Leggi questo articolo in Italiano

Investing “in Bitcoin” through listed securities: Bitwise's ETF

By Daniele Corno

Bitwise launches its new ETF OWNB, a product composed of listed companies that own at least 1,000 Bitcoins

A new product on the market

In the wake of the regulatory changes brought about by Donald Trump, requests for new, ETF (Exchange Traded Funds) in the crypto market are growing steadily in the USA and new products are being launched on the market.

Over the last two years, over 70 companies have added Bitcoin to their treasury assets, confirming a rapidly expanding trend, obviously led by Strategy. Given the volume of demand, and thanks to the outstanding performance of many of these companies, -which have obviously suffered in recent weeks- Bitwise has launched a new product on the market.

It is the Bitwise Bitcoin Standard Corporations ETF (OWNB). This product includes companies that have a minimum of 1,000 Bitcoins in their treasury assets. Available since yesterday, it is traded on the NYSE Arca with the ISIN code = US0917485098.

Teddy Fusaro, president of Bitwise Invest, said: “Adding Bitcoin to your balance sheet is an emerging trend for companies, and more and more are considering it as Bitcoin goes mainstream.”

Index composition

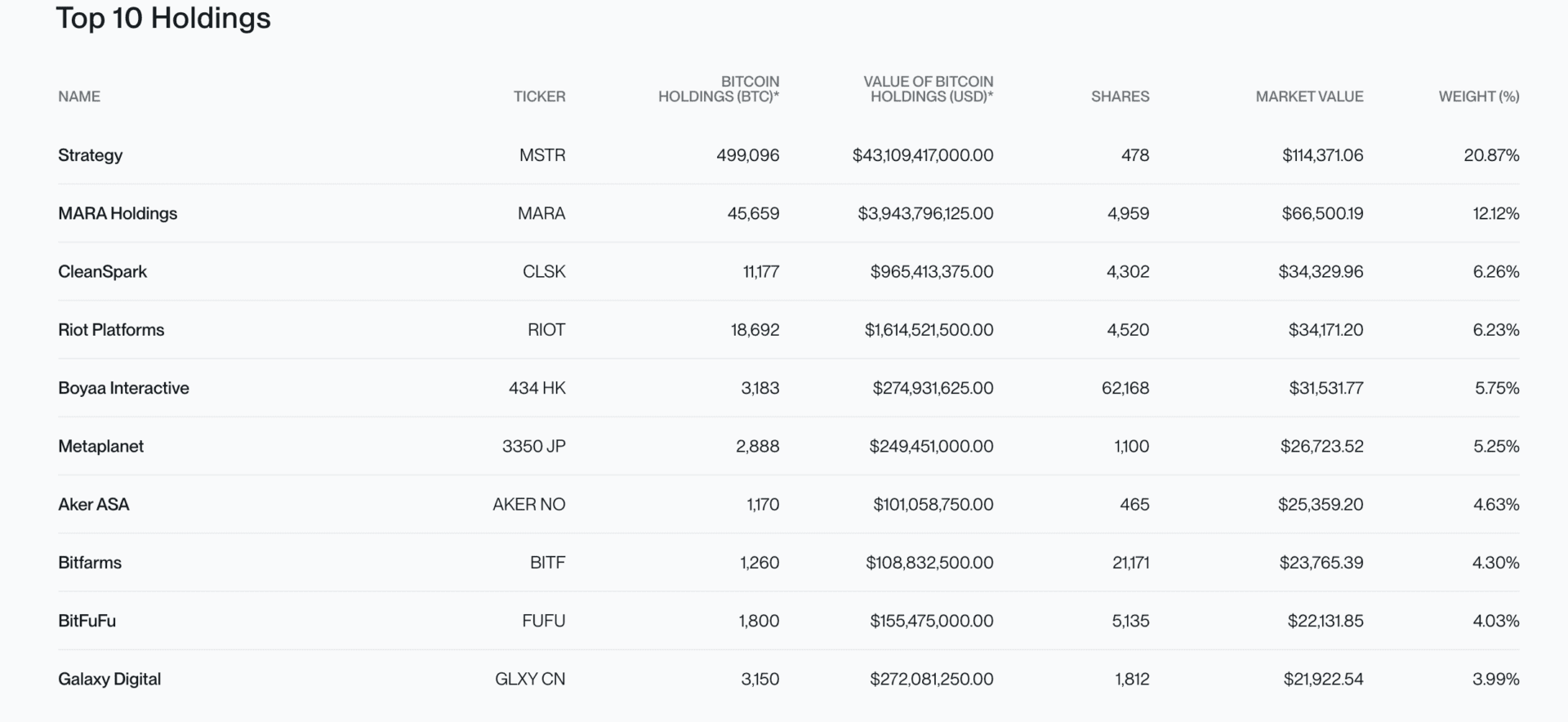

Considering Strategy, with almost 500,000 BTC in reserve, Bitwise has imposed maximum limits on the weight of a single company.

Companies with at least 1,000 BTC in reserve will be listed on the index and the maximum weight of a single company will be 20%. Companies that own more than 1,000 BTC but represent less than 1/3 of their balance sheet will be allocated a weight of 1.5%.

Approximately 45% of the weight of the product is divided among the top 4 companies, which are: Strategy, Mara Holding, CleanSpark and Riot Platforms. The complete list of the companies present is available on the reference portal provided by Bitwise.

The securities will be subject to quarterly rebalancing according to the amount of Bitcoin owned. The custody and administration of the product are instead managed by BNY Mellon.