Gas fees: introduction to transaction costs on blockchain

Gas fees are a fundamental element of the blockchain world. However, just like taxes in real life, their importance is met with little acceptance by users.

Here we are tackling a thorny topic that often figures prominently in crypto news. In the following paragraphs we will learn about this service fee that we are required to pay for each transaction.

We will answer questions such as “What are gas fees? ‘ and ’How are they calculated?”.

We will also unveil some tips on how we can save on gas fees, based on the assumption that there is no getting away from it altogether: something will still have to be paid.

On everyone’s lips during periods of Ethereum overload, gas fees are also part of the norm in many other blockchains. Let’s get acquainted with them!

Index

What are gas fees?

Gas fees are a fee that each individual is required to pay to complete a transaction on the blockchain. Think of it as a fee that has to be paid to take advantage of the service we are offered.

The amount collected usually ends up in the pockets of those who allow transactions to run smoothly, such as miners and validators. In some networks, a portion of the gas is burned or used to make improvements, start new projects, and provide various incentives.

Gas fees are almost always paid in the native currency of the blockchain: Ether on Ethereum, POL (ex MATIC) on Polygon, bitcoin on Bitcoin. However, there are exceptions and hybrid solutions.

The cost to be paid varies by network and is conditioned by several factors.

First of all, structural ones count: scalable and fast blockchains can process many transactions, thus proving significantly cheaper than limited realities. Linked to what has just been written, the demand for transactions at a given time leads gas fees to go up or down.

Let us compare two well-known realities.

Bitcoin is a very secure blockchain. However, this feature affects its performance: it takes as much as 10 minutes to validate a block, whose maximum size (1MB) does not allow it to hold a large number of transactions.

At times when many users use the chain, congestion creates queues that lead to long waits. In addition to this inconvenience, gas fees increase.

In contrast, Solana is a very fast chain, capable of processing a huge number of transactions. Even during periods of high traffic, gas fees still remain at negligible prices. This is at the expense of stability and security-the Solana team is constantly working to remedy these critical issues.

Gas fees are present in most blockchains. However, the debate on the issue usually revolves around Ethereum; let’s see why.

Ethereum is an ingenious blockchain, the “homeland” of major trends in the crypto world, among which we mention DeFi (decentralized finance) and Non-Fungible Tokens (NFTs).

Staggering sums of money, invested or at work on the countless portals available, turn daily on this network: think of OpenSea and MakerDAO, just to name a few illustrious names.

The great comings and goings generate so many transactions, which in turn are responsible for unsustainable gas fees. If at the time of writing the situation is calm (we are in a bear market and trading has been reduced), during periods of extreme hype gas has touched staggering figures: to move 3/400 dollars of countervalue one could comfortably spend 100 and even more.

Why the exaggeration? As we said, it all depends on demand and chain structure.

Ethereum is not at the levels of Bitcoin but neither is it as high-performing as Solana. Because it is heavily employed, saturation can easily be reached, resulting in skyrocketing prices. Beware, however, that fees are not entirely dependent on demand: we will see that shortly.

As one of the most important networks, it is worth taking a look at how gas fees are calculated on Ethereum (ETH gas fees) after the hard-fork London occurred in summer 2021.

Want to trade bitcoin, Ethereum and many other cryptocurrencies? Sign up with Bitget and get a 15% discount of fees forever. Read the Bitget article to learn more.

"Gas fee: la benzina che alimenta le transazioni di una blockchain"

ETH gas fees: how are they calculated?

Ethereum dominates the DeFi and NFT scene. As the blockchain has repeatedly spawned the big trends, metaverse included, it is natural to think that this could be the case in the future as well. So let’s find out how gas fees are calculated on this network.

In August 2021, hard fork London made significant changes to this blockchain. This was one of the preparatory steps toward the Merge, which successfully took place in September 2022.

London introduces the following formula for calculating gas:

Gas fee = Gas unit (maximum) x (Base fee + Priority fee).

For ease of reading and comparison with English-language sources, here is the non-Italian formula:

Gas fee = Gas units (limit) x (Base fee + Priority fee)

All values are expressed in gwei; 1 gwei = 0.000000001 ETH.

The Gas Unit (maximum) is the limit an individual wishes to spend to make a given transaction. Basically it is often set at 21,000 gwei but can be increased or decreased. Raising it does not necessarily mean that we will necessarily get to shell out that amount; lowering it, on the other hand, we may see the amount reduced but not be able to carry out the transaction: beware!

The Base fee depends directly on the congestion of the network: the more demand there is, the higher this figure will be; conversely, we will see the Base fee decrease. This fee is burned up, reducing Ether’s circulating.

Finally, the Priority Fee, also known as tip. Those who wish to fast-track their transaction can raise this figure; miners obviously give priority to those who spend more so they can earn larger amounts. Note: As of September 2021, with the change in the consensus algorithm, the figure of the miner falls into disuse in favor of validators.

Ethereum gas fees therefore vary according to demand but not only. In congested situations, users raise both Gas units and the tip to the maximum, so as to bypass the long queue ahead.

In contrast, in quiet moments, prices fall.

London had the merit of introducing a simple and accurate system for calculating gas, trying to remedy the crazy prices of peak usage periods. However, this is not enough. The Merge is an important step toward creating a more sustainable network. There is still a long way to go, however, and for now we have to be ingenious in chasing savings.

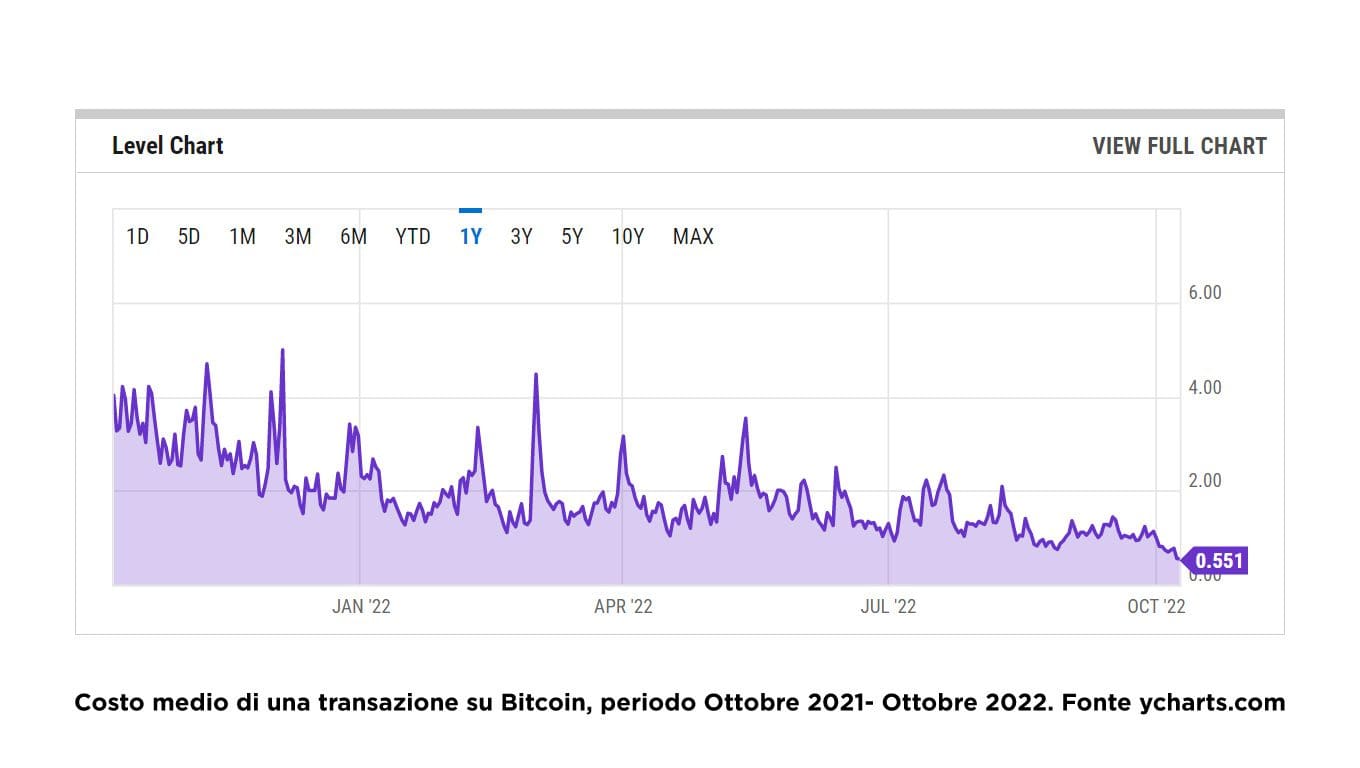

Incidentally, Ethereum is not the only blockchain facing periods of exploding gas fees: the chart below shows the price trend on Bitcoin blockchain over the past year, expressed in U.S. dollars. Not exactly cheap, there is little to say.

Do you need a gas fee calculator? Try this one, but beware: In practice you might incur expenses that are higher or lower than estimated from this gas fee calculator.

So whether on Ethereum, Bitcoin or other chain, how to pay less gas fee? We reveal it in the next paragraph!

"High ETH gas fee still remain a problem"

How to pay less gas fee?

All it takes to pay less gas fees is just a little experience and knowledge. Let’s take a look at the main methods to keep a few extra cryptos in your pocket.

Method 1: Save on gas fees by using layer-2s.

Layer-2 are structures built on top of the parent blockchain. While the security and stability aspects are still handled by the latter, the layer-2 takes care of processing transactions, thus avoiding weighing it down.

With these constructs, native platforms and services can be used, saving both time and money.

Still thinking about Ethereum, two important layer-2s come to mind: Arbitrum and Optimism. These environments offer the security of Ethereum, but avoid long waits and high gas fees (still paid in the native coin).

Moving to Bitcoin, Lightning Network is the idea to promote its mass deployment.

In addition to layer-2s, sidechains are also a viable alternative for saving money. These are realities that are independent of layer-1 and also have their own consensus algorithm; however, a link to the parent chain is retained.

These are higher-performing realities, with all the advantages we now know. The reduced gas fees are paid with the sidechain’s native coin (with some exceptions).

Method 2: Operate at times when the network is most unloaded

If we wish to stay on layer-1, the solution to save money is simple and somewhat obvious: arrange transactions at the times when the network is most unloaded. In fact, depending precisely on the demand of the moment, gas fees decrease at times when the workload is lowest.

How to know when the moment is right? The vast majority of portals dedicated to monitoring cryptocurrency performance also show the network load. Focusing on Ethereum, Etherscan is the benchmark.

Method 3: Avoid superfluous transactions (e.g., frenzied compounding in DeFi)

Another rather trivial method but one that should always be kept in mind, especially at the most exalted times.

Reducing the number of transactions also lowers the impact that gas fees have on our investment.

Especially in the DeFi environment, situations are quite common where we get carried away, for example, by compounding all-out to maximize gains. This choice is rather unnecessary, if not harmful: in fact, the costs may outweigh the benefits.

Therefore, we try to limit operations, perhaps combining this behavior with method 2.

Obviousness? Definitely, but if we came to have three-digit gas fees on Ethereum it means that many people were willing to pay that amount anyway. Euphoria always plays tricks, let’s never forget that.

Final tip: When operating on the Internet, the security of your privacy and your funds is paramount. That’s why NordVPN is one of the must-haves to sleep more peacefully. Join NordVPN now: for you a super discount and as many as 4 months free!

"Layer-2, sidechains and smart operations can save us a lot of money!"

Gas fee: joys and sorrows!

Gas fees are an indispensable part of the life of a blockchain. Without them, we would not be able to guarantee the operation of the structure, leaving aside the security issues. Therefore, we should be happy to pay them, because after all they make possible what we are using.

However, even the best of services comes with a price limit. Right to spend the right amount (pardon the pun) but forbidden to be fleeced. Therefore, it is necessary to carefully evaluate each operation.

First, let’s take a look at how high the gas fees are at that particular time. Are they high? Or affordable? Next, let’s consider the operation we have in mind: is it necessary? What figures are we talking about? Finally, are there cheap alternatives such as layer-2s?

It all comes down to common sense: spending $1 to move $1,000 may seem okay; is it still so when gas goes up to 10, or 100?

We are curious: tell us your worst experience on the gas fee issue via our social networks. We’re sure to hear about it.