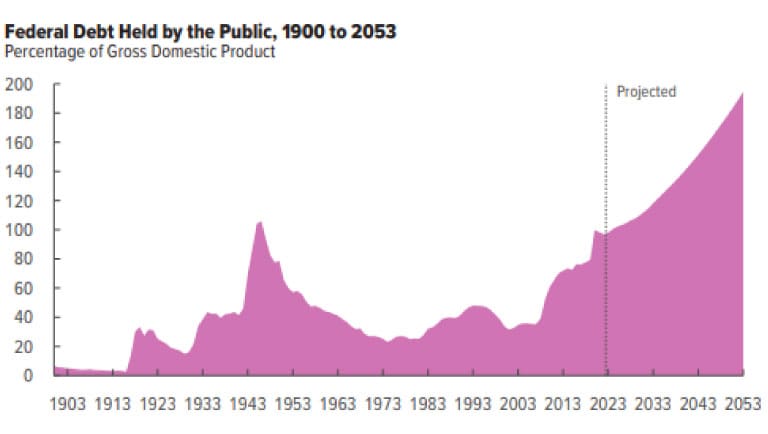

To assess where a state stands on the debt side, the tool par excellence is the debt-to-GDP ratio. It shows how much public debt amounts to in relation to Gross Domestic Product in a year, offering a percentage figure that is easy and straightforward to read. In fact, reading the debt total alone makes little sense: it all depends on the economy behind a country; to understand it, 1 trillion could be “peanuts,” as well as an unsustainable sum to manage.

Clearly, the lower the debt-to-GDP ratio, the better. In fact, going too high creates a potentially destructive mechanism: debt increases, the annual budget goes into deficit, more debt is used to repay the previous one, the pressure generated by interest grows, and so on. The danger is the default of the country, which may find itself in the situation of not being able to repay its creditors. Surely we have all seen at least once the various ratings of agencies such as Moody’s (e.g., AAA, BBB+ and so on): these are ratings of the reliability of a given country in repaying debts; the better the rating, the lower the possibility of default (one must still be careful).

But the issues do not stop at default. In fact, public debt is a boulder that burdens citizens in a non-proportional manner. Indeed, it is the younger generations that are most likely to suffer its consequences, which can be catastrophic. In fact, debt can trigger mechanisms that would impact production, employment, development and opportunities that can be seized. The services offered by a state, from health care to education, could come out weakened, directly affecting people. If we think about it, some of these dynamics we are already experiencing in our own borders.

In short: public debt, when contracted in the right way, has unquestionable utility. When it grows too large, however, it becomes a difficult problem to solve without decisive, time-consuming interventions.

"Public debt finances the state, but can have devastating consequences if out of control"

Highest public debt

Making use of data available on Wikipedia and other information portal, here is the ranking of the highest public debt to GDP (as of 2022).

Fifth place goes to our country (144.6 percent), which is ahead of Venezuela (157.8 percent). Bottom step of the podium for Eritrea (163.7 percent), while Greece comes second (177.4 percent).

The highest public debt in the world is Japan’s, touching over 261 percent. This impressive figure is the result of policies initiated in the 1990s to lift the country out of a troubling economic situation, a mix of deflation and low growth also due to demographic characteristics. In any case, Japan is a very special case that has been able to withstand this pressure without too much trouble.

The United States is not doing so well either, with a ratio to GDP around 129 percent as of December 2023 (see below, Wikimedia image). Monstrous US public debt total figure: more than $33 trillion.

Conclusions

We hope that this brief discussion of government debt will help you understand even more about economic and financial dynamics.

Thank you for reading us!