Leggi questo articolo in Italiano

Ethereum: three factors to push the price to new highs

By Daniele Corno

Bitcoin close to ETH, but Ethereum suffers. Here are the 3 factors for ETH's possible recovery to new price highs

Does the market want Ethereum?

With Bitcoin prices toward all-time highs, Ethereum and all altcoins are suffering.

Bitcoin dominance is currently at 60 percent. So the market’s interest is clear, investors’ eyes are on BTC while the entire sector suffers.

In fact, the price of Ethereum is -50% from its price high, marked on November 10, 2021 at $4,868. So let’s look at three of the main factors that may lead ETH to see new highs.

Merge, EIP 1559 and ETH burn

Unlike Bitcoin, Ethereum has an unlimited supply. The first key driver for Ethereum’s price is therefore issue control.

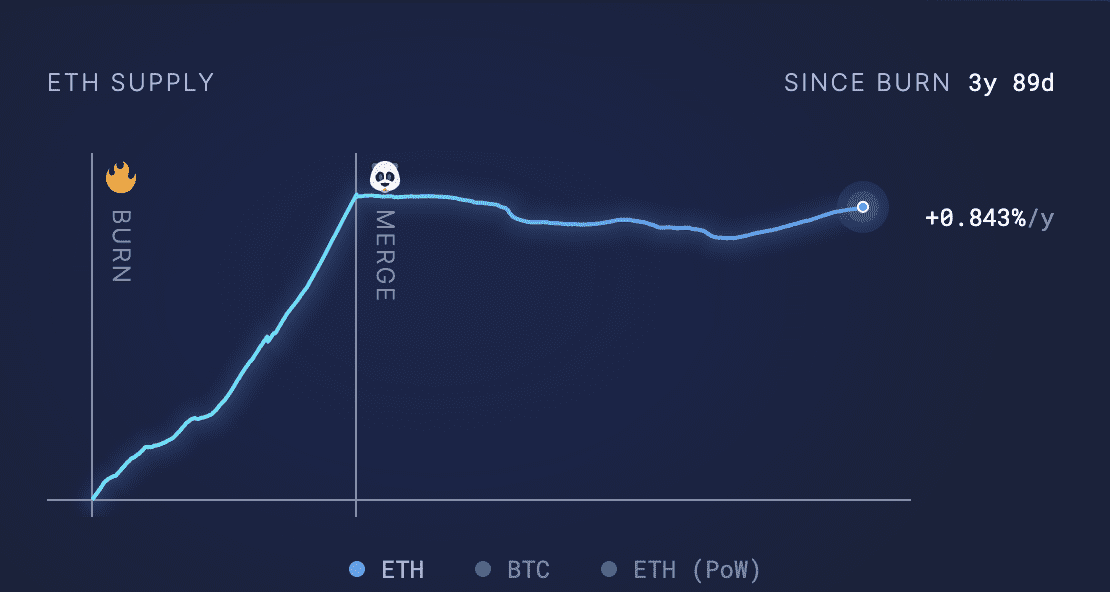

One of the key steps comes from MERGE, when Ethereum went from Proof of Work to Proof of Stake, also reducing ETH issuance per block by 90 percent. Even more important, however, for the long run, is the introduction ofEIP 1559, which took place in August 2021. With the introduction of BURN, some of the ETH used as gas fees are burned. This then allows the currency to maintain control over inflation.

With very low network utilization, as at the present time, inflation travels around 0.8 percent annually. The growth of the network and its utilization leads to greater Burn, allowing ETH to be in effect a DEFLACTIVE asset in the future.

ETH protects liquidity

By moving to Proof of Stake, ETH ensures the safety of the liquidity present within the network.

The field of DEFI and tokenization (RWA) is growing steadily. Defi on Ethereum currently has $56 billion, while the RWA sector is becoming a reality.

Products such as Blackrock ‘s BUIDL, bring the on-chain Defi sector , paving the way for one of the most liquid markets in the world. With similar prospects, the liquidity that can come on the Ethereum blockchain is in the trillions.

The role of ETH is precisely to ensure its security. Translated, this means that the value of ETH in staking, will have to be higher than the liquidity in the network. This opens up interesting prospects for the future price of Ethereum, which could see unexpected price levels in the future.

ETFs and multi-crypto indices

Global economies and their growth are measured through INDICES.

Indices measure the performance of a basket of stocks or financial instruments and are one of the benchmarks for monitoring the performance of a country’s economy or a sector.

They are also one of the most widely used investment tools for investors. Currently, in the crypto market we have products such as spot ETFs, which allow investors to allocate capital into a single crypto, in this case such as Bitcoin or Ethereum.

The introduction of multi-crypto ETFs will therefore allow investors to be able to offer an instrument that guarantees anallocation to the entire crypto sector. Considering that often, indices are composed of assets according to their weight in market capitalization, the weight of ETH in multi-crypto ETFs or structured products can ensure strong buying pressure.