Coinbase: introduction to an exchange giant

Coinbase is one of the world’s largest exchanges.

Its headquarters were located in Wilmington, Delaware, USA. Following the pandemic, Coinbase decided to become a company that operates 100% remotely.

The company was founded in 2012 by Brian Armstrong, a former engineer at the well-known holiday accommodation platform Airbnb.

Coinbase is the first ever exchange to go public. This leads it to be very stable and regulated, which is a key point to guarantee more security for customers.

The Coinbase exchange is certainly an excellent choice for anyone who needs to buy and sell cryptocurrencies. Furthermore, services such as Coinbase Pro, the Coinbase app and the wallet enhance the offer even further.

The downside is the higher commissions when compared to those of some larger competitors. However, the extra expense can be justified precisely in the higher security standards. In short, one spends but sleeps more soundly.

In this in-depth study, we will look at this company in detail. We will start with the basics, discovering how to register with Coinbase. We will then review the deposit and withdrawal methods. After that, we will see how to use the platform and reveal the Coinbase fees. Finally, space will be given to Coinbase Pro and Coinbase Wallet.

We have so much to say; let’s not dwell any longer and get started!

Index

- What is an exchange?

- How to register on Coinbase

- How do I use Coinbase? Overview

- How do I deposit at Coinbase?

- How to withdraw from Coinbase?

- Crypto deposits and withdrawals at Coinbase

- Which cryptocurrencies you can buy on Coinbase?

- Coinbase's fees

- What is the difference between Coinbase and Coinbase Pro?

- Coinbase Earn

- What is Coinbase Wallet?

- Is Coinbase safe?

- Coinbase support

- Coinbase opinions and conclusions

What is an exchange?

A cryptocurrency exchange is a virtual exchange where people can buy and sell cryptocurrencies.

In return for the service, the exchange charges a commission on each sale or purchase transaction.

The acronym CEX stands for Centralised Exchange. We therefore refer to all centralised, real companies that compete with each other. Be careful not to confuse this type of exchange with DEX, the decentralised ones typical of DeFi.

If you want to learn more about this topic, our article on exchanges is for you.

Having said that, let’s get down to business and find out how to register with Coinbase and how to do the Coinbase login.

"An exchange is nothing more than a place where people can buy and sell cryptocurrencies"

How to register on Coinbase

Creating a Coinbase account is not complex and takes only a matter of minutes.

From the main page of the site www.coinbase.com, all we need to do is click on the Sign up button in the top right-hand corner. A screen will appear where we need to enter our first name, surname, email address and a password.

Continuing on, the next step will be dedicated to KYC, i.e. the customer recognition procedure. This step is compulsory and stems from what the law requires.

After that, within a few hours but hardly more than a day’s wait, the account will be active and ready for use. At this point you can Coinbase login directly from the homepage of the site by clicking on the Sign in button.

What does it take to register with Coinbase? As with many other exchanges, in order to create a Coinbase account, you will need to provide your first and last name, your place of residence, a copy of your ID and your social security number.

How do I use Coinbase? Overview

Coinbase is designed to make the world of cryptocurrencies accessible to everyone. As a result, the standard platform is intuitive and easy to use, even for the neophyte.

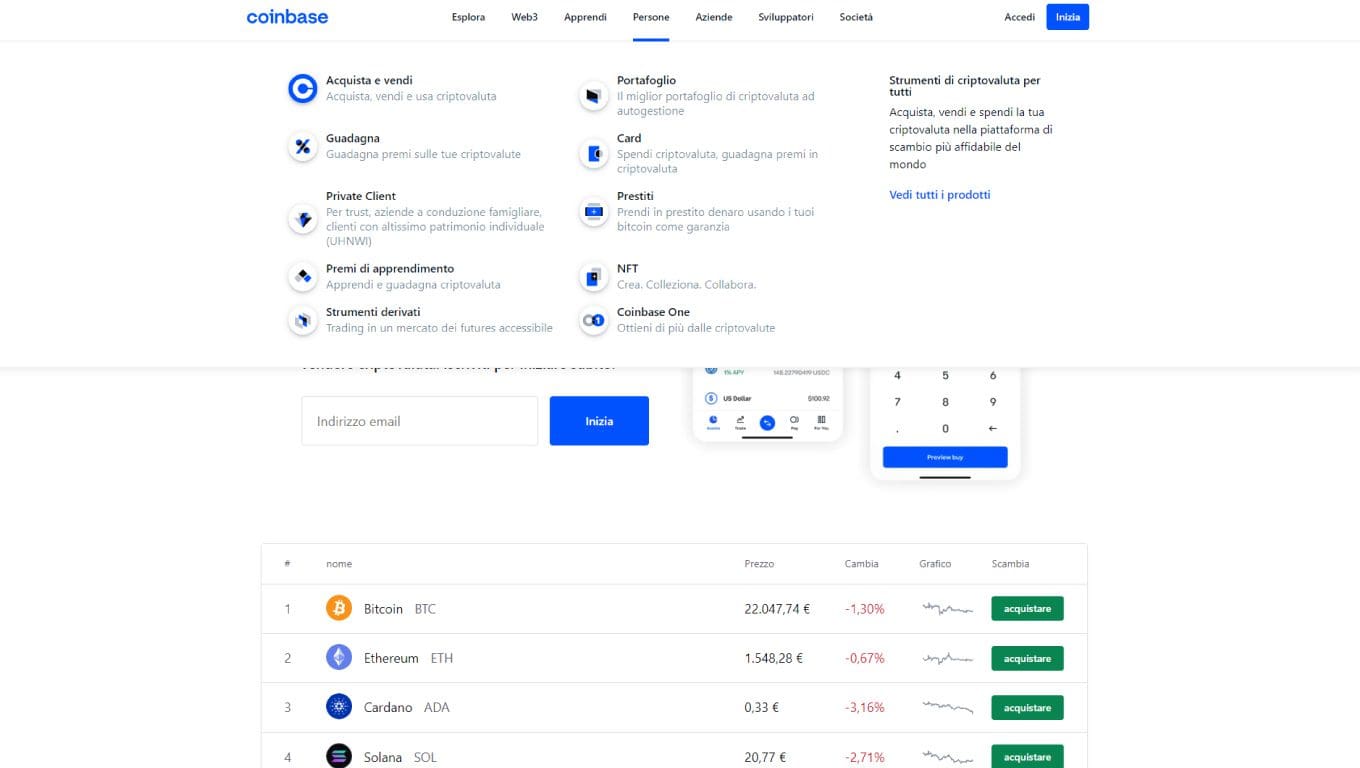

From the site menu at the top, place the mouse cursor over the word Individuals to open the drop-down menu that will show the services available to us. Here is the list and a brief description of each (items may vary by country):

- Buy and sell: section from which to buy and sell coins and tokens. Coinbase’s offer is extensive, we will not be disappointed.

- Earn: here we can earn a passive income on our deposits. We will talk about this in a later section.

- Private Client: a service dedicated to private individuals with significant capital, to whom Coinbase offers advanced tools and a dedicated team.

- Learning rewards: a learning platform that earns us small amounts in cryptocurrency upon completion of various courses. A short test must be passed in order to receive the reward.

- Derivatives: those with the right skills can take advantage of the futures area of Coinbase. These are risky and complex products, not suitable for the neophyte.

- Wallet: none other than Coinbase Wallet, the company’s non-custodial crypto wallet. We will return to this later in the article.

- Card: Coinbase Card is the prepaid Visa card that allows us to spend cryptocurrency on our purchases. It can be requested from this page and is linked to our Coinbase balance. Contactless and accepted wherever Visa is available, the card is issued free of charge.

- Loans: using BTC as collateral, we can apply for a cash loan. Service reserved for residents of certain US states.

- NFT: more than a marketplace, Coinbase NFT is an interface from which we can buy and sell Non-Fungible Tokens by relying on external platforms such as OpenSea. It is currently a beta version, therefore experimental and also subject to imperfections and problems.

We have registered and have an overview of the services designed for the retail customer. All that remains is for us to find out how to deposit and withdraw from Coinbase.

How do I deposit at Coinbase?

How do I deposit Euro on Coinbase? It’s a very simple procedure that we’ll go through straight away.

After you have created an account, you will need to click on the Add cash button in My Resources. You will then need to indicate one or more payment methods, including:

- Credit and debit cards, which is not recommended as it involves an additional fee. Keep it only in case of urgency.

- PayPal, available for withdrawal only.

- Bank account, a method we suggest.

Now that this formality is over, how do I make a deposit at Coinbase? Actually, by now the most is done. Again from My Resources, click on Add cash. Select the desired method and proceed.

If we opt for a card, we follow the steps that will lead to a direct deposit.

If, on the other hand, we would like to use the bank transfer, the platform will present us with a window containing all the necessary information for ordering the payment. Please remember to indicate the reference number in the reason for the payment; without this, Coinbase would not know to which account the transfer is associated, which would require our intervention and lengthen the waiting time.

How much does it cost to deposit on Coinbase? As we said, this depends on the method you choose. Depositing via bank transfer costs €0.15; cards, on the other hand, incur an additional 3% commission on purchases and sales. Always check the figures before investing-they may vary over time and by country.

"Credit, debit and bank account cards: here are the deposit methods supported by Coinbase"

How to withdraw from Coinbase?

After seeing the deposit, it’s only right to answer the question “How do I withdraw money from Coinbase?”.

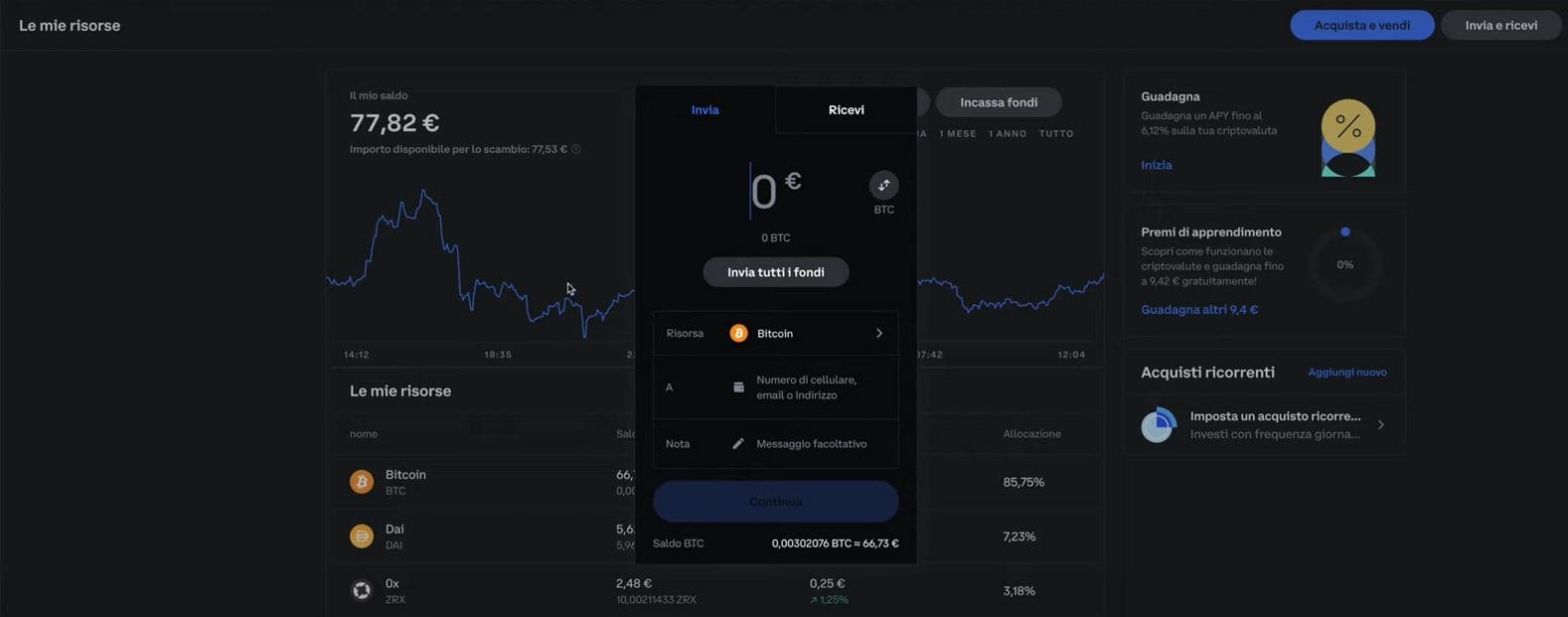

Great news: If you have already set up a payment method, everything is easier. Simply click on Cash out from the My Assets page and choose the method and amount. That’s it!

How much does it cost to withdraw from Coinbase? The amount varies depending on the type of transaction. For example, a transfer involves a negligible fee of €0.15. Before proceeding, however, the fee is indicated, so that you can make an informed decision.

"Cards, transfer and PayPal: here are the fiat withdrawal methods proposed by Coinbase"

Crypto deposits and withdrawals at Coinbase

Quick aside on cryptocurrency deposits and withdrawals.

Always operating from the My Resources page and clicking on the Send and Receive button, we can move coins and tokens quickly and without difficulty.

Be careful if we want to move an asset that supports multiple networks. For example, if we wish to receive ETH via the Ethereum blockchain, we select the correct network and avoid alternatives such as Polygon. The same applies to sending.

Which cryptocurrencies you can buy on Coinbase?

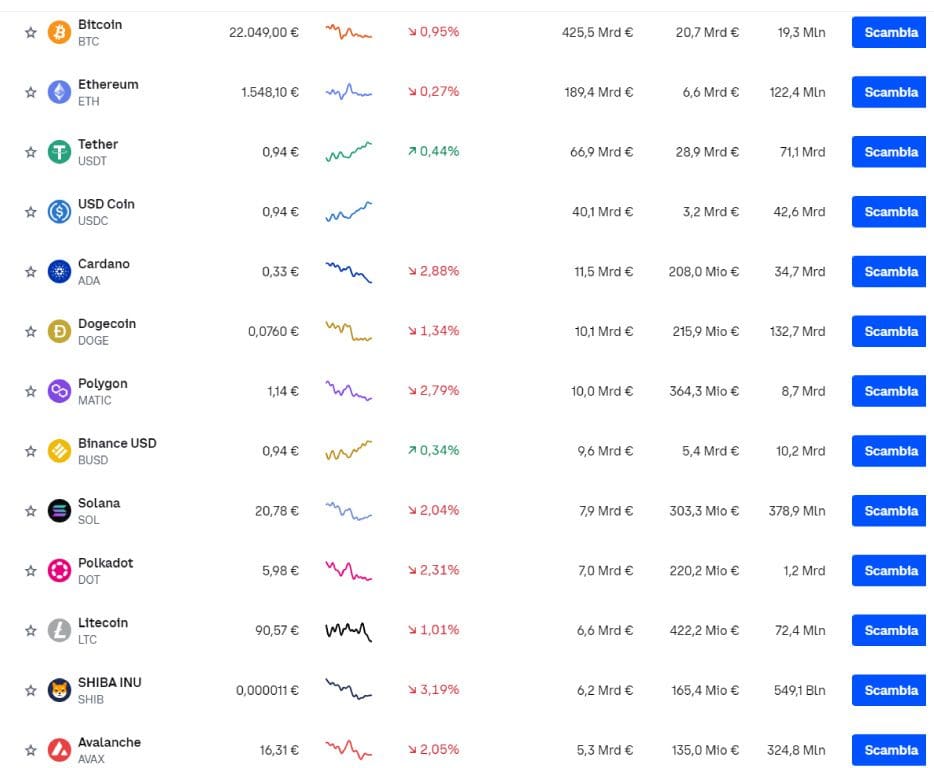

When it comes to available cryptocurrencies, you are spoilt for choice on Coinbase. From the most capitalised coins like bitcoin and Ethereum to the more exotic tokens, this portal will please almost everyone.

There is no shortage of major stablecoins such as Tether, USD Coin, Binance USD and MakerDAO’s DAI.

The most popular memecoins are also present, among which we mention Dogecoin and the ‘rival’ Shiba Inu.

OK, the choice is great, but what about the fees? How much does it cost to trade cryptocurrencies through Coinbase? It is really time to talk about the Achilles’ heel of this exchange: the fees.

Coinbase's fees

Figures reported may change over time: always refer to official documentation before investing.

Here we come to the bad part, namely Coinbase’s fees, which are notoriously high compared to many competitors.

To date, the standard version involves variable fees depending on the amount traded. Official documentation is sketchy on the subject, so here are the scales from tests we have carried out:

- If the amount exchanged is less than €10: €0.99 fee.

- Between 10 and 25€: 1.49€.

- Between 26 and 50€: 1.99€.

- Between €51 and €200: €2.99.

- Above 200€: 1.49% of the amount exchanged.

Attention: to these amounts we always have to add a bit of spread.

Figures in hand, Coinbase is not cheap compared to other exchanges. Unfortunately, the high security standards and compliance come at a price.

However, there is a way to save money: use the Coinbase Pro version. Let’s explore it and see what the differences are with the standard one.

What is the difference between Coinbase and Coinbase Pro?

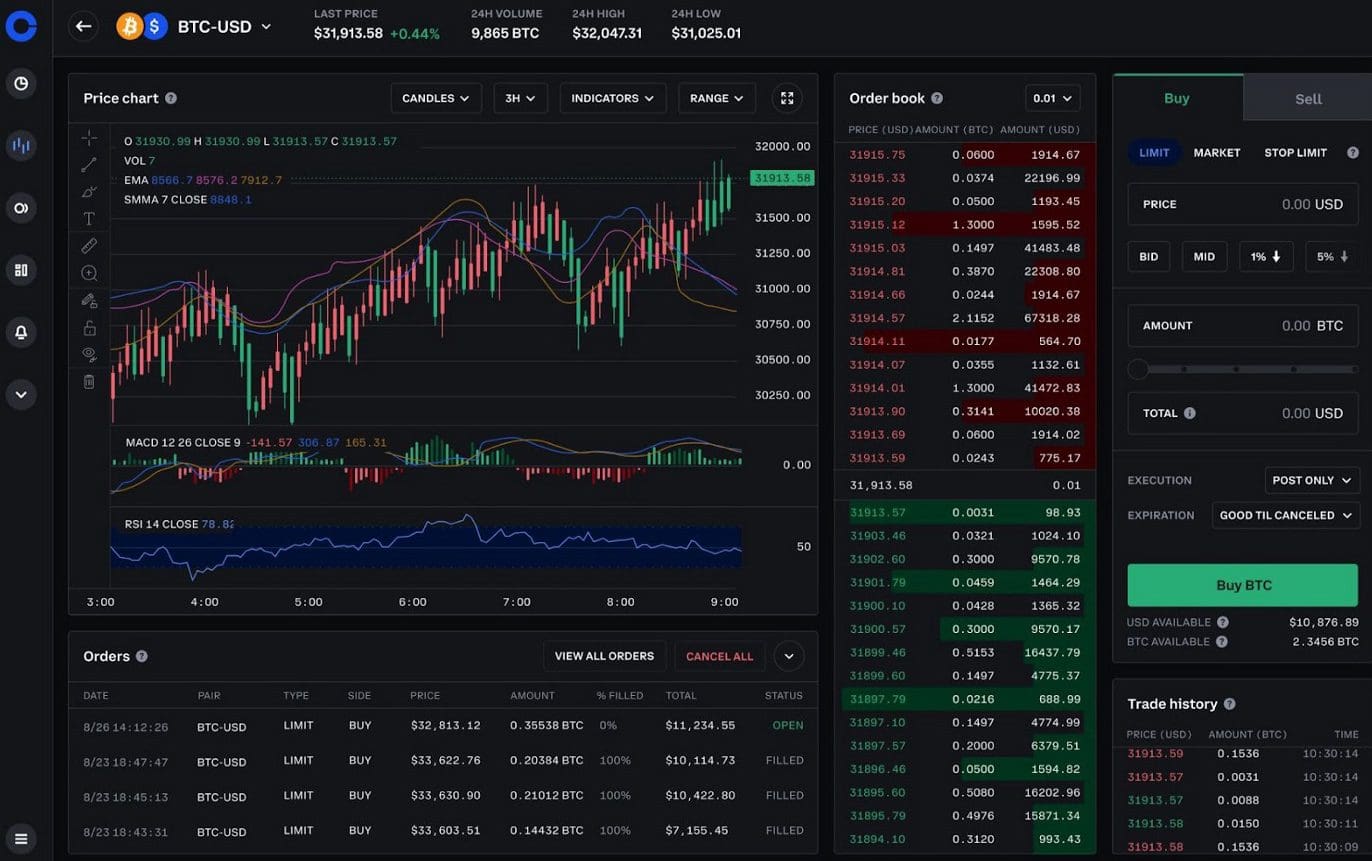

Coinbase Pro is a second version of the main application, with features specially created for more experienced users.

The platform offers interesting additional features such as:

- a high number of exchange pairs;

- more features related to buying or selling cryptocurrencies (such as limit orders);

- as mentioned earlier, lower Coinbase Pro commissions.

The two applications are designed for totally different audiences.

The first aims to make the purchase of digital assets more immediate and easier for everyone, even the less experienced; the downside is precisely the commissions… convenience pays!

The second is used by more experienced users who know well how to set up a limit purchase or sale, decreasing transaction fees precisely according to the amount of volume moved.

Here is the summary table on Coinbase Pro commissions; even if you move volumes under $10,000, the 0.6% fee is significantly cheaper than with the standard version of Coinbase.

We said that Coinbase Pro is a more advanced tool, suitable for users with a good deal of experience behind them.

The interface of the platform is decidedly different to the simplified one we find in the standard variant.

In any case, let’s not panic: those who have already relied on trading-oriented exchanges will not encounter any particular difficulties.

For the sake of the record, however, we must specify that Coinbase Pro is gradually saying goodbye. Its replacement is called Coinbase Advanced Trading. The image just above is taken from this evolution of the platform.

The Advanced version offers even more advanced tools, ideal for those who want to get serious about crypto trading.

Market orders, limit and stop loss should be just the beginning, as Coinbase aims to modernise and remain one of the benchmarks in the crypto exchange landscape.

Coinbase Earn

How to earn money with Coinbase? The answer is Earn, the exchange’s passive annuity programme.

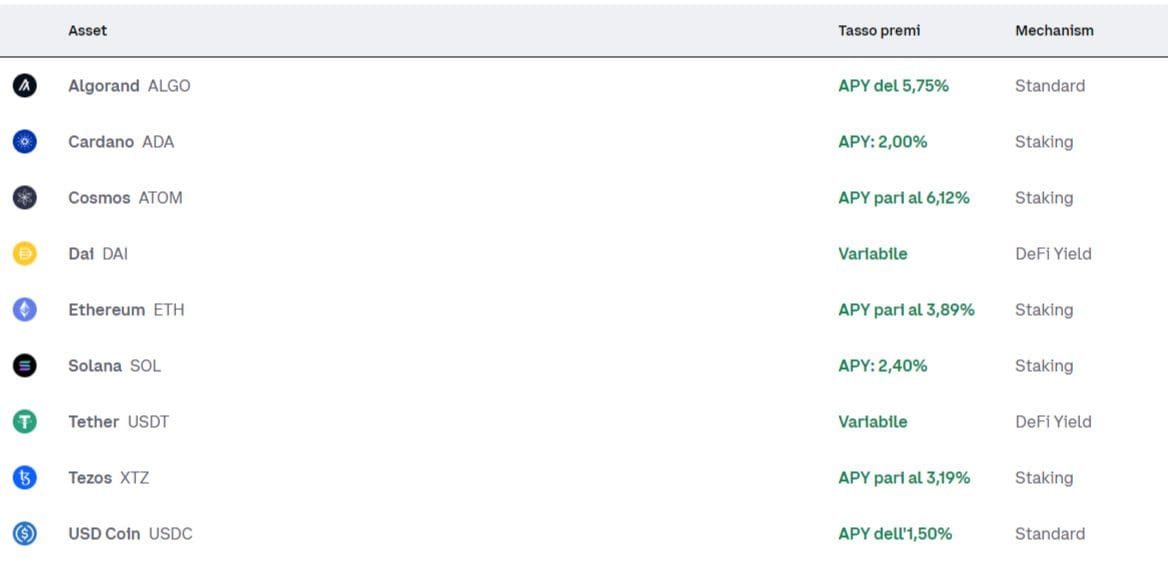

We have ways to invest different types of crypto assets, including Cardano and ATOM.

There are three types of mechanisms that generate earnings: Standard (ALGO only), Staking and DeFi Yield. These vary according to coin and country.

Yields are attractive and reach up to 6% per annum. Beware, however, of the product-specific risks as well as those associated with the platform itself.

The Earn service can be accessed from the Earn page. In just a few clicks, you can complete the procedure and immediately make your invested capital pay off.

Read the documentation well and reason about the risk/return ratio, taking into account our specific case, the propensity we have for danger, the percentage to be allocated and so on.

What is Coinbase Wallet?

What is the difference between Coinbase and Coinbase Wallet?

The Coinbase Wallet is the Non-Custodial wallet created by the developers of the platform. Its aim is to provide a place where the user can safely hold their private keys and, consequently, their deposited coins.

What does Non-Custodial mean?

When we use a centralised exchange, the funds deposited are never ours. In fact, all the wallets of these platforms are custodial, which means that the private keys are not in our hands, just like with a traditional bank. If the exchange were to have liquidity problems, or worse go bankrupt, we might not be able to see our funds again.

Therefore, the use of a custodial wallet is to be avoided, except for small amounts and for managing one’s own transactions.

Like other exchanges, Coinbase, however, wanted to solve this problem. Through the Coinbase Wallet, the currencies we hold are actually in our possession.

Beware, however, of the specific risks of a non-custodial wallet, because they do exist.

It will be essential to carefully preserve the associated seed phrase and set a strong password. The responsibility for the funds will be ours alone and customer support will not be able to do anything to come to our rescue; in fact, operators will not be able to access the user’s non-custodial wallet in any way.

In the tutorials just linked we explain these issues in more detail. We recommend starting with the in-depth discussion of crypto wallets, and then moving on to custodial and non-custodial.

Coinbase wallet is available as a browser extension (Google Chrome and Brave) and iOS and Android application.

Speaking of safe sleep – how secure is Coinbase? What are the risks and how can you avoid them? Let’s consider this point in the following paragraph.

Is Coinbase safe?

Among the centralised exchanges in circulation, Coinbase is undoubtedly one of the safest.

First of all, because of its longevity: in this industry, over 10 years of age is not a few years. In fact, this company was born at the dawn of cryptocurrency.

However, another feature is the most important on the subject of security: it is a listed company and this implies a number of obligations that reinforce its stability.

In any case, it is not possible to completely shield oneself from any risks.

Like any centralised company, Coinbase also entails risks, including liquidity crises. However, as it is precisely a company traded on the markets, the guarantees are certainly higher than average.

As for security on deposits, from the security settings of our account we can (and must!) activate two-factor authentication. Maximum security is achieved by integrating a hardware wallet, but relying on Google Authenticator may be sufficient; 2FA via SMS is not recommended as it is not very secure.

Cryptocurrencies deposited on Coinbase’s servers are covered by insurance protection up to a maximum of $250,000. However, we do not recommend holding assets on centralised realities without considering risks, advantages and your own personal needs.

Coinbase support

You can get help from Coinbase support directly from the Coinbase Help portal. Here you will find a comprehensive FAQ that will help you solve many of the most common issues. If, on the other hand, you should need personalized assistance, you can also contact customer service.

Coinbase opinions and conclusions

We have understood what the strengths and weaknesses of this exchange are. Let us summarise what we have just seen.

Let’s start by saying that the commissions are considerably higher than those of other exchanges; this is a big disadvantage of Coinbase, which is impossible to ignore.

On the other hand, the American company is currently the only one to be listed on the Nasdaq; this certainly denotes extra security when it comes to auditing financial statements.

For those interested, here is the trend of Coinbase stock. Source: TradingView, the best tool for technical analysis; sign up and take advantage of our discount.

However, we must bear in mind another aspect that is a major limitation for Coinbase, namely the restricted product offering, which is not as broad as that of its competitors.

We could sum it all up in one sentence: more security and transparency mean higher costs and less functionality.

In conclusion, for a user just entering the world of cryptocurrencies, the simplicity and immediacy of Coinbase is definitely worth considering. For all users with a little more experience, there are more comprehensive options.

Regardless of one’s level, the exchange is still an excellent choice if you want to put safety first; however, keep in mind that you can never be totally safe from risk.