A reliable crypto debit card

After the now very famous Binance Card (no longer available, at least for now) and Crypto com Card, we discover the Bybit Card, a definitely good product suitable for everyone.

To clarify in case you need it, the term “crypto card” means a debit card that allows you to spend your cryptocurrencies or Euros, getting a reward in return, usually cashback in coin/token.

The great strength of these cards is that they are fee and cost-free: they are ordered for free and have no annual fees.

But back to the subject of the day, Bybit’s card, which, unlike some competitors, does not require staking any assets to apply for it. This is no small advantage.

Let’s go on to analyze the Bybit Card in more detail, finding out what it can offer us in everyday life.

Index

Bybit card: what it is and how it works

The Bybit card relies on the MasterCard circuit , one of the most popular worldwide. Therefore, there is no risk that it will not be accepted: if the merchant has the “digital payment” option, they will almost certainly accept the card.

The Bybit card is a debit card. This means that you need to pre-load balance on the Bybit exchange, and then you can spend it. In contrast, it is not possible to make charges without a balance available to pay later, as is the case with credit cards.

Spends made will draw funds from the wallet defined as the “Funding Wallet” (i.e., the exchange’s default wallet). They will be made either through FIAT currencies (euros for us Europeans) or through certain cryptos. Specifically, one can spend bitcoin, Ether, XRP, USDT and USDC.

The card is available in both a virtual guise (immediately dispensed upon application), which can be used for any online purchase, and a physical guise , dispatched immediately after activation, which can also be used at POS.

The Bybit card is also compatible with Apple Pay and Google Pay.

How to get Bybit card?

First we need to create a Bybit account.

Once the account is up and running, we will have to go through the level 2 KYC procedure. As we know, this will involve providing some of our personal information, a copy of an ID and proof of residence. This step is essential in order to proceed and is required by current regulations.

At this point we will be in full compliance. We will then have to enter the Card section of the exchange portal and apply for it. Issuance is instantaneous for the virtual card, while for the physical one (it costs €5 one-time) we will have to wait for shipping and delivery times.

Bybit card cashback and rewards

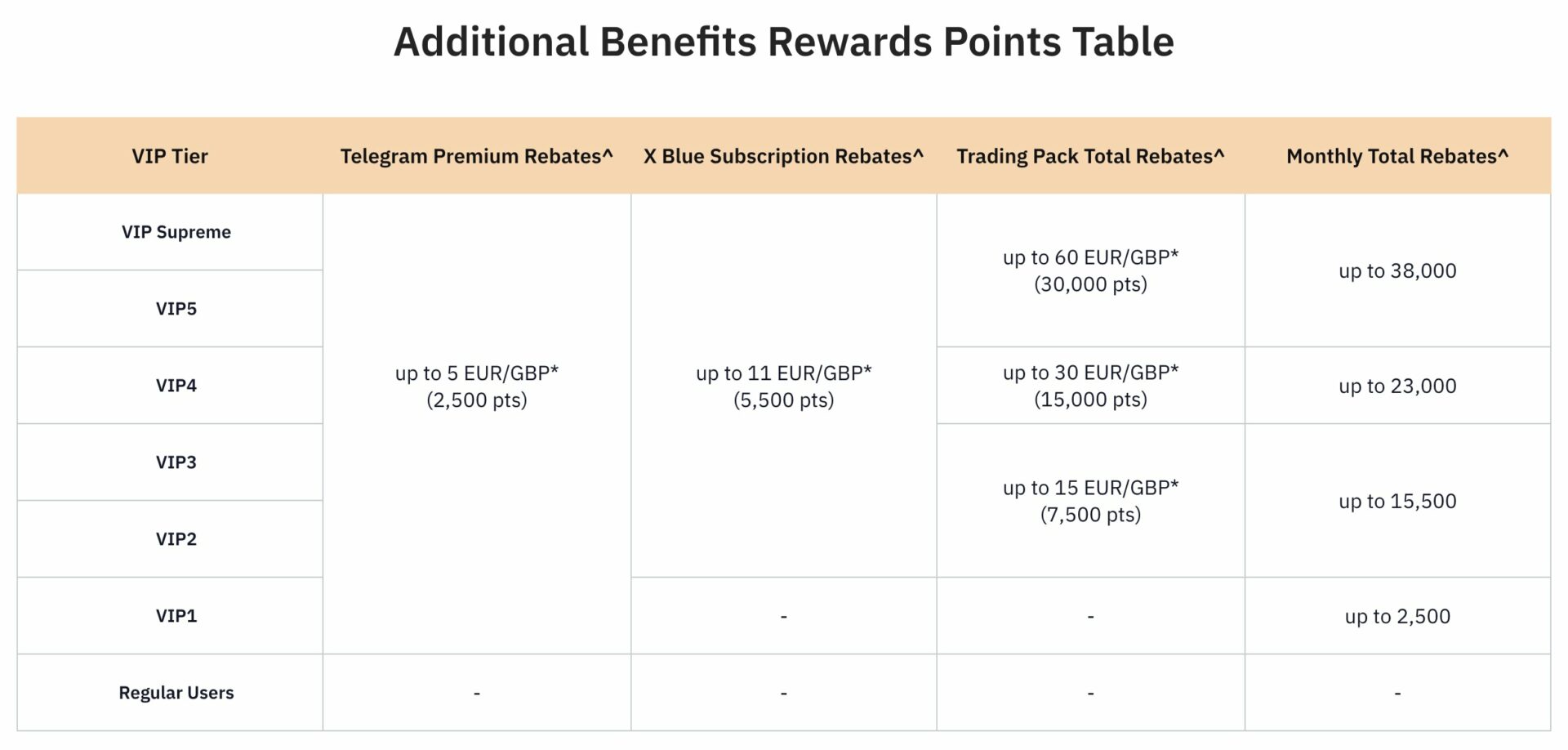

Of course, there is a rewards program active from April 2024.

The offers are exclusive and agreed upon with certain partners, but there are also (and especially) loyalty points, exchangeable for discounts or crypto as if it were cashback in its own right.

All without the need for staking any tokens:

Card fees and limits

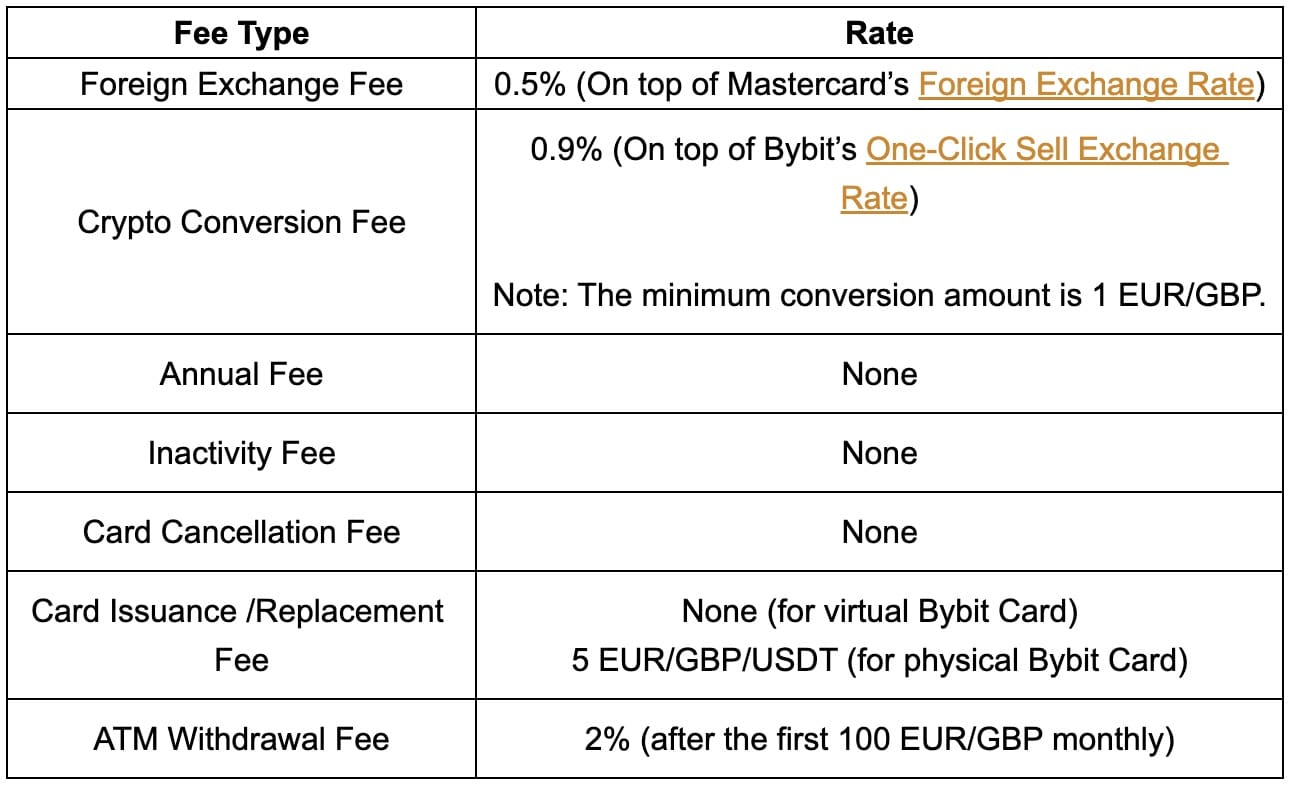

The fees are in line with the competition: zero on transactions executed in fiat (i.e., spending EUR directly), while we have a 0.9% fee on crypto/euro conversions made at the time of spending. This is because cryptocurrencies are converted in real time to fiat currency at the time of purchase.

Even on conversions between currencies (example: we pay in USD because we are in the US but have the card loaded with EUR) there is a fee, specifically 0.5%.

Everything else (card order, cancellation, virtual renewal) is free.