The Grid Bot in exchanges

The possibilities offered by the world of automated trading are among the most varied, depending on the type of approach everyone has to the relevant platform. And it is not to exclude those who offer this service among a multitude of financial instruments, namely exchanges.

Just to give a minimum of context, we will be talking in this case about Grid Trading Bots, which is a trading bot designed to assist users in implementing the Grid Trading strategy.

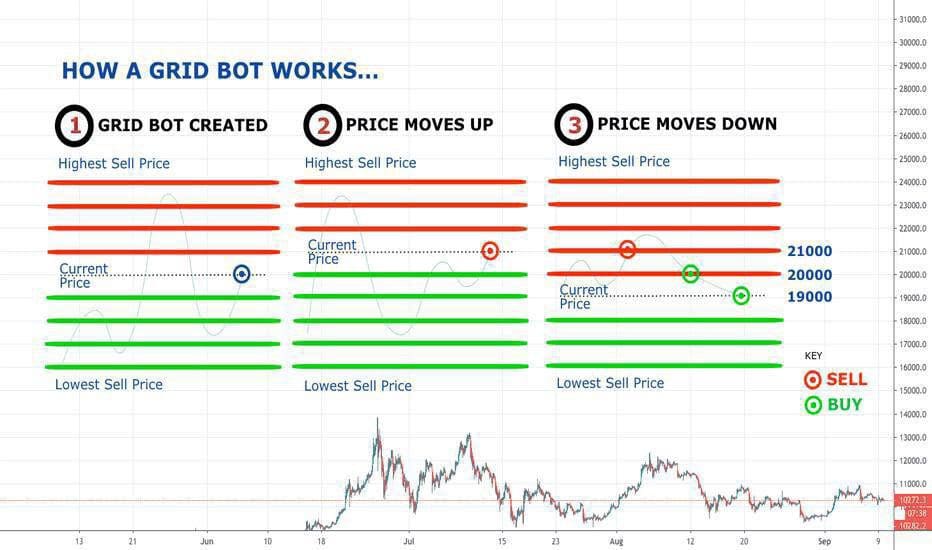

Specifically, it allows users to place a series of buy and sell orders within a given price range. When a sell order is successfully executed, it is up to the bot to instantly enter another buy order at a lower grid level. And the dynamic also occurs at the opposite end.

Index

Che cos’è il Grid Trading Bot

This strategy involves a series of buy and sell orders at predefined intervals around a fixed price. And it develops a trading grid in this way. In the crypto world, by the way, it is particularly effective, precisely because the bot works best in a competitive market with regular price changes. It ensures profitability whenever the selling price exceeds the buying price during a sideways price movement, and it automatically executes low buy orders that lead to high sell orders, thus eliminating the need for market forecasts.

Obviously, a whole range of factors need to be considered in order to increase earnings, but the bot addresses this very need, to earn revenue precisely by exploiting volatility, and automating trades on a regular basis over time. In an ideal context that sees an asset pair with frequent and large ups and downs, but a fairly constant average price over the long term.

All the benefits

Grid trading has been around for a long time and is a well-established approach. There are several instances of traders employing it in a variety of markets, but the crypto business has proven to be one of the most reliable venues.

The strategy is then relatively simple, as it contains no sophisticated calculations, measurements or market indicators, and it is easy to set up even for those who do not have particularly extensive experience in the field, either of trading in general or in cryptocurrencies.

The concept applied is perhaps the most mundane possible, namely “buy low, sell high,” and can be applied to almost any market regardless of market trend or behavior. And it can adjust according to the frequency and period chosen by selecting the price range and number of grids. The latter, can be set for the short term, getting hundreds of trades every hour to get microprofits from all the small changes of the day, or for the long term, selecting a wide range and letting it run even for months, to get profit from a trend change over a longer horizon.

The adaptability and freedom of choice of strategy setup then allows one to control the level of risk/return more actively than most other types of trading. One can leverage a Grid Bot to generate a modest and steady profit with almost minimal risk, for example, by choosing a stablecoin pair, or with greater risk and return with a low market capitalization currency that has high fluctuations.

Grid trading, by the way, is also particularly prone to automation, precisely because of its very nature, namely that its actions are predefined and unrelated to market behavior. And from another point of view, it is also one of the first suggested approaches to approach the subject of automation in general, since it can operate on virtually any market, under any conditions, 24/7, and can be set up for almost any period.

"A grid bot contains no sophisticated calculations, measurements or market indicators, and it's easy to set up"

Fees

Fees, in this sense, are a key aspect to consider, as they constantly influence trading results. Exchanges that offer minimal fees and periodic no-cost events or commission refunds have a significant influence on the instrument’s return.

It will therefore be necessary to find the best possible market pairs and circumstances, know how to read a minimum of market currents, look at charts, and gain an idea of what one would need to look for. For example, charts with a sideways or modest rise, but no indication of a long-term downturn. In short, a pair that has already seen frequent and significant price swings, but which does not look like it will break out of the identified (or budgeted) price range any time soon.

Binance Grid Bot

Grid trading is a quantitative trading strategy. The Binance bot , as anticipated in general terms, automates buying and selling on spot trading. And it is designed to place orders on the market at preset intervals, within an already configured price swing. They are placed above and/or below a set price, thus creating a “grid” of orders based on incremental price increases and decreases. And collaterally, it helps to make trades in a purely rational way by avoiding “fomo” wherever possible.

Operationally, to approach the grid trading strategy on Binance one needs to click from the main menu on “trading”, and then get via “Trading Strategy” to “Grid spot”, selecting a trading pair.

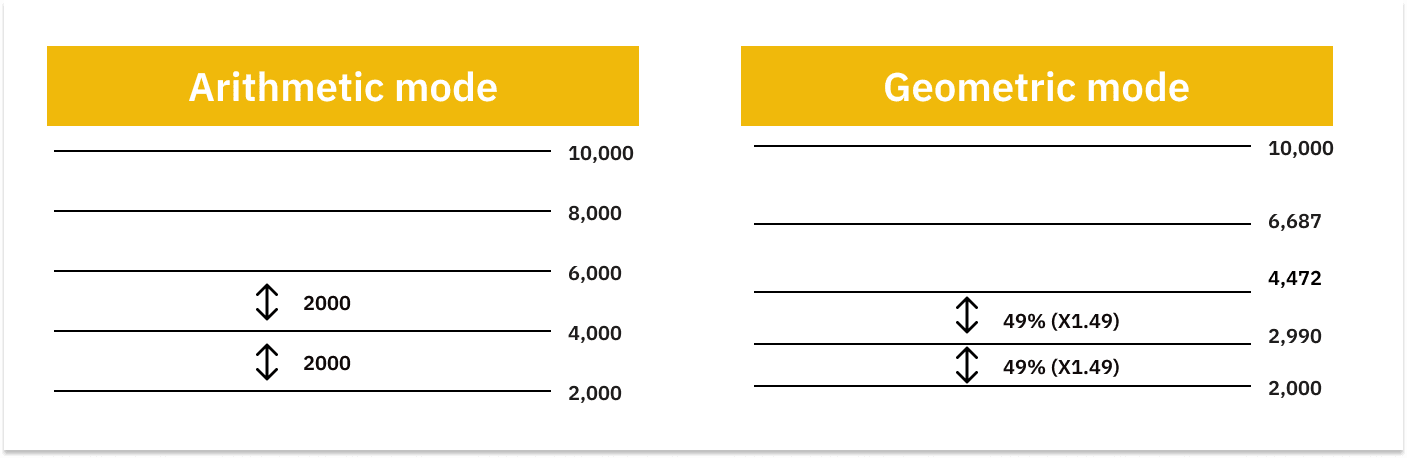

There are then two modes, “Arithmetic” and “Geometric”. And you will be required to set the parameters of the grid, including the maximum and minimum price, the grid number, and the cryptocurrency you want to invest. Once the amount to be invested has been entered, simply confirm to place the order. In the arithmetic mode, each grid has the same price difference. In the geometric mode, each grid has the same price difference ratio.

In addition, you will be required to set the “lowest price” and “highest price” from the outset, i.e., the lower and upper part of the price range of the trading grid beyond which the system will no longer execute orders. A grid divides the upper limit price range and the lower limit range into corresponding parts at this point, and it remains to choose the asset to invest.

Binance allows you to choose between one or two cryptos. For example, if you choose to invest in BTC, the strategy will use only BTC from your Spot wallet, while if you choose to do so via BTC and BNB, likewise the bot will leverage the two assets from the user’s wallet. Creating a grid, precisely because of this, may fail if there is not a sufficient balance in one’s Spot wallet.

Otherwise, it is possible to set (optionally) a trigger price, based on which grid orders are triggered when the last price rises or falls from the price entered, and a Stop trigger, which is the automatic termination of trading when the market price reaches those set.

Then there is the “Stop loss”, which stops grid operation when the last market price reaches the set price, and the “Take profit”, which works the same way but in the opposite way.

If you create a BTC grid order without a trigger price, a certain percentage of BNB will be bought immediately at the market price for the opening of the trading grid, while if you set it, then the system will wait for the market price to reach the trigger price. And in the case, investing in BTC and BNB can benefit as it would avoid paying additional fees for buying BNB.

Finally, the “terminate” option will cause the grid to stop working, and order execution will be canceled with all profits liquidated.

On the “running” tab, you can instead the order progress: the orders in progress, those already executed, and all the details of the grid settings, with the possibility of resetting or changing the prices related to the scheduled actions.

Practical example: BTC/BUSD

The strategy, in general, involves setting a grid to buy at a low price and sell at a high price.

Assume parameters set like this:

Highest price: 30,000 BUSD

Lowest price: 10,000 BUSD

Number of grids: 5

Mode: arithmetic

Amount invested: 10,000 BUSD

Current price of BTC/BUSD: 20,000 BUSD

The price structure of this strategy will be set at 30 thousand BUSD, 26 thousand BUSD, 22 thousand BUSD, 18 thousand BUSD, 14 thousand BUSD and 10 thousand BUSD according to the parameters set.

Binance’s spot grid trading uses normal grids, and orders are placed from the top grid to the bottom grid. When a buy order is executed, a sell order will be placed in the grid placed above. And since the upper price is set to 30 thousand BUSD, the grid strategy will start by placing a buy order at 26 thousand BUSD. This buy order price is higher than the current price (20 thousand BUSD), so in theory it will be executed immediately. Once the 26-thousand order is completed, a new sell order will be placed at 30-thousand BUSD.

And for an even more convenient approach to Binance, you can get a 20% discount on fees from here.