Leggi questo articolo in Italiano

Tariffs kill crypto investments: $795 million outflow

By Davide Grammatica

The market uncertainty generated by tariffs contributed to a $795 million outflow from crypto investment products in just one week

Crypto and Bitcoin: investors on the run

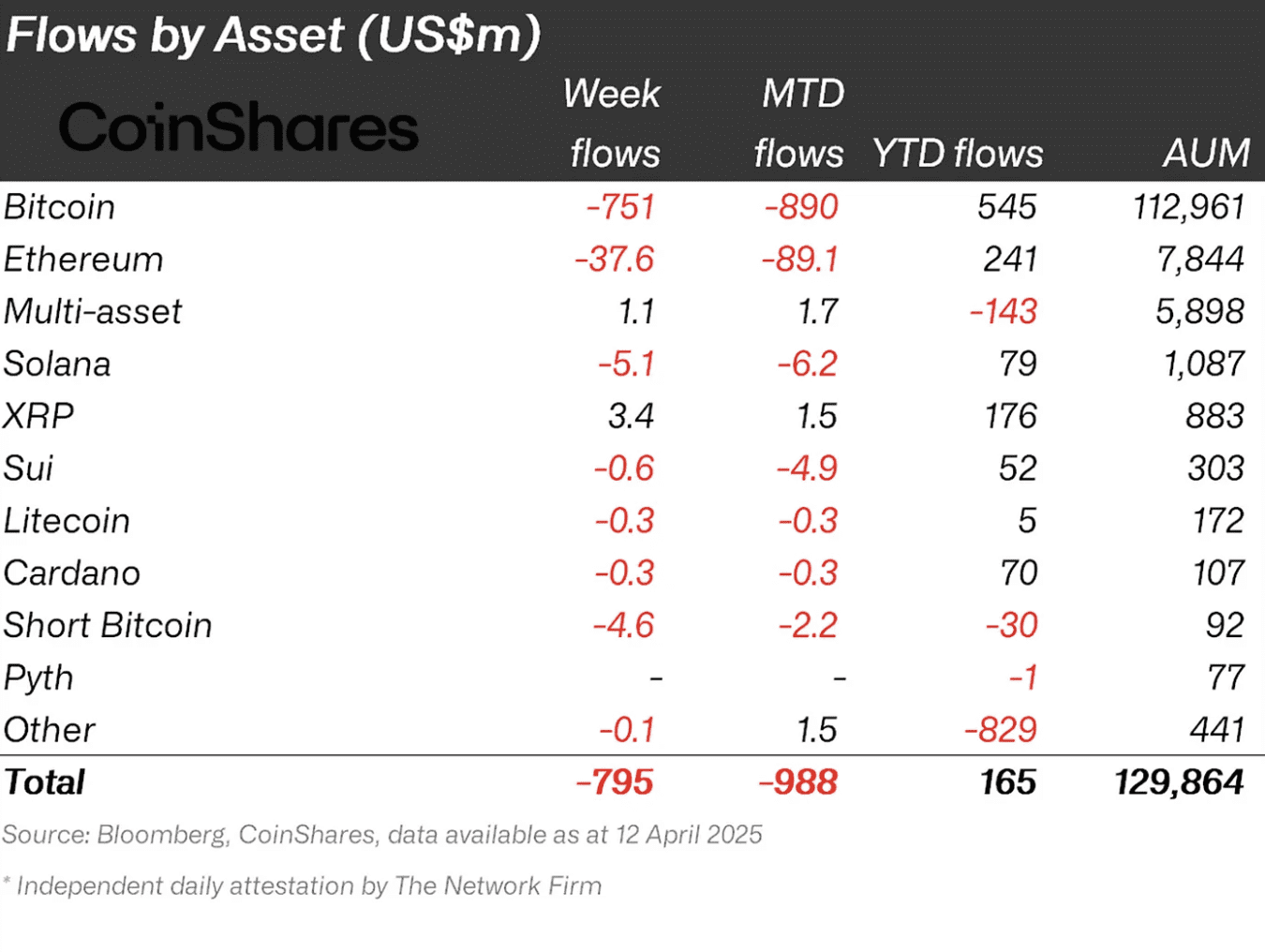

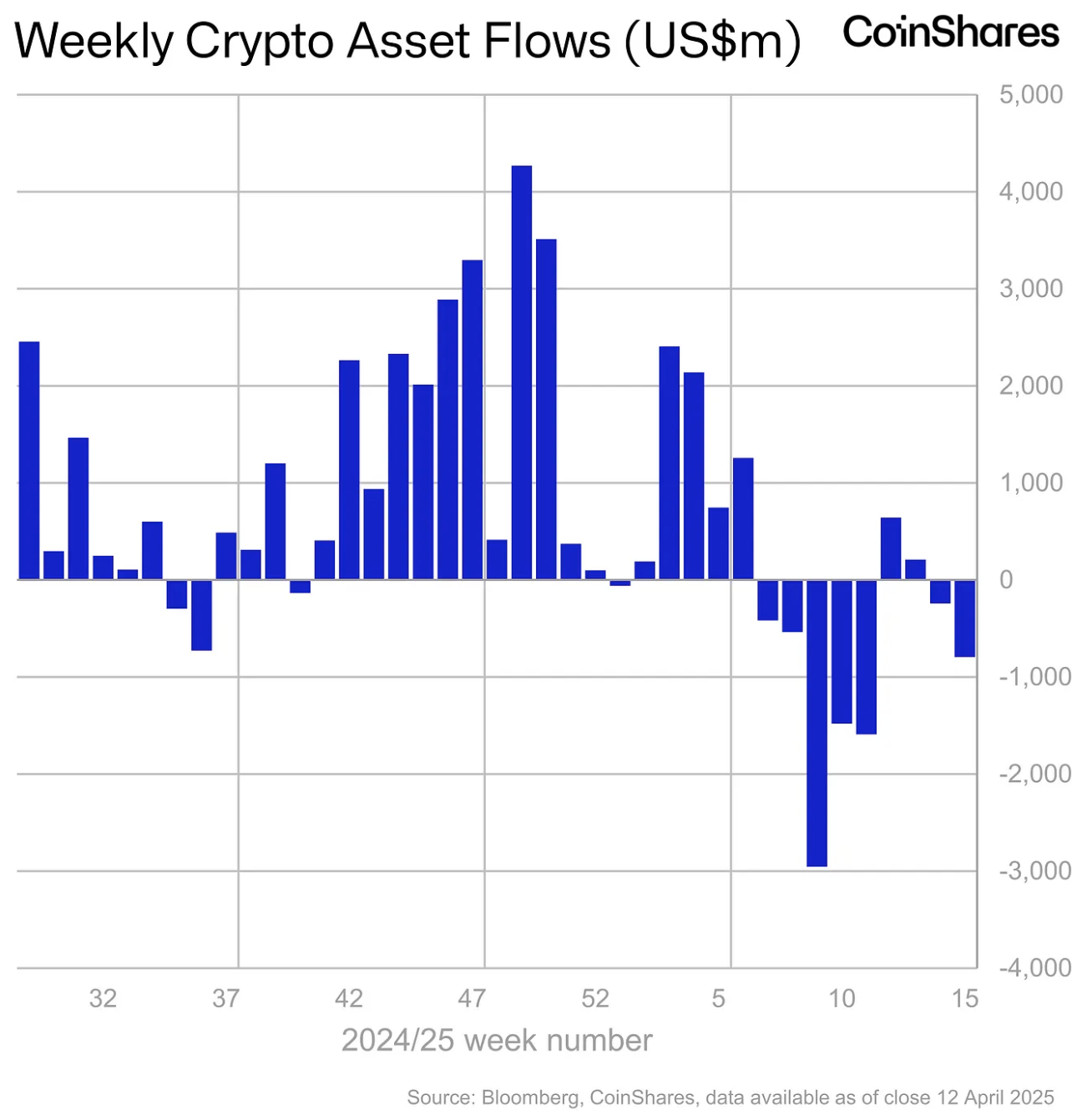

A complicated week for the markets was even more difficult for crypto investors, institutional and otherwise. Cryptocurrency investment products in fact recorded the third consecutive weekly round of outflows, with the various funds losing a total of $795 million, according to CoinShares.

Sentiment remains very pessimistic, and the constant macroeconomic uncertainty suggests that it will take a lot of effort to see inflows in the hundreds of millions of dollars again.

The total outflows of 2025 ($7.2 billion) have now erased the gains made since the beginning of the year, and to find some more reassuring data you have to dig deep.

One of these is perhaps the last few days of trading, which have been slightly up on the previous ones, with President Trump’s temporary revocation of tariffs reviving market confidence somewhat. Assets under management (AuM) have grown to $130 billion, up 8% from their low on April 8.

BTC in crisis, but there is hope for recovery

The outflows mainly concern Bitcoin, with $751 million outflow, but at the same time it is precisely the first cryptocurrency among the few crypto assets to maintain a positive balance for 2025 (+$545 million).

The products short on Bitcoin (-$4.6 million) also recorded outflows, and the more optimistic also read this figure as a sign of a possible recovery.

Altcoins, on the other hand, are following a clear downward trend, with Ethereum in the forefront ($37.6 million outflow). Behind ETH are Solana (-$5.1 million), Aave (-$0.78 million) and Sui (-$0.58 million).

Only XRP is saved, which despite the collapse of altcoins records an inflow of $3.5 million.