Leggi questo articolo in Italiano

Solana dexes push SOL. Only Raydium Surpasses Ethereum

By Davide Grammatica

The performance of Solana dex Raydium mirrors the health of the network. It alone outperforms Ethereum in daily fees collected

Raydium drags down all of Solana

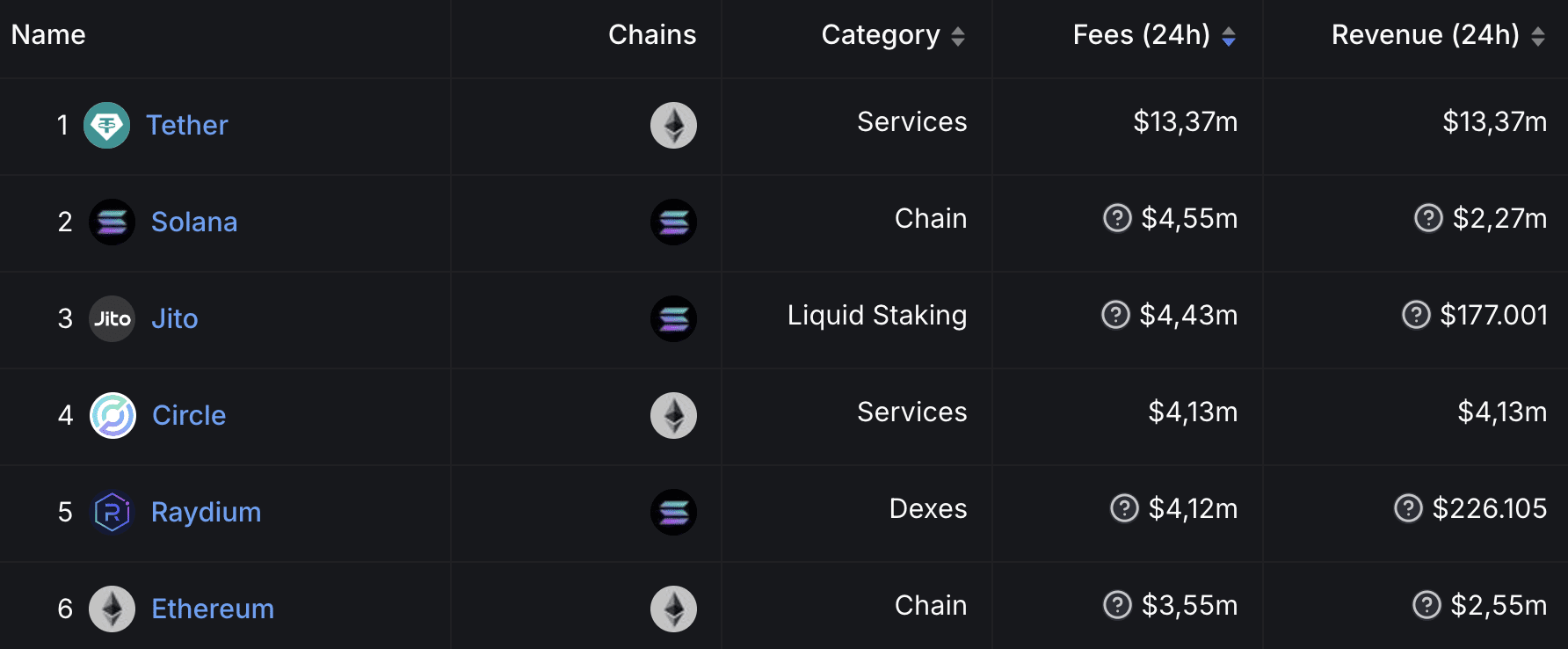

According to data compiled by Defillama, the Raydium dex , among the most important in the Solana ecosystem , has reportedly surpassed Ethereum in terms of daily commissions generated from swaps on the protocol.

We are talking, specifically, about $4.12 million in fees, higher than Ethereum’s $3.5 million. This figure alone is enough to offer a cross-section of the activity of DeFi users on the Solana network, who thus seem to be betting on a bullish rally in Layer 1 on the back of Bitcoin, which despite re-tests of support levels is still flowing on “bullish” tracks.

Also increasing are daily active addresses signaling buying trades , another beginning of strong bullish market support, both for SOL and of course for the RAY token.

Solana’s prospects, for many analysts, appear to be even better than those of BTC. If 2020-2021 was Ethereum’s time, the 2024-2025 season has all the makings of being Solana’s.

What to expect from BTC

A crucial role will be played by the now upcoming U.S. elections, a catalytic event for a BTC price that has long been on hold.

The cross-section of the short-term situation draws attention to the liquidity levels derived from the heatmap and the crucial levels indicated by price action.

We immediately observe some levels that serve as crucial points for price movement. These are:

- $70,000: Main bid level. As pointed out, there are orders there that could be easily intercepted and which, in the absence of demand follow up, could trigger a retracement.

- $64,000: Middle level of the impulse that just ended. This area shows a presence of orders that could provide support for trend consolidation and potential subsequent restart.

- $58,000: Lost the middle level of the dealing range, the reference low and liquidity waiting nearby would be the next target level.

Above $70k, the next targets are the ATH and finally the long-awaited price discovery, while breaking $58k would take us directly to the $47k area where a liquidity cluster resides.