Leggi questo articolo in Italiano

Bitcoin: all the scenarios of the week, and the risk of $70k

By Davide Grammatica

The $84k wall could push Bitcoin further down, with a bearish retest towards $70k. But there is also a bullish scenario...

A complicated week for Bitcoin

Investors remain cautious. And the resistance of $84k seems to be a litmus test for Bitcoin, which in this phase of retracing could threaten further declines.

The macro events of the week are being watched for any clues, particularly the FOMC, which could steer BTC’s movement in one direction or the other.

The Fed’s decision on interest rates will once again be decisive, with support at $80k still stable but in a context of FUD that could also lead the first cryptocurrency to a bearish re-test towards $70,000.

The most optimistic, however, see a consolidation of support, after a weekend of higher lows that could suggest the ongoing attempt to conquer new highs. In this sense, the test of multi-month lows may indicate a new liquidity grab, potentially lethal for “late” shorts and a harbinger of an upward breakout.

Not a bad sunday for #Bitcoin.

We still have Monday to go, but this looks like we’re making a new higher low on Bitcoin before attacking the highs again. pic.twitter.com/A9E6t0laGe

— Michaël van de Poppe (@CryptoMichNL) March 16, 2025

In the best case scenario, BTC could return above $100k in the next few weeks, with a cyclical analysis indicating a strong rise by June.

Appointment at the FOMC

However, as mentioned, everything seems to depend on the macro scenario. The FOMC will have an impact primarily on investor sentiment. And the signals are not particularly encouraging: even with inflation slightly down (see latest US CPI data) Fed officials seem firm in their aggressive stance on the economy.

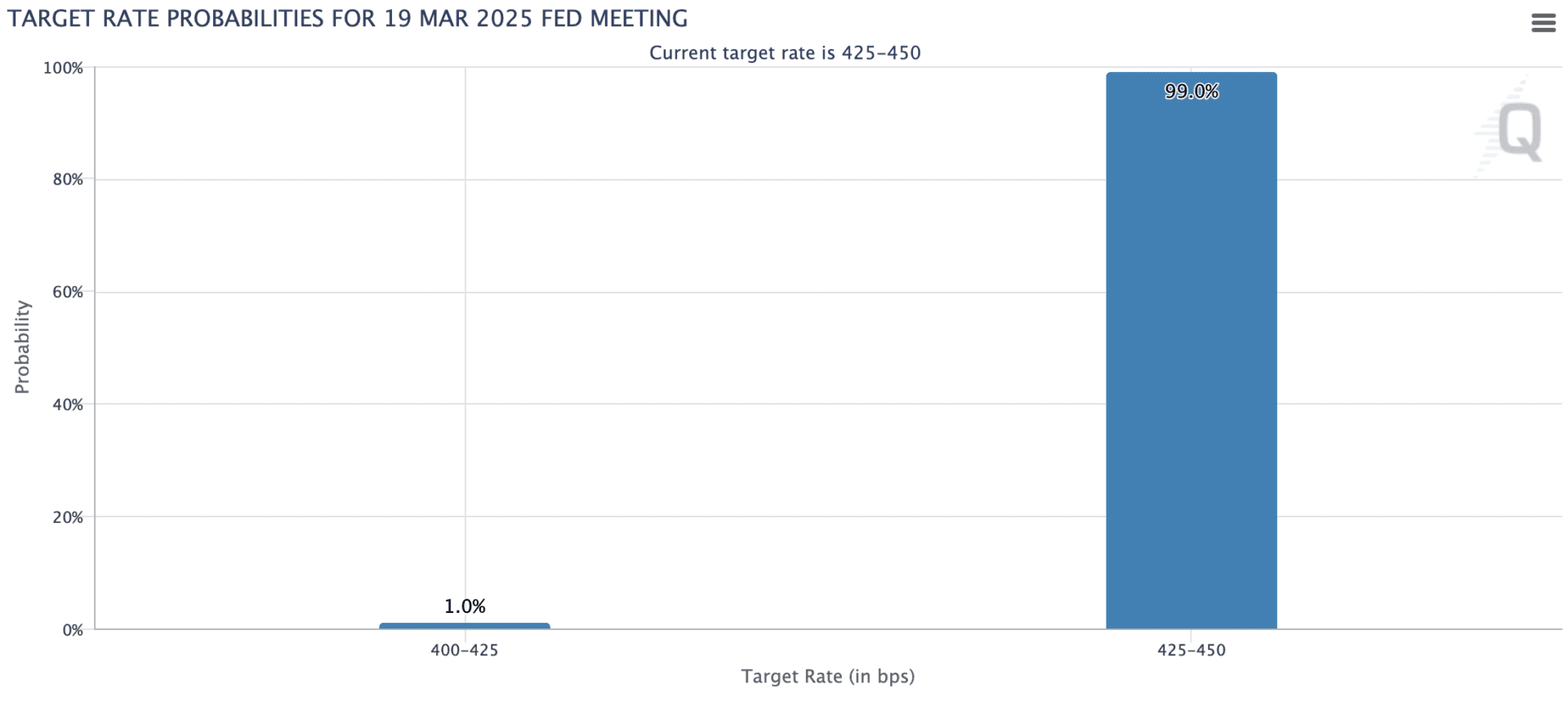

In other words, nobody is in a hurry to cut rates, so much so that CME Group’s FedWatch indicates a concrete probability that cuts will not come until June.

In the longer term, on the other hand, supporting the rise of BTC is the continuous increase in the money supply (M2) in the US, which is in its eleventh consecutive month of expansion, and in line with global liquidity.

Finally, it is interesting to note the attitude of the holders, which according to CryptoQuant is more “mature” than in the past. A part of investors (probably the most experienced ones) seems to be already accumulating, and supported by those who, despite an unrealized loss, “refuse to succumb to panic selling”.