Introduction to TradingView

Here is an in-depth look at the best technical and fundamental analysis services around: the TradingView platform.

We often talk about strategies and indicators, but how to set them up and consult them? What is the tool to use to do a perfect job of preparing and monitoring investments? TradingView is the answer.

The platform needs no introduction and has always been the best friend of so many traders and investors. Thanks to the abundance of charts, materials, news and data, this service allows us to be always informed and updated.

The following in-depth study is divided into two parts.

In the first, we will explore TradingView in a general way, discovering some of the most useful features.

Next, the content will be devoted to the interface and options, with a focus on the most common tools.

Finally, we will spend a few lines analyzing the various plans available to us.

At the end we will know how to move confidently in TradingView. It will then be easier to unearth and experiment with the (almost) endless features offered.

Remember that you can also use the TradingView app on your smartphone (TradingView download for Android and iOS), but given the small display, we suggest to use a computer.

A small clarification before going into full immersion: this tool requires good knowledge of the main concepts of technical analysis. Otherwise, it would be impossible to take full advantage of its potential.

Index

What is TradingView?

TradingView: one name, one guarantee.

Here we are dealing with one of the most popular platforms dedicated to technical and fundamental analysis on a variety of asset categories. Not only that: the portal also features social elements that allow users to share opinions and strategies.

When presenting a service, numbers are an indispensable business card. Therefore, here are a few definitely significant ones:

- Best website in the world dedicated to investing. Giants like Investing.com and CoinMarketCap look down on it;

- More than 30 million monthly visitors;

- More than 8 million scripts and opinions shared among the community.

In addition to the data, it is good to highlight one aspect: TradingView is a service entirely dedicated to analysis and there is no way to buy or sell assets. The user is not pushed to trade, and the company’s focus is only on quality and completeness of information, a great added value.

We can be novice investors, experienced traders, or just curious. Whatever the case, this platform is what we need.

TradingView makes it possible to monitor numerous markets and assets, covering almost all areas of interest.

Specifically, the portal contains charts and information on stocks, futures, indices, forex, cryptocurrencies, bonds and economic parameters. From the BTC-USD trading price to data on inflation and unemployment in a certain country, nothing is missing.

Each chart is customizable as desired. The user can include numerous indicators, write comments, prepare simple or complex strategies. In addition, news and technical and fundamental analysis parameters are available, which combine to create a truly comprehensive snapshot.

In addition, many assets have data from multiple sources. For example, the ETH-USD (Ethereum-US dollar) pairing involves a multitude of charts, each based on a particular exchange. We might decide to monitor its price on Bybit, Binance, or Crypto.com, just to name a few. This aspect is important: the user can choose the source based on the exchanges used.

Given the social nature of TradingView, users can share strategies and ideas with the community. Therefore, in addition to consulting numbers, we also have additional materials developed by other investors, which are useful for broadening one’s views and comparing notes.

Summing up what has been said in this fleeting first look: TradingView is the reference portal for studying both the fundamentals and technical parameters of an asset. Thanks to the tools offered, the investor can make an informed decision on how to move and what strategy to deploy.

What is TradingView used for?

The abundance of assets, features and indicators makes TradingView an initially difficult platform to digest. Not to worry: past the first stage it becomes more intuitive.

Let’s list the assets and markets available.

TradingView offers a wide choice in this regard. It is hard not to find what interests us.

First of all, the indexes. We can consult charts and data from all over the world. Impossible not to mention the fundamental ones such as S&P 500, Dow Jones, Nasdaq and Nikkei 225.

We do not stop there. For example, we are able to explore each of the 11 sectors that make up the S&P 500 index, so we have an even more accurate snapshot of the situation.

We then find the indexes for the major currencies. By studying this data we become aware of the trend of a given currency in a neutral and reliable way.

The platform also devotes ample space to futures, including major commodities such as gold, silver and oil.

Each item has its own advanced charts, indicators, news and community ideas. Here is an example: chart on gold futures accompanied by some indicators. On the right hand side we have opened the related news tab. Everything is just a click away, we don’t have to look for information elsewhere.

We cannot fail to mention stocks, among the main protagonists on TradingView. In addition to the American market, the platform offers charts and information on a variety of companies, including european ones.

Also present is constantly updated data on currencies and exchange rates. The trader in these markets will find what he needs to carry out his work to the best of his ability.

Also of interest are the economic and bond parameters from numerous countries. We know how crucial it is to keep track of data such as interest rates and unemployment: with TradingView it is possible.

Last, certainly not least, are cryptocurrencies. TradingView is a benchmark for investors in our industry. The charts are comprehensive and allow you to compare trends with both fiat currencies and other cryptos.

The community is very active, so there is no shortage of ideas and information. In short, we can be really happy.

Can you actually trade on TradingView? No, this is an analysis platform, not an exchange.

"A huge offer that pleases everyone: TradingView does not disappoint expectations"

TradingView feature overview

Okay, we have been talking for a while now and it is time to take a look at the TradingView interface. Before start, you will have to create an account and do the TradingView login. Here is a default screenshot related to BTC-USD.

Let’s break down the page to get to know it better.

In the center towers the big star: the TradingView chart (in this case TradingView BTC chart). Here we see it with Japanese candles of weekly duration. A little further below we find the volumes.

On the right side, on the other hand, the price of bitcoin, expressed in U.S. dollars, is clearly visible. By moving the mouse cursor over a particular point, we can view its value at that given historical moment.

At the top are buttons from which to edit the chart, add indicators, and set alerts. We specify that some features may be limited or unavailable in the free version: we will come back to it.

In addition, you can save the chart, take a screenshot and access the settings.

On the left we find controls for adding comments, lines and patterns. The right place to study, evaluate possible scenarios and create your own positions.

Going instead to the right, here are the buttons with which to customize (or remove) the sidebar. In our example, the customizable watchlist is visible. In the picture seen above, on the other hand, the latest news was viewable.

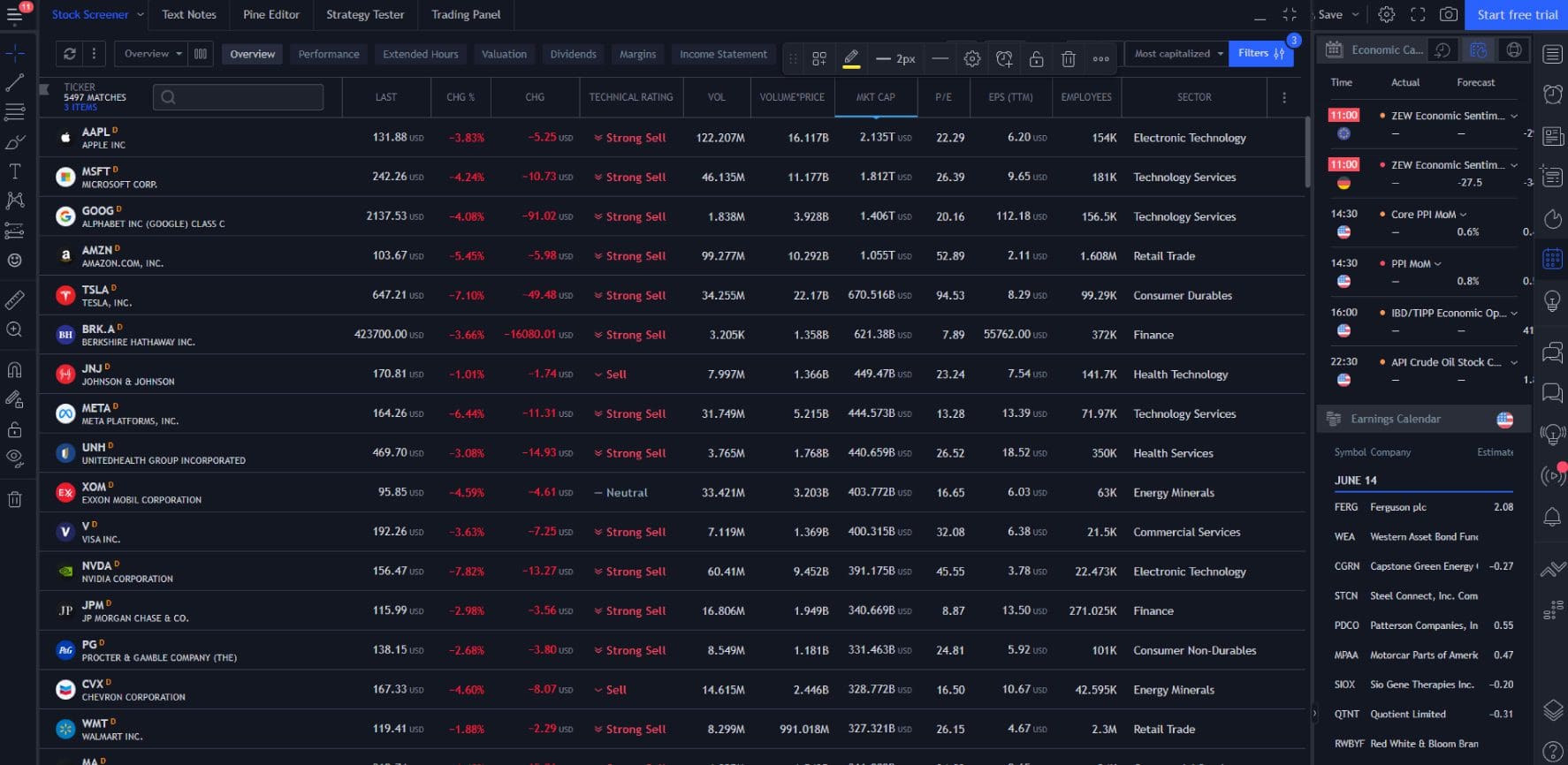

Finally, the sidebar below. In the screenshot just shown we intentionally minimized this section. If we wanted, we could expand it and consult other data (such as the stock screener, see image below) or write scripts.

TradingView gives maximum freedom to the user: knowing what you are doing, it is a very powerful tool.

TradingView basics: chart and indicators

Let’s go deeper and learn more about TradingView. We will start by studying the chart and then move on to how to edit it and set the indicators available.

To improve understanding we have broken down the screen into areas.

Ahead with the first one.

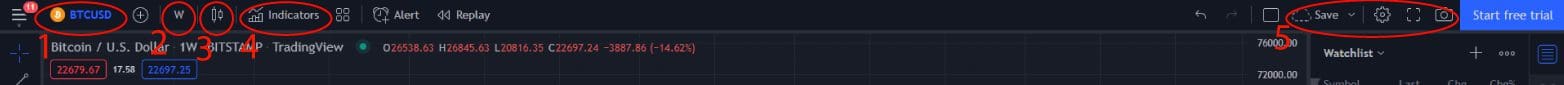

Here is the information that is essential to understanding what we are looking at.

In this case we know that the chart is on BTC-USD, source Bitstamp, one-week candles (1W = 1 Week).

We then find other data marked by the letters O, H, L, and C. They express respectively:

- O: Open, Opening Price;

- H: High, Maximum price;

- L: Low, Minimum Price;

- C: Close, Closing Price.

Finally, by connecting to your broker you can access the precise buy and sell quotes (red and blue boxes), as well as the spread.

Let us shift the focus to area 2, devoted to the choice of time horizon shown by the chart. It starts from daily (1D) and goes up to monthly and yearly. The calendar icon allows you to set custom intervals.

By changing the time frame, the Japanese candles will automatically adapt. For example, the daily chart will show 1-minute candles by default; the 5-year chart will switch to weekly candles instead. However, we have the option to change to our liking; we will see how shortly.

Now area 3.

A key piece of information is the time, which should always be kept in view. The default time zone is UTC. Click on it to change it and choose the one we are interested in.

Closing, we highlight the ability to switch to the percentage and/or logarithmic scale. These are useful functions for conducting more accurate analysis untethered from certain parameters. Conducting different research is like looking at something from various angles: only then can you appreciate every detail. Conversely, the risk is to miss some useful information.

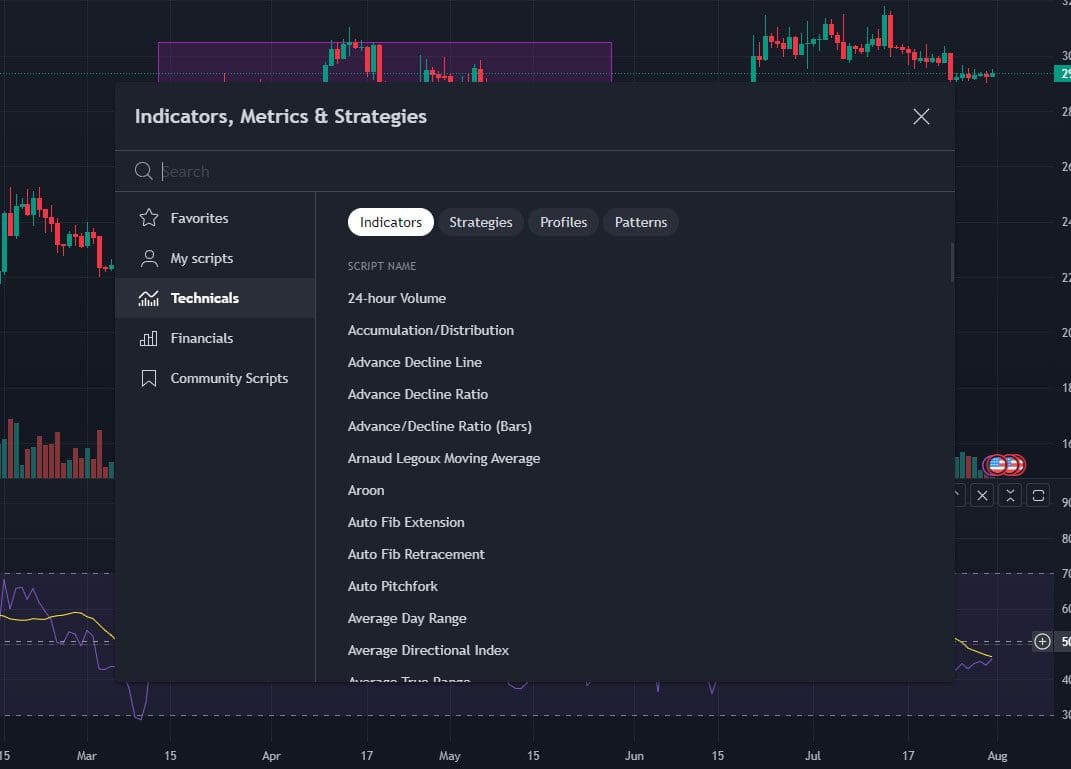

Let’s move on to the indicators, accessible from the top of the screen.

By clicking on point 1 we will be able to change assets and their chart. A screen will open from which to type in what we are looking for.

Button 2 is dedicated to changing the duration of candles (or other views, depending on our preferences).

Some intervals are available only with TradingView’s paid plans. However, the indispensable ones are also present in the free version, so basic analysis is not limited in any way.

Moving on to step 3, here is where to change the view. TradingView offers the following alternatives: Bars, Candles, Hollow Candles, Line, Area, Heikin Ashi, Renko, Line Break, Kagi, Point & figure, and Range.

Let’s move to step 4, which is the one reserved for indicators. Clicking on them opens a screen that is overflowing with tools of all kinds.

You are spoiled for choice. Be careful, however, not to overdo it: we recommend using only the familiar indicators, avoiding the more complex and “exotic” ones. Sometimes abundance is not good, let’s remember that.

Finally, point 5.

Starting from the left are:

- Button to change the layout of the page;

- Button to save the graphic in question, as well as make a copy and share it;

- Settings (gear icon), for full customization of TradingView;

- Fullscreen mode, to have a full-screen chart and not be distracted by anything else;

- Snapshot, so you can take a snapshot of the chart.

So much abundance, it would take a whole manual to describe everything in detail.

However, the default look and feel is already complete and performs well. Our advice is to start using TradingView by focusing on the content, customizing the form over time.

"TradingView is the ultimate tool for the investor-it would take an entire manual to describe all its functions"

TradingView basics: customization

Given the many settings available, it was a must to reserve a paragraph for customizations. Again, we must break down the following screen into several parts.

Let us start with the first area: a long list of buttons positioned one above the other. Starting from the top, let us briefly describe their purpose.

Note: many of these buttons contain a sub-menu accessible by right-clicking on them.

- Mouse pointer selection: cross, arrow, pointer or eraser (to erase what was previously drawn);

- Lines: from simple Trend Line to parallel channels, there is everything you need to set up strategies and analyze the trend of an asset.

- Section dedicated to more complex and precise tools such as Gann Box, retracements, circles and spirals. In short, a kind of trip to Disneyland for the most avid traders;

- Brushes, highlighters, pencils and shapes of various kinds: everything you need to leave nothing to chance.

- To be even more precise, why not add text or an image TradingView offers these possibilities;

- Here is a button from which you can enter patterns and waves. Again, the more experienced will appreciate the freedom of movement and customization;

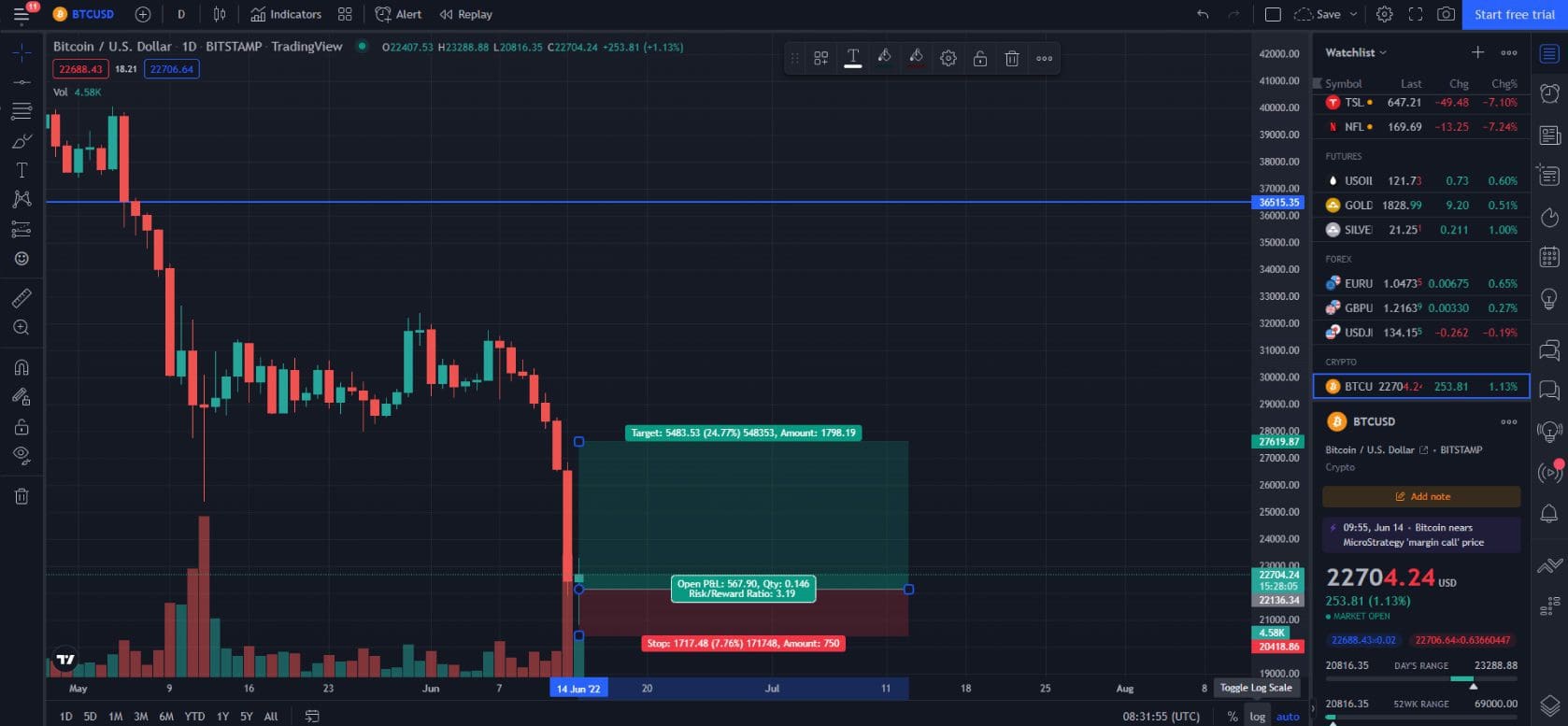

- Moving on, there can be no shortage of ranges. Above all, we think the short and long position features (shown in the photo at the end of the paragraph) are essential, perfect for implementing different tactics and evaluating parameters such as risk/return;

- Do we need an icon? An emoticon? We have them! Here, perhaps this is going a bit too far;

- Other buttons such as ruler and zoom in follow. One of the most important is the last one, the basket: if we had gone too far and wanted to free the chart, we click here and that’s it.

After some customization, here is what the graph might look like. Everything has been set up randomly and for educational purposes only.

Let’s move on to area 2, which is interesting and full of features.

First of all, the watchlist, fully customizable with favorite assets.

Also worth mentioning is the news. They are related to the subject of the chart: are we consulting BTC-USD? We will display the latest news related to bitcoin.

Alerts allows us to set alerts. Upon reaching certain levels decided by us, we will immediately receive a notification. We have a limited number of Alerts, based on the version of TradingView we own.

A very useful feature is the Calendar. It reports major events related to economics and finance. We will never miss an inflation figure again!

The public chat is quite busy. We always have to be careful about what we find, because not all people are knowledgeable. However, the set of messages can give us an indicative idea of the sentiments of other investors.

Also, by connecting to our broker we can view our orders, both open and closed. Another way to avoid the constant back-and-forth between platforms.

Other buttons take us to hotlists, video streams, and even more.

We confirm: we really should write a manual to cover every available feature. At times TradingView is perhaps too comprehensive: we need to be careful not to get distracted by such a broad and comprehensive offering.

How to set up RSI on TradingView?

Since this tool is among the most widely used, here is a worksheet on how to set it up.

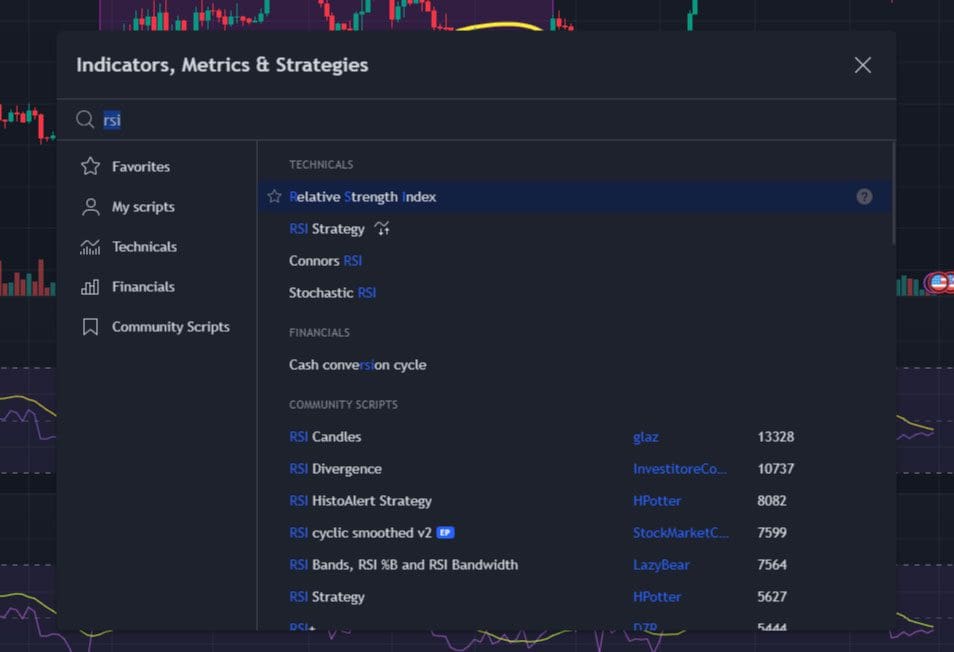

First, we access the chart of our interest. From the menu located at the top, we click on indicators; type in RSI in the search bar and we will see the various options available. We choose the first entry, Relative Strength Index.

The indicator will appear below the chart and will already be ready for consultation. By hovering the mouse over it, little buttons will appear in the upper right corner:

- The arrow allows us to move it above or below the chart;

- The “X” is used to close the indicator;

- The two little arrows allow us to minimize it;

- Finally, the last button zooms in/out the indicator.

How much does TradingView cost?

Is TradingView free? TV account can be either free or paid. Let’s see TradingView pricing.

If you are wondering “how to get TradingView for free?”, know that all you need to do is sign up for the platform. However, the free version is feature-rich and allows you to do your own analysis without any particular limitations. It represents the ideal choice for those who are just getting into the world of investing (not only in cryptocurrencies).

The moment you start to become a little more experienced, however, the upgrade becomes essential in order to have access to more advanced and customizable tools.

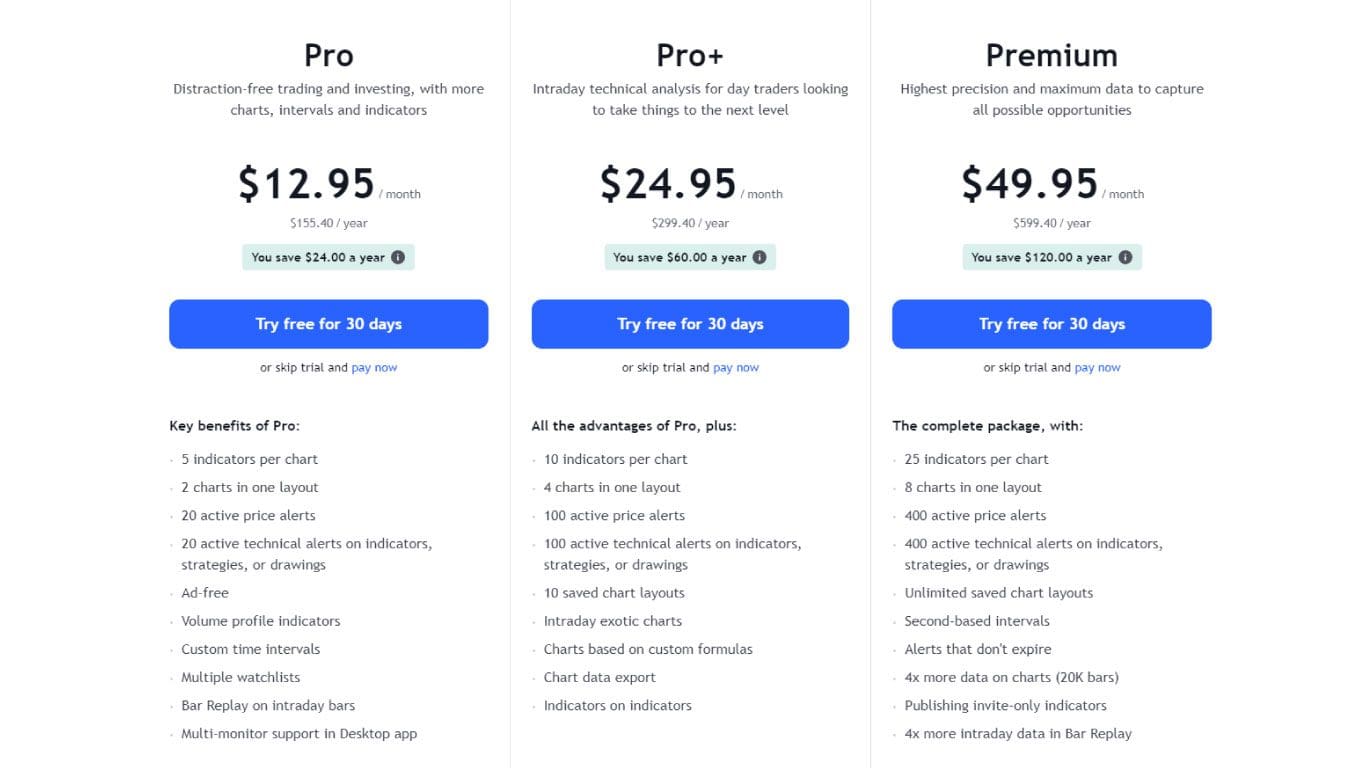

TradingView offers three different paid plans, each designed to meet specific needs. Let’s find out about them!

TradingView PRO Plan

TradingView’s PRO plan is the front door. It represents the best choice for most private investors. Excellent value for money.

First, each chart can accommodate up to 5 indicators. In addition, two charts can be displayed at the same time in the same window.

Of course, no advertisements will be shown, present in the free version.

The multi-screen support completes the offer, which is very useful for those who need to have a lot of data immediately visible.

The benefits do not end there: a variety of indicators, historical data and insights are unlocked.

TradingView PRO+ Plan

Moving up a notch, here is the TradingView PRO+ plan. This is an evolution of PRO, recommended for particularly demanding investors. The perfect choice for intraday traders.

Contemporary charts increase from 2 to 4 (per layout). The indicators also double to 10.

This plan also introduces several intraday charts not previously available.

In case of technical issues, worth mentioning is the right to quick assistance, a small evolution from the PRO version.

The TradingView PRO+ plan includes other additions that make it a powerful ally when employed properly.

TradingView Premium Plan

Here is the ultimate version: TradingView Premium, the option suitable for large investors and trading professionals.

Every limit is raised and each feature is unlocked. In a nutshell: we have in our hands the ultimate in technical analysis.

Clearly, increasing the equipment also increases the price. Money well spent, provided you are a super expert and with significant sums at stake.

Speaking precisely of costs, they vary according to the offerings of the moment and the payment. The monthly fee implies higher costs while the annual fee saves a lot.

In addition, any plan includes a 30-day free trial so we can see if the product is actually right for us.

But there’s more: if you have a referral code, savings are assured! If you’re interested, here’s our TradingView com referral: if you’ve never purchased a plan before, up to $30 bonus is waiting for you.

TradingView: super analysis platform

Let’s close this long review by further praising TradingView, a true super platform for technical and fundamental analysis.

As far as we can tell, no other reality offers so many features and customizations.

So we should not be surprised that Trading Viewer is the number one service in the world.

Happy trading!