What is Bitcoin halving?

In the context of blockchain, bitcoin halving is that process of inducing BTC price inflation by reducing the number of tokens issued and increasing demand for them, with implications that affect the entire ecosystem.

The last halving occurred in April 2024. More precisely, the event coincides with the time when the reward for bitcoin mining is halved, collaterally causing the inflation rate and the rate of new token entry to be cut as well.

When is the next halving of bitcoin? The next halving will be in 2028, four years after the last one. As always, this will be a very important event and one that could positively affect BTC’s performance.

Before we delve into the details, if you hadn’t guessed, in order to be able to precisely understand Bitcoin halving what it is you must first know how Bitcoin itself works. We recommend that you read the article just linked, and then return to this one.

Index

Halving Bitcoin 101

The blockchain, or the technology that lays the foundation for Bitcoin’s operation, consists of a chain of nodes (or computers, for short) that contains a partial or complete history of transactions that have occurred on its network.

Each node that hosts the entire transaction history on Bitcoin is responsible for approving or rejecting transactions. To do this, it performs a series of checks to ensure that the transaction is valid.

After approval, the transaction is transmitted to other nodes, on whose number the stability and security of the blockchain also depend.

It is a revolutionary solution for both the exchange and storage of value and for so many industrial applications, services, communication and even voting. So many ramifications and applications such as decentralized finance and NFTs have sprung up because of it. We are still in its infancy, however, because blockchain is just now beginning to spread like wildfire.

In this context, Bitcoin has the prominent role: it is the first comer and the example from which everything started. The BTC coin is the most highly capitalized cryptocurrency, compared by some even to gold. It is no coincidence that many investors, from small to large, are choosing this asset to secure the value of their money.

Mining and halving Bitcoin

Participation in the Bitcoin network is open to everyone and is possible through mining. Anyone with a computer can collaborate in processing and validating transactions, helping to keep the blockchain healthy.

The whole system is called Proof-of-Work (PoW) and describes the actions of miners, who are required to prove that they have done “work” in processing transactions so that they can then earn a reward. “Work” refers to two elements: time and energy. These are necessary for the node to be able to solve complex equations, which in turn perform the task of legitimizing a transaction.

The set of transactions in symbiosis with the blocks constitute the blockchain for all intents and purposes.

Miners receive a fee in relation to the transactions they manage to validate. Each block can contain a limited number of transactions, at which point this can be said to be completed.

One note: There is now too much computing power required to make mining worthwhile. While it is still theoretically possible to do it yourself with your home computer, “small fish” are forced to join specialized consortia to actually be able to make a profit.

BTC halving effects

Now that we have found the answer to “what is halving?”, let us understand its effects.

After the completion of 210 thousand blocks, roughly every 4 years, the reward allocated to miners for processing transactions is halved. BTC halving then occurs, which has the immediate effect of halving the rate at which new bitcoins are put into circulation. But not only that: this is also the dynamic by which bitcoin manages to impose arbitrary price inflation, at least until all bitcoins are put into circulation.

Because, in fact, there is a limit to the production of BTC and it will get there, according to estimates, around 2140. Only at that point, in fact, will the limit of 21 million supply bitcoins, the ceiling of distribution, be reached. After that, the miners will have as their only reward that of the commissions of the users who exploit the network. For now, however, we can forget about it: just under 120 years away!

Halving is thus a fundamental event, which determines the decline in the rate of bitcoin production inversely proportional to its approach to the supply cap.

"There is a limit to BTC production, and it will get there, according to estimates, around 2140"

BTC halving dates in history

At the end of 2024, the year of bitcoin halving, there are about 19.8 million BTC in circulation, with 1.2 still to be “mined.”

In 2009, the reward per mined block stood at 50 bitcoins, which became 25 after the first halving, then 12.5, 6.25 and 3.125 at the time of writing. Resorting to a metaphor, it is as if the amount of gold on the planet halved every four years, with a reduction in its production theoretically driving up its price.

If halving reduces the rate at which new tokens are created, this also correspondingly decreases the availability of supply, regardless of the increase in demand. This dynamic has consequences, as assets with limited availability can in turn cause an increase in demand for it, which pushes the price up.

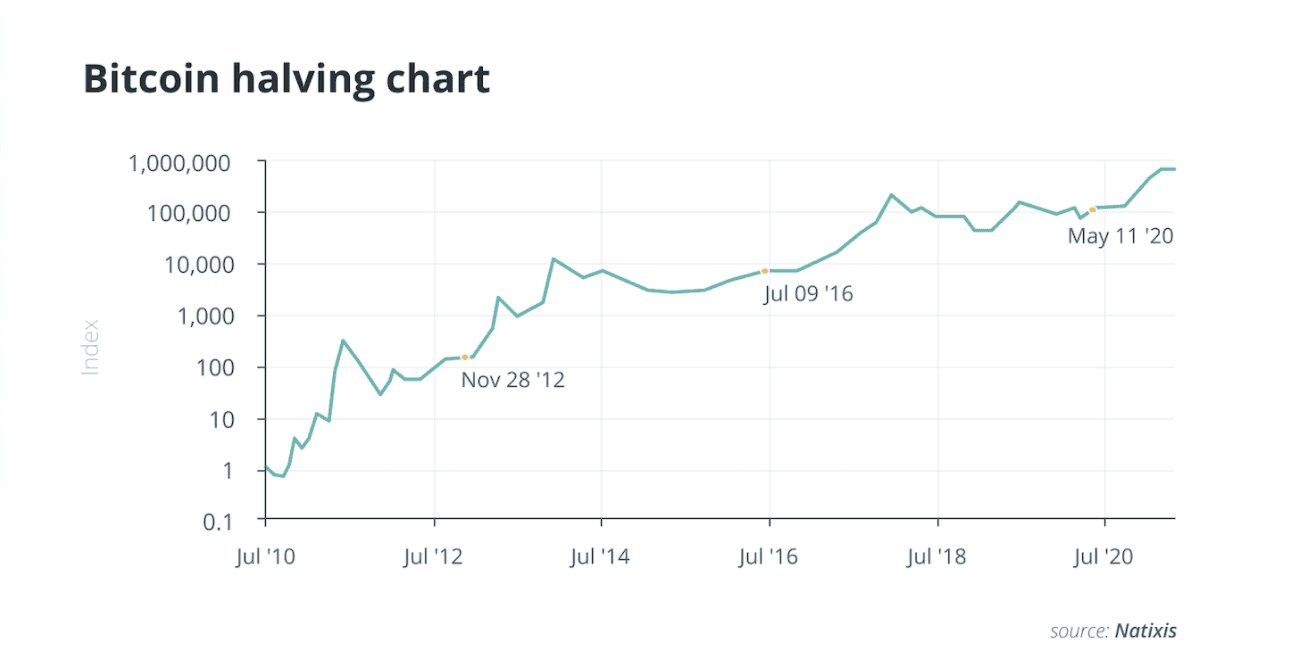

In fact, that is exactly what happened as a result of all the previous halving:

- The first, on November 28, 2012, saw the price of BTC rise from $12 to $1,217 within a year;

- The second, halving bitcoin 2016, on July 9, with the price rising from $647 to $19,800 on Dec. 17, 2017. In this case, the price subsequently collapsed to $3,276 on December 17, 2018, while still remaining six times higher than the previous halving.

The last in the series that we can analyze was the halving bitcoin 2020, when the coin was valued at $8,787. The price rose until it caressed $69,000 in the fall; after that it dropped, even returning below $20,000 for quite some time. Now we have to wait and see over the years whether the Bitcoin halving 2024 will also confirm what we have observed in the past.

Fun fact: Of the 19.8 million bitcoins in circulation, as many as 6 are estimated to be lost forever, largely due to forgetfulness and lack of attention. This shows how important it is to treat one’s noncustodial wallet with the utmost care.

Bitcoin halving implications

To summarize, halving could be reduced to a succession of reactions like this: the halved reward to miners causes a reduction in available supply, but an increase in demand is matched by an increase in price, which then makes the incentives to miners still worthwhile as the value of bitcoin is increased in the process.

But what if halving does not cause an increase in demand – and thus in price? Because, in that case, miners would have no incentive to process transactions. To avoid this, Bitcoin exploits a process that changes the difficulty required to obtain rewards derived from mining. In other words, if the value of bitcoin did not increase, the computing power required for a miner to mine it would decrease. The reward would still be less, but so would the difficulty of processing a transaction, saving energy.

So far, the halving process has always worked, but it should be remembered how the event is typically surrounded by immense speculation, due to the hype of the event and thus its contribution to token volatility.

Add in the fact that, in the case of the latest halving, this occurred in the midst of a pandemic, and it is really difficult to be able to predict what will happen in the future, given the ever-changing economic environment.

BTC halving, by necessity, also has a major impact on the entire network. There are mainly two stakeholders, however.

The first, of course, is the investors, because if halving is matched by an increase in prices, trading activity will increase in anticipation of its occurrence.

Then there are the miners, since on the one hand a decrease in the supply of Bitcoin increases demand, but on the other hand fewer rewards can make their survival complicated, especially in an environment where there is strong competition. Mining capacity is in fact said to be countercyclical to the trend of its price; when the price of cryptocurrency increases, the number of miners in its ecosystem decreases.

"Halving has always worked, but it is worth mentioning how the event is surrounded by immense speculation"

When is the next bitcoin halving?

We have to wait almost four years, because the next halving bitcoin will be in 2028.

If you are a sports fan, here’s a simple reminder: BTC halving is always in the Olympic Games year!

Halving: road to 2140

One of the last questions to be answered concerns the time interval of 4 years. In fact, why exactly 4 and not, say, 7? The answer is based on the structure of Bitcoin.

The algorithm for mining is set with the goal of creating new blocks in the blockchain every 10 minutes. This criterion is determined arbitrarily by the entire system, regardless of whether the number of participating miners increases or decreases, varying from time to time the resolution difficulty of Bitcoin’s algorithm (calibration, more precisely, occurs every two weeks or so).

To date, with halvings always being a success, the resolution time to mine a block has remained consistently under 10 minutes, on an average of 9.5 to be precise.

In 2140, when the last of the BTC is mined, halving bitcoin will cease to exist, as there will be a shortage of coins to be found. In any case, miners will likewise be incentivized to participate in the life of the network, as they are needed in the validation phase of transactions. And if, as is hoped and expected, bitcoin will have an even greater market value, also linked to the volume of transactions that will occur, miners will benefit from the increase in the total value of fees.

In closing, bitcoin is not the only blockchain implementing this practice. Think of the halving Litecoin, another well-known network. In this case, it occurs every 840,000 blocks, with identical timelines to Bitcoin (four years). To learn more, here is our in-depth article on Litecoin.