Leggi questo articolo in Italiano

Bitcoin: $750 billion in ETF volume, but sales are a concern

By Daniele Corno

Bitcoin spot ETF volumes exceed $750 billion in just over a year, but the market fears the sales of recent weeks

Interest is growing strongly

A little over a year after their launch, US Bitcoin spot ETFs have traded a cumulative volume of over $750 billion.

The growth of this figure validates strong investor interest in this type of financial product. The first $100 billion in volume was reached within 60 days of launch. The next 30 days saw an increase from $100 to $200 billion, in parallel with the strong market growth between March and April 2024.

The $500 billion mark was more difficult to reach, in fact I only reached it in November, following the rally following Donald Trump’s victory in the US elections. In the previous days, however, cumulative volumes exceeded the important figure of $750 billion.

As mentioned over and over again, the hegemony of trading volumes, as well as custodial holdings, are in the hands of Blackrock. In fact, IBIT accounts for over 75% of volumes and over 50% of Bitcoin in custody.

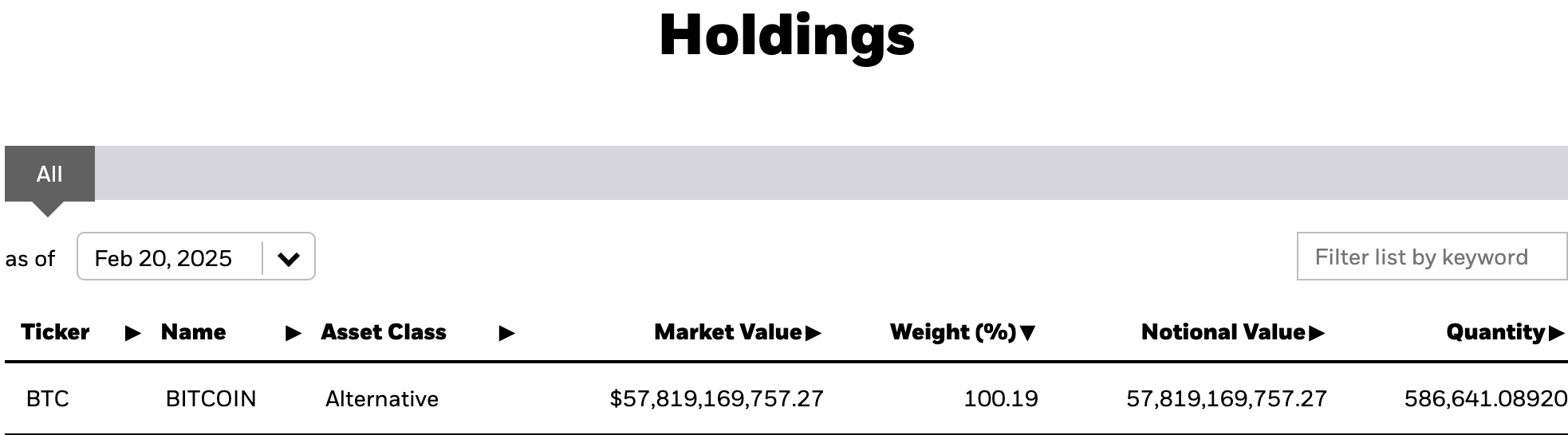

We’re talking about over 586 thousand BTC. With a value of nearly $58 billion, IBIT is the thirty-third largest ETF in the world.

Large funds in command, but recent sales hinder Bitcoin

Interest continues to grow, as demonstrated by the large holdings of states and large banks. The most recent examples are the sovereign wealth fund of Abu Dhabi and the British bank Barclays with investments of $437 and $131 million respectively, also through IBIT.

These funds join the main Hodlers such as Goldman Sachs and Millenium Management, which own over $2.7 billion.

JUST IN: 🇦🇪 Abu Dhabi’s sovereign wealth fund is now the 7th biggest holder of Blackrock’s Bitcoin ETF ( $IBIT) at $461.23 million.

They’re just getting started… 🚀

🫡 @JSeyff pic.twitter.com/GKViJorE7x

— Bitcoin Archive (@BTC_Archive) February 14, 2025

Despite this strong interest, the last two weeks have seen capital outflows respectively. -$580 million in the previous week and – $480 in the current one, act as an obstacle to the price of Bitcoin.

The price is currently trading in the area of $98,500, up +2% in the last 24 hours, but compressed below $100k.