Layer 2: the solution to the limitations of some blockchains

Arbitrum is the layer 2 remedy to Ethereum blockchain congestion problems.

The increasing prevalence of cryptocurrencies, DApps and NFTs may drive some networks to saturation.

There are blockchains born to process thousands of transactions per second. Instead, others struggle to keep up at times of peak demand. Ethereum is precisely one of them.

Until September 2022, the second most widely used chain was in fact based on the Proof-of-Work consensus algorithm. This implied that the validation of transactions had to go through the solution of complex computational operations. The computers used for this purpose, however powerful, took time to accomplish this task.

Proof-of-Work offers high security but there is a major problem: it is not possible to scale the chain and make it more performant if needed, at least in the short term.

This limitation leads to two complications that we know well:

- Operations become slow and take several minutes to complete. This is obviously a problem from a payment perspective but also from an investment perspective-no one likes to wait.

- They exponentially increase costs in gas fees, the fee that users pay when they make one or more interactions with the blockchain.

Ethereum congestion was mainly due to two causes: DeFi and NFT.

Decentralized finance was born on this very blockchain and has been one of the major trends from 2020 onward.

Each DeFi platform operates through numerous smart contracts and allows users to invest in various types of services.

A transaction on DeFi requires more interactions than simply transferring funds from one Ethereum wallet to another. The enormous success of this world has led to extreme growth in transactions, which is why gas fees have skyrocketed: as the demand for a service increases, so does its price.

In 2021, the NFTs delivered the final blow. They became the trend of the year, and a veritable speculative bubble was built on them. Prices reached unthinkable levels, and with them so did the demand for transactions: buying and selling a non-fungible token in fact requires several movements on the blockchain. The result: triple-digit gas fees for everyone!

The search for a solution then became indispensable.

On the Ethereum side, developers have fielded various solutions that will lead to a set of updates (once called Ethereum 2.0).

Among the various changes, the most important one occurred in September 2022 with the blockchain’s transition from the PoW algorithm to the Proof-of-Stake algorithm, which is significantly more scalable and energy sustainable.

This, however, is not enough. Time will bring further upgrades (such as Shanghai and Dencun, which occurred in 2023 and 2024); however, these must be accompanied by other solutions, not only to solve critical issues in the short term.

This gives rise to layer 2 blockchains: networks that take over the workload of their layer 1, delegating only the validation and security aspects to it.

There are numerous proposals available, some of them famous. For example, Lightning network helps to make the Bitcoin environment more usable and faster.

Given the characteristics of the chain and its ecosystem, the main layer 2s have developed right on Ethereum. Arbitrum One is one of the main ones along with Optimism.

In this in-depth look at one of the quintessential Layer 2s. Upon completion, Arbitrum will have no more secrets!

Index

What is Arbitrum?

Arbitrum is a layer 2 solution that makes the Ethereum blockchain scalable, eliminating slow transaction issues and lowering costs in gas fees.

A layer 2 chain exists only on top of its own layer 1, otherwise it would make no sense.

Like a Himalayan porter with clients’ mountaineering equipment, Layer 2s unload a lot of weight from the shoulders of the main network. The result is fast and economical operation while maintaining Layer 1 security standards.

Arbitrum One was born in 2021 with the goal of making Ethereum a sustainable place again for everyone. In fact, the massive use of this blockchain by DeFi protocols and NFT marketplaces had led to insane transaction costs as well as long waits.

Within a short time from commissioning, this layer 2 yes indeed proved to be a very good solution.

To date, Arbitrum holds several billion dollars in cash and has already been tested in the bear market that marked 2022. In any case, membership has been large and continues to grow.

The offerings of this layer 2 are rich and also include several famous DeFi platforms: we will discuss these in a few paragraphs.

The Arbitrum One network was born through the work of Offchain Labs, a company co-founded by Ed Felten. He has on his resume the role of White House technology adviser from 2015 to 2017, as well as employment as a professor at the renowned Princeton College.

The company Offchain Labs has over the years raised significant sums earmarked for development from players such as Coinbase Ventures (directly from the well-known exchange Coinbase), Compound and Pantera. Therefore, the project is serious and reliable.

Ready to get more technical? Very well, then let’s get on with it!

"From day one, Arbitrum has proven to be an excellent network layer-2"

Arbitrum One: technical characteristics of Ethereum's layer 2

Arbitrum is a layer 2 Ethereum of the optimistic rollup type. What does it mean? Let’s find out right now.

There are several layer 2 solutions; the rollup solution is currently the most popular and suitable in solving scalability issues.

Let us visualize the operation of a layer 1 blockchain. Transactions are validated according to the famous blocks we hear about all the time. As we said, if the number of operations increases, the number of blocks themselves increases with it.

A poorly scalable chain like Ethereum easily reaches the point where it has to queue the workload as it has become unsustainable. There is in fact a limit of transactions per second beyond which it is not possible to trespass. This figure will improve as new solutions are implemented but, to date, difficulties persist at times of heavy use.

Think of a supermarket with only one checkout counter open: as long as a customer comes every 4 to 5 minutes, there is no problem. However, the moment the influx of people increases, the cashier will not be able to meet that workload cleanly: queues will inevitably be created.

Layer 2 rollups offload weight from layer 1 by validating huge batches of off-chain transactions. After that, they go to synchronize with the chain mother at regular intervals, taking care to submit only essential data to it.

Layer 2 performs all the computational and storage part, relieving its own layer 1. The latter will have the sole task of verifying and validating what is submitted in order to ensure maximum security.

Layer 2 rollups fall into two categories: Zero-Knowledge (ZK) roll ups and Optimistic rollups.

The former exploit cryptographic proofs in block validation. They represent the future but still require some development and refinement, despite exploding between 2023 and 2024.

Optimistic rollups, on the other hand, assume that each new block in the chain is valid.

If a validator were to raise an objection, proposing another block as correct, they would proceed to meticulously break them down until the cause of the discrepancy was identified.

That done, it would be sent to layer 1 for final verification and approval of the truly valid block. The process ensures that all transactions are processed smoothly and prevents manipulation of the blockchain itself.

How do Arbitrum and Ethereum come into communication?

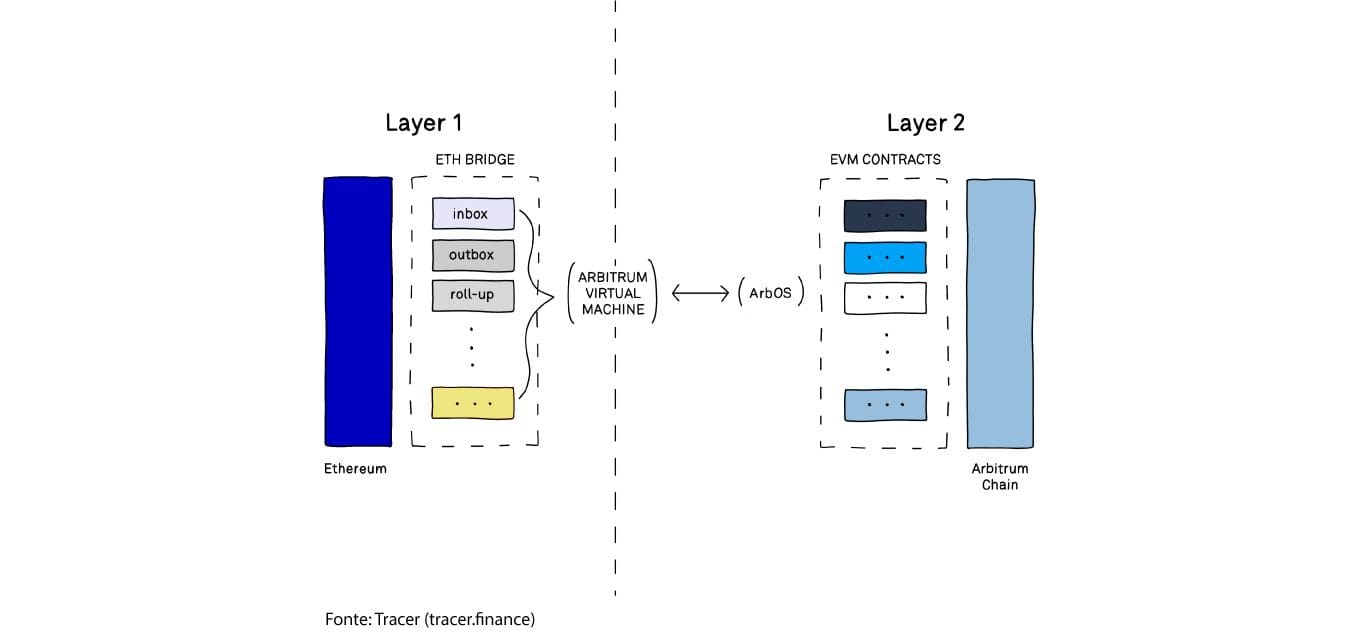

The image just above summarizes the interaction between Layer 1 Ethereum and Layer 2 Arbitrum.

The junction between the two worlds is a bridge, a real bridge.

Without going into too much technical talk, we can say that everything that needs to move on layer 2 moves right through the bridge. What are we talking about? Exactly what we were talking about a few lines above: transactions, that is, what goes into burdening poor layer 1.

The bridge relies on theArbitrum Virtual Machine. This is a computer that periodically checks the various shifts between layer 1 and layer 2, as well as the security checkpoints. This ensures the timely operation of the secondary network.

Translated into even more understandable terms: simple transactions and everything related to smart contracts (EVM contracts in the image) move from Ethereum to Arbitrum. Layer 2 bridges and virtual machines are responsible for this perpetual connection between “mother” and “daughter” blockchains.

Only one final point remains: how to be certain of the validity and order of transactions that have taken place on Arbitrum? If each had to wait for the okay from Layer 1 the much-vaunted lightening would be lost.

Therefore, Arbitrum is equipped with validators exclusively suited to individual transactions. Block validation, concerning the actual chain consensus, however, remains the responsibility of layer 1.

If all validators agree that the transaction is correct, no problem.

In the event that there is even one dissenting opinion, the breakdown mentioned a few lines above would be carried out instead.

Once the reason for the dispute is understood, it will be possible to identify the right solution. This means that even one honest validator is sufficient to ensure the proper flow of transactions. Recall then that Layer 1 is always there “standing guard,” ready to be called upon.

Currently, Arbitrum’s validators are shared with another well-known entity, Chainlink.

Additional details and trivia about layer 2 Arbitrum

Let’s look at some extra information inherent in this network.

First, gas fees, reduced but still present.

Like any layer 2, this reality employs the layer 1 blockchain currency. Therefore, transactions on Arbitrum are paid in Ether.

Moving on, let’s look at how the user can use it.

In this respect, nothing changes from Ethereum: Arbitrum behaves in the same way. Therefore, the user experience does not require any specific analysis.

At the technical level, we have already explained how the interaction takes place. So we know that consensus is carried out by layer 1, while Arbitrum deals “only” with the operational part related to transactions and interactions between smart contracts.

Regarding the reception, prominent figures in the blockchain world have expressed positive reviews about layer 2.

Vitalik Buterin himself had some very good words for Arbitrum One and rollups.

What will be the future of layer 2 after the update to Ethereum 2.0? Will there still be room for these technologies? The answer is yes for several reasons.

First, it will take years before all the planned upgrades are introduced.

In addition, although with sharding it will be possible to scale Ethereum, it is very likely that some basic limitations will persist. There’s more: in Ethereum’s upgrade roadmap, sharding has not been mentioned for some time, while rollups are identified as the optimal solution for improving performance. In short, something is boiling in the pot of good Vitalik, who has never hidden his interest in these solutions-

Regardless of what happens, Ethereum benefits from the presence of layer 2. After all, these are “branches” inextricably linked to it. There is no reason to cut off what gives value.

Now we know a little more and can take advantage of Arbitrum’s benefits with greater awareness.

Before briefly exploring the main DeFi platforms available, however, it is necessary to configure the wallet: only then can we interact with this layer 2.

So let’s see how to properly set up Metamask, the No. 1 choice for entering the Arbitrum universe.

Metamask wallet configuration and Arbitrum bridge.

To interface properly with Arbitrum layer 2, a wallet must be configured. Our choice falls on Metamask: widely used, well documented, and a good compromise between ease of use and security.

Metamask can be installed on mobile devices or via browser extension. Let’s see how to set the latter, usually the most popular option.

As a first step, we must have the wallet installed and ready to use.

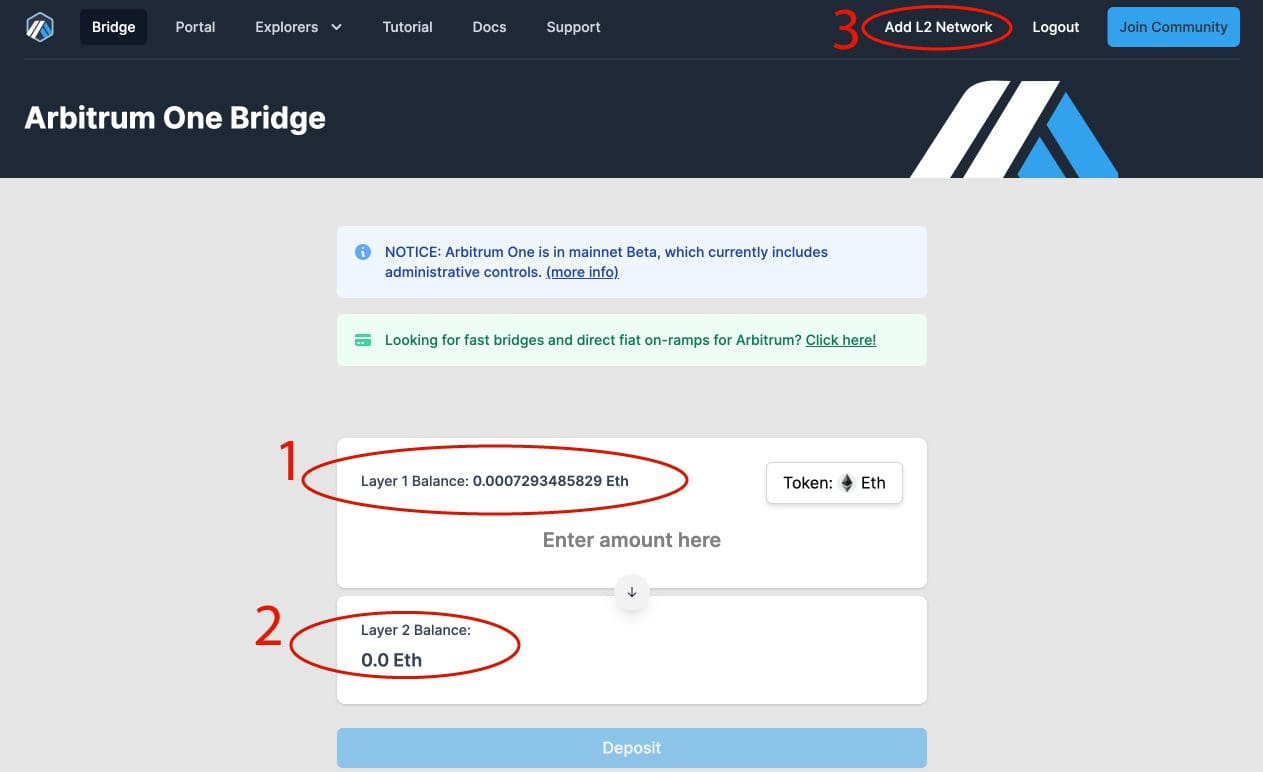

That done, let us go to bridge.arbitrum.io, the virtual place from which we can move assets from Ethereum to Arbitrum (and vice versa).

Let’s connect with the wallet via the “login” button. For now we stay in the Ethereum network.

As we can see from the image (area 1) the wallet balance in Ether is automatically loaded. If we wanted to convert another coin or token, we should click on the rightmost button(Token: Eth) and select the one we are interested in.

At this point we will only need to write the amount of coin to be moved to layer 2 (currently zero, see area 2) in place of the words Enter amount here. After that, click on the Deposit button.

Almost immediately a wallet window will open from which to confirm the transaction.

Arbitrum One saves a lot of money on gas fees. Moving assets from Ethereum to layer 2 still requires paying the transaction to the former, so let’s calculate how much is convenient for us based on our operations.

To add the Arbitrum network to Metamask, simply click on the highlighted text in the screen (area 3) and follow the instructions.

For the sake of completeness, however, here are the parameters to be entered into the wallet in case the bridge makes any changes:

- Network Name: Arbitrum One

- New RPC URL: https://arb1.arbitrum.io/rpc

- Chain ID: 42161

- Symbol: AETH

- Block Explorer URL: https://arbiscan.io

What about the other wallets instead?

The Arbitrum bridge also supports Coinbase Wallet and the ever-present WalletConnect.

The former can be installed as a browser extension or on mobile devices. The second one, on the other hand, allows linking different virtual wallets, such as Trust Wallet.

While the setting may vary, the procedure for moving cryptocurrencies from Ethereum to Layer 2 remains identical to that just illustrated.

"Metamask is the best-documented option and, barring specific needs, the best available"

A look at the DeFi proposal on Arbitrum

Finally, there is some talk about DeFi.

Arbitrum was created to overcome the limitations of Ethereum and fully supports everything the famous layer 1 has to offer. It was therefore natural that the world of decentralized finance would land en masse on this layer 2.

Even before coming online, developers of popular DApps had access to the Arbitrum network in order to migrate platforms there.

Impossible then not to mention Curve, one of DeFi’s leading portals, first.

The famous protocol immediately attracted good liquidity, increasing the proposal of available pools over time.

To date, operating through Arbitrum on Curve.fi it is possible to invest in the popular 2pool (USDC-USDT) as well as the equally popular tricrypto.

Let’s move on to another decentralized finance giant: SushiSwap.

Swap of low-cost native Ethereum tokens? no problem: thanks to this AMM this is possible.

There are also several very attractive liquidity pools with large amounts of deposited capital. This means maximum safety for everyone.

Are we more UniSwap types? There is of course also this protocol.

Avoiding repetition, a wide selection of exchangeable coins and tokens as well as pools and farms are available in this environment.

But the top prize in terms of capitalization goes to GMX, the DEX that specializes in derivatives.

Arbitrum’s DeFi goes beyond the protocols just listed-there really is a lot of choice.

As always, utmost care before trading, avoiding platforms of questionable reliability.

Also watch out for certain liquidity pools where the impermanent loss is always lurking!

Arbitrum One: a great solution to the limitations of Ethereum

Arbitrum is a valuable remedy to Ethereum’s limitations: it enables fast and inexpensive transactions, the user experience does not change, and security is guaranteed by layer 1.

The presence of numerous DeFi platforms immediately made this layer 2 particularly popular. Moreover, there is still a lot of room for development in terms of proposal, so an increase in overall utilization is desirable.

Ethereum benefits from the presence of Arbitrum in terms of both gas fees (paid in Ether) and workload relief.

In short, investors in this ecosystem can be happy with the way things are going.

Therefore, after appropriate individual research, all to make the most of Arbitrum One.

Are you interested in other Layer 2 Ethereum, find out about Optimism.