Introduction to Algorand

Algorand: a blockchain that we often hear about but has not yet taken off.

On the scene for about three years, this network is among the most innovative around. Let’s stimulate a little curiosity by giving a few previews.

First of all, it is a selective environment: using a programming language different from the usual ones (called TEAL), particular skills are required to be able to create applications.

Algorand is also carbon negative and makes eco-sustainability one of its pillars. It goes without saying how energy efficient this chain is.

Clearly, the network supports smart contracts. The Algorand Virtual Machine (AVM) is the tool in charge of interpreting what is written in the contracts.

The concept of ASA is also fundamental: Algorand Standard Assets.

A bit like in Ethereum, they provide a mechanism to represent any type of asset: from fungible tokens to NFTs.

In short, there are original and cutting-edge concepts that project this network into the future. The competition is fierce: we’ll see who comes out on top!

We should have succeeded in arousing your curiosity. We can therefore proceed further and find out in more detail what Algorand is.

Index

What is Algorand?

Algorand is a decentralized and open-source blockchain, launched in June 2019.

The main figure behind the project is Prof. Silvio Micali, Turing Award winner, researcher and teacher at the prestigious Massachusetts Institute of Technology (MIT).

An expert in various fields, including cryptography, Micali is the mind behind one of the most interesting blockchains to date.

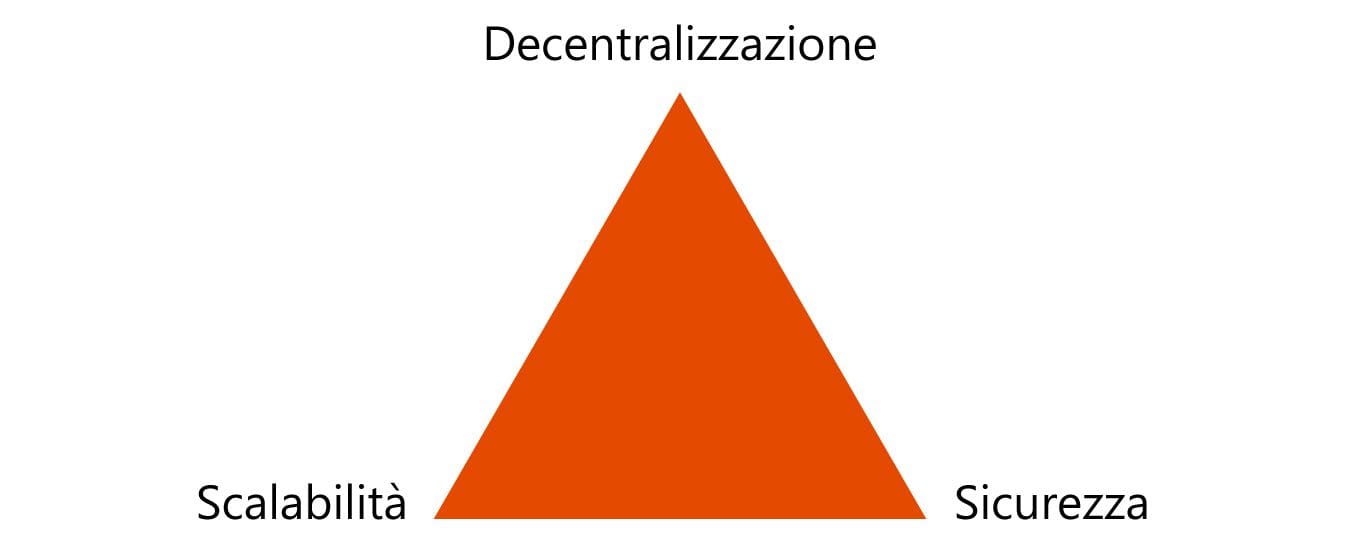

The main objective of this network is to solve the famous Blockchain Trilemma. Let’s briefly review what it is.

To be considered perfect, a blockchain should be decentralized, scalable and secure.

Until a few years ago, this goal was considered almost unattainable. In fact, it was very difficult to find the right balance between these three important characteristics.

Especially in older solutions, decentralization and scalability are sacrificed for security. At the same time, security would be inferior if we wanted to prioritize the first two points.

These considerations gave rise to the trilemma, mentioned for the first time by Vitalik Buterin, none other than the creator of Ethereum, the most famous smart contract platform around.

Fortunately, the blockchain world is quite ingenious when there is a limit to overcome or a problem to solve. So, in this case too, the search for a solution began.

The ideas that emerged in the wake of this movement are interesting. Among these, it is impossible not to mention what was called Ethereum 2.0, which led to the event called merge, i.e. the transition from the PoW consensus algorithm to PoS. In this way, the parent blockchain of smart contracts is more scalable, solving the age-old limit that was clipping its wings. But there is still a long way to go and challenges abound.

But let’s get back to the subject of our in-depth analysis. In fact, we have already mentioned that Algorand is specifically designed to overcome the trilemma, projecting itself into the future.

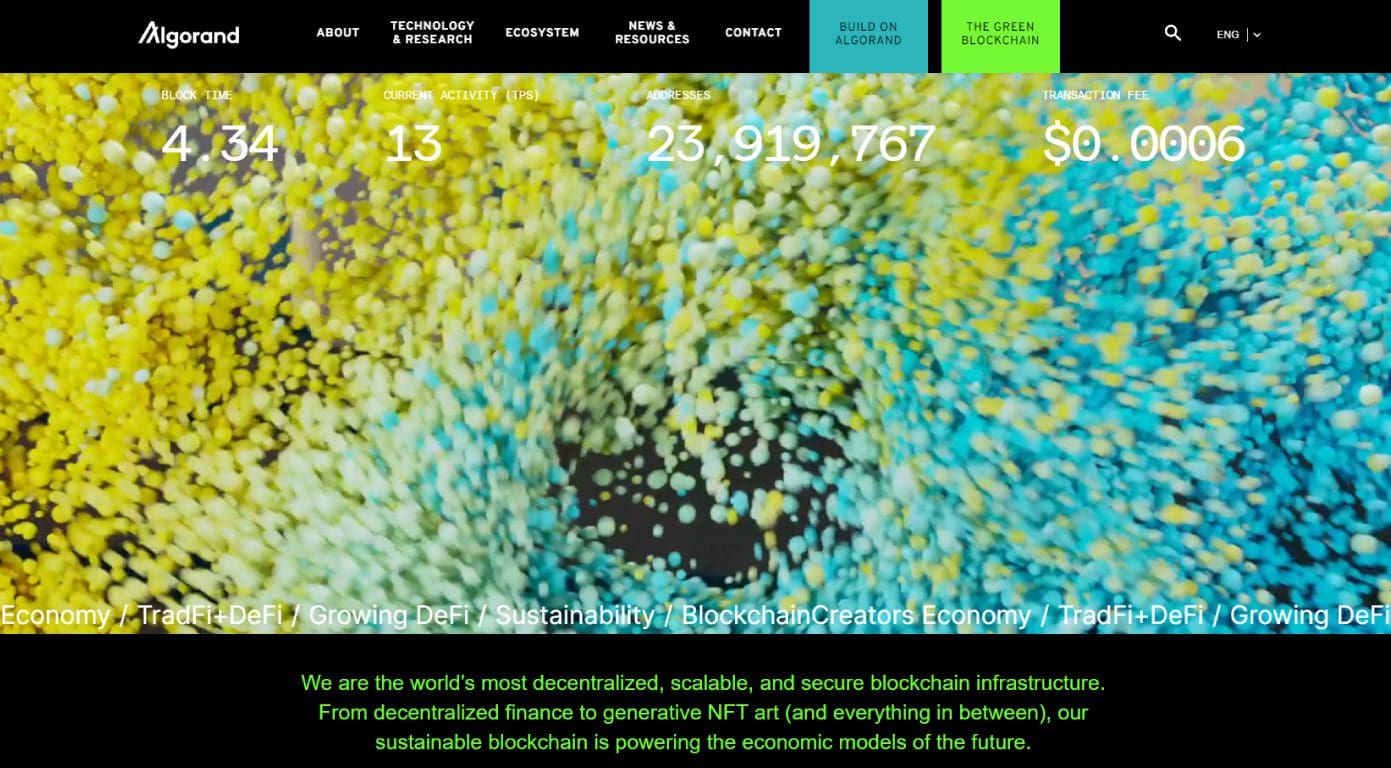

Thanks to the innovative consensus algorithm, Algorand offers fast transactions capable of satisfying high demand.

At the same time, security is a cornerstone of the network and is not sacrificed in the name of performance. The use of the aforementioned TEAL programming language, complex and less known to most, also contributes to this. Therefore, it is more difficult for an attacker to find any bugs or vulnerabilities.

Furthermore, there is an important aspect to highlight: Algorand is an inclusive chain. We’ll see why later.

We’ve laid the essential foundations to be able to continue. Now we can move on to some more technical notions, without going overboard, of course.

Structure, consensus algorithm and scalability of Algorand

Algorand is based on a dual layer native structure. This means that the chain integrates both a layer 1 and a layer 2.

The layer 1 is in charge of processing the primary operations, which are fundamental for the network to function properly. However, at the same time, these functions do not overload the chain.

As for layer 2, it deals with everything that would weigh down the network, such as normal transactions. Each operation is carried out off-chain; afterwards, the result is sent to layer 1, including a certification to guarantee the correctness of what happened.

This native architecture allows Algorand to process transactions in a matter of seconds. In addition, gas fees are negligible, even less than 1 cent.

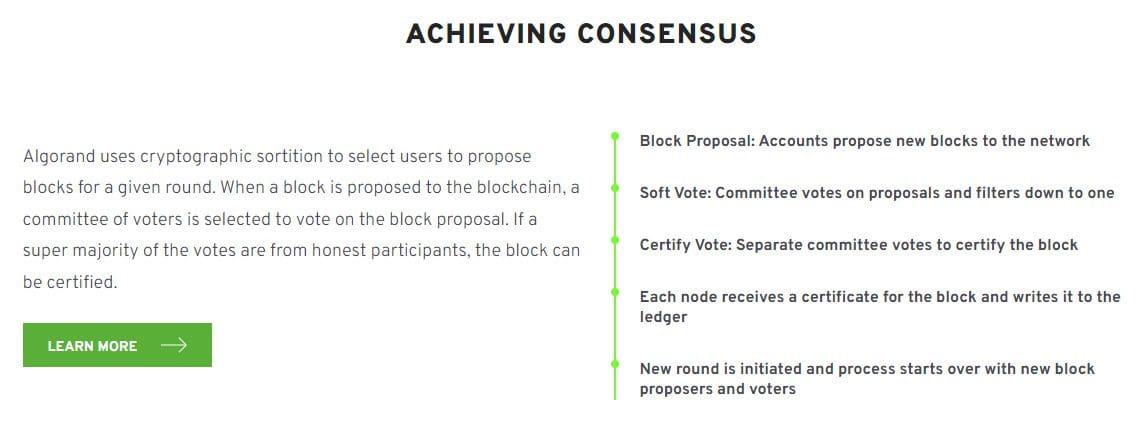

The structure of the chain contributes greatly to its efficiency. However, a fundamental role is played by the consensus algorithm called Pure Proof-of-Stake.

The basis of this technology is the possibility for any holder of ALGO coins to validate a block. That’s right, we didn’t make a mistake when we wrote it: there are no stringent stake limits or complex (and expensive) computer support required. Anyone who holds at least 1 ALGO has this opportunity.

The selection of the validator is random. The more ALGO you hold, the greater your chance of being chosen. The principle of proportionality is therefore maintained.

The random nature of the selection process is an added security value: not being able to predict with certainty who the next validator will be, an attacker encounters greater difficulties in planning his actions. Furthermore, by the time the attacker manages to identify the validator, it would be too late: the block would be history.

The consensus mechanism involves several votes and ensures the regularity of transactions. Algorand is able to withstand a high number of malicious actors: as long as 2/3 of the total stake is in safe hands, there is no possibility that the dishonest will gain the upper hand.

There is an image at the end of the paragraph dedicated to consensus.

The Pure Proof-of-Stake consensus algorithm (here to understand what PoS is) also guarantees that it is impossible to propose two blocks simultaneously in the same slot. In other words, the chain can never be forked.

Finally, we close this paragraph with another remarkable feature: co-chains.

In short, anyone can create additional chains on this network. They can be either public or private. The former are suitable for various projects; the latter, on the other hand, are suitable for meeting the needs of companies, institutions, economic and political actors.

Co-chains are able to interact with all the other structures in the Algorand world, thus opening the door to various combinations and possibilities.

The coin ALGO

Let’s take a look at ALGO, the native coin of the Algorand network.

We start with the maximum supply, set at 10 billion units. Of these, about 82% are currently in circulation (last update: May 2024).

The allocation of the ALGO crypto is as follows:

- 3 billion coins released in the first 5 years of the network’s life. This figure includes the 25 million ALGO coins involved in the initial sale;

- 2.5 billion coins to be distributed over time to Relay Nodes;

- An identical amount, 2.5 billion, is allocated to the reserves of the Algorand Foundation and Algorand Inc;

- 1.75 billion ALGO released over time as a reward to Participation Nodes. This figure may vary;

- Finally, 250 million ALGO reserved for grants to end users.

Let’s now see what the use cases of this cryptocurrency are.

As we already know, the stake allows you to participate in the validation process. Obviously, we have to be realistic: since the probabilities are proportional to the ALGO held, it will be difficult to be elected as a validator with a small stake.

However, the stake produces rewards, so it could be an interesting opportunity for investors in this network.

ALGO is also the crypto required to pay the chain’s gas fees. Therefore, anyone who wants to use Algorand will necessarily have to purchase a certain amount of this coin.

Finally, not a use case but still worth mentioning, ALGO can be a means of investing in the project. After all, if the network is to grow, an increase in the value of the related coin is desirable. Therefore, those who are bullish on Algorand might consider holding some ALGO.

Buying ALGO is simple: it is a cryptocurrency available on numerous exchanges including Binance, Kraken, Bybit, Bitget and Crypto.com.

Below is the ALGO Algorand value chart from TradingView, the reference platform for technical analysis.

Algorand Foundation and Algorand Inc.

The Algorand Foundation, an entity with various responsibilities, operates behind the entire project.

The Algorand Foundation tries to promote the project, encouraging its adoption by an increasingly large user base.

In addition, the Foundation is responsible for keeping the ecosystem healthy, especially by managing the aspects of decentralized governance.

In addition to this entity, there is also a real company: Algorand Inc.

It is responsible for managing the technical and operational aspects of the chain, the development of new functionalities and the integration with other platforms and realities.

Algorand Inc. is the economic actor with which companies and institutions interface, in fact partners and/or customers of the network.

"Oltre a essere una blockchain, Algorand è un'azienda che gestisce il progetto in tutti i suoi aspetti"

Algorand ecosystem and partnerships

Let’s take a look at the ecosystem of Algorand, so as to understand how it will develop in the future.

Folks Finance is a well-known DeFi platform in the industry. Also dedicated to lending, it offers some innovative features such as multiple incentives, Lock&Earn and a rewards aggregator.

We couldn’t leave out a DEX: here’s Tinyman, the main decentralized exchange on the Algorand chain. Although limited, the features are what you would expect from portals of this type: token and coin swaps, liquidity pools and farms. It seems well developed and has so far stood the test of time.

DeFi is nothing more than a part of the Algorand ecosystem.

There is no shortage of platforms dedicated to non-fungible tokens (NFTs). We’d like to mention AB2 Gallery and ZestBloom.

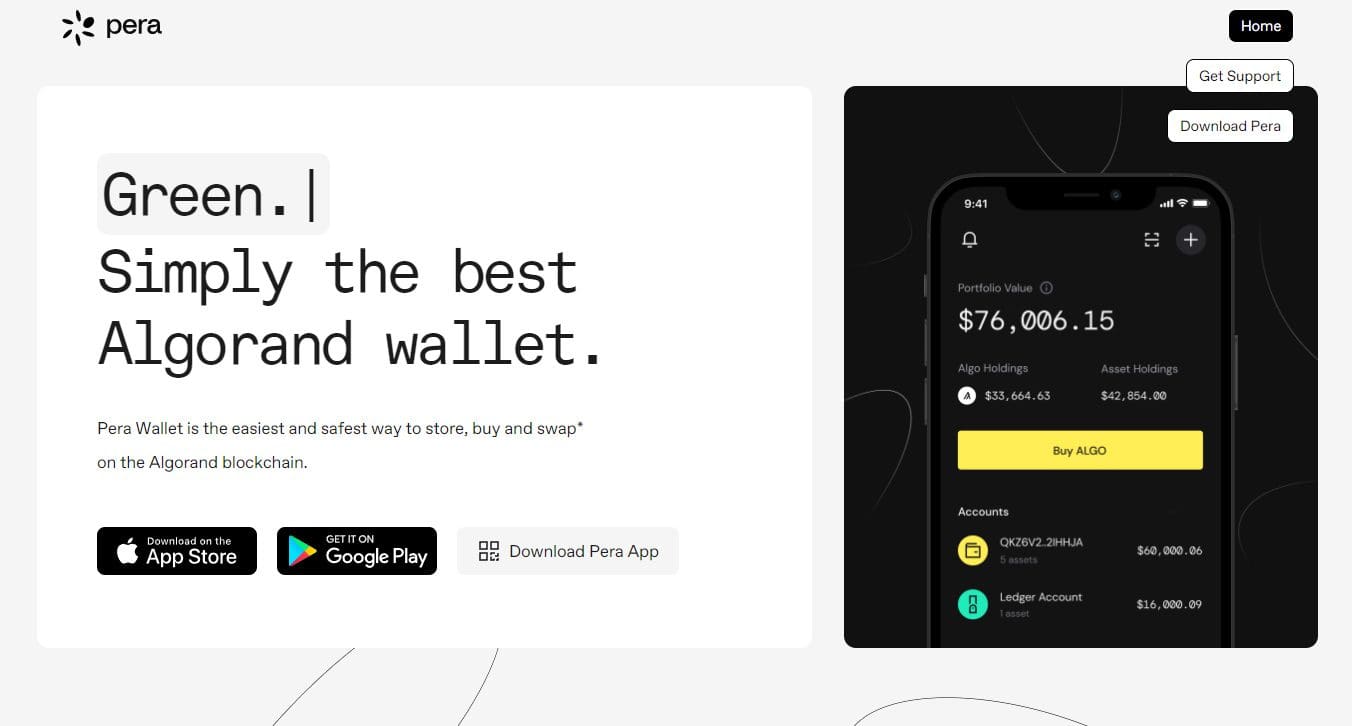

Let’s finish with Pera Wallet, one of the best crypto wallets for this blockchain. Available for both mobile and computer apps, Pera Wallet also supports Ledger. The first contact leaves you pleasantly surprised: it’s a fast, easy wallet with clean, modern graphics.

Algorand is a world in full evolution. If it manages to become one of the big players, there is no doubt that some of its current projects will play a leading role.

Let’s move on to partnerships, where the network is already a protagonist.

Among the latest news, Algorand has become the official blockchain of FIFA, the world’s highest authority on soccer (photo at the end of the paragraph, credits: FIFA.com). The company will collaborate with the federation to develop new strategies on digital assets, with the aim of breaking down distances thanks to technology.

We admit: it’s all a bit hazy for now. However, it is undeniable that this link will help increase the popularity of Algorand and the entire blockchain sector.

Finally, LimeWire, a software that once allowed the peer-to-peer exchange of multimedia content.

In ottica di rilancio, questa realtà ha stabilito una partnership con Algorand. L’obiettivo è di creare un marketplace di NFT, oltre a un relativo token. LimeWire a suo tempo ottenne enorme successo. Se dovesse bissare l’impresa, Algorand sarebbe il diretto responsabile del trionfo.

Concludendo, idee, potenzialità e progetti non mancano. Solo il tempo saprà dirci se i buoni presupposti saranno andati oltre, divenendo qualcosa di concreto.

Algorand: network on the launch pad?

Our overview of Algorand has come to an end. As always, we hope we’ve managed to arouse your curiosity.

Algorand is an innovative project with excellent potential. However, we know that this is not enough: hard work, continuous development and a bit of luck are needed to be successful.

Behind this network there is a truly brilliant mind, supported by skilled and carefully selected people. In short, nothing is missing: we just have to hope that everything goes well.

The projects, DeFi and non-DeFi, are mostly well thought out and have good potential. After all, Algorand uses technologies that set stricter entry requirements: you really have to want it, there’s no room for improvisation.

We will obviously keep you informed about this universe and make sure you don’t miss any updates: just follow us on this site and on our social channels.