Leggi questo articolo in Italiano

Arthur Hayes points to the finish line: crypto PICCO will be March

By Davide Grammatica

There is to be bullish, according to Arthur Hayes, at least until mid-March 2025, which is until U.S. monetary policy supports Bitcoin's rise

Hayes' new forecast

The former ceo of BitMEX and a point of reference for the entire crypto community, Arthur Hayes, is back to talk about the future of Bitcoin and cryptocurrencies as the new year opens. And he made it short: the peak of the crypto market will be reached in March 2025, and it will depend directly on U.S. monetary policy.

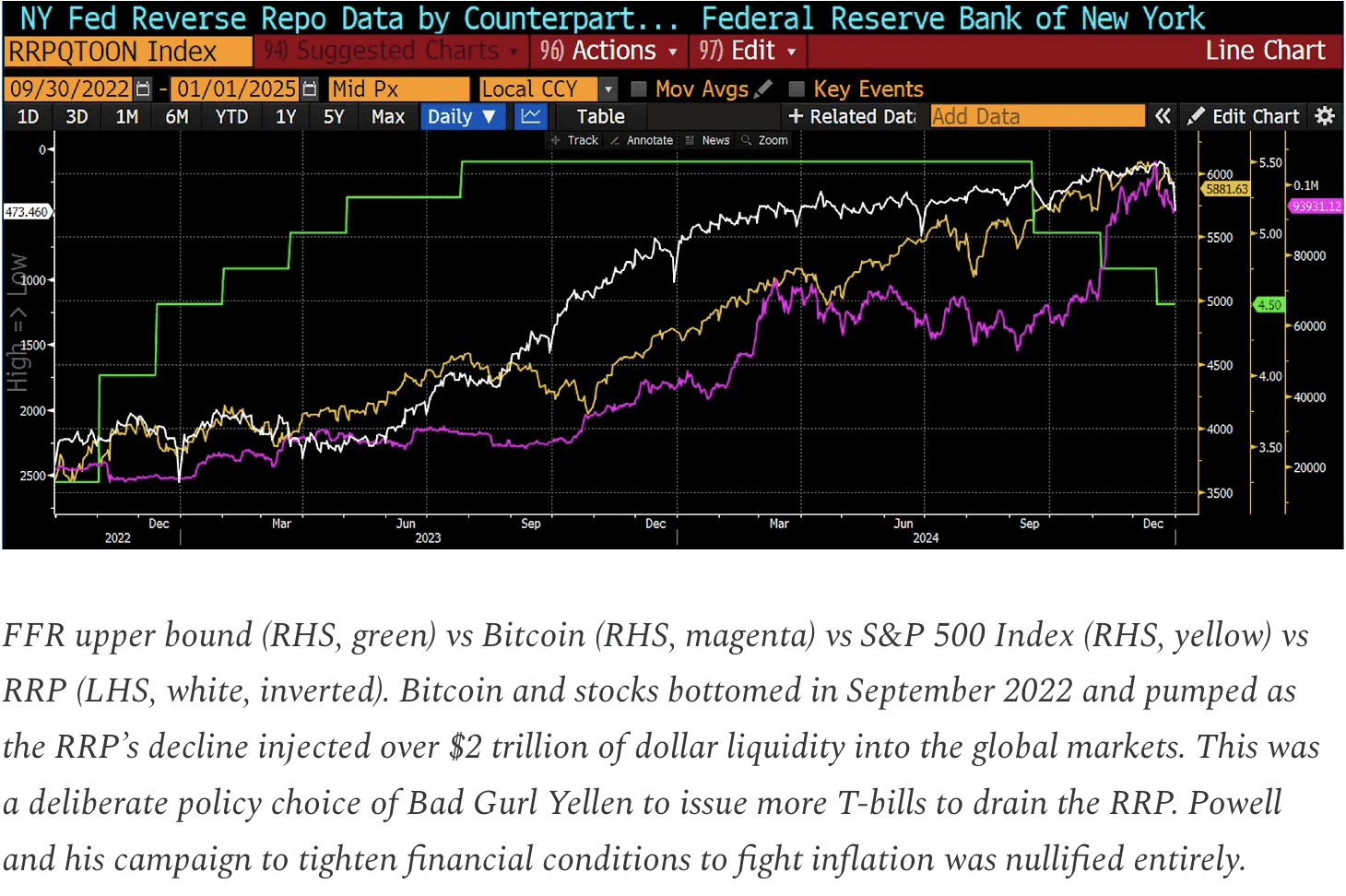

The key component is the liquidity of the dollar and its impact on global markets, with respect to which a direct correlation between the Federal Reserve’s Reverse Repo Facility (RRP) and the price of Bitcoin is highlighted, at least since the low touched in Q3 2022.

For the beginning of 2025, however, the price trend of BTC will still be influenced more than anything else by the “Trump” factor, pending his official entry into the White House this month. As reported earlier, this very occasion will be decisive in testing investor sentiment, but even in the face of corrections in the short term, the future of BTC seems destined to depend on the “macro” environment.

March 2025 target

Attention, according to Hayes, should be directed mainly to the evolution of U.S. dollar liquidity, squeezed on the one hand by the Fed’s quantitative tightening (QT) policy and, on the other, by the process of interest rate cuts, for a U.S. environment that should, in general, remain favorable.

Compared to the crypto market’s path, therefore, external factors, such as China’s new credit policies or the Bank of Japan ‘s approach to interest rates, are of more concern.

In the face of these factors, Hayes said he would still adopt a high-risk/reward strategy, focusing on niche sectors with great transformative potential (such as the emerging DeSci sector could be ).