BitMEX: an interesting crypto exchange

Since cryptocurrency exchanges can never be enough, in this in-depth study we explore BitMEX, an interesting reality especially for derivatives traders.

Although already known to investors in the sector for years, BitMEX gained popularity in our country thanks to the sponsorship on the A.C. Milan jersey, which lasted for a few years. From there, interest grew and more and more people asked “what is BitMEX?”, somewhat like what happened with Bitget, former sponsor of Juventus.

This exchange has always been characterized by a strong professional feel. Not coincidentally, it was born from the minds of people who have worked in finance, thus aware of the needs of those who operate in the markets on a daily basis.

This does not mean, however, that BitMEX is only for experienced traders. In fact, anyone can use it, provided, however, that they know it properly. At this point it’s our turn: let’s explore its features and describe how to use it.

To sign up for BitMEX and benefit from a 10% commission discount for 6 months, use this referral code.

Enough talk: let’s get started!

Index

BitMEX: general overview

BitMEX is a professional cryptocurrency exchange, where quantity gives way to quality of supply.

The company was founded in 2014 by a trio of economists and mathematicians-Arthur Hayes, Ben Delo, and Samuel Reed.

After the first round of funding, 2016 was the year of the real debut, when BitMEX launched its first perpetual on bitcoin. From there on, the story is one of development, refinement, and new products, always with the utmost attention to quality.

For this reason, BitMEX is a bit different than other well-known exchanges such as Binance and Crypto.com. Leaving aside for a moment the difference in volumes, which are undeniably lower, BitMEX is distinguished by a quantitatively restricted offering (especially on the spot market, where there are very few exchange pairs).

This characteristic is due to the very nature of the exchange, which has been oriented from the beginning to give its products a more professional feel, neglecting its ubiquity. Not that other exchanges are not professional, quite the contrary. However, BitMEX has taken a different path, perfect for those who wish to trade a few exchange pairs, focusing on the advanced nature of the tool.

Let us therefore list the features of BitMEX:

- Spot market trading;

- Derivatives (the heart of the platform);

- Convert, to quickly trade cryptocurrencies;

- Options;

- Social trading through Bitmex Guilds.

Let’s analyze the services point by point, finding out how to use them smoothly.

BitMEX buy crypto

Before we begin, we must possess the necessary coins or tokens.

BitMEX is an exchange that does not directly offer the purchase of cryptocurrencies from fiat currencies such as Euro and Dollar. However, this does not mean that the user has to leave the portal and turn to an additional platform: one can buy cryptos directly on BitMEX, but using the third-party service that the exchange relies on.

In the past, the user could choose between Banxa and Mercuryo. Today, however, things are different and BitMEX relies only on a provider called Onramp.

The payment methods offered are varied, but using SEPA bank transfer is strongly recommended. By calling in other methods, such as credit cards, we may in fact find ourselves paying hefty fees. We suggest employing another exchange and then turning the funds over to BitMEX, so as to keep costs down and avoid providing personal data to an outside provider.

BitMEX’s weakness lies here: not offering the trade directly. When the capital is then ready to be invested, the portal shows it knows how to do it by putting the user in a position to trade professionally in the crypto markets.

Of course, what has just been said applies only if the starting point is traditional currency. In case we already have coins such as Bitcoin, Ethereum or USDC, the problem would not arise: since it is a crypto exchange we can convert them between them directly on BitMEX. To do this, we access the Convert tool (under Trade in the menu), select the assets to be traded and confirm. Or we operate from the spot market (we will see this shortly).

On a pleasant note, BitMEX does not charge deposit fees on either Bitcoin or the other cryptocurrencies traded. Withdrawing BTC is also free, while withdrawing Ether, USDT, and other ERC-20 tokens incurs a variable fee depending on network conditions.

BitMEX Spot Market

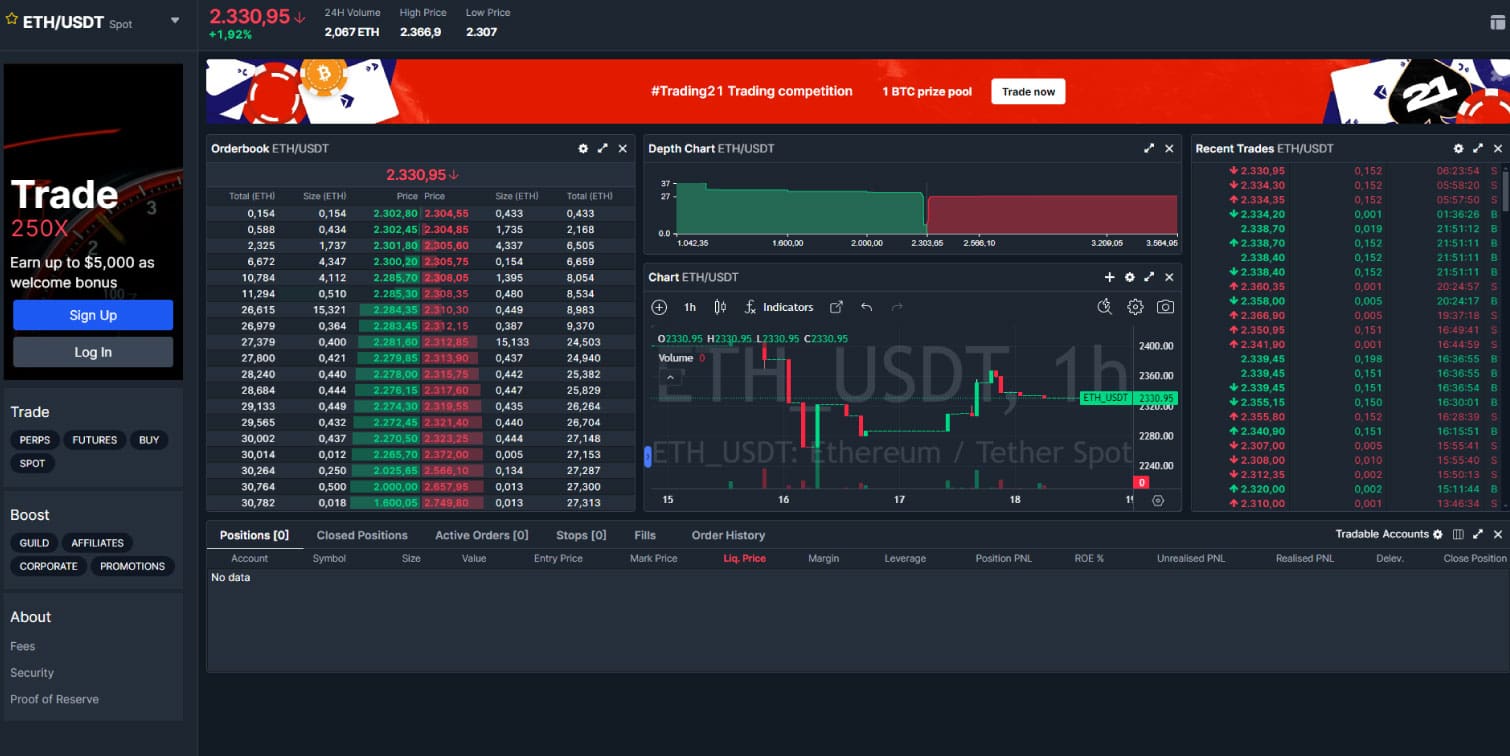

BitMEX’s Spot market does not require complex explanations: we simply buy one cryptocurrency in exchange for another in our possession.

The feature is accessible from the site menu at the top of the portal. Under the Trade heading we will see the words Spot, to be clicked on to find ourselves on the page that follows.

Okay, don’t panic if you are a novice: let’s analyze what we are seeing and remove any doubts.

In the left column, positioned at the top, we find the area from which to select among the various exchange pairs on which to trade in the spot market. By default we will be in XBT/USDT, but we can easily change pairs by opening the convenient drop-down menu; at that point, all the data will update and we will be ready to buy or sell.

In the center, the chart stands out. Packed with data, it is customizable to personal preferences and needs. It can be opened in a separate window, so you can view that of

TradingView, the best platform for technical analysis. If you are not handy with this tool, read our in-depth discussion on TradingView: it will help you a lot!

To the left of the chart is the order book. For those who don’t know what it is, let’s imagine it as a book in which all orders placed by users, whether buy or sell, are noted. This is where supply and demand interact and bring to life the movements that take place on a daily basis. In short, a real place where “goods” are traded all the time.

Above the chart and order book is placed a strip full of relevant information such as the price, its change in the last 24 hours, lows, highs and volumes.

In the right column is placed the tool with which to interact to place buy or sell trades. Just choose the type of order, the limit price, if any, and you’re done.

At the bottom of the page, the history of the operations carried out can be consulted. Not only that, we will also find open orders, value and much more, all in one place.

On the right hand side, on the other hand, we will display the latest trades that have occurred on the relevant exchange pair.

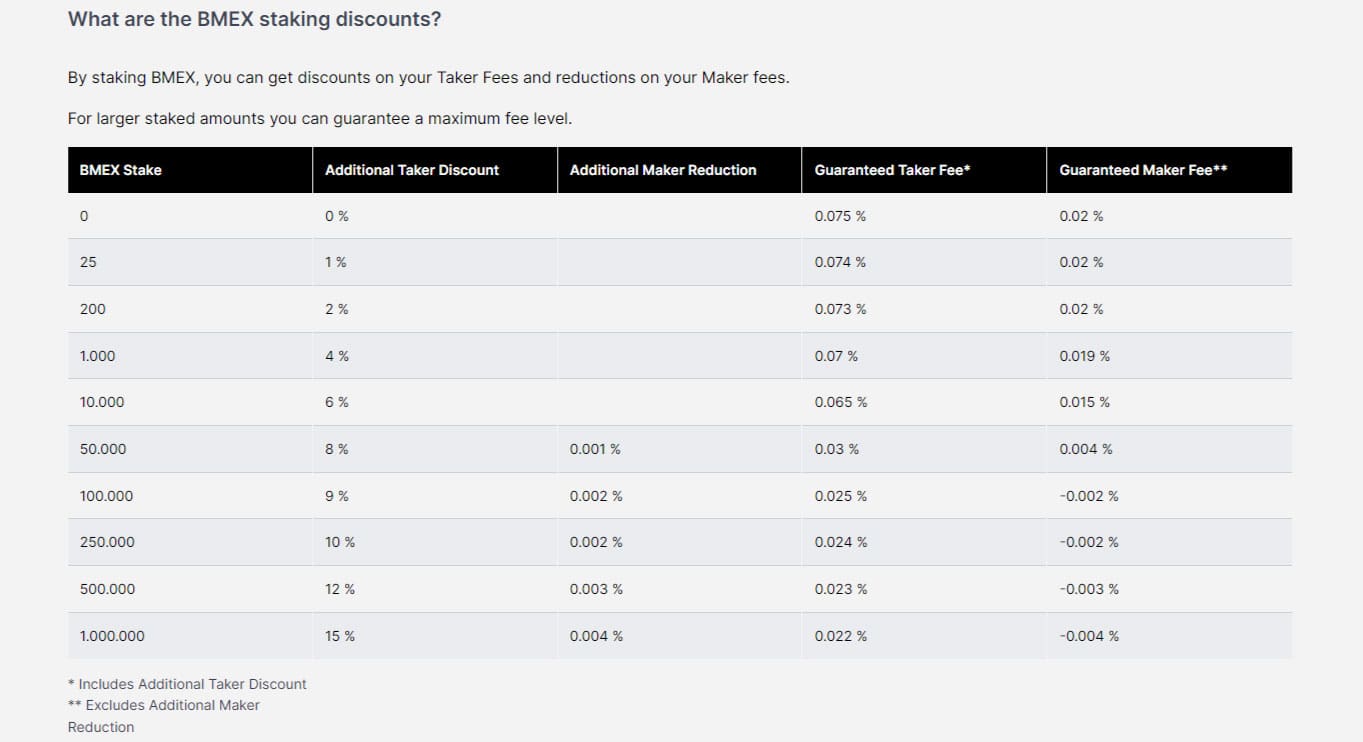

Speaking of costs, good news: they are contained. BitMEX structures fees based on Tiers. Two variables determine the expense:

- The volumes of the last 30 days; simply put, the more money we move, the less we pay in commissions. This data is what actually allocates the Tier.

- The number of BMEX tokens held. This number allows us to reduce the fees of a specific Tier, but without triggering us into the better one.

Tier B is the starting Tier and covers all users who have moved less than $1,000,000. Taker fees are 0.0750% on XBT and USDT; maker fees are 0.020% Taker and -0.0150% Maker.

Going up Tier and combining BMEX tokens, the costs go down quite a bit. Of course, we put ourselves in the shoes of the average user who does not move huge volumes; so we keep the Tier B data in mind.

To cut fees by 10 percent in the first six months, sign up for BitMEX with my referral. Registration is, of course, free and non-binding.

BitMEX crypto derivatives

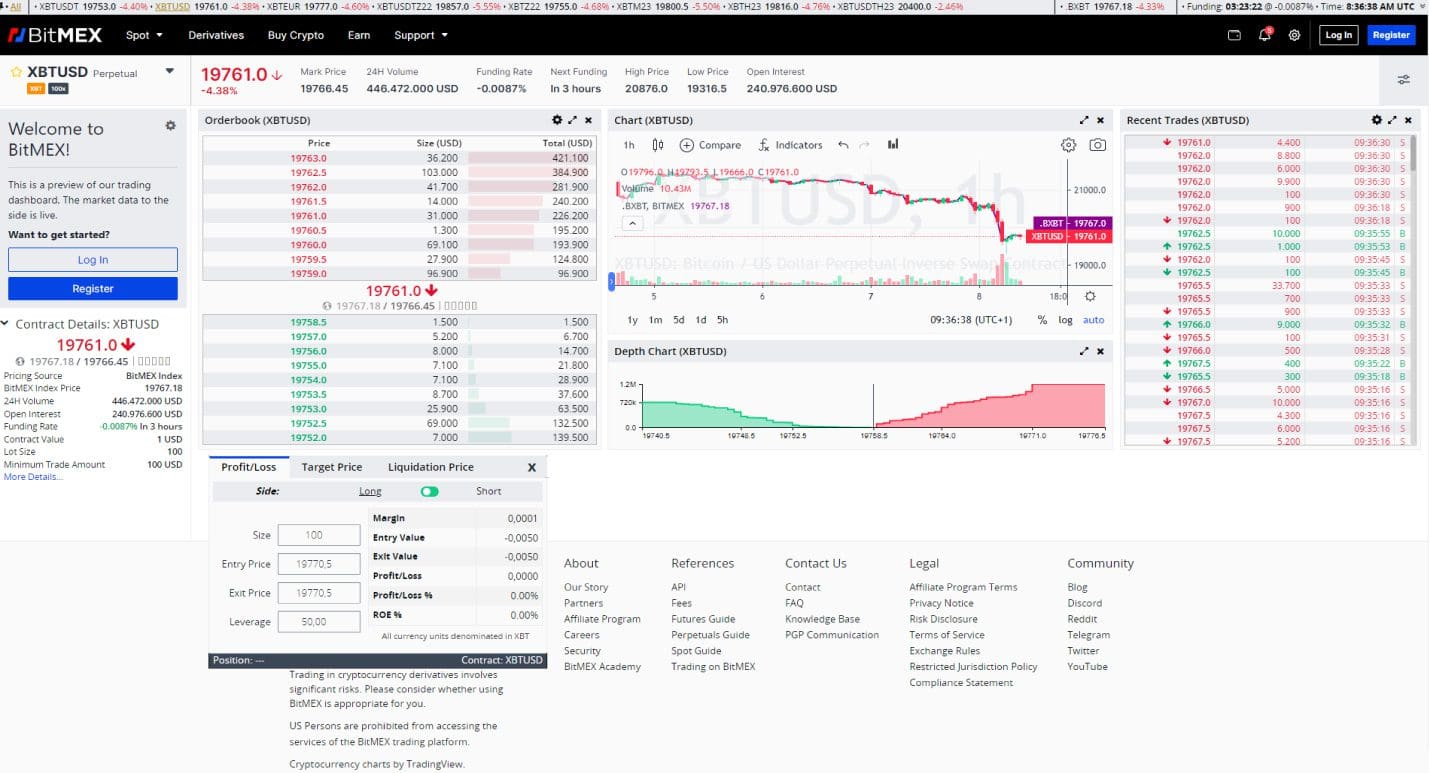

Here we come to the heart of BitMEX: derivative products. This is where the offerings become broader and even the platform itself is transformed, and we may be momentarily bewildered. We will get to that shortly.

Before we explore the derivatives area, let’s see what products are on offer. We find twoetypologies of them:

- Perpetuals: these are derivatives that are almost identical to futures but have no maturity. A perpetual can be held indefinitely and is great for setting up hedging positions, as well as for investing in a cryptocurrency without trading directly in the spot market.

- Futures: unlike perpetuals, futures do have an expiration date. The areas of application are many and depend on the strategies of each investor and trader.

Okay, now we are ready to take a look at the interface, which can be reached from the main menu by clicking first on Trade and then on Derivatives.

As we can see, less attention is given to the chart in favor of the order book. Space is also given to the Depth Chart, which is useful for understanding how supply and demand are behaving, identifying any barrages (called walls) that denote greater strength of a side in a certain price range.

Each box can be easily enlarged by clicking on the appropriate button next to the “X” in each section.

We are also able to move the blocks to our liking, so as to create the perfect configuration for our tastes. The same goes for sizes and other customizations: each section can be modified according to our needs.

In addition, by pressing the customizations button (the icon in the upper right corner, just below the blue Register button) we can remove or add elements.

Also visible in the image is a built-in calculator, suitable for simulating positions before opening.

Trading BitMEX derivatives is simple for those familiar with these products. By doing Log In, the gray box visible in the previous image will give way to this one (note how different this interface looks after customization):

At this point, following our intentions and analysis, we can open and close positions.

To switch from perpetuals to futures or FX, we click on the downward-pointing arrow next to the name of the instrument. In the image it is in the upper left corner, next to the words XBTUSD Perpetual.

Watch out for the leverage, which is available up to 100X and therefore very aggressive. Needless to say, only those who know the context well can use it; otherwise, better to avoid getting hurt.

Let’s see what fee BitMEX has in store for us.

As written by the platform itself, the trading fee structure follows the classic standards. Here, too, there are Tiers and rebates based on the BMEX tokens staked.

The entry Tier is B. Here the Maker Rebate fee is 0.02%, while the Taker fee starts at 0.075%.

What can we say, BitMEX derivatives do not disappoint. We would like to emphasize that these are complex products and not suitable for everyone. Therefore, it is better to spend some time on study and practice before jumping into the fray, so that you do not collect absolutely avoidable losses.

"The derivatives interface is customizable and designed for more experienced traders"

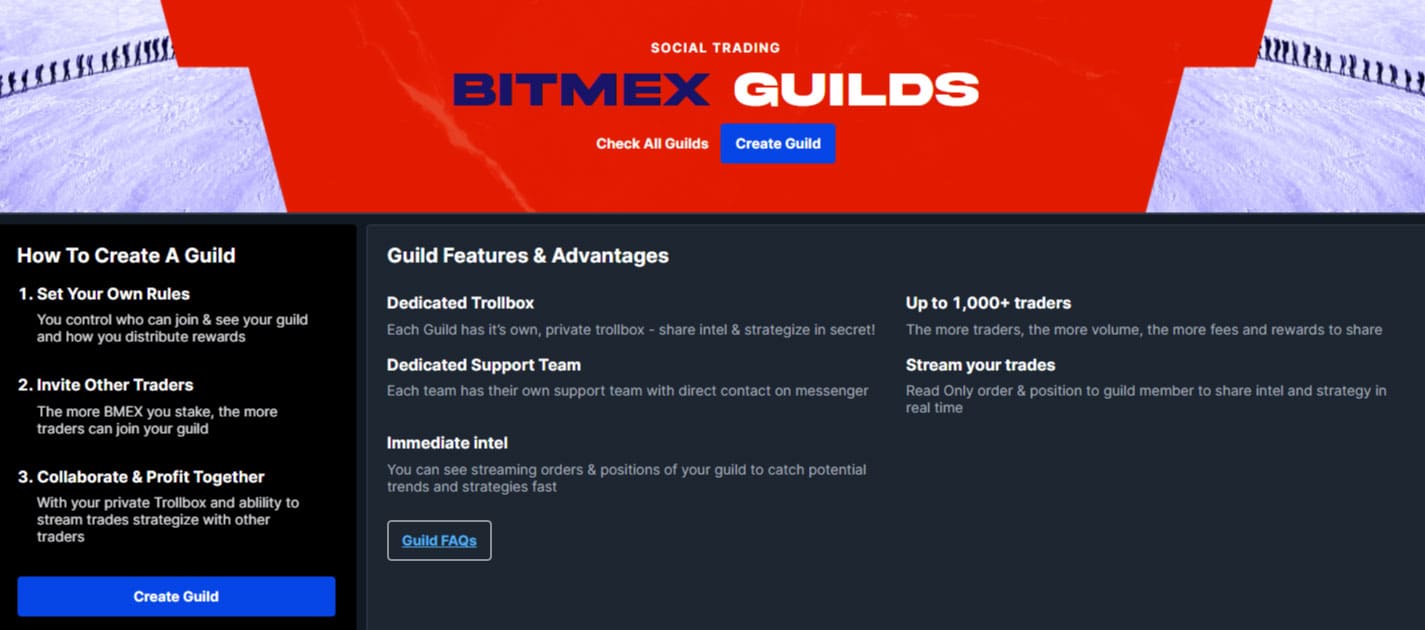

BitMEX Guilds: the social trading feature.

It is time to talk about BitMEX Guilds, the feature that allows social trading directly from the exchange.

This particular form of trading is very much in vogue and allows you to engage with other people and share your ideas. BitMEX has structured an interesting product that also seeks to cater to fans of this niche..

Users can start real guilds with limited numbers (the maximum is based on the BMEX owned by the guild owner), where they can share information and insights through the dedicated Trollbox. The idea is to create a common strategy and, by joining forces, try to achieve the best possible profit.

Social trading thus becomes more interactive thanks in part to weekly competitions, as well as the possibility of obtaining rewards.

BitMEX, a good alternative among exchanges

Those looking for a full-featured exchange may be disappointed. In fact, BitMEX does not offer all the products and services that characterize some giants: no crypto cards with cashback, no launchpool and launchpad, fan tokens, exotic altcoins, NFTs, and you name it.

BitMEX stands out as a good alternative to the usuals especially on derivatives, the house’s flagship product. Other features are not to be disdained, although there are better alternatives in terms of cost and choice.

We recommend BitMEX without hesitation, as long as derivatives trading is one of the necessities. Impossible not to appreciate the interface and quality of this service: it will not disappoint expectations!

Have you already used this exchange? What do you think about it? You can tell us about it on our social channels!