Leggi questo articolo in Italiano

Bitcoin and the $90k challenge: What is BTC missing?

By Davide Grammatica

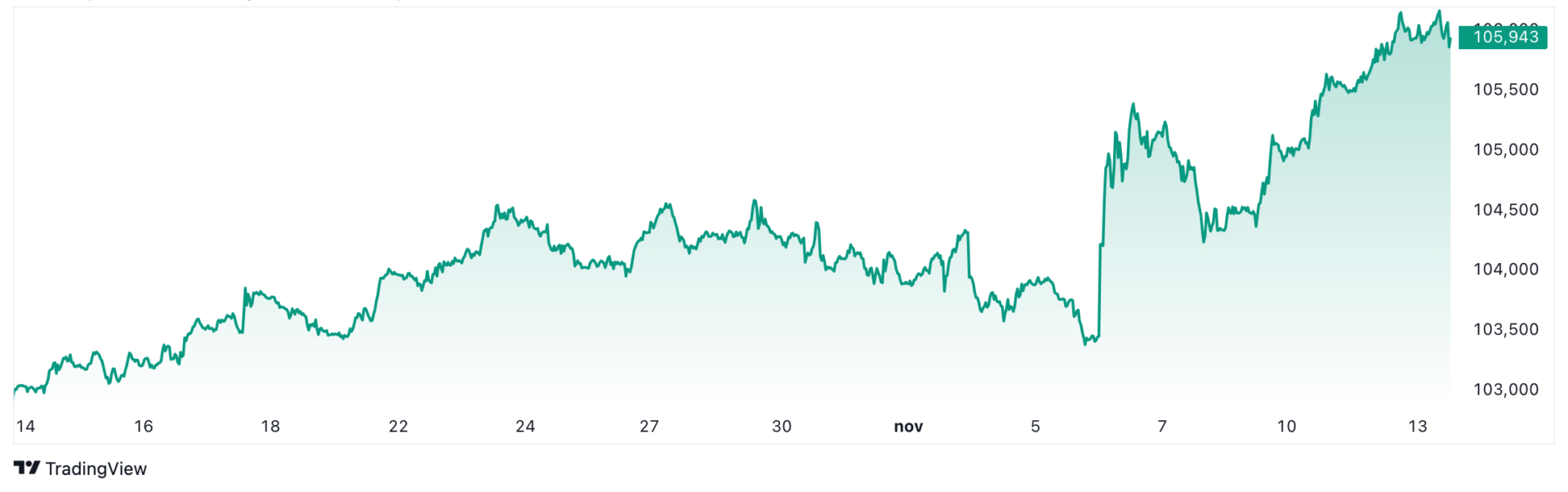

Bitcoin's rally seems to have hit the $90k wall: dollar trend not helping, but there is confidence for new ATH

Is the dollar playing against BTC?

After a +20% bullish rally in one week, it was natural that Bitcoin would run into resistance levels. The most important of these seems to be the $90,000 wall, and breaking through it may take longer than expected.

This is the opinion of several traders, who saw the simultaneous rally in the “U.S. dollar index” (DXY) as potentially damaging to BTC’s rally. The U.S. dollar, in fact, would be performing better than foreign currencies for a month now, to a consolidating value that is generally never a good signal for “riskier” assets.

We may simply be seeing a pause before a new upward phase toward $110k, but increased betting toward a continued rise in the DXY should not distract from possible setbacks.

The ball is in Trump's court

Volatility, meanwhile, has already risen sharply, and it is becoming increasingly complicated to take advantage of the U.S. Election effect. The “Trump trades,” in some ways, seem to have already lost their effectiveness, and now all that remains is to return to looking at BTC in relation to other factors.

The DXY, at its highest in the past six months, could even restore the historical negative correlation between the latter and BTC, to the point of disrupting the former cryptocurrency’s upward race. At the same time, again supporting the U.S. dollar, U.S. government bond yields are also signaling a strengthening.

It is not at all easy, consequently, to predict the consequences of the new economic policy announced by Trump. Indeed, while the new president pushes the crypto sector by dint of favorable statements, several moves (starting with the announced “deportations”) could force the Fed to stop the process of interest rate cuts that began last year.