Leggi questo articolo in Italiano

BlackRock mette Coinbase alle strette: Bitcoin on-chain entro 12 ore

By Daniele Corno

Blackrock recommends Coinbase to deposit Bitcoin on-chain within 12 hours. The end of “paper Bitcoins” for ETFs

BlackRock requires Coinbase to impose stricter rules on Bitcoin deposits

BlackRock has required Coinbase to transfer Bitcoin directly on-chain within 12 hours of each newETF share purchase, responding to investor concerns about the possible use of “paper BTC” in its funds.

This update aims to increase transparency by ensuring that spot ETFs are truly backed by physical Bitcoin.

Indeed, Bitcoin spot ETFs are based on the direct holding of the asset, avoiding the risk associated with derivatives or other virtual representations.

Coinbase responds to new guidelines and upgrades custody service

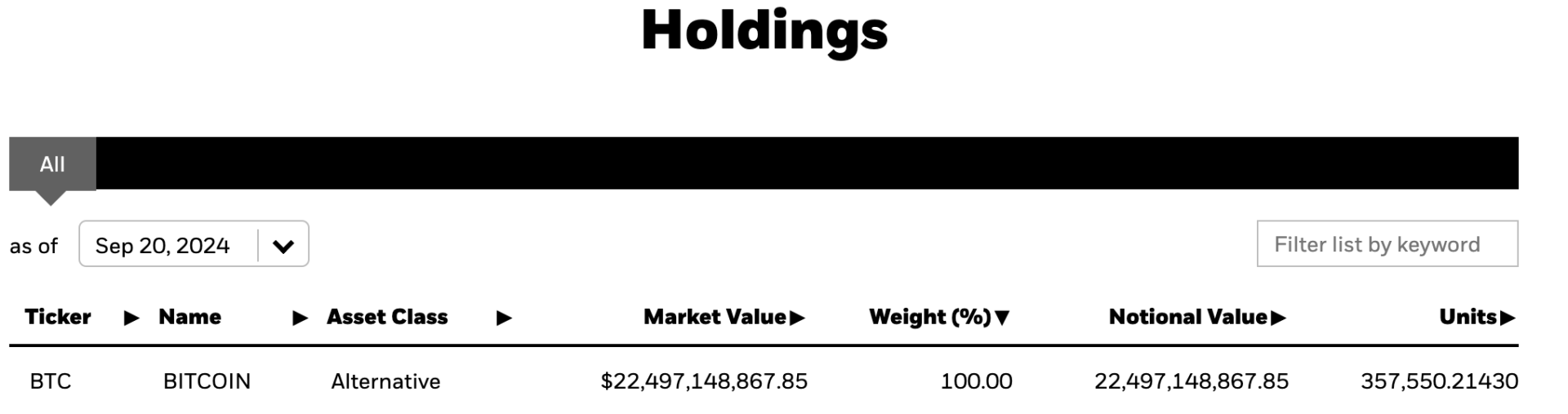

The recent agreement between BlackRock and Coinbase underscores the importance of transparency in the cryptocurrency sector, especially considering that BlackRock’s ETF holds over 357,550 BTC.

This move aims to ensure that the funds are actually backed by real Bitcoin, thus avoiding the risk of selling “paper BTC” to investors.

Bitcoin custody is a prerequisite for the operation of spot ETFs, as it requires the physical holding of the underlying asset. By providing greater clarity on transactions, BlackRock aims to strengthen investor confidence in its ETF, thereby addressing growing concerns about digital asset management.

The impact on the crypto market and the future of ETFs

This new policy from BlackRock represents not only a step toward greater transparency, but also an opportunity to integrate the crypto sector with traditional finance.

By implementing additional measures that ensure thephysical custody of Bitcoin, BlackRock could attract a large pool of liquidity, which is critical to setting new standards in the market.

If other institutions follow suit, we could see growing investor confidence, thereby creating a more robust and regulated ecosystem . This scenario promises greater stability and innovation, paving the way for a future in which cryptocurrencies and traditional finance coexist in synergy.