What is Chainlink used for?

Chainlink (LINK) is a decentralized network of oracles, which is really useful for taking full advantage of the potential of blockchain.

Over the past few years, our industry has been experiencing a huge growth phase. In fact, this technology is increasingly being adopted by large companies, small businesses and even institutions and states.

The applications are almost endless, but the goal remains the same: to optimize the timing, security and efficiency of a given process.

As an investor, blockchain is critical but more attention is paid to the assets that flow through it. In contrast, an economic actor employs the infrastructure in a more comprehensive and customized way.

In all of this, regardless of the type of user, smart contracts represent the beating heart of this world. Indeed, an investor makes extensive use of them in the DeFi world; at the same time, a company can employ them to achieve a wide variety of goals.

The main feature of smart contracts is that they allow the removal of all intermediation. By doing so, we have total control over our actions without having to depend on an outside figure.

In addition, it is possible to schedule contracts tailored perfectly to our needs-there really is no limit:

- Do we want to automatically turn over a certain amount to someone, meeting certain timelines? It can be done;

- Do we want to manage departure and arrival times at an airport? No problem;

- Do we need to check the availability of a spare part at a depot, paying for it instantly if it is there? This, too, is feasible.

A problem arises, however: how to obtain information that is present in real life? In the examples just given, the last two points require a bridge between the blockchain and our surroundings.

Again, think about data regarding lottery draws: somehow it will have to get to the contract.

We are therefore faced with a major criticality. In fact, there is more: blockchains are numerous, so the solution has to be able to interact with different realities, not just Ethereum or Solana.

Well, as is almost always the case, our industry comes up with ingenious and innovative remedies…it’s really hard to put it on the back burner!

Chainlink is the bridge that connects blockchain and the real world, ensuring that smart contracts can be leveraged to their full potential.

Okay, no spoilers, let’s postpone everything to the next paragraphs!

Index

What is an oracle network?

Before delving into the discussion regarding Chainlink, it is crucial to understand what an oracle network is.

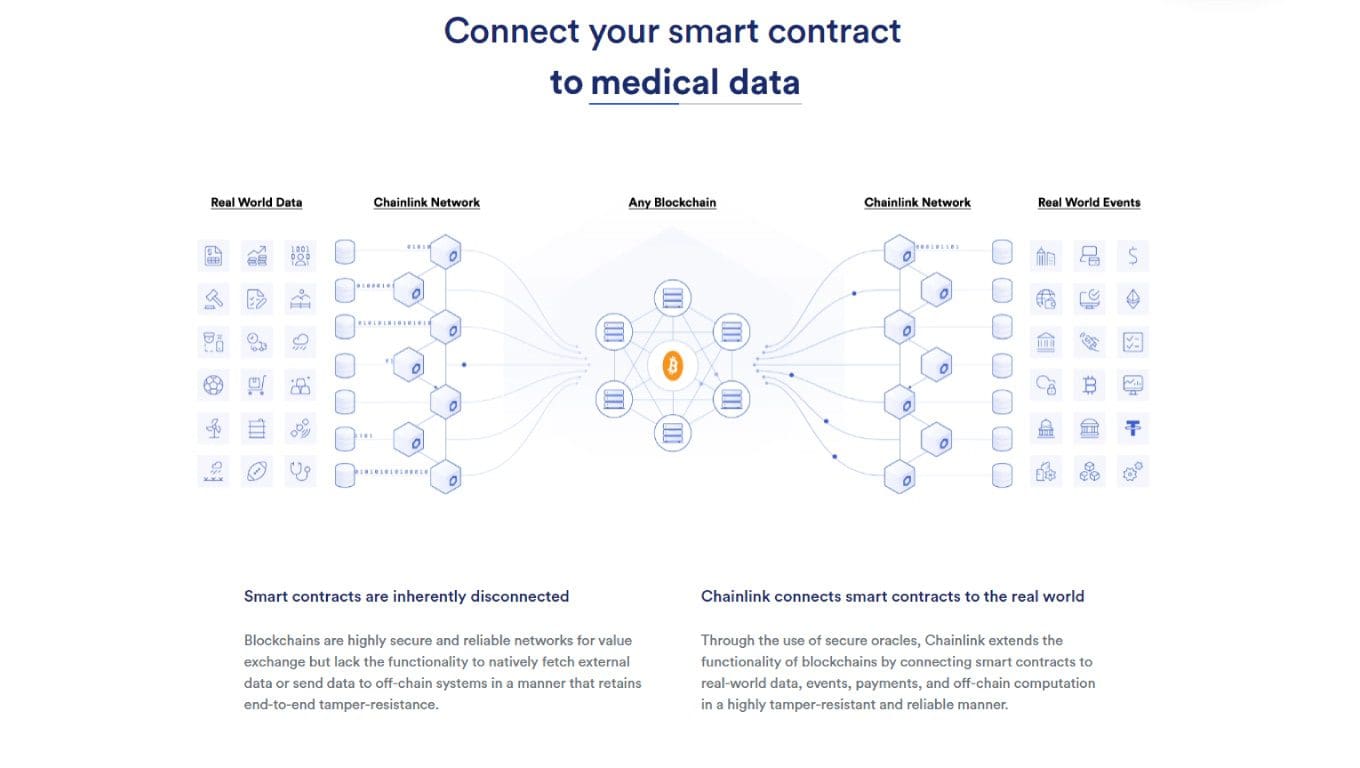

In short, it is a structure that can connect what is off-chain with the blockchain itself and smart contracts.

The concept is quite simple: the contract can be developed to handle any kind of information. However, the latter has to come from somewhere; it is not assimilated automatically. Think of the computer: we can send e-mails and share articles about cryptocurrencies, however, these have been created and uploaded by someone.

A network of oracles deals precisely with providing data and acting as a bridge between digital and real; in our case, between smart contract and real, just so we don’t get confused.

Not only that, the network also follows all the steps of checking and verifying data and sources.

Taking another example, the service will not just take the results of the last Formula 1 GP and move them to the smart contract. It will in fact cross-reference information obtained from various sources, authenticating the real ones and discarding inaccuracies.

An oracle network employs various IT solutions to accomplish its task, among which APIs stand out. In short, a lot of development work by experienced programmers is behind it.

Now that we have a clearer idea, let’s move on to the subject of our in-depth study: Chainlink (LINK).

How does Chainlink work?

As anticipated and now intuitable, Chainlink is a decentralized oracle network developed on the Ethereum blockchain. The key objective is to move data from the real world to smart contracts (from off-chain to on-chain and vice versa).

Be careful, however, that’s not all: in addition to transferring information, Chainlink also provides for verifying and authenticating it, as well as ensuring that it cannot be tampered with once it is published on the blockchain.

The data involved can be of a variety of types; there are no limitations other than those of each specific smart contract. Therefore, from sports results to checking the availability of funds, anything is potentially possible.

As pointed out in the introduction, Chainlink solves the problem arising from the lack of a bridge between the off-chain and on-chain worlds. We had also emphasized the need to communicate with different networks.

The proposed solution does exactly that and interacts with multiple blockchains simultaneously. This means that whatever the data is, it will arrive on all the smart contracts we are interested in at the same time, taking a lot of thought off our minds.

Let’s try to think of a weather application that leverages Ethereum (ETH) and Solana (SOL). Lo and behold, thanks to Chainlink, updates from weather stations will be routed to the different smart contracts effortlessly, totally automatically.

Chainlink has a variety of providers from which it buys data to then publish on the blockchain. That’s right: the service not only transfers and verifies it but also procures it!

The information is reliable because it is authenticated. Moreover, the providers who procure it are incentivized to make sure that it is real and of quality, on pain of removal from the network and consequent financial damage.

The amount of information available is really large, in the order of thousands and thousands of data concerning multiple realities.

How does Chainlink work?

Let’s ignore the image momentarily: we will come back to it in a few lines.

Chainlink is a project launched in June 2017 at the hands of Sergey Nazarov and Steve Ellis, founders of the company Smartcontract.com, which has now become Chainlink Labs.

A true pioneer in the industry, Chainlink has gained an important reputation over time. In fact, several prominent companies and entities leverage its solutions to solve a variety of problems.

Technically, this network is definitely complex. However, the basic operation can be broken down into a few steps, making it easier to describe…let’s see it now!

It all starts with a developer/team/project that needs to get certain data on a smart contract, perhaps updated on a regular basis.

Chainlink analyzes the needs of this entity and cross-references them with the available oracles, selecting those that are appropriate for the case. For example, if the smart contract were to receive the results of Spanish league soccer matches, Chainlink will match providers that deal with this very field.

Then, the developer (or team, or CEO, etc.) will be required to deposit Chainlink tokens (LINKs) into the contract they are going to enter into. This amount will be used to repay the oracles, of course if the information is of quality and in line with what has been established.

To ensure that everything goes according to plan, users must use the Service Level Agreement (SLA). This is software in which to indicate what is needed, so that there is no misunderstanding.

In the second stage, the designated oracles can roll up their sleeves. Here, information is researched and entered into the network. Next, Chainlink aggregates the data, cross-references it, verifies and eliminates inaccuracies.

Finally, the package of information moves to the client’s blockchain.

Thanks to the process described above, what is received will be accurate and reliable, avoiding loss of time due to further verification.

At this point, the flow can continue indefinitely. This solution is perfect for realities that need continuous updates, such as a portal that transmits the prices of major cryptocurrencies or the stock market.

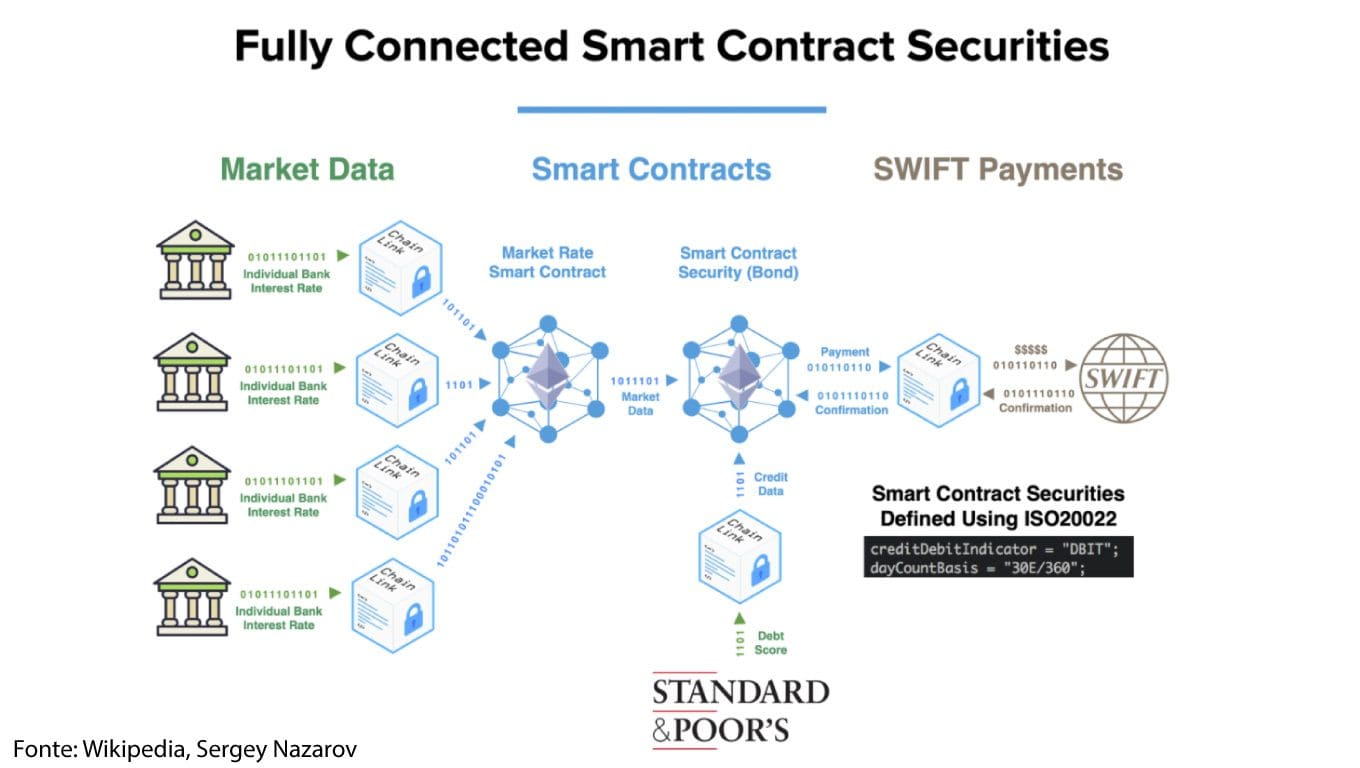

Now the image placed a few lines above should be clearer. It shows a Smart Bond structure.

We pay attention to the bridging role played by Chainlink in the interaction between market data (interest rates of each individual bank) and SWIFT circuit, also integrating the rating coming from Standard & Poor’s. A complex architecture but definitely lightweight, cheaper and more secure than non-blockchain solutions.

On Chainlink’s official page, chain.link, there are other interesting use cases and every related to Chainlink news.

Chainlink is thus a network that satisfies very diverse requests and further enhances the possibilities offered by blockchain.

One question remains: how can the ordinary user enter this world without having to develop an ad hoc application? Very simple: just invest in the Chainlink token (LINK). Let us therefore get acquainted with it!

Chainlink LINK price and tokenomics

Chainlink (LINK) is the token of the network and now you may be wondering: is Chainlink a good investment? Let’s find out by analyzing its tokenomics

The supply is 1 billion Chainlink coins, of which nearly 600 million are currently in circulation.

The allocation follows these percentages:

- 30% to the project team (constantly engaged in the work of improving and maintaining it);

- 35% directed to sale to the public;

- 35% allocated to oracles and guarantors of network security.

In the September 2017 ICO, the token was sold at 11 cents. Today it trades at around $20…lucky early investors!

The current market cap is around US$8 billion. This value touched 22.5 during the all-time high that occurred in May 2021 (link coin price over $52).

LINK is an ERC-677 token, effectively an extension of Ethereum‘s famous ERC-20.

Its main use case is to pay oracles for their service.

In addition, LINK is deposited by users within the SLA, the agreement we mentioned in the previous paragraph.

Holding LINK does not require any particular wallet as it is absolutely compatible with all those that support ERC-20 tokens. Therefore, Metamask and Trust Wallet can be safely employed.

Regarding the investment in Chainlink, it may be a good choice.

After all, it is a good network designed to solve a specific and real problem.

In addition, it can be expected that in the future its proposed solutions will be increasingly in demand: if blockchain integration were to continue, bridges between off-chain and on-chain worlds would certainly be needed.

Moreover, 2022 should finally give Chainlink (LINK) holders the opportunity to stake it, which has not been possible so far. This will allow a steady return to be generated over time, and the asset will gain further intrinsic value.

However, ours is not financial advice, and this token may not be suitable for all investment strategies. Just take a look at the graph: the trend is definitely choppy.

To remove any doubt, a good fundamental analysis is what is needed.

How much does a LINK cost? Where can i monitor the Chainlink price fluctuations?

Here is the real-time trend of LINK/USD (chart from Coinbase on TradingView platform):

Where can I buy Chainlink?

The LINK coin is available on virtually all large centralized exchanges such as Bybit, Binance and Crypto.com.

You can also buy and sell through DEXs, where it is quite widespread. A few useful names: Uniswap, PancakeSwap, and Sushi.

Chainlink: bigger than it looks?

A question should arise after what has been written: could Chainlink be a future industry leader?

Blockchain is increasingly being integrated by companies, businesses, and states. Playing the role of glue between on-chain and off-chain, while also providing reliable and automated information, well, it really puts one in a prominent position.

Effectively Chainlink could become something bigger than what it is today. Of course, the competition will not sit idly by and even more ingenious and modern alternatives may come alive. However, today the scepter goes to this network.

In a very chaotic landscape, full of projects “stepping on each other’s toes” and elbowing each other out of the way, Chainlink proposes a solution that is original, useful and, above all, already tried and tested and working.

As ordinary users, it is quite likely to have come into contact with a service of this network without even noticing it.

In conclusion, Chainlink does well what it sets out to do. Should the future continue on this path, we will hear a lot about it.