Leggi questo articolo in Italiano

Bitcoin: liquidations of $520 million crush BTC

By Davide Grammatica

In the past 24 hours or so, liquidations in the crypto market have touched $520 million, fueling volatility and BTC's decline

New difficulties for Bitcoin

Over the past day, traders and investors have been grappling with the downward movement in Bitcoin, which has resulted in the liquidation of more than half a billion dollars worth of positions across the crypto market.

The increased volatility of BTC and ETH has generated much instability in the broader crypto market, so much so that there are more than 186,000 traders liquidated in the last day, according to Coinglass.

Bitcoin is the top asset to weigh in on liquidations, covering over $142.5 million of the total share. Of this, $101 million was related to long positions. Ethereum, however, was not spared either, with liquidations of $89.9 million ($49.2 million long).

Significant losses by traders fueled even more the downward movement of Bitcoin, which in the last week seems to have lost the vigor needed to fight for the $100k fundamental level.

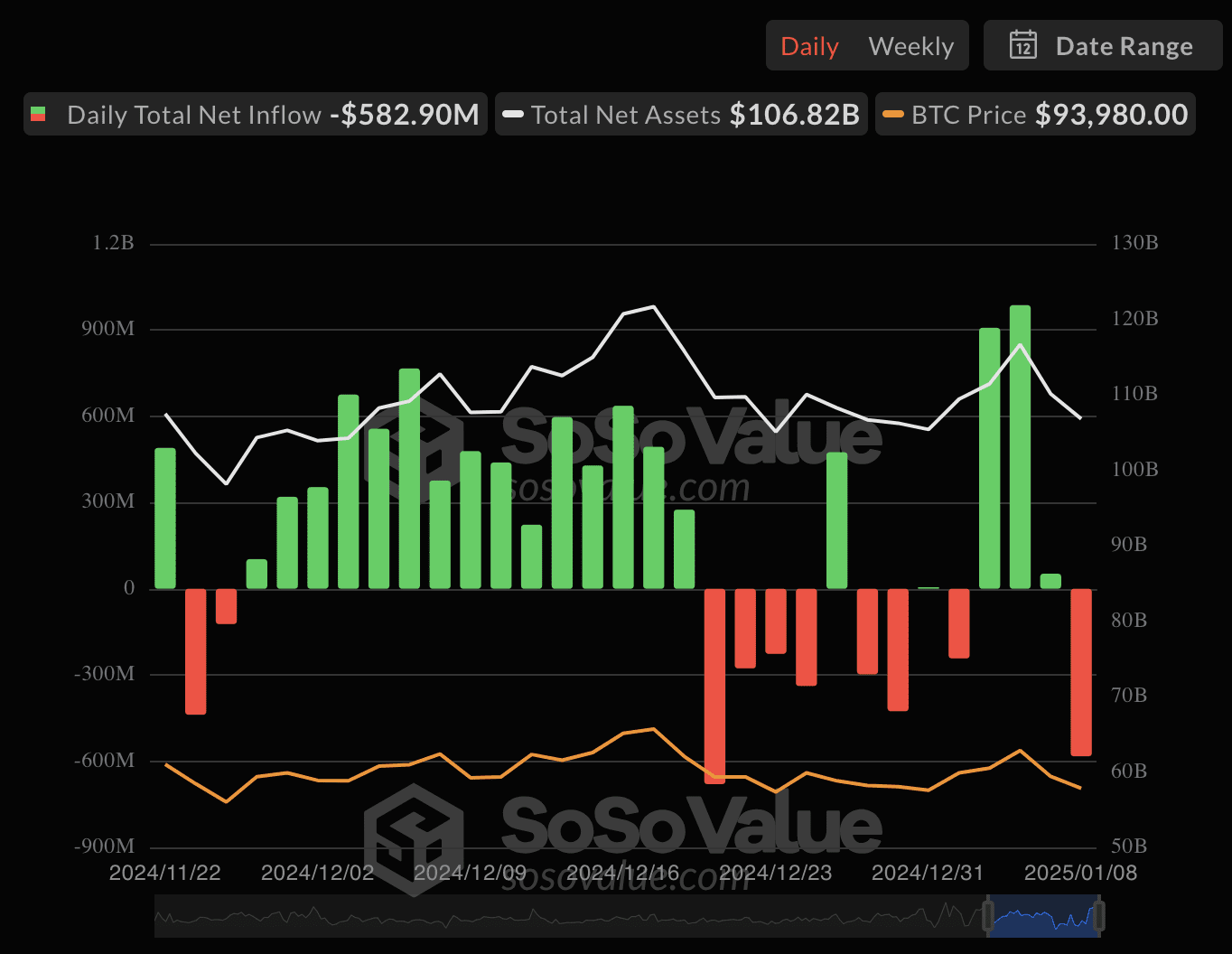

ETFs are also suffering

Right now, BTC sits below $94k, after a performance in the last 24 hours of -2.4 percent. No longer enough, it seems, is the enthusiasm around Trump ‘s entry into the White House and a new pro-crypto U.S. administration, and macroeconomic factors seem to be coming back to have a greater influence on the premier cryptocurrency.

In addition, the support of ETFs also seems to be coming down, which, at the tail end of the falling BTC spot price, are registering major outflows. For Fidelity, then, it is daily negative record, with over $258 million in outflows in 24 hours. It is not much better for BlackRock‘s IBIT either, which instead records the third largest daily net outflow ever, with $124 million in outflows.