Operations Management: who nothing risks, nothing holds

To continue our journey in learning about trading, today we will look at a very important aspect of this world: a feature that allows us to get better than expected results from the market without changing sensitive parameters such as risk and exposure.

Well, yes, the market continually provides opportunities for profit, the cost we are willing to pay to participate in these opportunities we decide: sometimes we will pay the full ticket, sometimes we may get a free ride, and sometimes we will be able to take home the much-desired profit.

In the financial markets, what must be clear is that, if you want steady growth, you cannot avoid risk: he who risks nothing, holds nothing, a reinterpretation of a famous saying that fits well with today’s reading.

Index

Risk of Ruin

In the previous paragraph we talked about optimizing the outcome without changing the risk, because it is certainly easy to say, “Instead of gaining 3% of the portfolio by risking 1%, you can get 30% of the entire balance by risking 10%.”

In the case of a negative series of trades, however, in the previous example we burn out our account in 10 trades while we employ 100 consecutive failed trades with the 1% example.

We should always consider the Risk of Ruin of our trading, depending on the type of approach to risk: aggressive, moderate or conservative will be more or less likely. Let us remember that to recover a -50% one must then get 100% back to the initial equity.

So let us see what parameters in operations management allow us to optimize results intelligently.

Partials

This tool allows us to split the closing of our position across different price levels. Securing part of the profit generated, while letting the gain of the remaining portion left open run.

How and in how many partials to split our profit taking, will depend on the statistics of our operation. We tend to place several profit points, when along the path from entry to target, there are intermediate zones of likely reaction.

They can be either rigidly predefined (TP1 and TP2 are placed with limit orders), or a systematic profit taking can be set by accompanying the asset in its price action, but we will see this later, in the operational management types.

Break-Even

If the partial allows one to extract profit from the market once a certain price excursion is realized, likewise one can bring the stop loss to the Entry level, to reset the risk in the event of a market reversal.

The Stop at Entry operation, also called Break-Even (break even), should take into account the cost of the transaction fees, then position slightly above the entry price.

Depending on the statistics extracted from the trading journal, it will be clear to us if and when it is appropriate to put the stop at BE. It tends to be an asset that respects structures, allows this trade once directionality is confirmed, but especially in the crypto market, manipulations and stop hunts are frequent so, DYOSstatistic.

Stop Profit

A particularly useful tool, once our trade has taken directionality according to our forecast.

It allows us to extract profit from the market once the price action shows signs of weakening, it is the check point below which we do not agree to reduce our gain.

It raises the stop by hedging behind the structure and following the price in its excursion, once the trend is broken we will be out of the market, but we will have a chance to see if that break will actually lead to a reversal or if it was just a reaccumulation zone.

Fees

Important fixed cost of our business, variable depending on the platform you use, in conclusion we will leave you with some links that will allow you to get discounts for trading on major platforms.

It will be necessary to pay attention to the difference between spot and derivatives: in spot trading the fees are only for opening and closing operation, while using derivative instruments should also be considered the operation management fees.

The statistical data collected by the Trading Journal, will make it possible to highlight the average time duration of trades, so that the average cost of our positions can also be calculated in the hypothetical return.

Static Operations Management

We then clarified what parameters can be changed to maximize returns. Operational management is nothing but the combination of using these factors to maximize the RR of our operations.

Let us look at the three main types of operational management accompanied by simple examples:

Static Management: Every trade, from when it is opened to when it is closed follows an unchanging path. Both entry and exit prices are predetermined, one enters with the entirety of the expected exposure and at target one closes the entire trade;

Particularly used in the initial stages of strategy application, it does not allow the trader to interfere with the operational advantage; it is also very useful for the type of trader who has little time to stay on the chart and therefore intercepts movements through pending orders.

"The Risk/Return is fixed."

Dynamic operational management

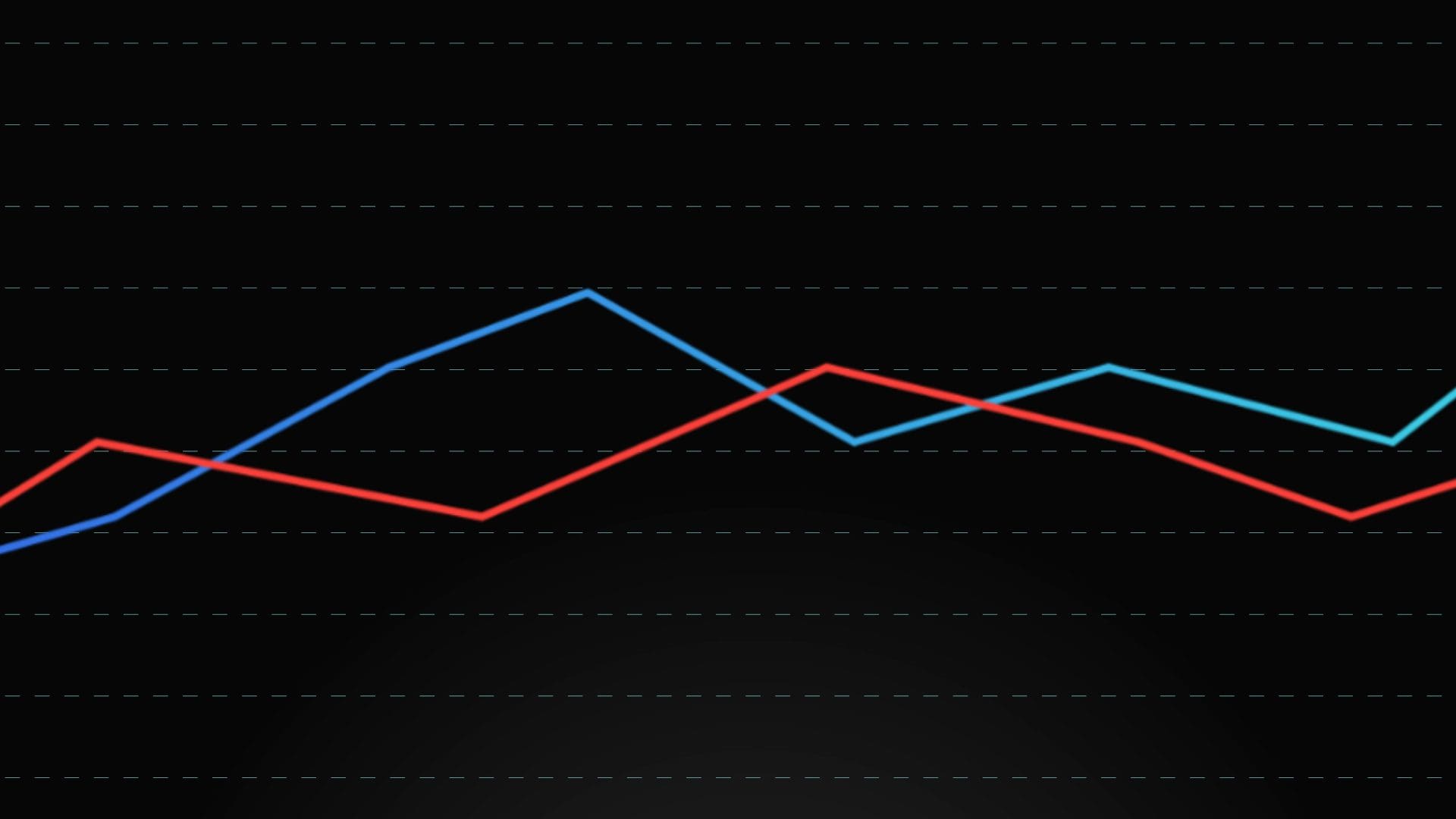

In contrast to the static version, the trade path, dynamically managed, adapts to market responses:

- Introducing partial profits placed at fixed RRs or potential reversal zones

- Zeroing in on risk by placing stops at BE the moment the first structural break is created

- Using the Trailing Stop, securing part of the profits by protecting behind the structure, by doing so we can find the optimal return for each intercepted move, exiting the market only at the moment when the price responds negatively to our analysis (subject to statistical evidence that, by doing so, we get better results).

Hybrid operational management

Whenever price arrives in zones identified as potentially reactive, we assess the price reaction, waiting for closes in the reference time frames, to confirm our directional bias.

Once we have qualified the reaction in the zone, for the continuation or not of the movement and consequently of our trade, we decide whether and how much to unload and how to move the stop loss.

This is a type of operational management, aimed primarily at traders who are advanced in their understanding of PA dynamics and have plenty of time to devote to analysis and management.

It can also be implemented with the support of alerts to warn us when the price approaches the attention zone.

Conclusions on operations management

We have discovered what tools characterize operational management and the various types of management, as the title suggests this is a dance, you have to be perfectly aligned with the rhythm of the market and know exactly the steps to perform to know how to dance well.

One path you can take, is to gradually implement the various points seen today, checking in the backtest which ones work best for you and your strategy.

We thank you for your attention and hope your trading can be steady and profitable.