Leggi questo articolo in Italiano

Bitcoin: the BULLISH correlation with global liquidity

By Davide Grammatica

Bitcoin is increasingly the “liquidity barometer” in the global economy, being correlated more than any other asset to the global money supply index

BTC and the relationship with global liquidity

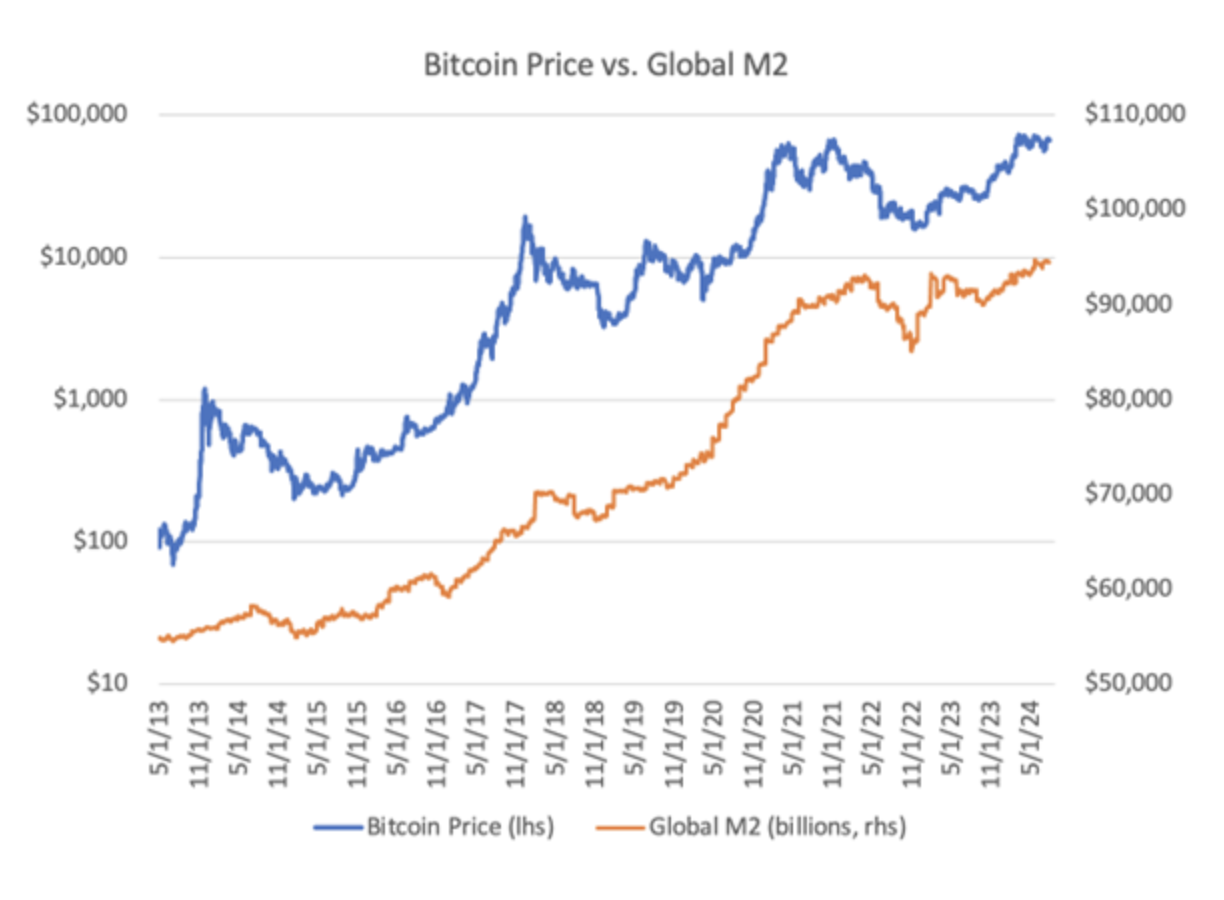

A recent report prepared by Sam Callahan and commissioned by research firm Lyn Alden Investment Strategy highlighted a curious correlation betweenBitcoin‘s price performance and that ofthe global money supply.

“Global liquidity” refers to the supply of the currency by including two basic components, namely the ‘private’ and the ‘financial’ components. On the one hand, the assets available to settle interbank claims and stimulate the financial sector, and on the other hand, the cross-border and commercial transactions conducted by banks and other financial institutions.

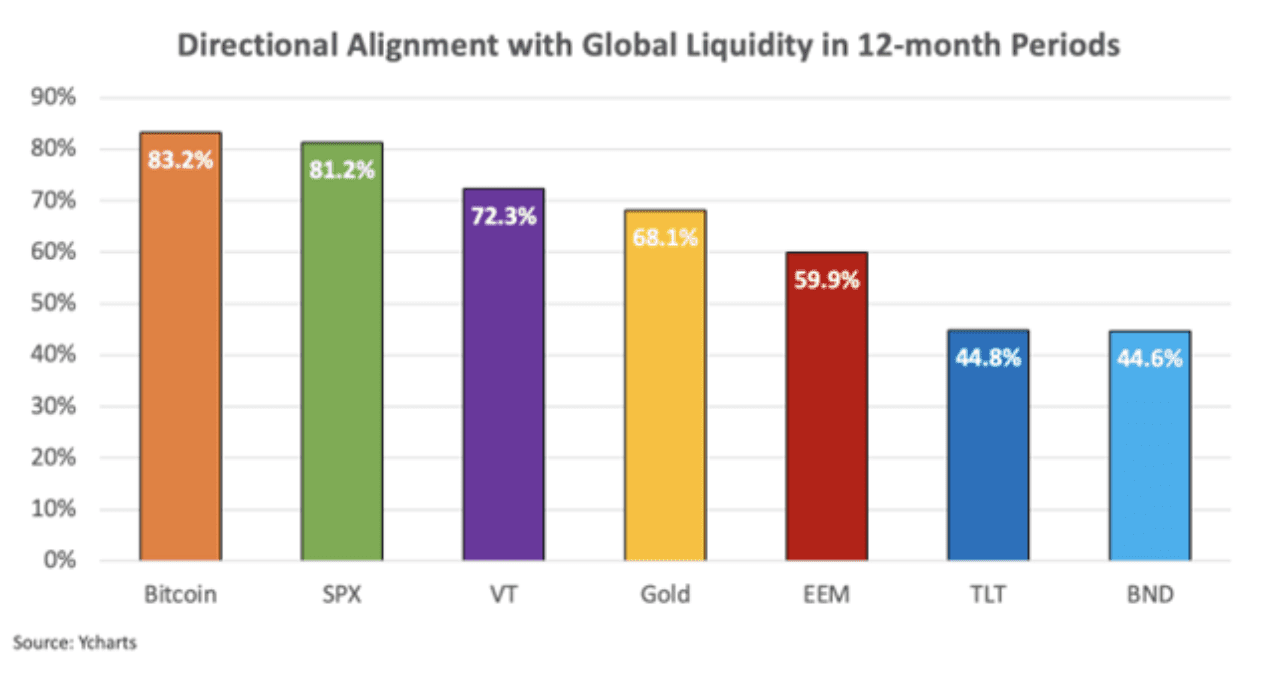

Well, all of this, which is then to be understood as the global monetary supply, would be closely linked to the performance of Bitcoin. According to Alden, BTC would move in the same direction 83 percent of the time, more than any other asset.

Bitcoin would thus also be a very useful “liquidity barometer,” useful for interpreting various macroeconomic factors and a functional tool for investors and traders in this respect as well.

A BULLISH correlation

The study looked at data ranging from May 2013 to July 2024, and found a correlation index of 0.94, meaning a very close relationship between the two elements that is incomparable to that of the stock market or assets such as gold. “Bitcoin is treated as ‘risky’ gold, basically,” the report reads. “It is a mirror reflecting the rate of global money creation and the relative strength of the dollar.”

The only problematic element in this correlation is BTC’s volatility, but this only seems to affect the analysis in the short term.

Should this correlation persist into the future, the news would be decidedly positive. Indeed, the Global Liquidity Index (M2) is on the rise, and Lyn Alden has already predicted that BTC will reach $200,000 within two years.