Leggi questo articolo in Italiano

Bitcoin spot ETFs bring millennials into tradFi

By Davide Grammatica

Bitcoin spot ETFs have narrowed the generation gap between Millennials and Gen X with respect to interest in tradFi financial products

Bitcoin opens tradFi doors to millennials

That the crypto world has always been of greater interest to younger investors (under 35, to be clear) we have recounted many times. Young technology for young users, which while growing over time has never been able to fully open its doors to older investors.

It is complicit in a not insignificant technological entry barrier, which often precludes adoption in large stretches, but as time goes on, new developments multiply to foster the growth of increasingly user-friendly protocols.

We forget, however, that the converse has always also applied in reverse. Cryptocurrencies, from this point of view, have also been an opportunity for investors who, contrary to what has been said before, had no way to approach traditional finance in a way.

Schwab's report

A recent study published by Schwab Asset Management, on a sample of 2,200 individual investors between the ages of 25 and 75, however, revealed that over the past year this gap would have narrowed sharply, and credit would go to the newBitcoin spot ETFs .

BTC spot ETFs and later ETH spot ETFs have, yes, led many institutional players to approach crypto, but at the same time they have also led young users to approach tradFi.

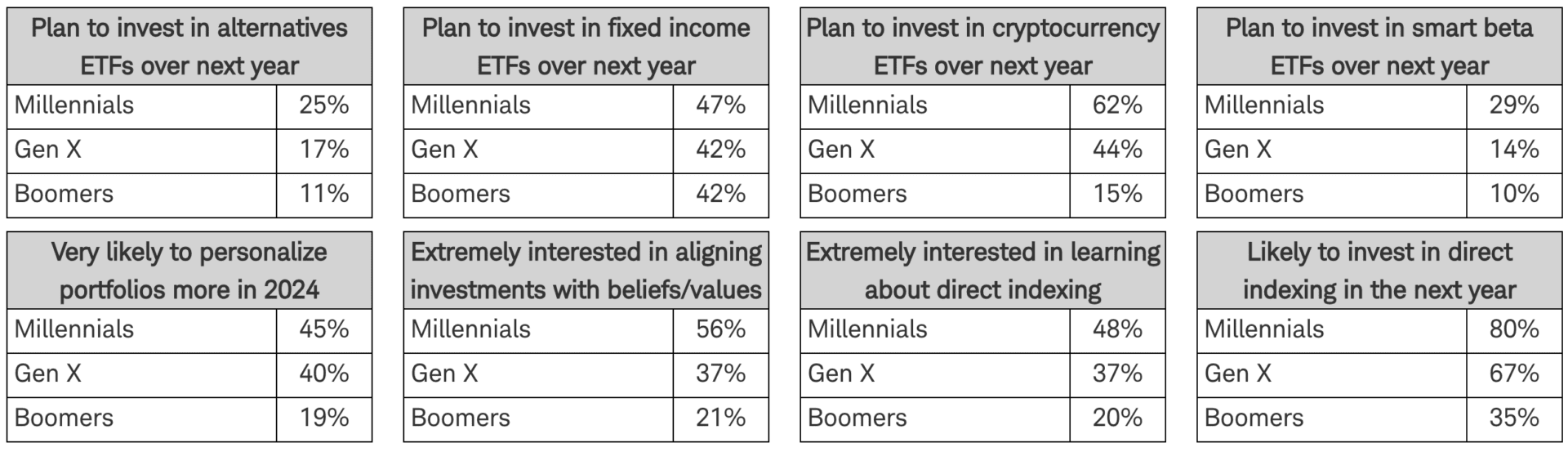

“’Millennial’ ETF investors have the strongest appetite for ETFs, and are interested in more personalized ways to invest,” Schwab wrote. “They have higher levels of interest in direct indexing, and are more likely than other generations to invest in the coming year.”

Sixty-two percent of Millennials, according to the study, plan to invest in ETFs in the coming year. For Generation X we are talking about 44 percent, while for Baby Boomers it is 15 percent.

At the same time, spot BTC and ETH ETFs would make up 27 percent of investors’ portfolios in the sector, with 65 percent of them planning to increase their exposure. In addition, 47 percent of traditional hedge funds would already be exposed to digital assets.