Leggi questo articolo in Italiano

Crypto AI sector collapses on Nvidia sell-off: The DeepSeek case

By Daniele Corno

Nvidia slumps to -14.5% on the daily after DeepSeek case and sharp sell-off in US markets pushes crypto AI sector down

Crypto AI in crisis in the wake of Nvidia's collapse

Black Monday for the sector related toartificial intelligence. News about DeepSeek, a Chinese AI model in direct competition with Open AI’s Chat Gpt, has largely affected the markets in this early week.

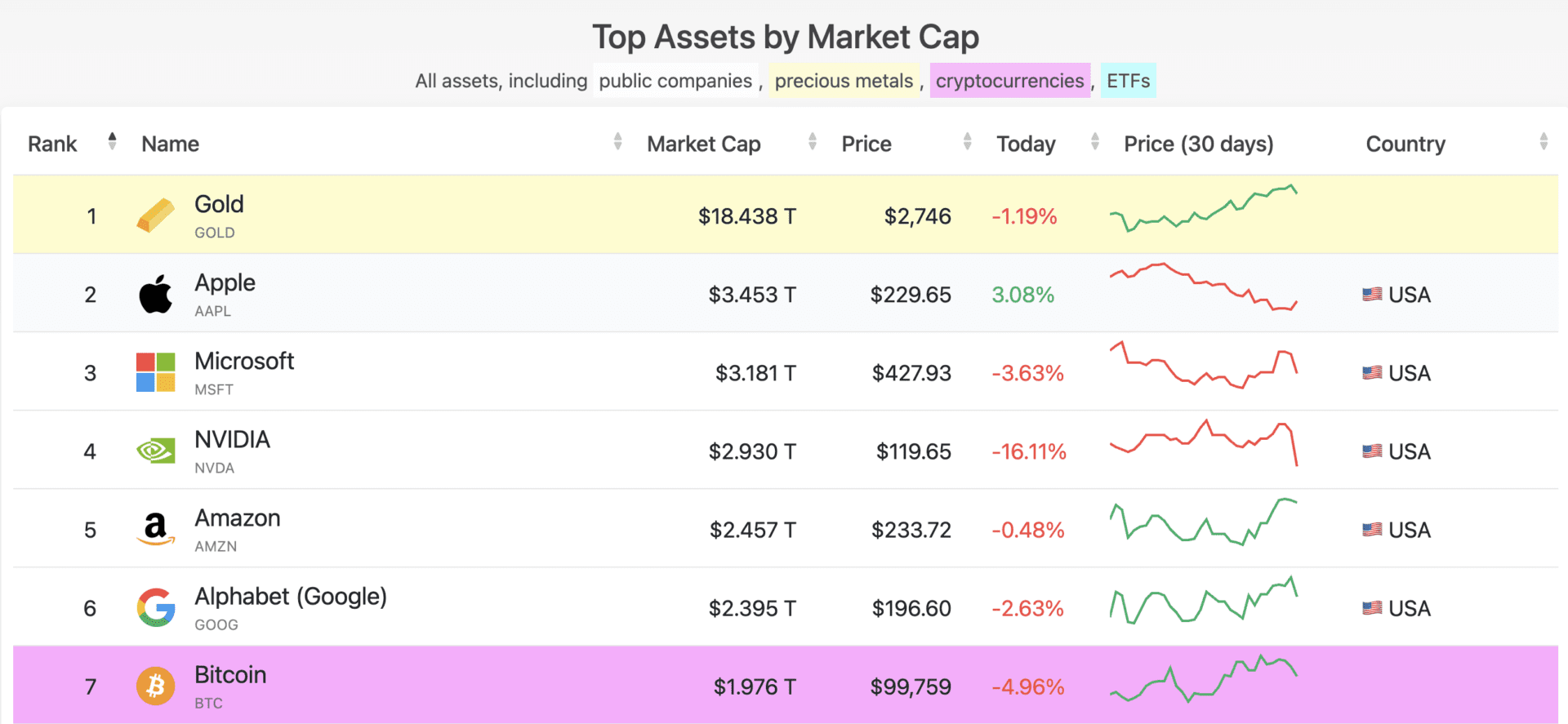

NVDA stock posted a loss on the daily of more than 15 percent with a loss close to $500 billion in a single session. Nvidia, until a few days ago was theworld’s largest company with a capitalization of more than $3.5 trillion. With today’s decline however, the company has lost two market positions, with Apple regaining the lead followed by Microsoft.

Nvidia’s fall dragged with it the entire Crypto AI sector, which posted double-digit percentage losses.

Among the most highly capitalized cryptos, NEAR, ICP, RENDER, FET, GRT, and VIRTUAL are seeing heavy losses, ranging from 8 percent to 17 percent, creating great uncertainty in the AI sector.

Crypto AI: Opportunity or risk for investors?

DeepSeek has sparked a debate on investing in AI, offering drastically lower costs than competitors. JPMorgan warns that model efficiency could signal an overestimated AI investment cycle, while other analysts point to dependence on advanced hardware such as GPUs.

Despite the volatility, Redstone COO Marcin Kazmierczak, urges consideration of the uniqueness of Crypto AI projects , highlighting the potential of collaborations between AI agents. However, macroeconomic factors, such as U.S. rate decisions, expected on the evening of Wednesday 29, amplify uncertainty.

DeepSeek could reshape the industry, but investors must balance innovation and risk in an ever-changing market.