Stablecoin: introduction to stable cryptocurrencies

In the volatility and frenzy of the crypto universe there is also room for coins that keep their value stable, pegged to another asset: stablecoins.

Translated “stable currency,” this term denotes a broad set of cryptocurrencies that only look identical on the surface. In fact, the various stablecoins have distinctive features that make them anything but similar.

They are widely spread assets that are indispensable in the composition of a reasoned investment portfolio.

However, generalization reigns supreme, and often an investor cannot decide which is the best choice for his or her specific needs.

In this in-depth discussion we will go on to clearly define what a stablecoin is, describing its main types and uses.

We will then spend a few lines on the best-known coins, identifying their strengths and weaknesses.

At the end of the article we will know more and be able to move with greater awareness in buying and selling these assets.

Index

What are stablecoins?

Stablecoins are cryptocurrencies that keep their value pegged to that of another asset, from dollars to gold.

For example, Tether USDT has the valuepegged(pegged) to the U.S. currency, that is, 1 USDT = $1.

In order to succeed in this not-easy feat, stablecoins are generally collaterali zed (backed) by reserves of assets that guarantee their value.

Citing USDT again, the capitalization is high and in the tens and tens of billions of dollars.

Somewhere in the world, the company Tether (owner of USDT) then holds an equal amount of U.S. dollars so that it can guarantee the value of USDT. We shall see that this is not strictly so, but for now let us just assimilate this concept.

U.S. dollars are, of course, not the only asset used for this purpose: let us look at the three main types of collateralization.

Collateralization of stablecoins: fiat, crypto and non-collateralized

Stabilecoins collateralized by fiat-currencies represent the most widely employed option.

Tether USDT, the first stablecoin by capitalization, uses this method. Each USDT is worth one U.S. dollar; as collateral, Tether’s dollar reserves cover the value of all outstanding specimens.

The concept is simple: the company is willing to give 1 USDT for each dollar received, as well as the exact opposite.

Let us now turn to stablecoins backed by other cryptocurrencies.

In this case, there are no traditional coins to guarantee the value of the coin.

An example in this category is DAI, where the value is always pegged at US$1. As collateral, however, we find a mix of cryptocurrencies such as Ethereum, WBTC, and other stablecoins (including USDT itself).

Compared to fiat-collateralized, this category is more exposed to the risk of price volatility. At the same time, however, the effects due to inflation are mitigated.

Finally, here are the uncollateralized coins.

There is no asset deposited. Instead, we find a specific algorithm to protect the value of the coin.

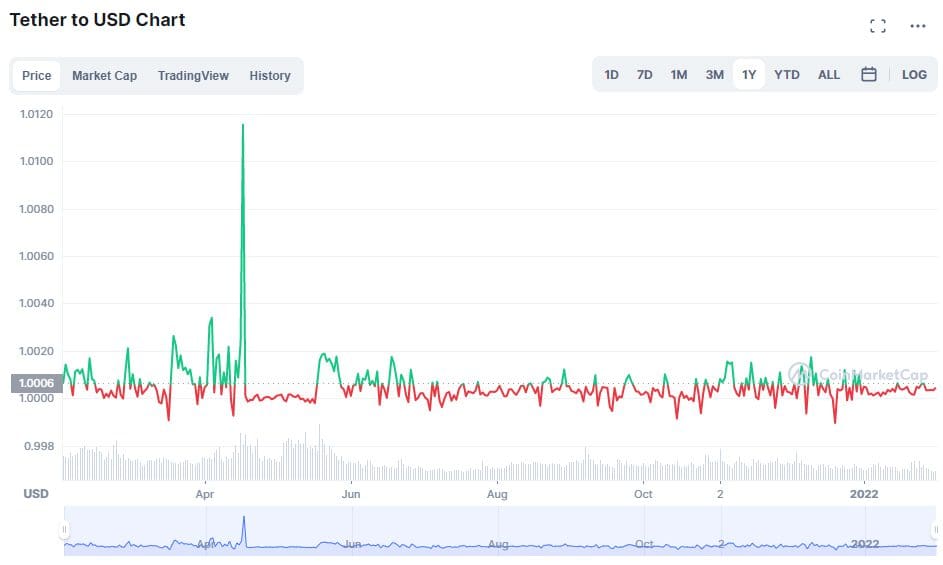

Except for the obvious spike where the peg has temporarily failed, here is what the graph of a stablecoin should look like.

However, volatility can also affect this family of cryptocurrencies, especially those not backed by traditional coins.

However, to ensure safer sleeps for holders, there are mechanisms designed to contain this event.

Before continuing, however, a question must be answered:

Why do stablecoins exist?

We know: the cryptocurrency world is decidedly turbulent. Days of deep red can be followed by triumphant pumps, just as it is possible to see one’s funds churned by 15 to 20 percent in a matter of hours.

On the one hand, the beauty of crypto is also this: counterbalancing the high risks are profit opportunities that cannot be found elsewhere.

In everyday life, though, this volatility poses a problem.

Imagine selling a car today in exchange for some Bitcoins and suffering a -10% loss tomorrow. If the plan had been to sell them back shortly, we would have cashed in a major loss. A currency that can be spent every day must provide constant purchasing power at least in the medium term. In addition, a well-structured portfolio should not be composed only of super-volatile assets: you need a solid fraction that you don’t have to worry about.

Stablecoins solve this problem: fully digital assets but with the security of a fixed value. Doing so avoids unwanted rides on the roller coaster of traditional cryptocurrencies.

It is time to describe some applications of these currencies more specifically.

What are stablecoins used for?

Let’s discover some possibilities for using stablecoins.

Let’s start with the simplest application: exchange currency. Because of the guaranteed purchasing power, stablecoins are excellent cryptocurrencies for buying and selling products and services. If we were to sell an item right now for 1,000 USDC, in a month’s time the value of the same will be the same: $1,000.

Crypto-lovers like us wish for mass adoption. Offering currencies with linear value is an indispensable step toward the ultimate goal.

This consideration leads to another use: investment.

Developing a balanced portfolio clamors for stablecoins as risk mitigators.

Thanks to CeFi and DeFi platforms, it is possible to put these assets to income. Very attractive gains can be made without having to worry about fluctuations in price. By doing so, the impact of standard cryptocurrency volatility on the portfolio will be mitigated by safe and very low-risk income. They can also be combined with each other in liquidity pools, benefiting from excellent rewards.

Stablecoins are also perfect assets in the role of currency reserves. Think of DAI, stable coin collateralized by other cryptos. In the mix of value-backed assets we find just USDT and USDC. Or, moving to non-digital applications, a company or institution might want to hold a certain percentage of its reserves in stablecoins.

The process of digitizing money is already underway and accelerating dramatically. Traditional banks are being joined by entities that are making cryptocurrencies one of their workhorses. Volatility is what holds back change the most, a blessing and a curse at the same time.

Stablecoins will therefore play an increasingly central role in bringing even the most wary to this world, from ordinary people to institutions and states.

We have mentioned how with the term “stablecoin” there is a great tendency to generalize. Instead, the realities are very different: from collateralization to the presence (or absence) of acentral authority, each coin has its own characteristics. We can therefore get confused and find ourselves operating on something we are not perfectly familiar with.

So here is what is needed to solve the problem: a roundup of the main currencies in the family. What are the main stablecoins? Let’s find out.

Tether USDT

Let’s start big with the most capitalized stablecoin, ranking third among all cryptocurrencies: Tether USDT.

The coin is owned by the company of the same name and is priced pegged to the dollar (1 USDT = 1 U.S. dollar).

The value is secured by the collateral held by Tether: each USDT is fully backed by $1 physical, held at banks and/or deposits.

Here, actually, the last statement is not quite true. In fact, Tether does not leave the funds entirely stationary but implements fractional reserve: a smaller slice actually remains on deposit; the other part is invested in a variety of ways. This has always attracted numerous complaints, motivated by the fact that there would not be enough liquidity available in case of a sudden maxi sale.

However, this practice is also common and proven in the traditional banking system. Nothing new then.

A plus point lies in its wide dissemination: from DeFi to exchanges via CeFi, USDT is exchangeable almost everywhere.

However, there is no shortage of critical issues.

First, USDT is entirely centralized: reserves are held by Tether and users have no say in the company’s own decisions.

From a purely cryptomaniac perspective this is a problem: isn’t decentralization one of the most fascinating aspects of cryptocurrencies?

Tether USDT has also cashed in on much criticism regarding its lack of transparency. The absence of audits and the constant shifting of its locations clearly denotes a desire to escape state regulations.

So there are some shadows but no fear: USDT is a solid entity that even the major exchanges rely on. So while the lack of transparency is bad, one can consider oneself safe.

What’s more, since summer 2022 the Company has begun to change its approach on the issue, opening up more and more toward user information.

USD Coin USDC

Among the top five cryptocurrencies overall is USD Coin.

This stablecoin is very similar to USDT: centralized, pegged to the dollar and collateralized by it; again, fractional reserve plays a starring role.

Behind it is Centre, a company that specializes in creating stablecoins. What makes USDC different is the most absolute transparency, the exact opposite of the “rival” we mentioned earlier. Centre’s approach is one of maximum openness: an American company, it regulates all its creations according to SEC regulations and current (very stringent) laws. In addition, the code is open-source, available to anyone who would like to use it or simply consult it.

Finally, Centre publishes periodic audits, conducted by external entities, designed to show the availability of the collateral.

Speaking of critical issues, while transparent, this stablecoin is still company-owned, therefore entirely centralized. Purists may not be very happy with this feature. Moreover, since a company is behind it, USDC is censurable. Centre can then block or restrict certain transactions and wallets, effectively controlling everything that happens around the coin.

USDC is widely used in both exchanges and CeFi. It becomes less available than USDT in the DeFi world, depending on ecosystems and platforms.

Binance USD BUSD

The third coin in our roundup is Binance USD, created by the exchange of the same name in collaboration with Paxos.

Also pegged to the dollar and collateralized by it, it offers an important variation from what we have seen so far: the reserve is non-fractional. Therefore, the entire collateral is held on current accounts and immediately available.

BUSD is regulated by the New York State Department of Financial Services, making it fully recognized and regulated.

An audit report is published monthly on the coin’s official website to assure users and investors.

The main criticality of BUSD lies in the limitations due to the ecosystem: being the stablecoin of Binance, outside of this world it is less widespread and used.

TrueUSD

Another well-known reality full backed by the U.S. dollar is TrueUSD.

This currency consistently ranks among the top stable coins, usually behind USDT, USDC, Binance USD, and DAI.

Natively available on numerous blockchains, TUSD was launched in April 2018. Over time, investments have come in from big names in the crypto and economic landscape.

Except for a few slight deviations (highs of $1.08, lows at around $0.98), TrueUSD has consistently proven itself as a reliable alternative to other coins pegged and hedged by the U.S. dollar.

Terra USD (UST)

In May 2022, UST and the entire Terra ecosystem collapsed. We are leaving this paragraph for informational purposes, so you can learn about what had been the benchmark algorithmic coin. Here is an article to learn more about the loss of UST’s peg.

UST was the main stable coin of the Terra ecosystem (LUNA) and differed greatly from the realities mentioned so far, with which it shared only the peg to the U.S. dollar.

This stablecoin is part of the family of algorithmic ones; the value is then maintained by some specially developed code.

The workings of UST may seem complex, but in fact it is not: with each piece minted, $1 of LUNA is burned from the TerraUSD reserve.

Of course, it is not we who dispose of the LUNAs in question: it is the algorithm that does the work according to demand.

How was the price balance guaranteed?

We always keep in mind that UST and LUNA are deeply linked and interdependent. When the value of UST exceeded the dollar, LUNA holders could sell and get UST in exchange. In doing so, the supply would increase and the price would fall. On the other hand, the value of LUNA went up as burning them would decrease the circulating supply.

Otherwise, USTs could be sold in exchange for LUNA, returning stablecoin to its value of $1. At the same time, a certain amount of LUNA was still being burned, decreasing its supply for the benefit of value.

In fact, the value of LUNA drops only when capital is removed from the entire Terra ecosystem.

TerraUSD is a decentralized coin with no regulations.

Algorithmic stablecoins have often proven to be unreliable. Terra seemed to have found the correct fit, but it did not. Unfortunately, at the very time when the weaknesses of the project were being ironed out, a combination of factors caused the entire ecosystem to fail.

Can algorithmic stable coins have a future? At the moment it is difficult to say, and the case of UST would lead one to say “NO!” However, we cannot rule out the possibility that a truly earthquake-proof system will be developed in the future so that other events such as those related to blockchain Terra can be avoided.

USDD di Tron DAO

From a failed algorithmic to one that is still quite young and holding its own for now: USDD, Tron DAO’s stablecoin.

This stabecoin works in a very similar way to Earth UST. Indeed, one only needs to replace LUNA with TRX, the native coin of the Tron ecosystem.

Arbitrage is at the heart of the whole system and should ensure that the peg holds. Unfortunately, we know that this may not happen; therefore, one wonders if it is worth the risk and using USDD.

No one can know the future, otherwise we would long ago be on some Caribbean island enjoying the profits. However, we can reason and make assessments based on our own characteristics.

Algorithmic stablecoins have proven to be risky and potentially destructive to people’s capital. The collapse of UST has left wounds that are struggling to heal.

Therefore, it all depends on each person’s risk appetite.

Aware of the criticality of the model itself, the people behind Tron are considering various possibilities to avoid an event like the one that swept UST away.

Among the ideas is the rather concrete possibility of diversifying USDD’s hedge, including a substantial share of assets that are not very volatile and therefore low-risk.

MakerDAO (DAI)

DAI is the stablecoin of the famous MakerDAO platform, native to the Ethereum chain.

As with all the currencies explored so far, the peg is on the U.S. dollar: 1 DAI = $1.

DAI is a fully decentralized stablecoin, where people retain control of their assets.

The value is guaranteed by over-collateralization in other cryptocurrencies. Therefore, if USDT has real dollars to hedge, DAI gets its back from coins like Ether.

In order to get DAI on the parent platform, MakerDAO, we will have to deposit one or more crypto assets more than required.

For example, by providing $1,000 in ETH, we will be able to get at most 750/800 DAIs (it depends). In this way, the protocol takes a margin of safety in case of sudden collapses in collateral.

This is complemented by settlement mechanisms that close users’ positions when a certain threshold is reached.

DAI is also purchasable on other platforms and expendable as a regular currency.

The significant success achieved has taken this stablecoin to the top positions in the capitalization rankings.

The project is well successful and perfectly in line with the thinking of crypto-irreducibles.

PAX Dollar

Let us come to the twin of Binance USD.

Paxos is in fact the company that Binance partnered with in the creation of its stablecoin.

PAX Dollar is an almost identical currency: pegged to the dollar, collateralized by it and with the reserve fully available. As with BUSD, there is complete regularization by the New York State Department of Financial Services.

The company regularly publishes audits certifying the soundness of the situation. The stated goal is to stabilize the dollar with blockchain, allowing anyone to exchange PAX Dollar for USD.

As for availability, it depends: large exchanges like Crypto.com and Bybit or CeFi like Nexo include it; overall, however, it is slightly more difficult to move and invest.

PAX Gold

In contrast to those seen so far, PAX Gold is pegged to a highly coveted safe haven asset: gold

Not only that, collateralization is also done through the use of this precious metal.

In difficult times, stablecoins provide a valuable hedge: by buying them, one hedges against sharp price fluctuations while still generating income through lending and liquidity pools. Some, however, may want to opt for the ultimate safe haven asset, namely gold.

How can one invest in this metal but not get out of the cryptocurrency world? PAX Gold is the answer.

The big advantage lies in the possibility of buying even small amounts, which is not possible through traditional channels or the physical asset. The main disadvantage lies in theexposure to gold: by hedging through a stablecoin, we do not risk changes in the price.

By opting for PAX Gold, then gold, we are instead subject to its changes in value.

This is a very interesting, recognized and regulated reality.

Celo Euro

We close on a high note with Celo Euro, the Euro-pegged stablecoin of the Celo blockchain.

This network shares several features with what was Terra Classic. In fact, stablecoins occupy a central position in the project and aim to spread more and more.

The team’s will also shines through in the structure of the ecosystem itself; we find, for example, Valora, an application dedicated to the exchange of currency between people.

However, the similarity with Terra should not worry us: Celo Euro, as well as its “sister” Celo Dollar, are certainly safer thanks to the over-collateralization that characterizes them.

In fact, to guarantee value we find a mix of more or less volatile cryptos, continually modified according to market trends.

At celoreserve.org it is possible to take a look at the assets at any time. At the time of writing, the assets that make up the reserve are distributed according to these percentages:

- 42.25% in CELOs

- 7.05% in bitcoin

- 7.17% in Ethereum

- 23.91% in DAI

- 19.53% in USDC

- 0.09% in cMCO2

The ratio of coin to reserves is 2.53.

However, we do not want to claim that there is no risk: we follow the trend and take action if there are dangerous signals.

Which stablecoin to choose?

After this roundup and before we say goodbye, one question remains: what is the best stablecoin?

Well, there is no definitive answer; it all depends on what we want to do.

If our desire is to hold this asset for a long time, perhaps investing it on CeFi platforms or exchanges, the best choices are USDC, PAX Dollar and BUSD.

More generally, outside of these three, we should seek to own transparent and regulated stablecoins: only then will we be 100 percent protected.

Operating in trading or buying and selling on exchanges almost compulsorily requires the use of USDT: pairings, especially in trading, often involve this coin.

In some cases, stablecoins can also be useful for buying NFTs on certain platforms.

Moving to DeFi we will instead choose realities such as DAI. Obviously in this environment the risks increase: let us therefore make sure we understand them and select stablecoins that in any case go to reduce them as much as possible.

We have described UST. To date, distrust of algorithmic stablecoins remains justifiably widespread.

There was no shortage of stablecoin linked to the Euro, which is important for those of us who use it on a daily basis.

Finally, we saw how PAX Gold allows us to acquire the best-known safe haven asset without operating in traditional markets. All with the guarantees offered by the regulatory-transparency duo.

In a world increasingly moving toward digital and blockchain-based finance, stablecoins bear the burden of acting as a bridge. Indeed, by eliminating volatility, even the most wary will slowly move closer to our world.

However, there is no shortage of failed projects and dangers. We also always stay up to date when it comes to stablecoin, never taking anything for granted.

No matter how much algorithms and/or reserves are behind it, a stable currency can still lose its peg and suffer volatility in price. We must therefore opt for the best solution according to our needs.