Leggi questo articolo in Italiano

Institutional and crypto: Coinbase talks about increasing exposure

By Davide Grammatica

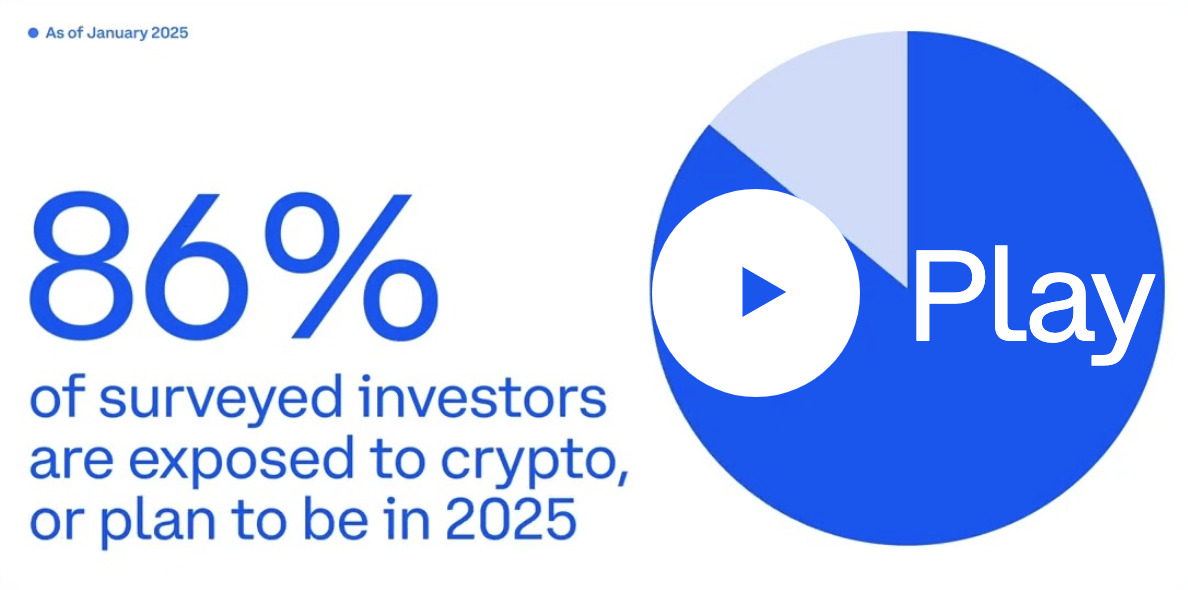

A Coinbase survey has revealed that the majority of institutional investors are inclined to increase their exposure to cryptocurrencies

The Coinbase study

A recent report by Coinbase has revealed that the vast majority of institutional investors plan to increase their exposure to Bitcoin and cryptocurrencies during 2025.

The study was carried out at the beginning of January 2025, when BTC reached its ATH of over $100. For this reason, the data could be reevaluated today, but it signals a proactive attitude that is difficult to suppress (even in the face of a collapse of BTC on the scale of recent weeks).

The survey was conducted on a sample of over 350 institutional investors, and revealed that “over three quarters of the investors interviewed plan to increase their allocations to digital assets in 2025. 59%, on the other hand, plan to allocate over 5% of assets under management to digital assets or related products”.

Among other things, the interviews do not take into account the changes introduced by the election of Donald Trump in the USA, with a new administration that is totally pro-crypto.

Not surprisingly, the report also states that the main requests from investors are for greater “regulatory clarity” that would allow for greater allocation without greater risk.

The strength of ETFs

Spot ETF funds for BTC, on the other hand, are the preferred investment vehicle. BlackRock, with the launch of IBIT, has already raised several billion dollars, and demand still seems far from running out.

“60% of investors prefer to gain exposure to cryptocurrencies through registered vehicles,” the survey reads. ”And ETFs are at the top of the list.”

Among all investors, however, 74% of them would also have exposure to other altcoins besides BTC and ETH, demonstrating that interest is not limited to the two main crypto assets.