Leggi questo articolo in Italiano

FED: the U.S. Federal Reserve

By Gabriele Brambilla

Brief journey through the Federal Reserve System (FED): what it is, how it is structured, and what its duties and responsibilities are

The central bank of the United States

In a previous article we discovered the European Central Bank; today it is the turn of its overseas colleague, namely the Federal Reserve (also known as the FED).

These institutions play a central role in a country’s monetary policies. Their decisions have direct consequences on the economy and finance, as well as on people’s lives.

Knowing what the Federal Reserve is is also important from an investment perspective: by knowing what their areas of operation are, we have a way to understand in advance what might happen as a result of the decisions they make.

Let us delay no longer and enter the world of the Fed.

Index

What is the Fed?

The Federal Reserve System, usually abbreviated to Federal Reserve, but for “friends” also known as FED, is the central bank of the United States of America.

Founded in 1913, this ultracentennial institution has lived through and faced all the pages of history that marked the twentieth century and the beginning of the new millennium. We are talking about events such as the Big Crash of 1929, followed by the Great Depression, the energy crises, all the way to the Great Recession that began in 2007.

The succession of appointments with history has brought greater responsibility and power to the Fed, now a major player in American and world economic life.

The Federal Reserve owes its birth to the act of the same name (Federal Reserve Act), by which the U.S. Congress defined its main tasks. Like any central bank, the Fed must pursue the following objectives:

- Ensure price stability, intervening if necessary to counter excesses (including inflation);

- Closely related, maintain long-term sustainable interest rates for all involved;

- Foster the best conditions for the labor market.

But that’s not all. The Federal Reserve oversees banks and seeks to position itself as a figurehead in the economic landscape.

It is a prestigious entity with enormous power that can potentially determine the fate of the country’s growth. What is more, since it is the United States, the Fed’s decisions also affect the rest of the world.

The structure of the FED

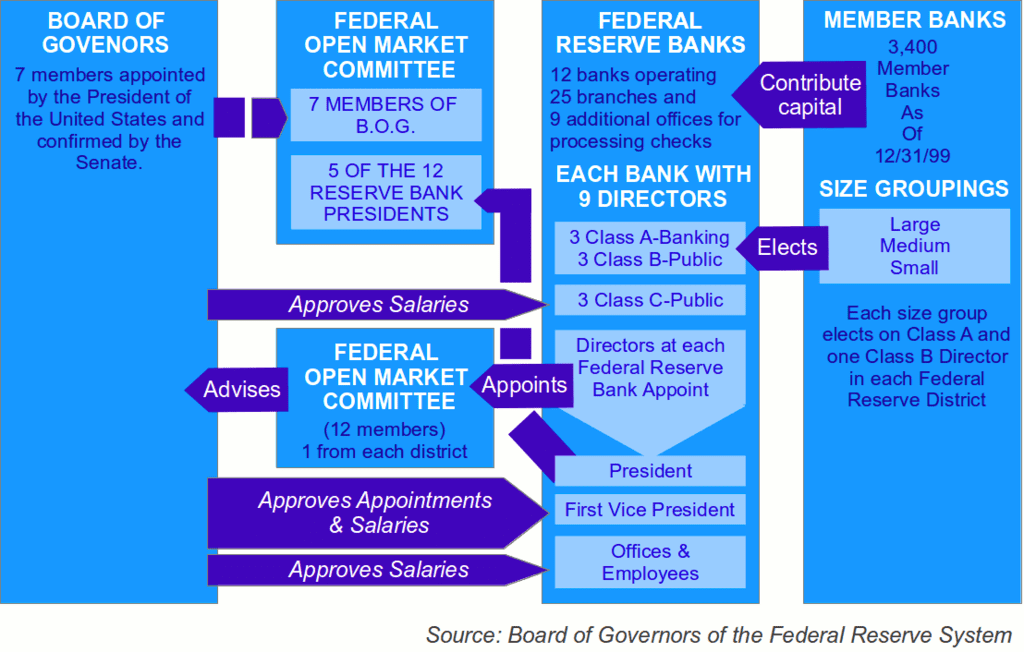

The structure of the Federal Reserve System is quite complex and is based on four main blocks:

- Board of Governors;

- Federal Open Market Committee (FOMC);

- Regional FED banks (12 in all, located in some of the most important cities in the States);

- Member Banks.

Image: Kimse84 from Wikimedia Commons

The Board of Governors is a seven-member federal agency. Its main objective is the supervision of banks and general districts. In addition, the Board sets monetary policies.

To join the Board one must obtain tenure directly from the president of the United States, as well as confirmation by the Senate.

The FOMC is a key committee in macroeconomic terms. We should know it very well, because every forty days or so we eagerly await what it sets regarding U.S. interest rates. To elaborate, here is an article devoted precisely to the FOMC.

Regional FED banks have direct responsibility for the relevant districts, as well as the member banks that operate within them.

Members of the Federal Reserve System are banks located throughout the country. It is a private institution, where each member holds shares in its regional FED bank. Just under 40 percent of U.S. banks are also members of the FED System.

Where is the Federal Reserve?

The headquarters of the Fed is located in Washington D.C., inside the iconic Eccles Building.

But as we know, the Federal Reserve is a system, so there are several regional headquarters located throughout the country: as many as 12.

Major cities to call upon include Chicago, Boston, New York, San Francisco and Dallas.

"The image on the cover depicts the Eccles Building itself."

Who is the chairman of the Fed?

Republican Jerome Powell is chairman of the Board of Governors, the highest office in the Federal Reserve System.

Born in 1953, Powell is a lawyer and banker with an enviable resume.

He majored in politics at Princeton, then went on to Georgetown, and in the 1980s shifted his focus to the investment industry.

In 1992 he became undersecretary of the Treasury for domestic finance under President George H.W. Bush. While there he was also a partner in the Carlyle Group, a large asset management firm that he left in 2005.

In 2012 he joined the Board of Governors, and then was elected president in 2018, under the Trump administration.

We all know the more recent history: COVID, stimulus to the economy and following inflation, which required interventions over which Powell had a lot of decision-making responsibility.

"Jerome Powell is the chairman of the US Federal Reserve."

Now that you know her...

…you know that you will have to pay close attention to upcoming FOMC meetings and updates from the world of the FED.

Let us close with a note: Let us not confuse this institution with the SEC, or Securities Exchange Commission. The latter has authority over financial markets, but it cannot in any way express opinions (let alone make decisions) regarding the economy and monetary policies.