Leggi questo articolo in Italiano

US: GDP growing more than expected. Good or bad for BTC?

By Davide Grammatica

The stable but precariously balanced US economy does not seem to undermine Bitcoin's bullish rally. The “Trump” factor is the decisive one

A complex “macro” environment for BTC

In a busy week on the macroeconomic front, data on the U.S. economy and unemployment are another element in thoroughly assessing the economic environment with which Bitcoin will have to deal.

In its struggle to maintain $100k, the premier cryptocurrency has come up against downgrades in forecasts of new interest rate cuts for 2025 (estimated at 50 basis points for next year), as well as a Fed reluctant to the establishment of a “national” Bitcoin reserve, which Donald Trump and the entire Republican establishment have been hoping for.

Labor market data offer a measure of the health of the U.S. economy, which has been decidedly resilient in recent months despite an inflation rate struggling to return to the Fed’s desired levels (2 percent).

Jerome Powell was nonetheless “very optimistic” about the state of the U.S. economy, saying the U.S. is very close to the “end of the current rate easing cycle.” However optimistic, at any rate, FOMC members do not expect a return to the 2 percent inflation rate before 2027.

US economy faster than expected

Labor market data these hours indicate a slowdown in new applications for unemployment benefits, 220,000 for the week ended Dec. 14, and lower than analysts’ expectations.

As a result, the U.S. labor market appears to be slowing down in an “orderly” manner, without jeopardizing the Fed’s plan to depreciate interest rates. Not surprisingly, Powell himself had spoken yesterday of “diminished downside risks to the labor market.”

The resilience of the sector reflects historically low layoffs, and supports economic growth through steady consumer spending.

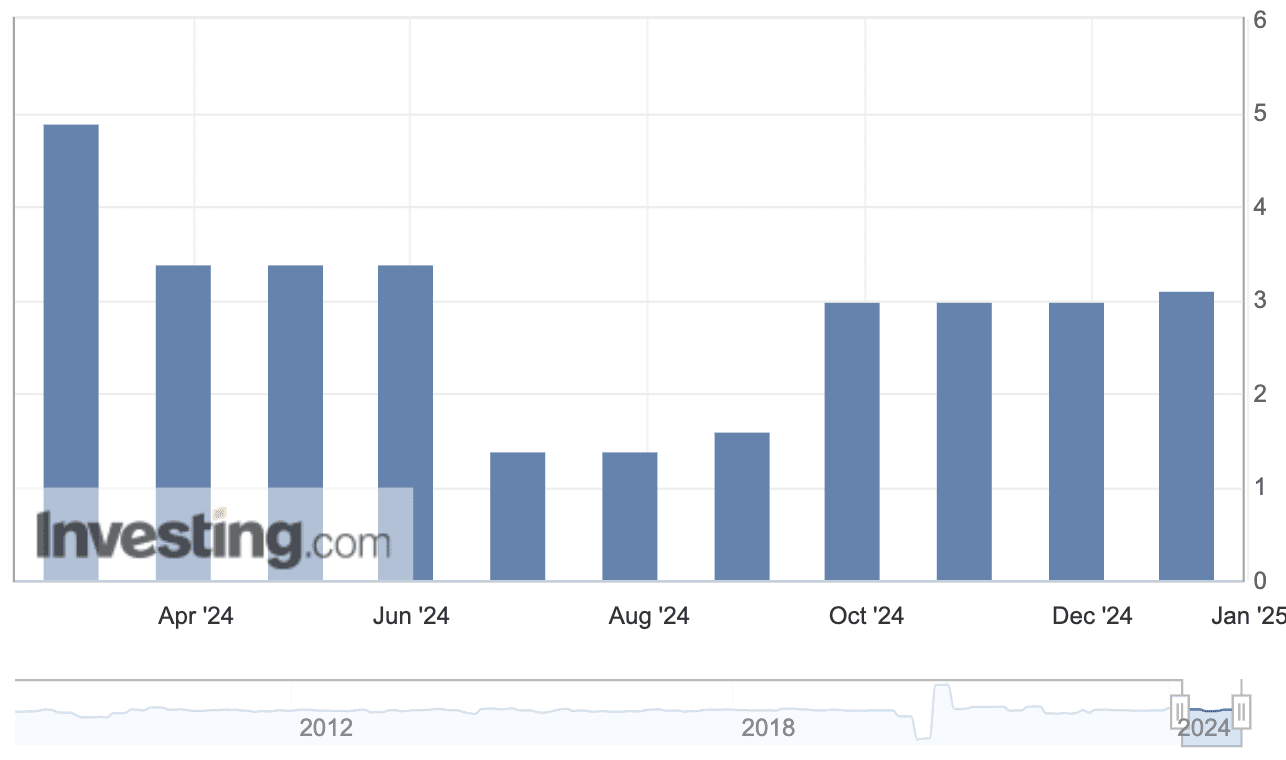

As a result, the U.S. GDP growth of 3.1 percent in the third quarter of 2024, above analysts’ expectations (which put it at +2.8 percent), is surprising to some extent. In the second quarter, GDP had grown by 3 percent.

For Bitcoin, the situation is therefore “quiet,” with its bullish trend fueled, it seems, by other factors, starting with the support of the new Trump administration.