Leggi questo articolo in Italiano

Ethereum at $4k: new start or finish of bullish cycle?

By Davide Grammatica

$4k is historically a critical price level for Ethereum, but this round there is more optimism that the bullish rally can continue

Ethereum back above $4,000

In the last few hours Ethereum (ETH) has returned above $4,000. This price has always represented a critical level for the asset , beyond which, realized historical ATHs have always gone into sharp corrections.

At this turn, however, several data suggest that there may be room for a new upswing, for ETH to break through those historical resistances that have precluded it from achieving new ATHs for years.

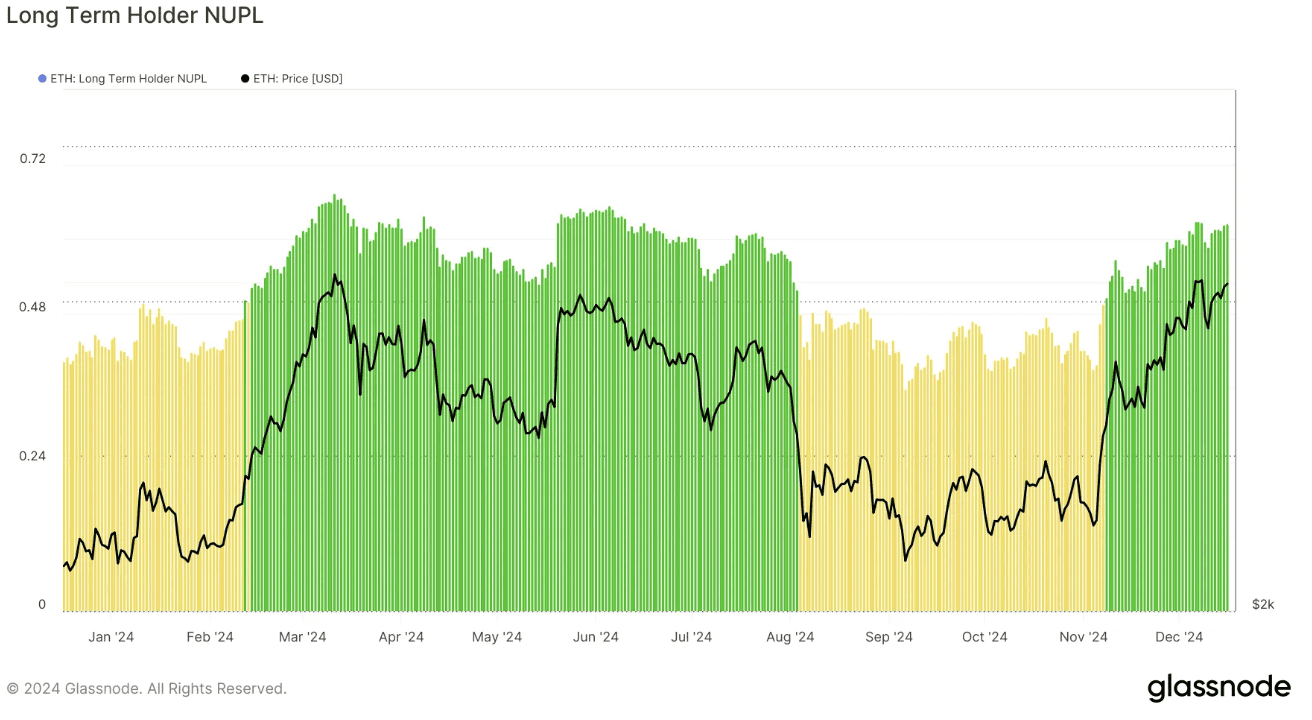

The first factor working in favor of the second largest cryptocurrency by capitalization is surely the number of long-term holders (LTH) and their behavior at this price. In fact, as shown by Glassnode, the relationship with the Unrealizes Profit/Loss (LTH-NUPL) metric would suggest that sentiment toward ETH is still quite optimistic.

ETH's next challenges

To read this data, according to several analysts, we would still be in the “conviction” phase, and not the “euphoria” phase (the level where historically there have been the most substantial gains). Therefore, the outlook for ETH would remain excellent even above $4k.

Another interesting metric is then the “Market Value to Realized Value” (MVRV), which assesses market profitability by judging how overvalued (or undervalued) the asset may be. According to Santiment, Ethereum’s 30-day MVRV ratio is 8.73 percent, lower than the 22.61 percent reached in March, the last time it touched $4k.

All this, of course reinforces the idea that ETH may touch new heights in the coming weeks and months. Should the trend hold, the most optimistic traders look to $4,400 as the most likely target in the short term. On the downside, however, the first resistance is around $3,500.