Introduction to the BNB Smart Chain (BSC)

What is BNB Smart Chain?

On the market since 2020, BNB Smart Chain (formerly Binance Smart Chain) is among the most widely used and well-known networks in our industry.

This creature is part of the broader ecosystem created by Binance, the world’s leading crypto exchange. It complements the BNB Beacon Chain – BNB Chain Governance (formerly Binance Chain) and exceeds its limitations. The end result is a powerful and opportunity-rich environment.

The story of the “Made in Binance” networks began in April 2019 with the launch of the Binance Chain, whose main task was to provide a suitable infrastructure for the smooth operation of the exchange itself. In fact, this blockchain is designed for Binance’s trading activity and optimizes its performance on every front.

Everything seems perfect but it is not: the Binance chain was doing its job perfectly but had shortcomings elsewhere. Since it was developed for a specific purpose, the developers were in fact forced to make sacrifices. Unfortunately, as with a host of other services, blockchain often has to make compromises.

Among the limitations are the non-compatibility with the Ethereum Virtual Machine (EVM) and smart contracts. In addition and more generally, it was mainly flexibility that suffered, to which scalability was also added.

We say it often and repeat it with pleasure: the world of blockchain is vibrant and almost always problems are solved with ingenious and quality technical solutions. In this case, the rule was confirmed; to overcome the limitations of the BNB Chain, Binance decided to launch another network: the Binance Smart Chain (shortened to BSC).

As of February 2022, the two entities changed their names: the Binance Chain became BNB Beacon Chain; the Binance Smart Chain, on the other hand, changed to BNB Smart Chain. The abbreviations remain the same.

In addition to this change, other changes were made to which we will return later. Combined, these two networks form the BNB Chain.

In the next few paragraphs we will find out what the BNB Smart Chain is and how it works.

We will then shift our attention to BNB, the native coin of both networks, which has long been among the top five cryptocurrencies.

In keeping with tradition, we will list its pros and cons so you can use it in an informed manner.

Before concluding, there will be no shortage of an overview of the best-known DeFi platforms.

Let’s waste no more time and find out what the BSC is.

Index

What is the Binance Smart Chain (BSC)?

The BNB Smart Chain (BSC) is the compatible EVM blockchain of the Binance ecosystem. It is not to be considered a layer 2: it is a network that can function independently of the BNB Beacon Chain.

As we said in the previous section, the creation of the BSC was necessary to go beyond the limitations of the BNB Beacon Chain, at the time known as the Binance Chain.

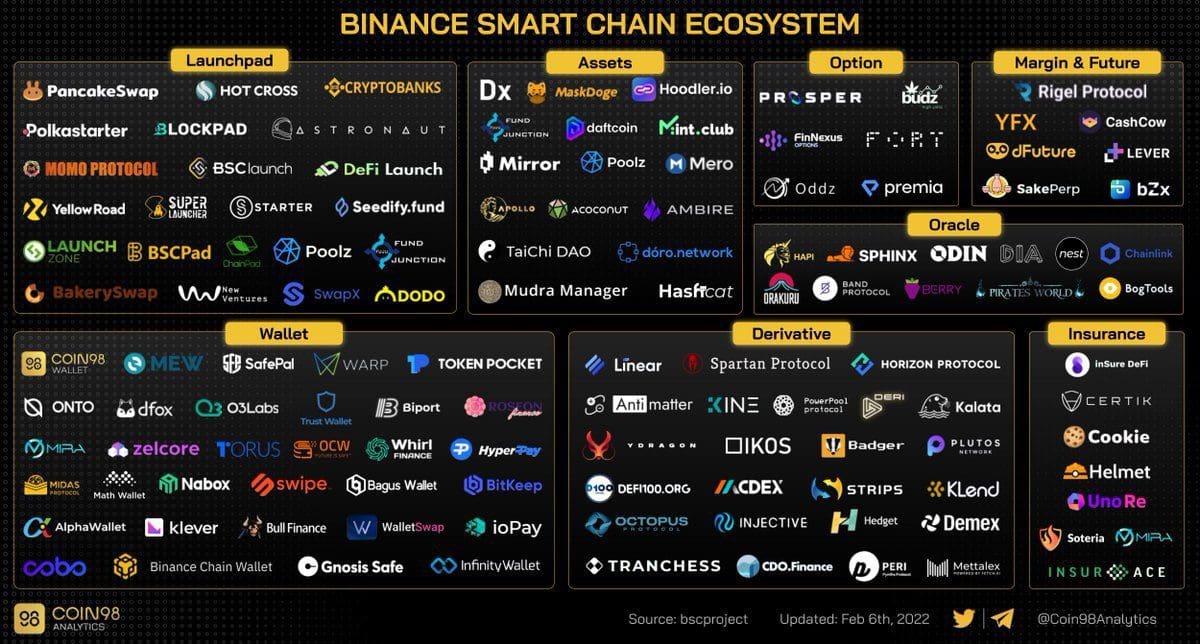

The BNB Smart Chain supports smart contracts and has spawned one of the most vibrant DeFi ecosystems in the entire crypto landscape. Later we will take a quick look at the most popular protocols that still dominate the scene today.

EVM compatibility, mentioned several times, is the gateway for forks of projects already on Ethereum or other blockchains that support its virtual machine. In addition, this feature allows the use of popular wallets such as MetaMask.

This last step is more important than it might seem.

The user does not have to start from the beginning and learn everything from scratch: he or she already knows how to use the wallet, the forked protocols work according to mechanisms identical to the “parent,” and maybe even knows a few bridges.

Thus, compatible EVM chains have a strength in terms of user experience that is not insignificant.

Moving on to performance and technical aspects, the BSC is a very valid blockchain.

The block time is about 3 seconds; therefore, transactions are definitely fast. Let’s also add inexpensive, because very few BNB shards are needed to move cryptocurrencies or interact with smart contracts and DeFi protocols.

The consensus algorithm employed is a declination of Proof-of-Stake, more specifically a Proof-of-Staked-Authority (PoSA). The substance does not change: the BNB coin stake is the principle on which everything else runs.

On validators, there is a system of electing every 200 blocks that aims to encourage rotation. Their number is 41 (March 2022). Of these, only 21 are elected and actually at work.

The BSC is a technically sound blockchain in all respects, but a major problem jumps out here: centralization. There are very few validators; this ensures the excellent performance we see but makes everything more closed, controlled and potentially censurable.

Addressing instead the relationship between this network and the BNB Beacon Chain, they are obviously able to communicate nimbly. After all, there is always Binance behind the scenes.

Therefore, thanks to special technical solutions, users have a way to move coins and tokens from one side to the other without much thought.

Assets on the BNB Beacon Chain are of the BEP-2 type; those on the BNB Smart Chain, on the other hand, are called BEP-20 (a non-random similarity to Ethereum’s ERC-20).

We have mentioned the BNB coin several times but went no further. So let’s look at some background information in order to have a more complete picture.

BNB, the cryptocurrency of BSC

Build aNd Build (formerly known as Binance Coin) is the native cryptocurrency of the entire BNB Chain. It is therefore used on both the Beacon Chain and the Smart Chain.

This coin is also very interesting as a potential asset to invest in, let’s take a look at tokenomics.

The supply is 200 million and there is no mechanism in place to increase the number. On the contrary, thanks to periodic burns, BNB’s circulating supply is reduced over time. Binance’s plan is to destroy about 100 million pieces (50 percent of the supply).

Instead, distribution is broken down as follows:

- 100 million in the market, launched with an ICO back in 2017.

- 20 million intended for investors. Since there has been no vesting, the eventual pressure to sell can be said to have long since ended.

- 80 million reserved for Binance founders and unlocked over four years. As of Q2 of 2019, these funds are burned and no longer pocketed.

Let us now take a look at the use cases.

First, BNB is the currency needed to pay the gas fees of both blockchains that make up the BNB Chain. Since we are talking about Binance and a major DeFi marketplace, demand for this crypto is always brisk.

Then, as with many exchange-linked cryptos, ownership entitles one to discounts/reductions on trading fees. Those who move large amounts of capital and trade frequently will certainly be pleased.

BNB is the asset to hold to join Binance’s launchpads, a service popular with communities and investors.

Shall we stick to the classic? The BNB coin can be staked to contribute to the smooth operation of the infrastructure. In return we will receive an attractive passive income.

But this cryptocurrency is much more: Binance is an evolving exchange that is constantly looking for new services to offer its customers. In this process, the coin almost always plays a leading role.

This crypto has a high intrinsic value and could be a profitable investment going forward.

Be careful, however, because nothing is guaranteed and this is not meant to be financial advice: we cannot have any certainty.

Those interested in learning more should exhaustively study the entire Binance ecosystem and decide whether it is actually worth committing their money. In this sense,fundamental analysis is a must.

Buying BNB is super easy: just create a Binance account, the world’s largest crypto exchange, which is regularly registered with the OAM.

If you don’t have an account yet, our Binance referral will entitle you to a 20% discount on fees forever…take advantage of it!

Want to learn more about this cryptocurrency? Here is an article devoted entirely to BNB Coin.

Pros and Cons of the BNB Smart Chain Network

Let us consider what we know about the BSC and evaluate what is good about it and what should be improved.

Among the PROs, let’s talk about performance right away. This blockchain is fast and stable, hard to be disappointed.

Gas fees are also a reason for happiness: although there are even cheaper networks, with a few cents on the dollar, transactions are approved even on DeFi platforms.

As for security, nothing abnormal to report.

Another plus point is the presence of a player like Binance, a guarantee for the smooth operation and updating of the chain over time.

Adding to these favorable aspects is EVM compatibility and a comprehensive decentralized finance ecosystem. One is unlikely not to find what one is looking for.

Unfortunately, there are also downsides.

The most prominent one is probably the talk about centralization.

OK Binance, OK also security but there are very few validators. On the one hand this ensures good performance, but on the other hand it opens the door wide to control and censorship. In short, not really a good thing.

An additional downside lies in the fact that the BSC is a chain that hosts numerous scam tokens and shitcoins of various kinds.

Let’s be clear: the infrastructure has no responsibility for this. Unfortunately, thanks to detailed tutorials on the web, anyone can create a BEP20 token and publish it on the blockchain. This is also automatically integrated by PancakeSwap. The whole thing requires very few dollars, barely what a breakfast would cost us.

A scammer has an easy time technically: all he needs is some funds to provide decent liquidity for his creation and a good marketing campaign.

The abundance of shitcoin thus throws mud on a technically well-designed and valuable infrastructure.

One final note: what has just been said happens on many other networks as well. To avoid buying tokens with no intrinsic value, one need only inquire. In most cases, by checking supply, deployment and use cases we will already have a sufficient picture to discard the good from the bad.

"Overall, the strengths of the BNB Smart Chain win hands down over the weaknesses"

Best Projects on the BNB Smart Chain

It’s not really an in-depth look at a blockchain without taking a look at the best proposed projects.

Let’s start with a big one: PancakeSwap-who doesn’t know it? This celebrated DeFi platform is a fork of Uniswap, another name in the Olympus of decentralized finance.

PancakeSwap ‘s proposition is huge and geared toward keeping the user within its environment: DEX AMM with Liquidity Pool and Farming, Stake, IFO, NFT Marketplace, Lottery…ask and you’ll probably get it!

Using the BNB Smart Chain it is really unlikely not to happen upon this protocol from time to time.

Let’s change names but stay among the big boys with Venus, Compound’s fork lending portal.

If PancakeSwap is the one-stop shop for buying and selling cryptocurrencies, Venus is the BSC’s most important money market. Investors setting up strategies based on Lending and Borrowing crypto will find what they are looking for.

We have both DEX and money market, what is missing? That’s right, a protocol dedicated to yield optimization.

Alpaca Finance is the largest Yield Farming protocol in the BNB Smart Chain, also available on Fantom network.

Do we want to increase yields on our deposits in liquidity pools, while also avoiding manual compounding? Alpaca Finance is the place to do it.

An innovative alternative to the latter is Tranchess. Interesting is the distinction of products into Rook, Bishop, and Queen, harking back to the chess game pieces.

Depending on the choice we will be exposed to different cryptocurrencies and risks, following different strategies.

Those who were looking for a particularly efficient DEX might take a look at Ellipsis Finance.

Liquidity providers will also have a good proposition among pools of stablecoins or synthetic tokens that follow the same cryptocurrency. Nearly zero impermanent loss risk and good returns.

Finally, we mention Beefy Finance, the Yield Aggregator present on so many blockchains including Polygon, Arbitrum and Optimism.

There is no need for any introduction: excellent earning possibilities for a decidedly small commitment.

This is not the end of the story, indeed: this was just a taste of what decentralized finance offers on the BNB.

The BNB Smart Chain is a perfect network for the emergence of new DeFi projects as well as for forks of existing ones. Credit to EVM compatibility, low gas fees, good performance and the equally good promotional work carried out by Binance.

Let’s avoid getting too gullible and be cautious: DeFi is great but dangers are constantly lurking.

BNB Smart Chain: a project of value

The BNB Smart Chain is a valuable project with a fair amount of experience on its back. Having a giant like Binance behind it is the famous icing on the cake.

Everything is already in this environment and more will be added as time goes on.

New blockchains and ecosystems are springing up all the time, often giving change to those that fail; to date, the BSC is in excellent health and is a safe place to work and invest in.

Of course, care is always needed because the crypto world is still experimental. We trust that the BNB Smart Chain can be confirmed for many years to come.

How do you feel about the BSC? Do you confirm our positive opinion or do you disagree? We look forward to your feedback on our social channels.

We say goodbye with a video dedicated to the real protagonist of all we have just delved into: Binance. Enjoy your viewing!