Leggi questo articolo in Italiano

Grayscale launches two new crypto funds: trusts on LDOs and OPs

By Daniele Corno

Asset manager Grayscale launches two new “Trust” funds in the Ethereum world: it's the turn of Optimism's OP tokens and Lido Finance's LDO

New products on the Ethereum world

Asset manager Grayscale has announced the launch of two new investment products, “Trusts ” related to the Ethereum world . The two funds will in fact be dedicated to OP tokens , related to Layer 2 Optimism and LDO tokens , from the Lido Finance protocol.

The price of Ethereum near $4,000, correlated with the growth of sectors such as DeFi and RWA, put those concerned with two key aspects in the spotlight: security and network scalability.

The launch of these two funds, also follows the release of Grayscale‘s latest product , related to AAVE, the leading lending protocol.

These products are intended only for accredited investors, that is, individuals with assets over $1 million or household incomes over $300,000 annually.

Optimism and Lido Finance, two strategic products

The latest products launched by Grayscale follow a strategic logic.

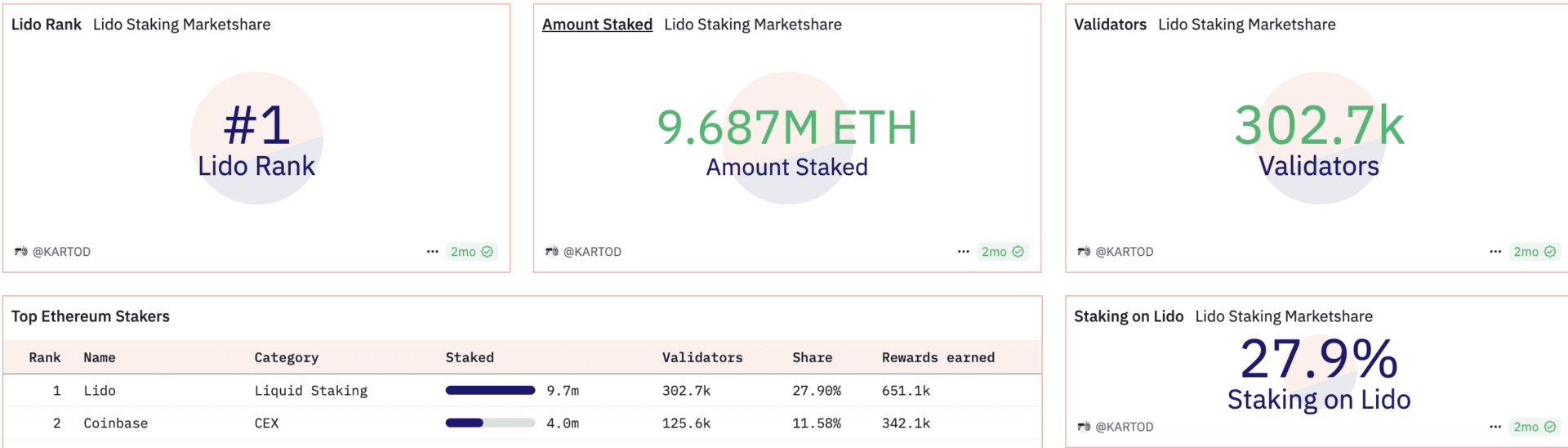

Security: Lido Finance in fact, a Liquid Staking protocol, is the largest present in DeFi, with an LTV close to $40 billion. Nearly 10 million Ethereum are staked on LIDO, which manages 30 percent of all ETH staked in the market.

Scalability: Optimism , on the other hand, among Ethereum’s main Layer 2, is the originator of the “Superchain” concept as well as provider of theOP stack. Thanks to this standard, similar to Atom ‘s SDK concept , anyone can with extreme ease build their own Layer 2. Projects such as Base, Blast, Worldcoin and Mode are in fact built using OP stack.